Business

Fidelity Bank to Help Entrepreneurs Explore US Market

Fidelity Bank to Help Entrepreneurs Explore US Market

Leading financial institution, Fidelity Bank Plc, is set to host a workshop for businesses looking to scale and expand their reach into new international markets.

The training, which is scheduled for Wednesday, 6 April 2022 in Aba, Abia State, is being put together in collaboration with Export & Sell Limited -a trade enabling platform that facilitates the listing of Nigerian businesses on Amazon as well as access to other US off-take markets.

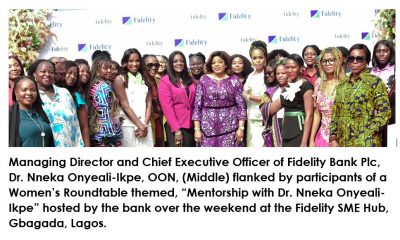

Speaking on the rationale behind the workshop, Mrs. Nneka Onyeali-Ikpe, Managing Director/CEO, Fidelity Bank Plc, said, “For more than three decades, we have helped customers scale up their businesses through the right mix of financial and non-financial solutions including access to markets initiatives like our Export and Sell workshop scheduled for Aba. With the workshop, we aim to guide customers and prospects in developing the competence necessary for selling to the US market.”

Similarly, Nduka Udeh, Managing Director/CEO of Export and Sell LLC, expressed his excitement to collaborate with Fidelity Bank on the project and commended the financial institution for the initiative.

Giving a summary of what participants are to expect, Udeh explained, “The training offers a practical approach to exporting and will show businesses how to prepare the correct documentation required to export to the United States of America (USA), how to find buyers, how to list products and sell on Amazon, how to export food products and the various licenses needed as well as other aspects of exporting”.

He added that assisting businesses to export would have an enormous ripple effect across the economy by increasing the volume of export earnings.

According to the bank, the seminar is designed for businesses in the following sectors: Food and Beverage; Fashion and Textile; Leather and Foot ware; Furniture and Woodwork; Art and Craft, Beauty and Cosmetic Industries, Pet Products, Building Materials; Light Equipment; as well as Chemical and Petrochemical industries.

After the training, Export & Sell would help businesses to revamp their products packaging, and sales literature, making sure they meet the specifications to sell on Amazon and other US outlets.

The workshop comes to join a long list of dedicated initiatives put in place by the bank to help local businesses play on the global scale and attract foreign exchange earnings. For instance, it’s Export Management Programme (EMP), which was launched in 2016 and is hosted in partnership with the Lagos Business School and the Nigerian Export Promotion Council (NEPC), equips participants with requisite knowledge for driving non-oil exports. The bank also launched the CBN RT200 FX Policy Sensitisation series in February 2022 to highlight opportunities for importers looking to pivot to exporting with the aid of the policy.

Fidelity Bank is a full-fledged commercial bank operating in Nigeria with about six million customers who are serviced across its 250 business offices and digital banking channels. The bank was recently recognized as the Best SME Bank Nigeria 2022 by the Global Banking & Finance Awards and in 2021, the bank won the awards of the “Fastest Growing Bank” and “MSME & Entrepreneurship Financing Bank of the Year” at the 2021 BusinessDay Banks and Other Financial Institutions (BAFI) Awards.

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING