Business

Interview: Meet First Bank First Female Chairman Ibukun Awosika As She Want An Economy That Works For All

Published

7 years agoon

Ibukun Awosika is an entrepreneur of many virtues, and the first woman to be appointed the chairman, board of directors of the country’s oldest bank, First Bank of Nigeria Limited, after 123 years of existence. She is also the founder and CEO of The Chair Centre Group. The companies in the group include: The Chair Centre Limited, Sokoa Chair Centre Limited, Furniture Manufacturers Mart, TCC Security Systems and Cubes and Boxes Limited. These companies are involved in manufacturing, retail and bank-way security systems services. She sits on the boards of Cadbury Nigeria Plc., Digital Jewel Limited and Convention on Business Integrity (CBI). She was Chairman, FBN Life Assurance Limited, FBN Capital Limited and Kakawa Discount House Limited. She also served on the board of Nigerian Sovereign Investment Authority (NSIA).

Ibukun is a graduate of Chemistry from University of Ife (now Obafemi Awolowo University), Nigeria; an alumna of the Chief Executive Programme of Lagos Business School; the Global Executive MBA of IESE Business School, Barcelona-Spain; and Global CEO Programme of Wharton, IESE and China European International Business School (CEIBS).

In this interview, Awosika speaks on the transformation of the depository as the bank of choice and efforts being made by the board and management to grow the larger economy, particularly the SME sector.

As the chairman of Nigeria’s biggest bank, FirstBank and given that banks have been recently blamed for being partly responsible for the current recession that we are witnessing in the economy because they allegedly have refused to lend to the real sector. How would you assess this, given your position as a stakeholder?

I will answer your question with a question. My question is, if you are a business person who sets up business to trade in a particular product and you have to find buyers for your product, does it make sense for you not to want to trade in that product? Except if you have set out to fail. Money is the product banks trade with and lending to customers that want to borrow from the bank is one of the core businesses of the bank. So, obviously, it is not logical that the bank would just want to sit on the money and not want to give loans to customers.

Things are not isolated. You can’t look at the decision an institution takes based on one factor. The banks themselves will be responding to the overall economy and whatever it is saying at any point in time. It is in the interest of all financial institutions that there is a dynamic economy because that is where you make money from. When businesses are growing, when businesses are doing well, then you can prosper, everything we offer as a financial institution will be active and a lot of value will be created for the institution and stakeholders. So the greatest benefactor of a dynamic economy is the financial services sector. So it is not logical that banks would not lend to the real sector.

As an insider and a key player in the economy, what would you attribute or blame for the lack of adequate funding to the real sector ?

Well, let’s not play a blame game. What do we all want? I am known for always being clear about what our goal is. We want a Nigeria that works; we want an economy that works for all of us. And what is important is that we all work together – government in its role in terms of policy, creating the enabling environment and encouragement for all the different sectors. All of us working together to make sure that we can provide the right products, the right service to support the real sector in its effort and commitment to create dynamism within the economy.

Obviously the real sector itself being responsible for productivity, because without the real sector functioning, being dynamic and productive, a major part of the economy will be affected. And as a major employer of labour, whether it is from SMEs to larger corporations, it is obviously in the interest of the banks to lend to the sector so as to create the expected dynamism within the economy.In doing that, we create a cycle that continues to work, the real sector works, the financial services sector works, government gets taxes, the GDP of the country is great, government gets good recommendation. So it is not about who is responsible, it is about every one of us standing up in own our space and being responsible for our part of the whole system and making sure that it works. When it works, it works for all of us.

But when I think of your throwback question and then I look at your full year report for 2016, given what you just said about helping the SMEs to grow because of their importance in the economy, you find that in your loan book for 2016 you had a high percentage that went to Oil and Gas alone.

If you look at the banking sector, that is something that is common. The loan book portfolios are all heavily tended towards the oil and gas, power sector etc perhaps partly because of the significant importance the sectors havein thecountry’s economy.

As at today, FirstBank is the biggest lender to the SME sector. I believe that in 2016 we gave out over 24 billion naira. Our investment in the SME sector is beyond money. As an established entrepreneur, starting from a small business to where my businesses are right now and from my experience, most times people think you just need to give money to entrepreneurs or people with business ideas and you will get the kind of return you want. But in my interaction with business people and entrepreneurs I have also realised there is a lot of knowledge gap within that segment.

So as a Bank, we have been very committed to investing in the development of entrepreneurs for the long-term gain of the economy.I remember about three years ago, there was a programme I hosted on TV called Ignite TV Nigeria. It was a project funded by FirstBank, Lagos state government and Bank of Industry.

If you go on YouTube, there are still all 52 episodes of the programme for people to watch. It was also broadcasted live on Channels TV and LTV. For three years, we ran those series because we realised that filling the knowledge gap will be critical to empowering the SMEs to be successful. And we knew that after we’ve done that for a season, we can thenmove to having enlightened entrepreneurs as SMEs that you can better commit money into their hands.

Now don’t forget that banks are businesses, the money traded with belongs to shareholders and depositors. It is a responsibility of the banks to ensure that the money given out comes back; otherwise we will all be in trouble. And as you can see, there’s a reason people don’t like it when you have to provide for a lot of Non performing loans (NPLs) as we’ve had to do in a short while. But what we are doing is cleaning up so we can move forward. But the lessons have been learnt. The amount an individual SMEs will take compared to what one oil and gas transaction will require is what will create the difference in the weighted average of the amount that goes to SME and the amount that goes to a particular sector. Whether it is oil and gas or agriculture, whether it is power and infrastructure etc, as the largest bank in the country and the most embedded in the economy, we are fully entrenched and involved because our commitment as a bank is to be a facilitator of the growth and development of the country. That will inevitably show up in our numbers and sometimes you won’t always get it all right because when things go wrong in those sectors, the Bank also gets impacted.

In the SME sector, the loan book percentage might look smaller, but you should look at the absolute numbers. And with over N24 billionIn 2016alone to the SME sectorand you know the size of the portions of each SME will take, that will give you an idea of the number of SMEs that the Bank has impacted and you can now better appreciate the level of support not in percentage term, but in absolute size and numbers.

As proof of our commitment to the SME sector, we invested heavily in their skill development and capacity building and we have continued in many other ways including our ongoing partnership with the Lagos Business School in running the FirstBank Sustainability Center to build capacity for SMEs, SME-centric radio programme on Sundays featuring established entrepreneurs who share their success story and tips for building sustainable businesses.And we have multiple products that will make the life and business development of most SMEs better. Last week,, my team and I and multiple other teams within the Bank were at different locations having engagement with SMEs to educate them on the requirement and procedures to access the CBN FX window. Very few SMEs are aware of the procedures and documentation required to obtain FX from the CBN provision for their businesses.

We identified the knowledge gap in relation to the low uptake and decided that beyond advertising, it was important to make the investment in enlightening the SMEs on all the benefits related to the new FX policy of the Central Bank for SMEs. For us, this initiative will help the SMEs to build strategically and build forward. Because the more successful businesses that are built, the more successful customers we get and the better for us and for the economy.

That is our commitment.

NPL has been an issue in the banking sector and FirstBank is not insulated from this, what are the steps being taken by the Board and the Management to address the issue and achieve an NPL portfolio within the regulatory thresholds.?

What you’ve just asked is what keeps us awake at night, and I mean that with all sense of seriousness. We understand that millions of people have trusted the Bank with their monies because that is what shareholders do when they invest in the shares of an institution. We do everything in every way to protect that. Since the new management team took over in January 2016, we have effectively worked to restructure our loan books to mitigate a spike in NPL which is a situation every bank faces. If the economy is challenged and businesses are challenged, the ability to payback is also challenged.

We remain committed within our means to recover and remediate whatever risk assets thatare challenged. From the board level down, we have constituted deliberate teams to lead the recovery drive and resolve as many NPL issues as possible. We are applying a corporate responsible approach as a bank, first being transparent and open, second in making provisions aggressively in compliance with regulatory requirements. The recovery and remediation task is a fulltime job for my entire board and I believe that shows how engaged we are in this process.

Would you agree with the general notion that banks are more interested in racking up numbers as against contributing to the economy growth

The banks are not isolated from the economy. It is foolishness for a bank to think it can continue to sponge on an economy without contributing to its growth. There will be a point where there is nothing to take because if the economy does not thrive, business also cannot thrive. For some seasons of imbalance it might look like that but in reality there have been so many regulatory changes that make it difficultfor banks to make arbitrary charges. In total, if we do not conduct our business in a responsible and sustainable manner to facilitate the growth of the economy, we ourselves as a business will be challenged. This is my submission, even with my experience in the real sector.

Any bank that isn’t smart enough to harmonise its desires and dreams as an institution to align with the survival and growth of the economy will ultimately pay the price down the line. And you can see that banks are continually making efforts to engage the real sector through funding, facilitation and business support. At the end of the day, you cannot be a responsible institution if you do not look beyond the numbers into the community where you operate. That is why we will invest so much in supporting SMEs and building long term capacity to serve our entire clientele better.

Beyond SMEs, we understand that agriculture is part of diversification of the economy – a major focus of the government. We have heavily invested in agric development. We had an agric forum and fair in Lagos recently where we worked with the Federal Ministry of Agriculture to expose, support and facilitate effective development of the agricultural sector. We’ve worked to fund other projects such as the Fiesta of Flavours to create empowerment for the entire value chain in this sector, including agro allied industries,and to boost job creation.

FirstBank is an aggressive CSR institution in many spaces. We are funding the creative and performing arts industry together with its value chain as well as other areas we believe are critical to building a complete community. As stakeholders in these communities, the sanity and success of this community is what feeds our business.

It’s been two years since the implementation of the Treasury Single Account (TSA) How would you assess its impact on the banks and the banking industry liquidity?

On government policies and regulations, the government has the right to enact these regulations and when that is done, they remain binding. What is important for me is that – we were not affected because we are one of the most liquid institutions in the country today with a liquidity ratio of about 52%, revealing that TSAhas hadlimited effect on our liquidity position.

The government made its own decision for good reasons. What is important is for the private sector to adjust itself in order to do business without being awash with public funds in the financial sector, and I believe that has already happened. Ultimately, the financialsector has settled and is moving on.

Delay in passing the national budget and its implication on the economy

When you live within a context or reality, you adjust yourself to thrive within that context. What the budget does is that it releases funds and stimulates spending activities in the economy. The political process which leads to it is not one in which you and I are involved in. What we can do as citizens is to pray and push for a system where the budgets kick in as early as they can so we can get the full benefit of the economic plan the budget is based on within the year it is assigned for. That will be a great blessing for the economy because a lot of things are held up before it kicks off.

Let us go back to FirstBank, looking at your full year report, you came out stronger. All the indices were up and better., what are the drivers of growth for this positive numbers?

First and foremost, we are pretty focused on what our goals are and we have invested heavily in restructuring from the board all the way down. We have a board that has been strengthened in many ways, governance has been at the centre of our board processes and we have strengthened our hands to have better oversight of the institution.

On the management side, we have had a lot of qualified new hands from across the world. We have attracted and retained the best talents in our team. In terms of our systems, we are investing heavily in the right technology to aid all our processes and the way our business is done. We are also investing in our people in training and development.Our risk oversight system is totally overhauled. We are also engaged in strategic partnerships with leading institutions that are aligned to achieving our corporate goals. We are running a very transparent shop and have accepted the results of the environment and the season that we are in vis-a-vis its impact on our business. We have set ourselves a deliberate goal of cleaning up and forging ahead,which is what we are currently doing with all the provisioning that we have made in a short period of time, knowing that once our goal is accomplished, the sky becomes our limit as to where we can go.

We have assembled the best group of talents in the industry, and we are focused on driving stronger business performance.

When you are an institution of 123 years old, it means that you must have been doing things right over the years for you to get to where you are. We intend to lay a sound foundation for the next 120 years of the bank, and I know that we will by the grace of God.

Credits: Nike Sotade, Clara Nwachukwu and Chijioke Nelson,

Source: The Guardian.

Related

Sahara weekly online is published by First Sahara weekly international. contact [email protected]

You may like

Business

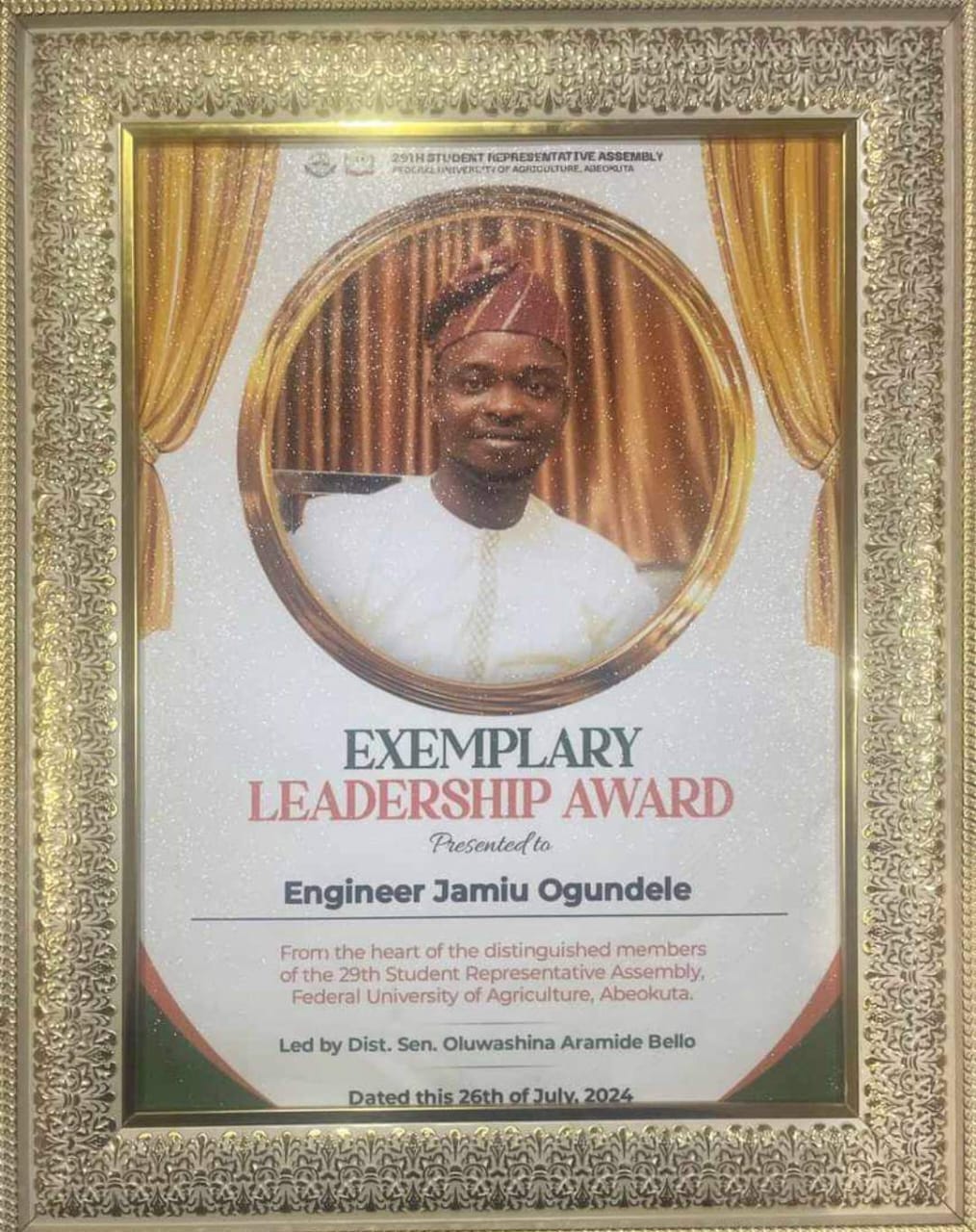

Jamsalod Nigeria Limited Director, Engr. Jamiu Ogundele Honoured With Exemplary Leadership Awards

Published

35 mins agoon

July 27, 2024

Jamsalod Nigeria Limited Director, Engr. Jamiu Ogundele Honoured With Exemplary Leadership Awards

Sahara Weekly Reports That The Managing Director of Jamsalod Nigeria Limited, Engineer Jamiu Ogundele has been awarded with exemplary leadership awards by Federal University of Agriculture Abeokuta today 26th of July 2024.

According to Distinguish Senator Oluwashina Aramide Bello, he said Engineer Ongundele Jamiu was awarded based on his exemplary leadership acumen and philanthropy to the people at large.

The awards were presented on the 26th of July, 2024.

In his acceptance speech, Engr. Jamiu Ogundele appreciated the Students of Federal University of Agriculture Abeokuta FUNAAB for deeming it necessary to bestow him with a leadership awards. He promise to continue rendering assistance to the less privileged and sponsorship of education for children and youths whose parents are not financially buoyant to send them to school.

Related

Business

Lion Oshiyemi Pledges redefinition, reposition as he emerges 20th President of OGUNCCIMA

Published

13 hours agoon

July 26, 2024

Lion Oshiyemi Pledges redefinition, reposition as he emerges 20th President of OGUNCCIMA

Lion Niyi Oshiyemi has been invested as the 20th President of the Ogun State Chambers of Commerce, Industry, Mines and Agriculture (OGUNCCIMA) at the Chamber’s 40th Annual General Meeting.

The investiture ceremony of the new OGUNCCIMA leadership was held on Thursday at Tunwase Hall in Ijebu Ode, Ogun State with top Chamber movement members in attendance.

The President In his acceptance speech, expressed gratitude to the immediate past President, Engr. Mike Akingbade, and the Chamber for entrusting him with the esteemed position.

He pledged to leverage available opportunities to redefine and reposition the Chamber, creating platforms to influence legislation and improve the business environment.

“I am honored to lead this prestigious organization and I promise to harness all available opportunities to redefine and reposition the chamber of commerce movement in the state”.

“I will continue to create platforms to influence legislation and other measures affecting trade, improve the business environment, and build a Nigerian economy of thriving business opportunities through networking”.

“I wish to enjoin you all who represent businesses, if you have not joined the OGUNCCIMA, please come and lend your voice to others. The bigger the network, the louder the voice and the stronger the influence”.

“Our advocacy seeks to ensure that the business community can have its voice heard on issues that are important to it”.

“I’d like to introduce to you my Presidency’s flagship project “OGUNCCIMA Secretariat”: The project is massive and requires a lot, I therefore seek your support and look forward to partnering with all stakeholders – the state government and it’s agencies (Federal and State Ministries, Departments and Agencies), development partners, the diplomatic communities, the media, and other stakeholders”, he said.

Oshiyemi also praised the founding fathers of the Chamber, saying, “I laud the vision of our founding fathers, who have laid a solid foundation for us to build upon. I am committed to taking OGUNCCIMA to greater heights and making it a beacon of hope for businesses in Ogun State.”

The Ogun State Hon. Commissioner for Industry, Trade and Investment, Hon. Adebola Sofela Emmanuel, in his keynote address said by the Permanent Secretary, Ministry of Trade and Investment, Dr. Olu Ola Aikulola, said over the years that the Ogun State Chambers of Commerce, Industry, Mines and Agriculture (OGUNCCIMA), has not only remained a beacon of entrepreneurial excellence, but also partners in driving economic growth, fostering trade, and promoting investment opportunities in the state.

He said: “I would like to extend my heartfelt congratulations to OGUNCCIMA on this historical movement. Forty years of dedicated service to the industrial, trade, and agricultural sectors of Ogun State is no small feat”.

“Over the years, the Ogun State Chambers of Commerce, Industry, Mines and Agriculture (OGUNCCIMA) has not only been a beacon of entrepreneurial excellence but also a pivotal partner in driving industrial growth, fostering trade, and promoting investment opportunities”.

“Today, as we elect new officers to continue this legacy of excellence, I urge all members to approach this process with a spirit of unity, fairness, and foresight. The future of our chambers and the economic well-being of our state depend on the collective wisdom and strategic vision of our leaders”.

“For us, as a government, we will continue to put in place Institutional mechanisms that will guide our various developmental programmes in all sector of the economy”, he added.

In his remarks, NACCIMA President, Dele Kelvin Oye, represented by the Director – General, Olusola Obadimu, urged the new leadership of OGUNCCIMA to reflect on the the Chambers achievements and chart the course for the future.

“Today, as we gather for the 40th Annual General Meeting and Investiture of New Executives, I want to charge the new leadership to be dedicated and build on the achievements of the past administrations”.

“On behalf of NACCIMA, I congratulate the new officers and may our shared efforts continue to bear fruit, and may new officers lead us for greater heights of success and prosperity”, he concluded.

Related

Business

ASR AFRICA FLAGS OFF CONSTRUCTION OF A N280 MILLION INTEGRATED PUBLISHING HOUSE FOR BABCOCK UNIVERSITY, ILISHAN-REMO, OGUN STATE, NIGERIA

Published

17 hours agoon

July 26, 2024

ASR AFRICA FLAGS OFF CONSTRUCTION OF A N280 MILLION INTEGRATED PUBLISHING HOUSE FOR BABCOCK UNIVERSITY, ILISHAN-REMO, OGUN STATE, NIGERIA

Sahara Weekly Reports That The Abdul Samad Rabiu Africa Initiative (ASR Africa), the philanthropic initiative of the Chairman of BUA Group, Abdul Samad Rabiu (CFR, CON), has flagged off the construction of a N280 million Abdul Samad Rabiu Integrated Publishing House for Babcock University, Ilishan-Remo, Ogun State. This project will enhance the capacity of the University from basic press status to a modern, integrated publishing house to encompass publishing, print production, and other related diversified services. The one-storey building facility will serve as a laboratory and studio for training students of communications, media studies, and allied disciplines as well as other disciplines.

At the groundbreaking event, the Vice Chancellor of the University, Prof. Ademola S. Tayo, expressed satisfaction at the nomination by ASR Africa, under its Tertiary Education Grant Scheme. He added that the choice of the project was a response to the vision to take the Mass Communications Department of the University to a whole new level. According to him, the university’s vision is to produce young men and women capable of critical thinking, and problem-solvers capable of proffering innovative solutions to problems of everyday life, be it social, political, and cultural.

In his response, Dr. Ubon Udoh, the Managing Director of ASR Africa, expressed his delight at the University’s choice of establishing an Integrated Publishing House. He added that when information is appropriately applied, human society is empowered to liberate itself from limitations and attain its full potential. Dr Udoh reiterated the commitment of the Chairman of ASR Africa, Abdul Samad Rabiu to supporting quality education within the tertiary education system in Nigeria and urged the institution to focus on the sustainability of this noble project. He also reiterated the importance of cooperation and collaboration between the university and the contractor for the timely delivery of the publishing house.

About ASR Africa

ASR Africa is the brainchild of African Industrialist, Philanthropist, and Chairman of BUA Group, Abdul Samad Rabiu, the Abdul Samad Rabiu Africa Initiative (ASR Africa) was established in 2021 to provide sustainable, impact-based, homegrown solutions to developmental issues affecting Health, Education and Social Development within Africa.

Related

Cover Of The Week

- Africa: Finance and foreign ministers call for remaking the international financial system in the interest of developing countries July 26, 2024

- Economic Community of West African States (ECOWAS) Centre for Renewable Energy and Energy Efficiency (ECREEE) Inaugurates Solarization of Three Hospitals in Ghana July 26, 2024

- Tunisia: Amnesty International’s Secretary General denounces rollback of human rights upon concluding four-day visit July 26, 2024

- Merck Foundation Chairman & Chief Executive Officer (CEO) meet Botswana President & First Lady to launch long term partnership to build healthcare capacity, stop infertility Stigma & Gender-based Violence (GBV) and Support girl education in Botswana July 26, 2024

- Uganda: Children’s Parliament calls for end to hunger, malnutrition July 26, 2024

- Uganda: Aleper eulogised for uniting Karamoja July 26, 2024

- Call for the 2024-2025 Fellowship for Young African Professionals July 26, 2024

- Uganda: Northern Corridor Integration Projects Drive Regional Progress July 26, 2024

- South Sudan eyes Water Convention accession for stronger water governance and development opportunities July 26, 2024

- Strengthening Fisheries Cooperation: Indonesian Ambassador Meets with Angolan Minister of Fisheries July 26, 2024

- Africa: Finance and foreign ministers call for remaking the international financial system in the interest of developing countries July 26, 2024

- Economic Community of West African States (ECOWAS) Centre for Renewable Energy and Energy Efficiency (ECREEE) Inaugurates Solarization of Three Hospitals in Ghana July 26, 2024

- Tunisia: Amnesty International’s Secretary General denounces rollback of human rights upon concluding four-day visit July 26, 2024

- Merck Foundation Chairman & Chief Executive Officer (CEO) meet Botswana President & First Lady to launch long term partnership to build healthcare capacity, stop infertility Stigma & Gender-based Violence (GBV) and Support girl education in Botswana July 26, 2024

- Uganda: Children’s Parliament calls for end to hunger, malnutrition July 26, 2024

- Uganda: Aleper eulogised for uniting Karamoja July 26, 2024

- Call for the 2024-2025 Fellowship for Young African Professionals July 26, 2024

Trending

-

Business6 months ago

Business6 months agoFintech Guru, Jesam Micheal Opens Biggest Apple Store In Africa, Reveals Why

-

Business6 months ago

Business6 months agoFintech Guru, Jesam Micheal Opens Biggest Apple Store In Lagos On Saturday (Video)

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoTop Lagos Monarch Receives Jesam Micheal, Urges Him on First AAS Solar Powered Estate Project

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoMFM WINS AGAIN AS US COURT SLAMS BLOGGER, FUNKE ASHEKUN WITH 50,000 DOLLARS FOR SLANDERING CHURCH AND DR OLUKOYA

You must be logged in to post a comment Login