Business

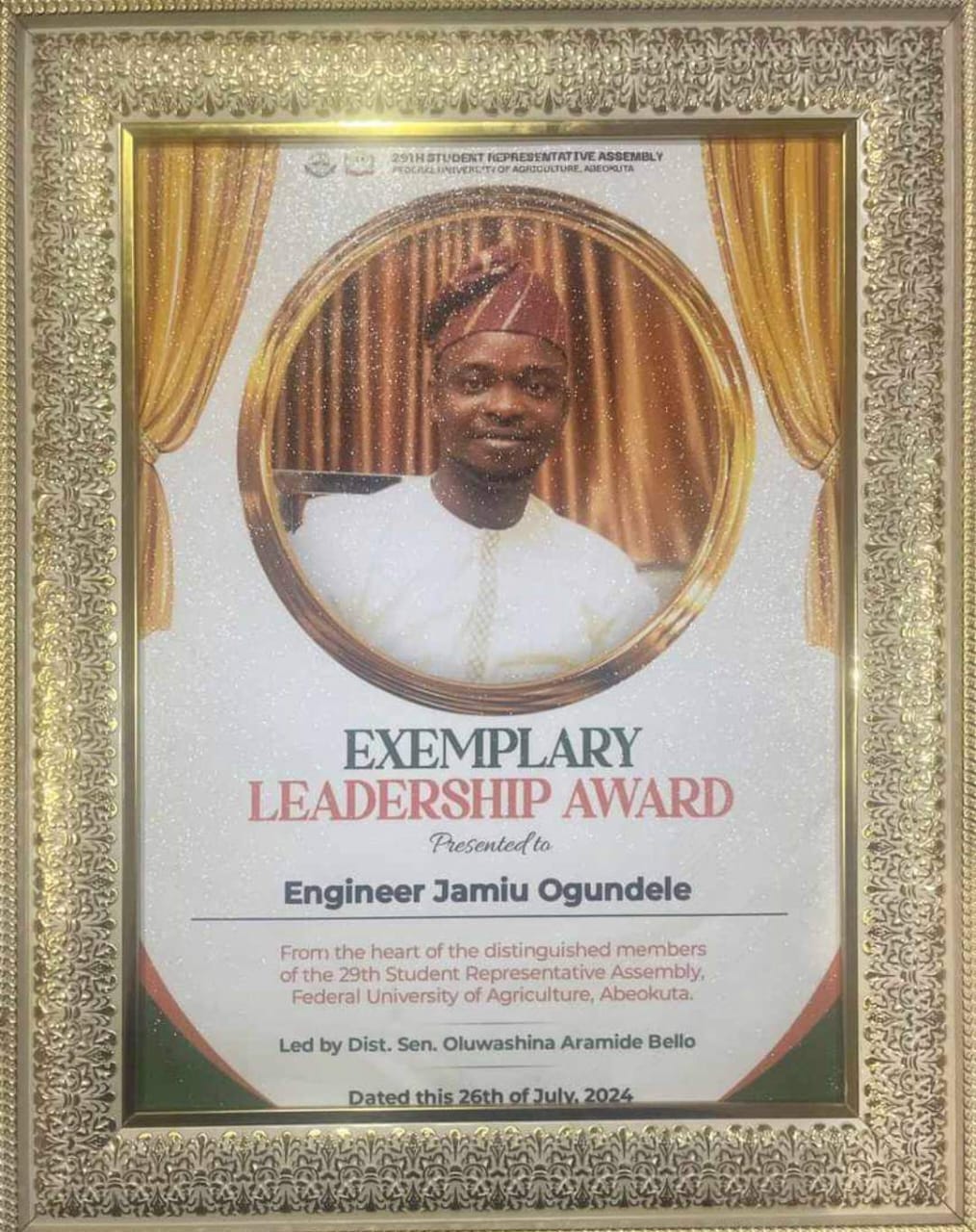

Jamsalod Nigeria Limited Director, Engr. Jamiu Ogundele Honoured With Exemplary Leadership Awards

Jamsalod Nigeria Limited Director, Engr. Jamiu Ogundele Honoured With Exemplary Leadership Awards

Sahara Weekly Reports That The Managing Director of Jamsalod Nigeria Limited, Engineer Jamiu Ogundele has been awarded with exemplary leadership awards by Federal University of Agriculture Abeokuta today 26th of July 2024.

According to Distinguish Senator Oluwashina Aramide Bello, he said Engineer Ongundele Jamiu was awarded based on his exemplary leadership acumen and philanthropy to the people at large.

The awards were presented on the 26th of July, 2024.

In his acceptance speech, Engr. Jamiu Ogundele appreciated the Students of Federal University of Agriculture Abeokuta FUNAAB for deeming it necessary to bestow him with a leadership awards. He promise to continue rendering assistance to the less privileged and sponsorship of education for children and youths whose parents are not financially buoyant to send them to school.

Business

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

The Aig-Imoukhuede Foundation is pleased to announce that applications are now open for the sixth cohort of its transformative AIG Public Leaders Programme (AIG PLP).

This flagship six-month executive education initiative, delivered by the University of Oxford’s Blavatnik School of Government, is designed to empower high-potential public sector leaders across Africa with the tools, networks, and strategic insight required to deliver meaningful reform across African public institutions.

Applications are now open to qualified public servants from all English-speaking African countries and will close on Sunday, April 12, 2026. The programme commences in October 2026.

Since its inception in 2021, the AIG PLP has built a formidable reputation for creating tangible impact.

Alumni from the programme have gone on to design and implement more than 230 reform projects within their ministries, departments, and agencies across Africa.

An impact survey revealed that 62% of alumni have earned promotions or assumed expanded leadership roles post-training, demonstrating the programme’s direct effect on career advancement and institutional influence.

“Across Africa, the complexity of public sector challenges demands more than good intentions. It requires reformers who understand systems, can navigate institutional realities, and are equipped to implement sustainable change.

The AIG PLP is designed to meet this need,” said Ofovwe Aig-Imoukhuede, Executive Vice-Chair of the Aig-Imoukhuede Foundation.

As part of the programme, a PLP alumna, Titilola Vivour-Adeniyi, Executive Secretary of Lagos State DSVA, launched a secure self-reporting tool that allows survivors of domestic and sexual abuse safely document incidents and preserve evidence.

Survivors are already accessing support, and the tool ensures that crucial proof is protected until justice can be sought. This is one of over 230 impactful reform projects being implemented across sectors as diverse as healthcare, finance, agriculture, and education.

We are seeing proof every day that investing in the capacity and leadership potential of people, delivers the kind of transformation that policy alone cannot achieve.”

The AIG PLP is a blended learning experience that combines online sessions with an intensive residential module.

It is offered at no cost to selected participants, with the Foundation covering all costs of the programme including accommodation and feeding during the residential weeks.

Participants gain direct access to world-class faculty from the University of Oxford, and learn to tackle core public sector challenges such as: Negotiating in the public interest. Harnessing digital technology for governance.

Strengthening public organisations.

Upholding integrity in public life.

The curriculum culminates in a capstone reform project, where participants apply their new skills to a real-world challenge within their institution.

This practical component ensures that learning translates directly into actionable solutions.

Interested candidates are encouraged to apply early. For more details on the application process and to apply, please visit the Aig-Imoukhuede Foundation website.

Business

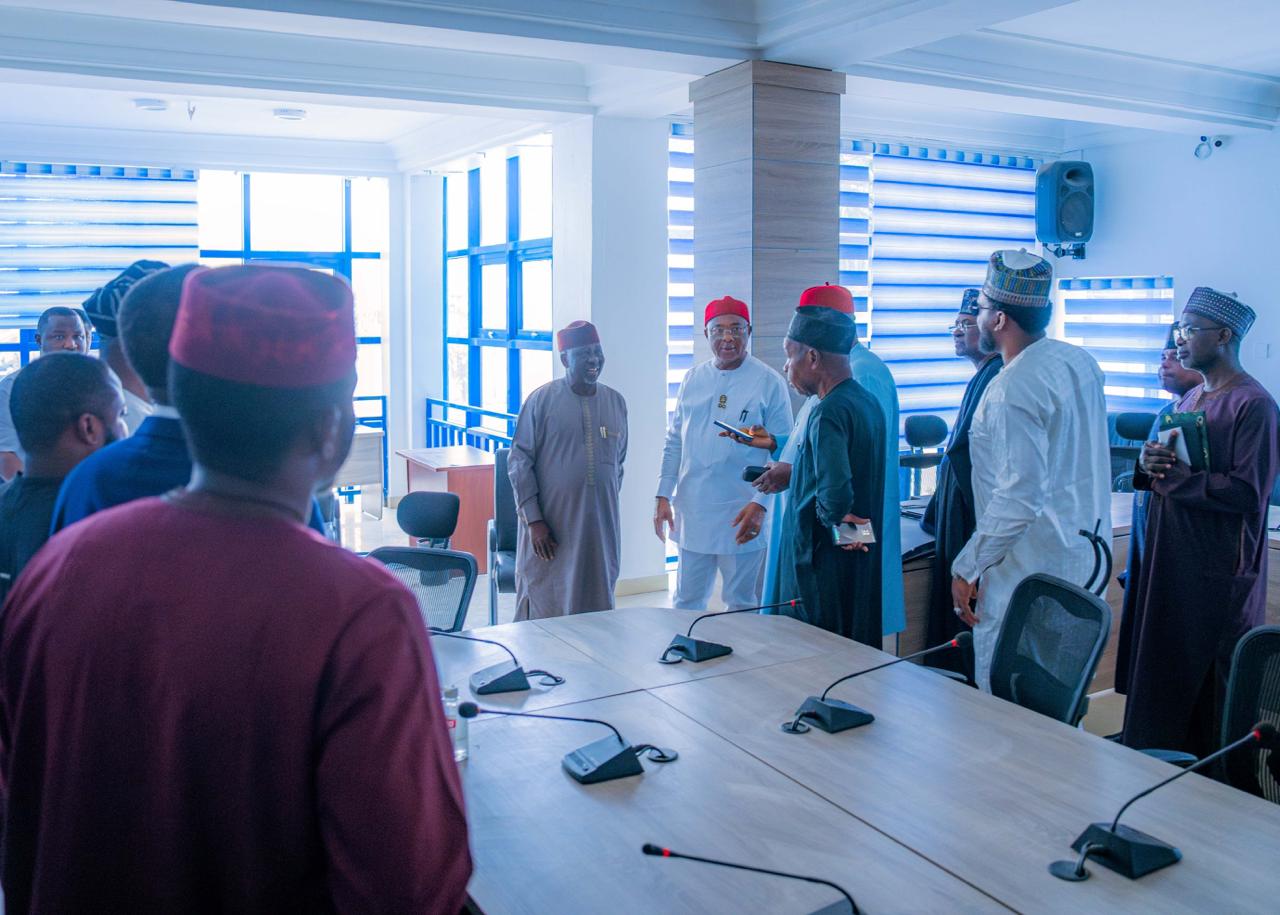

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors, led by its Director-General and the Governor of Imo State, Hope Uzodinma, alongside Zonal Coordinators (NW, NC, SE), the Media & Publicity Directorate, and other key stakeholders, inspected the RHA Secretariat two days after President Bola Tinubu unveiled the Renewed Hope Ambassadors grassroots engagement drive in Abuja.

Business

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Garden & Estate Development Limited has expanded its development activities across Ibeju-Lekki, pushing the projected long-term value of its estate portfolio beyond $1 billion.

Led by Chief Executive Officer Hon. Dr. Audullahi Saheed Mosadoluwa, popularly know Saheed Ibile, the company is developing seven estates within the Lekki–Ibeju corridor. Details available on Harmony Garden & Estate Development show a portfolio spanning land assets and ongoing residential construction across key growth locations.

A major component is Lekki Aviation Town, where urban living meets neighborhood charm, located near the proposed Lekki International Airport and valued internally at over $250 million. The development forms part of the company’s broader phased expansion strategy within the axis.

Other estates in the corridor tagged as the “Citadel of Joy” (Ogba-idunnu) include Granville Estate, Majestic Bay Estate, The Parliament Phase I & II, and Harmony Casa Phase I & II.

With multiple projects active, the rollout of the Ibile Traditional Mortgage System, and structured expansion underway, Harmony Garden & Estate Development Ltd continues to deepen its presence within the fast-growing Ibeju-Lekki real estate market.

-

celebrity radar - gossips7 months ago

celebrity radar - gossips7 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society7 months ago

society7 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING