celebrity radar - gossips

New PENCOM initiatives dominate Stanbic IBTC Pension Managers’ forum

Describing measures taken by the National Pension Commission (PENCOM) to sustain growth of the Nigerian pension industry as apt, Stanbic IBTC Pension Managers Limited has said the micro pension scheme, multi-fund investment structure and Pension account transfer window, to mention but a few, are among initiatives capable of putting the sector in stronger footing going forward.

The company, Nigeria’s biggest pension fund administrator (PFA), spoke against the backdrop of the recent announcement by the industry regulator that the multi-fund structure would become operational from July 1, 2018.

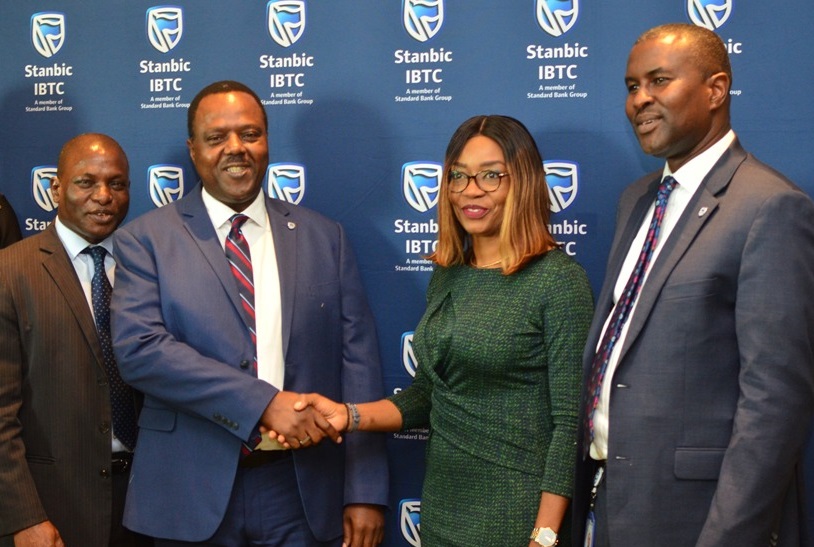

Speaking during a media interactive session in Lagos on Monday, May 28, 2018, Chief Executive, Stanbic IBTC Pension Managers Limited, Mr. Eric Fajemisin, said such reforms and innovations are necessary to maintain the strength and depth of Nigeria’s Contributory Pension Scheme (CPS). The session was one in the series of strategic approaches by the PFA to engage industry stakeholders on ways to strengthen the Nigerian pension industry and boost wider participation by Nigerians.

Fajemisin noted that the Retirement Savings Account (RSA) Multi-Fund Investment structure, which replaces the “one-size-fits-all” arrangement that puts all active contributors into one RSA Fund, would resolve the challenge of asset-liability risk management faced by the operators. By aligning the age and risk profile of RSA holders to match the four funds, contributors would have a better chance to earn improved returns on their investments in proportion to their risk appetites.

The different categories of the multi-funds structure are Fund 1, Fund 2, Fund 3 and Fund 4. Fund I is targeted at people of 49 years and below who in the quest for higher returns are willing to take more risks. Fund 2 is aimed at people who are aged 49 years and below and still working but are satisfied with moderate returns and levels of risks. Fund 3 targets people 50 years and above but still working and have very low risk appetite. In Fund 4 are retirees who have the lowest risk profile of all categories.

Among its other benefits include improved standard of living for the elderly, safety of funds and access to other incentives, such as mortgage facilities and health insurance. In addition are flexible contribution remittances, the opportunity to make withdrawal prior to retirement and the enhancement of financial inclusion in the country.

Speaking on the micro-pension scheme,Fajemisin said it would help in deepening asset accumulation in the country, and provide the crucial capital required for investment in critical sectors of the economy. As an initiative designed to cover an estimated 70 percent of Nigeria’s working population in the informal sector, the scheme offers enormous benefits to the society and ensure improved standard of living for the elderly, guarantee the safety of funds and may provide access to other incentives, such as mortgage facilities and health insurance., regardless of challenges associated with its seamless implementation.

On the proposed pension transfer window, which allows a RSA holder to switch PFA once a year, the Stanbic IBTC Pension helmsman said it would deepen the democratic space in the pension industry as well as encourage healthy competition, resulting in further transparency and accountability, which would in turn enhance efficiency, innovation and service delivery.

Fajemisin also reviewed the 2014 Pension Reform Act and the impact on the CPS. On the enabling law, he said the introduction of more stringent penalties for erring operators and directors, especially as it relates to mismanagement of funds, has engendered greater corporate governance, making it almost impossible to misapply pension funds by anyone. By increasing the contributions of the employer and employee to 10 and 8 percent respectively, Fajemisin said the Act has ensured the availability of more benefits to contributors at retirement. In addition, the Act makes the non-remittance of employees’ contribution by the employer an offence which the regulator can prosecute in court.

Amongst its provisions, which expanded its coverage, private sector organizations with just three employees or more are required to register under the scheme; while the law also compels an employer to open a Temporary Retirement Savings Account (TRSA) on behalf of an employee that fails to open a Retirement Savings Account within three months of being employed.

The PFA’s Head of Business Development, Mrs. Nike Bajomo, said the company is already reaching out to its over 1.6 million RSA holders nationwide to create awareness about commencement of the multi-fund structure with effect from July 1, 2018. She said the PFA will continue to engage various stakeholders on developments in the industry to ensure the provisions of the CPS are fully harnessed to the benefit of all. Such platforms as the employers’ forum, preretirement seminars, among other initiatives Stanbic IBTC Pensions organises yearly, are fashioned to ensure regular engagement and to drive awareness.

Backed by the experience and expertise of Stanbic IBTC Group, a member of the over 155-year-old Standard Bank Group, Bajomo said the PFA will not relent in providing excellent services to its RSA holders and Nigerians. Stanbic IBTC Pension Managers Limited, she said, has over 1.6 million RSA holders nationwide, with assets under management in excess of N2 trillion. It pays approximately N1.3 billion to over 37,000 retirees monthly and over N279 billion has been paid to retirees since the PFA commenced operations in 2006, Bajomo added.

Stanbic IBTC Pension Managers Limited is a subsidiary of Stanbic IBTC Holdings, a member of Standard Bank Group, a full service financial services group with a clear focus on three main business pillars – Corporate and Investment Banking, Personal and Business Banking and Wealth Management. Standard Bank Group is the largest African financial institution by assets. It is rooted in Africa with strategic representation in 20 countries on the African continent. Standard Bank has been in operation for over 155 years and is focused on building first-class, on-the-ground financial services institutions in chosen countries in Africa; and connecting selected emerging markets to Africa by applying sector expertise, particularly in natural resources, power and infrastructure.

celebrity radar - gossips

E‑Money’s Grand Gesture: A Closer Look at the SUV Gift to Chinedu “Aki” Ikedieze

E‑Money’s Grand Gesture: A Closer Look at the SUV Gift to Chinedu “Aki” Ikedieze

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

“Public Generosity, Celebrity Loyalty and the Symbolism of Wealth in Nigeria’s Entertainment Elite.”

On Tuesday, February 17, 2026, Nigerian billionaire and entrepreneur Emeka Okonkwo, widely known as E‑Money, once again captured national attention with a lavish and highly publicised act of generosity, gifting a brand‑new 2024/2025 Ford SUV to veteran Nollywood actor Chinedu Ikedieze, affectionately called Aki, during his high‑profile birthday celebration.

The event, held in Lagos amidst a constellation of entertainers, business figures and socialites, was itself part of an annual tradition in which E‑Money marks his birthday (on February 18) with large‑scale giveaways and spectacular shows of material philanthropy. This year, he announced the gift of over 30 cars to friends, staff and family, a gesture that quickly went viral as videos and images circulated across social media platforms.

In the case of Ikedieze, E‑Money’s gift appeared to be deeply personal. During the festivities, E‑Money stood beside his elder brother, Grammy‑nominated musician KCee and recounted how Ikedieze stood by him at his 2007 wedding. The billionaire explained that the SUV was a “token of appreciation” for the enduring support the actor had shown over the years which is a narrative that blends friendship with public celebration.

Ikedieze, a Nollywood staple with a career spanning more than two decades and over 150 film credits, including the iconic Aki na Ukwa franchise, visibly reacted with humble surprise as he received the vehicle, bowing his head in respect and gratitude. The actor later shared the moment on his Instagram account with a caption celebrating the gift, further fuelling online engagement around the event.

Beyond the spectacle, this incident underscores evolving dynamics in Nigerian celebrity culture and the intersection of wealth, influence and reciprocity. Sociologist Dr. Chinedum Uche of the University of Lagos, speaking on the broader implications of such high‑profile gifts, notes: “Philanthropy that is highly publicised can reinforce social bonds, but it also reflects a culture where generosity is intertwined with reputation economy; where giving becomes as much a social signal as it is an act of kindness.” The quote highlights how public acts of wealth transfer among elites serve layered social functions that extend beyond pure altruism.

Critics of such displays argue that ostentatious giveaways, particularly in a country with stark economic disparities, risk amplifying social envy and exacerbating perceptions of inequality. Economist Dr. Ifunanya Nwosu from the Lagos Business School observes: “In societies marked by economic stratification, celebrity largesse may inspire admiration, but it can also inadvertently highlight structural inequities; prompting questions about systemic investment in public welfare versus individual generosity.”

Still, supporters maintain that E‑Money’s annual tradition (which has in past years included cash gifts to his brother KCee, comedians and even domestic staff) reflects genuine gratitude and a commitment to uplifting his immediate circle, albeit within the private sphere.

For Ikedieze, the SUV stands both as a heartfelt gesture from a longtime friend and a public affirmation of their enduring relationship. As the video of the moment continues to circulate, the broader narrative has ignited discussions about the role of private wealth in public life, celebrity culture and how acts of giving are interpreted in contemporary Nigerian society.

In a landscape where influence and generosity often play out in equal measure on public stages, E‑Money’s gift to Aki is more than a headline, it is a flashpoint in ongoing debates about wealth, friendship and visibility in Nigeria’s entertainment and entrepreneurial ecosystem.

celebrity radar - gossips

Spiritual Reality: Wicked People Are Possessed by Wicked Spirits — Dr. Christian Okafor

Spiritual Reality: Wicked People Are

Possessed by Wicked Spirits — Dr. Christian Okafor

…..“You don’t need to offend them before they attack you.”

…..“Your only true help comes from God.”

Demons are strategic and calculating. They detect threats quickly and position themselves to resist any power that may expose or overpower them.

According to the Generational Prophet and Senior Pastor of Grace Nation Global, Christian Okafor, spiritual intelligence operates both in light and in darkness—and believers must understand this reality.

Dr. Okafor delivered this message on Thursday, February 19, 2026, during the midweek Prophetic, Healing, Deliverance and Solutions Service (PHDS) held at the international headquarters of Grace Nation Worldwide in Ojodu Berger, Lagos, Nigeria.

The Operations of Demons

Teaching on the subject “Spiritual Reality” with the subtitle “Operations of Demons,” the Man of God explained that when demons possess individuals, their behavior changes. Such people may attack, bully, or resist those sent by God to help them, unknowingly rejecting divine assistance and prolonging their struggles.

“You don’t need to offend a demon before it attacks you,” he said. “What you carry is enough to provoke opposition. The greater your potential, the greater the battle.”

Dr. Okafor noted that many believers misinterpret battles as signs that God has abandoned them. However, he explained that some battles are permitted for growth, training, and divine glorification.

According to him, God may allow certain confrontations so that believers understand spiritual warfare and emerge stronger.

“Some battles are necessary,” he emphasized. “They push you into your turning point.”

He further stated that God does not respond to lies, blackmail, or bullying. He responds to His Word. Therefore, opposition is not proof of God’s absence, but often evidence of destiny at work.

The Weapon Against Demonic Attacks

Addressing solutions, Dr. Okafor described prayer as the strongest weapon against satanic operations.

“Prayer is the license that invites God into your battles,” he declared. “God does not intrude—He responds to invitation.”

According to the Apostle of Altars, understanding the principles and discipline of prayer enables believers to receive divine strategies for overcoming demonic resistance. Without prayer, he warned, spiritual help cannot be activated.

“You cannot receive help without God,” he concluded. “And you cannot engage God without prayer.”

Manifestations at the Service

The midweek gathering was marked by a strong move of the Spirit, with testimonies of deliverance, miracles, restoration, and solutions to various challenges presented before God. Several individuals reportedly committed their lives to Christ during the service.

celebrity radar - gossips

Kingdom Advancement: God Does Not Confirm Lies or Gossip — He Confirms His Word .” — Dr. Chris Okafor

Kingdom Advancement: God Does Not Confirm Lies or Gossip—He Confirms His Word

“When Doing Business with God,

People’s Opinions Do Not Count.”

— Dr. Christian Okafor

The greatest investment any Christian can make is partnering with God. According to the Generational Prophet of God and Senior Pastor of Grace Nation Global, Christopher Okafor, when a believer commits to serving and advancing God’s kingdom, no barrier, lie, gossip, or blackmail can prevail against them.

This message was delivered during the Prophetic Financial Sunday Service held on February 15, 2026, at the international headquarters of Grace Nation Worldwide in Ojodu Berger, Lagos, Nigeria.

Doing Business with God

Teaching on the theme “Kingdom Advancement” with the subtitle “Doing Business with God,” Dr. Okafor emphasized that when a believer enters into covenant partnership with God, divine backing becomes inevitable.

“God is still in the business of covenant,” he declared. “When you make a covenant with Him, He honors the terms. When you win souls into the kingdom and remain committed to His work, He rewards you with what you could never achieve by your own strength.”

The Man of God stressed that God does not confirm lies, gossip, or negative narratives—He confirms His Word. Therefore, anyone genuinely committed to kingdom business should not be distracted by public opinion.

“No matter the blackmail or falsehood circulating around you, if you are focused on God’s assignment, those attacks will only strengthen you,” he stated.

He further noted that a believer’s understanding of God’s covenant determines their experience. “Your mentality about God’s covenant becomes your reality. When you truly know the God you serve, no devil can move you.”

Biblical Examples of Kingdom Partnership

Dr. Okafor cited several biblical figures who prospered through their partnership with God:

Abel

Abel served God with sincerity and offered his very best. His sacrifice pleased God, demonstrating that when a master is honored, he responds with favor.

David

David’s heart was fully devoted to God, and in return, God’s presence and favor rested upon him throughout his life.

Hannah

Hannah made a covenant with God, promising that if He blessed her with a child, she would dedicate him to His service. After fulfilling her vow, God rewarded her abundantly, blessing her with additional children.

Peter

Peter, a professional fisherman, surrendered his boat at Jesus’ request for kingdom work. Through that act of partnership and obedience, he experienced supernatural provision and divine elevation.

Conclusion

In closing, Dr. Okafor emphasized that one’s approach to God’s covenant determines the level of success and prosperity experienced. Commitment to kingdom advancement secures divine confirmation and supernatural results.

The Prophetic Financial Sunday Service was marked by prophetic declarations, deliverance, healings, miracles, restoration, and solutions to diverse cases presented before Elohim.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login