Bank

Revealed! How Chiamaka Agim Must have Compromised Her Details, Lost 4million Naira in 20 minutes

Revealed! How Chiamaka Agim Must have Compromised Her Details, Lost 4million Naira in 20 minutes

It is no more news that one Agim Chiamaka took to the social media to call out Zenith Bank over some missing N4 Million from her bank account.

Sadly, further diggings have exposed how she singlehandedly allowed fraudulent activities on her account and in a way to cover up, is blaming it on Zenith Bank Plc.

Recall that Agim Chiamaka on Tuesday, 13 January 2023 shared a video crying at the banking hall over the missing money.

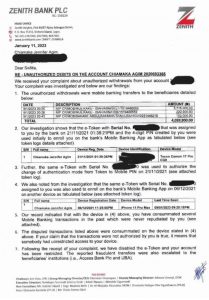

However, Zenith Bank swung into action to investigate how the money was moved from her account to other accounts. The Bank in response to her explained in a two-page investigative report sent to Agim Chiamaka on how her details was compromised to fraudsters using the same device she has used to carry out mobile banking transactions in the past which was never repudiated by the complainant.

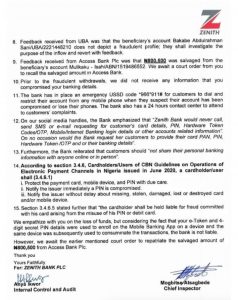

According to Zenith Bank “Prior to the fraudulent withdrawals, we did not receive any information that you compromised your banking details. The bank has in place an emergency USSD Code *996*911# for customers to dial and restrict their account from any mobile phone when they suspect their account has been compromised or lose their phones”.

” If your claim of that the transactions were not authorized by you is true, it means that somebody had unrestricted access to your phone”.

Contrary to Chiamaka’s claim of not having a token to initiate her transactions, Zenith Bank investigation shows that her claim is false as she was assigned a token on 21st November, 2021, at 01:38:21PM and 4-digit PIN was created by her (AS REVEALED IN THE ATTACHED MATERIAL) and that she has been using to consummate several mobile banking in the past.

Furthermore, the response letter signed by Internal Control Unit, Zenith Bank noted it can only recover a sum of N800,500 out of the missing sum and advised her on need to get a court order to repatriate #800,500 from Access Bank Plc.

The question is: Did Chiamaka reported to anyone that her mobile phone/Device was stolen?

Where was her device when the transaction took place?

Rather than giving false information, as being speculated by Chiamaka on social media, it is better you (Chiamaka) report this to SPECIAL FRAUD UNIT (SFU) so as to help apprehend the culprits as its obvious that people close to her executed this act.

In lieu of this, I will advise chiamaka to give full details of where her phone was during the period this transaction took place because investigations show that the same device and the same token assigned to Chiamaka were used to initiate this transaction during the period the fraudulent withdrawal was made.

As against the narratives that have been pushed out to the public, it’s obvious Chiamaka’s carelessness played a huge role in her unfortunate loss. Instead of blaming it on the innocent bank, It will be advisable for her to state the true situation of things to enable swift investigation that may lead to her recovery.

Bank

Alpha Morgan Bank Deepens Presence in Abuja with New Branch in Utako

Alpha Morgan Bank Deepens Presence in Abuja with New Branch in Utako

Marking another milestone in its expansion drive, Alpha Morgan Bank has opened a new branch in Utako, Abuja, reinforcing its strategy of building closer institutional ties within key business communities and bringing its financial expertise closer to individuals, and enterprises driving the city’s growth.

The new branch, located at Plot 1121 Obafemi Awolowo Way, Utako, Abuja is strategically positioned to serve individuals, entrepreneurs, and corporate clients within Utako and surrounding districts.

The expansion follows the Bank’s recently concluded Economic Review Webinar held in February 2026, as the bank continues to position as a thought-leader in the financial services industry.

Speaking on the opening, Ade Buraimo, Managing Director of Alpha Morgan Bank, said the move underscores the Bank’s commitment to accessibility and service excellence.

“Proximity matters in banking. As communities grow and commercial activity expands, financial institutions also evolve to meet customers where they are. The Utako Branch allows us to deliver our services to people in that community efficiently while maintaining the high standards our customers expect,”

The Utako location will provide a full suite of retail and corporate banking services, including account opening, deposits, transfers, business banking solutions, and financial advisory support.

Customers and members of the public are invited to visit the new Utako Branch to experience the Bank’s approach to satisfying banking.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Bank

Separating Fact from Confusion: What Nigerians Need to Know About the 7.5% VAT on Banking Service Fees

In recent weeks, digital-banking customers and social media, especially on Twitter have raised concerns about deductions labelled as “VAT” on transfers and other charges.

Some dangerously false narratives, which when you take a critical look, you’ll clearly see that they have been orchestrated and sponsored by malicious elements, have given the impression that the 7.5% Value Added Tax (VAT) is a new or arbitrary charge introduced by fintechs, or that it applies to the amounts customers send. These claims are misleading and deserve careful clarification which is the purpose of this piece.

First, it’s important to understand how VAT works in Nigeria’s financial sector today. VAT on fees and charges for financial services has long been part of Nigeria’s tax system. The then Federal Inland Revenue Service (FIRS) had issued information circulars on March 31, 2021 where it stated that VAT on Financial Services (Circular No. 2021/04) that most fees, commissions, and charges by financial institutions (banks, insurance companies, brokers) are subject to 7.5% VAT.

This justifies a recent advertorial the Nigeria Revenue Service (NRS) which stated unequivocally that VAT was not newly introduced on banking service charges by recent tax reforms, and that it did not impose a new tax obligation on customers in that regard.

However what was left unsaid in that publication was that on the 12th of December, the tax agency had written to all financial institutions and payment gateways based on past meetings with operators that following from the new Tax Act, they were reminded of their mandatory obligations to collect, deduct and remit VAT at the prescribed rate.

The Agency then gave an 18- day grace period to all players to configure and align their systems while directing full compliance with the directive with effect from January 19, 2026. And so, some fintechs sent messages to their customers in the spirit of clarity and transparency.

It must be said that what has changed is that in a bid to widen the tax net, microfinance banks and fintechs who were not obligated to deduct and remit said VAT before now, have now become compelled to do so. The enforcement and standardised collection of VAT across banks and fintech platforms including mobile transfers, USSD transaction fees, and card issuance fees with compliance deadlines issued by tax authorities. So why anyone would vilify any financial institution obeying the laws of the land beats my imagination.

For those who have raised questions around transparency and wrongly suggesting that fintechs are suddenly imposing new, unexplained costs on users – as it has been explained above, this is a matter of regulatory compliance, not a lack of transparency or customer exploitation. These VAT deductions are not new fees created by the companies themselves, and providers are not arbitrarily raising their prices.

In closing, two things that everyone must bear in mind as we move forward in this new tax climate – all stakeholders including fintech platforms and regulators must communicate better and clearly. Nigerians must refrain from peddling unsubstantiated claims and malicious narratives, it has no benefits for anyone and erodes trust in systems.

-

society6 months ago

society6 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news3 months ago

news3 months agoWHO REALLY OWNS MONIEPOINT? The $290 Million Deal That Sold Nigeria’s Top Fintech to Foreign Interests

-

society6 months ago

society6 months ago“You Are Never Without Help” – Pastor Gebhardt Berndt Inspires Hope Through Empower Church (Video)

-

Business6 months ago

Business6 months agoGTCO increases GTBank’s Paid-Up Capital to ₦504 Billion