Business

The Aviation General: Celebrating Festus Keyamo’s Transformative One Year in Office

One Year In Office: Celebrating Festus Keyamo’s Developmental Strides As Aviation General

Exactly one year ago, the appointment of Festus Keyamo SAN CON FCIarb (UK) as Nigeria’s Minister of Aviation and Aerospace Development was met with widespread skepticism. A renowned lawyer and public advocate, Keyamo was seen as an outsider to the aviation sector—a square peg in a round hole. Critics questioned his ability to navigate the complex world of aviation, where technical expertise and industry experience are often considered prerequisites for success. However, as we mark the one-year anniversary of his tenure, it is clear that Keyamo has defied expectations, emerging as a transformative force and a visionary leader in the aviation sector.

From the outset, Keyamo demonstrated a proactive approach that would come to define his leadership. One of his earliest victories was the realignment of Nigeria with the Capetown Convention, a crucial move that will open doors for local aviators to access international leasing markets. This achievement was not just a matter of policy but of strategic diplomacy. Keyamo’s engagement with the Attorney General, the Chief Justice of Nigeria, and other legal stakeholders is paving the way for this milestone, setting a strong foundation for future growth in the aviation sector.

Keyamo’s foresight was further evident when he facilitated the launch of Air Peace’s London Gatwick route. Many faulted his involvement in this endeavour, viewing it as too patronizing. Today, Keyamo’s decision has proven to be a masterstroke, significantly enhancing Nigeria’s presence on the global aviation stage. This bold move is a reflection of his broader vision to elevate the country’s aviation industry to international standards.

Central to Keyamo’s agenda has been the renegotiation of the London Heathrow Bilateral Air Service Agreement (BASA). Recognizing the imbalance in the current agreement, Keyamo has been a staunch advocate for fairness and reciprocity. His efforts to secure more favorable terms for Nigeria’s flag carriers underscore his commitment to ensuring that Nigerian airlines are not merely participants but key players in global aviation.

When tensions flared in the aviation sector over the contentious 50% revenue deductions, it was Keyamo’s diplomatic finesse that averted a potential crisis. His open letter to aviation workers, coupled with strategic negotiations with the federal government, resulted in a reduction of the deductions to 20%, thereby easing tensions and restoring industrial harmony. This episode highlighted Keyamo’s ability to navigate complex challenges with tact and resolve.

Keyamo’s engagement with global aviation giants like Boeing and Airbus further illustrates his determination to position Nigeria as a significant player in the industry. His discussions with Airbus in Toulouse and ongoing talks with Boeing in the U.S. are aimed at facilitating dry leasing options for Nigerian airlines, a move that could significantly boost the sector’s capacity and competitiveness.

Under Keyamo’s watch, Nigeria’s major airports have undergone significant improvements. From tackling corruption and touting to launching a Ministerial Task Force on Illegal Private Charter Operations, the transformation is palpable. Perhaps one of his most notable achievements was the swift resolution of the protracted land dispute that had stalled the Abuja Second Runway project for years. In just two weeks, Keyamo achieved what his predecessors could not, clearing the way for the commencement of construction—a clear indicator of his no-nonsense approach to governance.

Keyamo’s impact extends beyond infrastructure. Within a month of taking office, he ordered all international airlines to relocate to the new Lagos terminal, making it fully operational. His quick fixes to design flaws and collaboration with the immigration service to remodel Wing E at the Murtala International Airport, Lagos, have transformed the terminal into a state-of-the-art facility. This public-private partnership model exemplifies the innovative spirit Keyamo brings to his role.

The reactivation of Lagos’ Second Runway, which had been out of service for two years, is another feather in Keyamo’s cap. His decisive action restored full operational capacity to Nigeria’s busiest airport, further demonstrating his ability to tackle longstanding issues with urgency and efficiency.

One of the most vexing challenges in the industry—trapped funds for foreign airlines—was also resolved under Keyamo’s leadership. By working closely with the Central Bank of Nigeria, he cleared the backlog, restoring confidence in Nigeria’s aviation sector and reaffirming the country’s commitment to honoring its international obligations.

Some of the benefits of clearing the foreign airlines’ trapped funds is the resolve of Dubai visa issuance to Nigerians and the return of Emirates’ Nigeria/UAE flights, which industry experts have applauded as commendable. In not so long a time, specifically by October 1st, this year, Nigerians will have the luxury of reverting status quo by having the opportunity of frequenting the UAE once again, both for leisure and business purposes.

Keyamo’s successful negotiation with UK authorities to grant Air Peace reciprocal operating rights was a groundbreaking achievement. This move broke the longstanding monopoly of foreign airlines on the UK-Nigeria route, leading to more competitive airfares for Nigerian travelers and enhancing the nation’s aviation footprint.

In a bold step towards financial sustainability, Keyamo obtained Federal Executive Council (FEC) approval to require all VIPs to pay access fees at airport toll gates nationwide. This decision, ending decades of tradition, is a testament to his willingness to challenge the status quo in pursuit of progress.

Another monumental achievement under Keyamo’s watch was the United States-Nigeria Open Skies Air Transport Agreement entering into force. This agreement will pave the way for Nigerian airlines, as long as they can show capacity and consistency, to operate more freely on this crucial route, marking a significant leap forward for the industry.

Keyamo’s relentless efforts to establish a standard Maintenance, Repair, and Overhaul (MRO) facility that’ll accommodate wide-body-aircraft in Nigeria are nearing fruition. This initiative is poised to be a game-changer, reducing reliance on foreign facilities and cutting costs for airlines—a testament to Keyamo’s forward-thinking approach.

Perhaps one of his biggest challenges, the National Carrier project, is being handled with the utmost care and precision. With the supervision of Mr. President, Keyamo is keen on ensuring that this initiative is not just another political gimmick but a sustainable and profitable venture that will stand the test of time.

To combat illegal private charters and boost revenue, Keyamo launched a task force dedicated to this purpose. This initiative is already yielding results, with increased revenue generation for the industry and enhanced regulatory compliance.

Keyamo’s tenure has also been marked by a firm stand against corruption and misconduct in the aviation sector. His crackdown on touts and corrupt officials at airports has restored a sense of order and discipline in these critical hubs, enhancing the overall experience for travelers.

The ongoing upgrades to airport infrastructure across the country are a direct result of Keyamo’s proactive approach. His focus on quality and efficiency is evident in the improved facilities that travelers are beginning to experience, setting a new standard for the industry.

As the Honourable Minister celebrates his first year in office, it is clear that his appointment was one of the most astute decisions of President Tinubu’s administration. In just one year, he has laid a solid foundation for what promises to be a transformative tenure. His leadership is not just about fixing immediate problems but about building a legacy of excellence that will endure long after he has left office.

This 21-gun salute is not just a tribute to his remarkable achievements but a signal of the great things yet to come. With Festus Keyamo at the helm, Nigeria’s aviation sector is set to soar to new heights, cementing its place on the global stage.

Comrade Onajite Usman is a public affairs analyst and commentator from Ubiaja, Edo State.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

Business

BUA Group, AD Ports Group and MAIR Group Launch Strategic Plan for World-Class Sugar and Agro-Logistics Hub at Khalifa Port

BUA Group, AD Ports Group and MAIR Group Sign MoU to Explore Collaboration in Sugar Refining, Agro-Industrial Development, and Integrated Global Logistics Solutions

Abu Dhabi, UAE – Monday, 16th February 2026

BUA Group, AD Ports Group, and MAIR Group of Abu Dhabi today signed a strategic Memorandum of Understanding (MoU) to explore collaboration in sugar refining, agro-industrial development, and integrated global logistics solutions. The partnership aims to create a world-class platform that strengthens regional food security, supports industrial diversification, and reinforces Abu Dhabi’s position as a hub for trade and manufacturing.

The proposed collaboration will leverage BUA Group’s industrial and logistics expertise, Khalifa Port’s world-class infrastructure, and AD Ports Group’s operational experience. The initiative aligns with the objectives of the UAE Food Security Strategy 2051, which seeks to position the UAE as a global leader in sustainable food production and resilient supply chains. It also aligns with Nigeria’s food production- and export-oriented agricultural transformation agenda, focused on scaling domestic capacity, strengthening value addition, improving post-harvest logistics, and unlocking new markets for Nigerian produce across the Middle East, Asia, and beyond.

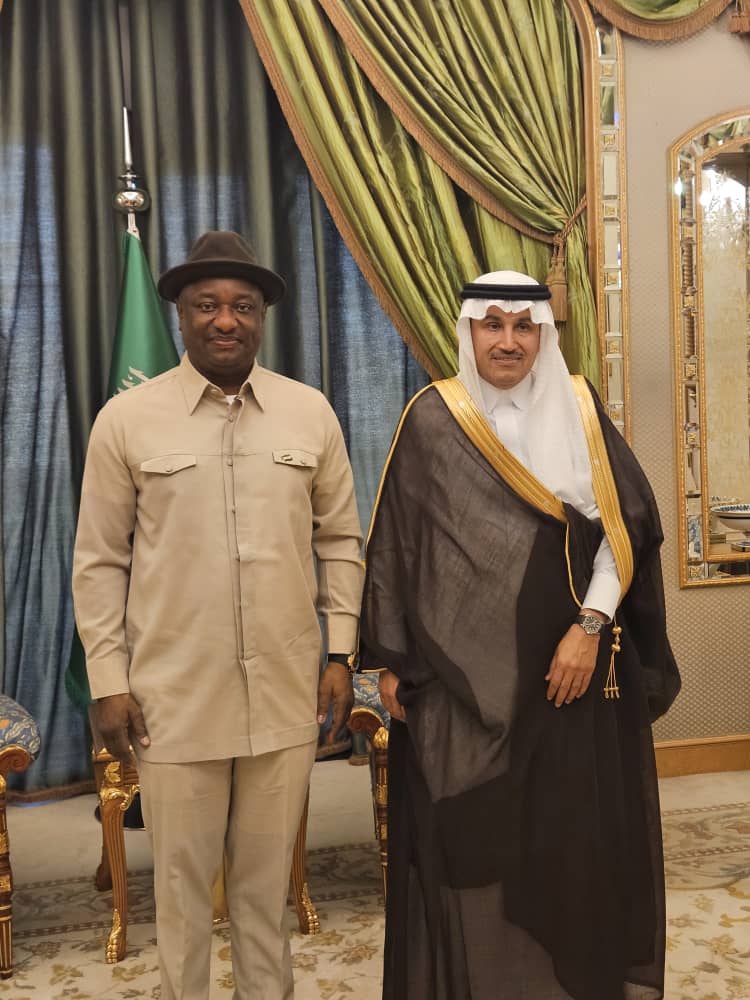

Photo Caption: L-R: Kabiru Rabiu, Group Executive Director, BUA Group; Cpt. Mohammed J. Al Shamisi, MD/Group CEO, AD Ports Group; Saif Al Mazrouei, CEO (Ports Cluster) AD Ports Group; Abdul Samad Rabiu, Founder/Executive Chairman, BUA Group; and Steve Green, Group CFO, MAIR Group

Through structured aggregation, processing, storage, and maritime export channels, the partnership is designed to reduce supply chain inefficiencies, enhance traceability and quality standards, and also create a predictable trade corridor between West Africa and the Gulf.

BUA Group—recognised as one of Africa’s largest and most diversified conglomerates, with major investments across sugar refining, food production, flour milling, cement manufacturing, and infrastructure- brings extensive industrial expertise and large-scale operational capability to the venture. MAIR Group will provide strategic support in developing integrated logistics and agro-industrial solutions, creating a seamless platform for production, storage, and distribution.

Abdul Samad Rabiu, Founder and Chairman of BUA Group, said:

“This MoU marks an important milestone in BUA’s international expansion and reflects our long-term vision of building globally competitive industrial platforms. Together with AD Ports Group and MAIR Group, we aim to develop sustainable food production and logistics solutions that strengthen regional supply chains and support the UAE’s Food Security Strategy 2051.”

He further added that, “This partnership represents not just a commercial arrangement but a strategic food corridor anchored on shared economic ambition, resilient infrastructure, and disciplined execution, reinforcing long-term food security objectives for both nations.”

A representative of MAIR Group added:

“This collaboration underscores our commitment to advancing strategic industries in Abu Dhabi and building integrated solutions that reinforce the UAE’s position as a global hub for trade, food security, and industrial excellence.”

A spokesperson from AD Ports Group commented:

“Our partnership with BUA Group and MAIR Group highlights Khalifa Port’s role as a catalyst for high-impact industrial investments. This initiative will enhance regional food security, strengthen global trade connectivity, and support Abu Dhabi’s economic diversification goals.”

This MoU marks a historic collaboration that combines world-class infrastructure, industrial expertise, and strategic vision, setting the stage for a sustainable and resilient food and logistics ecosystem that will benefit the UAE, the region, and global markets alike.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth