society

Three Nigerians Named on FBI’s Most-Wanted List for Alleged $6M Fraud Scheme

Three Nigerians Named on FBI’s Most-Wanted List for Alleged $6M Fraud Scheme

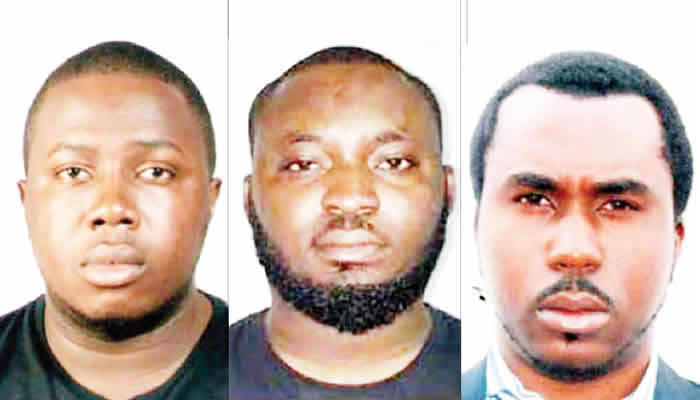

Three Nigerians, Nnamdi Benson, Richard Uzuh, and Felix Okpoh, have been added to the United States Federal Bureau of Investigation’s (FBI) Most-Wanted List for their alleged roles in a $6 million Business Email Compromise (BEC) scheme. The trio reportedly defrauded over 70 businesses in the U.S. using sophisticated cybercrime tactics, according to notices published on the FBI’s website.

The alleged scheme involved the use of spoofed emails and fraudulent wire transfers, targeting unsuspecting businesses. The FBI notes that the suspects conspired to launder proceeds from these scams through an intricate network of collaborators in the United States and abroad.

Details of the Allegations

Nnamdi Benson

Benson is accused of providing bank accounts to facilitate the receipt of funds from fraudulent transactions. He is also alleged to have engaged in romance and advance-fee fraud schemes independently. In August 2019, he was indicted in the U.S. District Court, District of Nebraska, on charges of conspiracy to commit wire fraud. A federal warrant for his arrest was issued the following day.

The FBI notice states:

“Benson allegedly provided bank accounts to Richard Izuchukwu Uzuh that were used to receive fraudulent wire transfers. On August 21, 2019, Benson, along with Felix Osilama Okpoh and Abiola Ayorinde Kayode, was indicted for Conspiracy to Commit Wire Fraud.”

Felix Okpoh

Okpoh is accused of supplying hundreds of bank accounts to Uzuh and other co-conspirators, enabling the transfer of over $1 million in fraudulent proceeds. Like Benson, he was indicted in August 2019 and is wanted on charges of conspiracy to commit wire fraud.

The FBI highlights:

“Bank accounts provided by Okpoh received fraudulent wire transfers from victim businesses totaling over $1 million.”

Richard Uzuh

Uzuh is alleged to have orchestrated the fraudulent scheme by sending spoofed emails to businesses across the U.S., requesting wire transfers. He reportedly worked closely with other members of the syndicate, including money launderers and romance scammers, to move stolen funds.

Uzuh’s indictment dates back to October 2016, making him the earliest member of the trio to be charged. The FBI stated:

“Uzuh allegedly worked with money launderers, romance scammers, and others involved in BEC schemes to launder proceeds of their crimes.”

Extradition of Co-Conspirator Abiola Kayode

The case has seen recent developments, with the extradition of a key member of the syndicate, Abiola Ayorinde Kayode, from Ghana to the United States. Kayode was arrested in Ghana in April 2023 following an indictment filed in Nebraska in August 2019.

On December 13, the U.S. Attorney’s Office for the District of Nebraska confirmed Kayode’s extradition. He is now in U.S. custody and faces prosecution for his alleged involvement in the cybercrime network.

FBI’s Warning and Public Appeal

The FBI continues to urge individuals with information on the whereabouts of Benson, Uzuh, and Okpoh to come forward. The agency has emphasized the global reach of BEC schemes and the devastating financial impact on victims.

Business Email Compromise remains one of the costliest forms of cybercrime, with perpetrators leveraging fake identities, fraudulent communications, and elaborate laundering networks to exploit victims.

society

Underfunding National Security: Envelope Budgeting Fails Nigeria’s Defence By George Omagbemi Sylvester

Underfunding National Security: Envelope Budgeting Fails Nigeria’s Defence

By George Omagbemi Sylvester | Published by saharaweeklyng.com

“Fiscal Rigidity in a Time of Crisis: Lawmakers Say Fixed Budget Ceilings Are Crippling Nigeria’s Fight Against Insurgency, Banditry, and Organized Crime.”

Nigeria’s legislature has issued a stark warning: the envelope budgeting system; a fiscal model that caps spending for ministries, departments, and agencies (MDAs) is inadequate to meet the country’s escalating security challenges. Lawmakers and budget analysts argue that rigid fiscal ceilings are undermining the nation’s ability to confront insurgency, banditry, kidnapping, separatist violence, oil theft and maritime insecurity.

The warning emerged during the 2026 budget defence session for the Office of the National Security Adviser (ONSA) at the National Assembly in Abuja. Senator Yahaya Abdullahi (APC‑Kebbi North), chairman of the Senate Committee on National Security and Intelligence, decried the envelope system, noting that security agencies “have been subject to the vagaries of the envelope system rather than to genuine needs and requirements.” The committee highlighted non-release or partial release of capital funds from previous budgets, which has hindered procurement, intelligence and operational capacity.

Nigeria faces a multi‑front security crisis: persistent insurgency in the North‑East, banditry and kidnappings across the North‑West and North‑Central, separatist tensions in the South‑East, and piracy affecting Niger Delta oil production. Despite declarations of a national security emergency by President Bola Tinubu, lawmakers point to a “disconnect” between rhetoric and the actual fiscal support for agencies tasked with enforcement.

Experts warn that security operations demand flexibility and rapid resource allocation. Dr. Amina Bello, a public finance specialist, said: “A static budget in a dynamic threat environment is like sending firefighters with water jugs to a forest fire. You need flexibility, not fixed ceilings, to adapt to unforeseen developments.”

The Permanent Secretary of Special Services at ONSA, Mohammed Sanusi, detailed operational consequences: irregular overhead releases, unfulfilled capital appropriations, and constrained foreign service funds. These fiscal constraints have weakened intelligence and covert units, hampering surveillance, cyber‑security, counter‑terrorism and intelligence sharing.

Delayed capital releases have stalled critical projects, including infrastructure upgrades and surveillance systems. Professor Kolawole Adeyemi, a governance expert, emphasized that “budgeting for security must allow for rapid reallocation in response to threats that move faster than political cycles. Envelope budgeting lacks this essential flexibility.”

While the National Assembly advocates fiscal discipline, lawmakers stress that security funding requires strategic responsiveness. Speaker Abbas Ibrahim underscored that security deserves “prominent and sustained attention” in the 2026 budget, balancing oversight with operational needs.

In response, the Senate committee plans to pursue reforms, including collaboration with the executive to restructure funding, explore supplementary budgets and ensure predictable and sufficient resources for security agencies. Experts warn that without reform, criminal networks will exploit these gaps, eroding public trust.

As one policy analyst summarized: “A nation declares a security emergency; but if its budget does not follow with real resources and oversight, the emergency remains rhetorical.” Nigeria’s debate over envelope budgeting is more than an accounting dispute; it is a contest over the nation’s security priorities and its commitment to safeguarding citizens.

society

Rev. Mother Kehinde Osoba (Eritosin) Celebrates as She Marks Her Birthday

Rev. Mother Kehinde Osoba (Eritosin) Celebrates as She Marks Her Birthday

Today, the world and the body of Christ rise in celebration of a rare vessel of honour, Rev. Mother Kehinde Osoba, fondly known as Eritosin, as she marks her birthday.

Born a special child with a divine mark of grace, Rev. Mother Eritosin’s journey in God’s vineyard spans several decades of steadfast service, spiritual depth, and undeniable impact. Those who know her closely describe her as a prophetess with a heart of gold — a woman whose calling is not worn as a title, but lived daily through compassion, discipline, humility, and unwavering faith.

From her early days in ministry, she has touched lives across communities, offering spiritual guidance, prophetic insight, and motherly counsel. Many testify that through her prayers and teachings, they encountered God in a deeply personal and transformative way. Near and far, her influence continues to echo — not only within church walls, but in homes, families, and destinies reshaped through her mentorship.

A mother in every sense of the word, Rev. Mother Kehinde Osoba embodies nurture and correction in equal measure. As a grandmother, she remains energetic in purpose — accommodating the wayward, embracing the rejected, and holding firmly to the belief that no soul is beyond redemption. Her life’s mission has remained consistent: to lead many to Christ and guide them into the light of a new beginning.

Deeply rooted within the C&S Unification, she stands tall as a spiritual pillar in the Cherubim and Seraphim Church globally. Her dedication to holiness, unity, and prophetic service has earned her widespread respect as a spiritual matriarch whose voice carries both authority and humility.

As she celebrates another year today, tributes continue to pour in from spiritual sons and daughters, church leaders, and admirers who see in her a living reflection of grace in action.

Prayer for Rev. Mother Kehinde Osoba (Eritosin)

May the Almighty God, who called you from birth and anointed you for His service, continually strengthen you with divine health and renewed vigour.

May your oil never run dry, and may your prophetic mantle grow heavier with greater glory.

May the lives you have nurtured rise to call you blessed.

May your latter years be greater than the former, filled with peace, honour, and the visible rewards of your labour in God’s vineyard.

May heaven continually back your prayers, and may your light shine brighter across nations.

Happy Birthday to a true Mother in Israel — Rev. Mother Kehinde Osoba (Eritosin).

More years.

More anointing.

More impact.

If you want this adapted for a newspaper page, church bulletin, Facebook post, or birthday flyer, just tell me the format and tone.

society

Electoral Act Signed Amid Debate — Tinubu Warns: “We Must Avoid Glitches and Hacking”

Electoral Act Signed Amid Debate — Tinubu Warns: “We Must Avoid Glitches and Hacking”

By George Omagbemi Sylvester | Published by saharaweeklyng.com

“President defends hybrid voting framework, says mandatory electronic transmission could expose Nigeria’s elections to cyber vulnerabilities and infrastructural breakdown ahead of 2027 polls.”

In a pivotal move shaping Nigeria’s electoral future, President Bola Ahmed Tinubu signed the Electoral Act 2026 (Amendment) Bill into law on Wednesday, February 18, 2026, at the State House, Abuja. The assent, attended by key legislators and political leaders, marks a decisive moment ahead of the 2027 general elections. Tinubu cited the need to safeguard elections against technological failures and cyber threats as the central reason for his decision.

“The transmission of that manual result is what we’re looking at, and we need to avoid glitches; interference, unnecessary hacking in this age of computer inquisitiveness,” Tinubu stated, framing the amendments as essential procedural safeguards rather than partisan interventions.

The law retains manual voting, counting and collation as the foundation of Nigeria’s electoral process. Ballots are cast and counted physically at polling units, after which Form EC8A is electronically transmitted to the Independent National Electoral Commission’s (INEC) portal. If electronic systems fail, the manually endorsed Form EC8A remains authoritative. This compromise reflects a balance between technological innovation and practical reliability, ensuring elections can proceed even amid infrastructural challenges.

A contentious element, Clause 60(3), empowers electronic transmission but stops short of making it mandatory, granting INEC discretion in areas with limited connectivity. Critics argue this optionality could weaken transparency, while proponents defend it as a pragmatic safeguard against system failures and cyber vulnerabilities.

Senate President Godswill Akpabio, who oversaw the National Assembly’s harmonization process, hailed the law as meeting Nigerians’ aspirations and addressing perennial weaknesses in result collation between polling units and central offices. He also highlighted provisions strengthening party democracy and internal election processes.

Former FCT Minister Nyesom Wike praised the prompt signing, emphasizing that it demonstrates a commitment to strengthening Nigeria’s democratic institutions and reducing legal and political uncertainty surrounding elections.

Despite these endorsements, some civil society organizations and opposition voices caution that the law may not fully prevent electoral fraud or politically driven result manipulation, particularly given the optional electronic transmission. This debate underscores broader concerns in Nigerian politics about institutional trust, digital readiness, and confidence in the electoral framework.

Electoral experts note that technology alone cannot guarantee transparency. One specialist observed, “Real-time transmission is a powerful tool, but without resilient infrastructure and institutional safeguards, its promise can become a vulnerability.” Tinubu’s cautious approach reflects this logic, prioritizing reliability over speed.

The 2027 elections will be the first test of this hybrid system. Success will depend on the integrity of officials, the robustness of the INEC infrastructure and the electorate’s confidence. Tinubu stressed that public trust is central: reforms must be credible and fully implemented to reinforce democratic legitimacy.

In sum, the Electoral Act 2026 represents a defining moment for Nigeria’s democracy, positioned at the intersection of technological opportunity and practical governance. Its effectiveness in delivering credible, transparent and trusted elections will set the tone for the nation’s political trajectory in the coming years.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING