news

TINUBU SIGNS LANDMARK TAX REFORMS INTO LAW, SETS NIGERIA ON THE PATH TO A $1 TRILLION ECONOMY

By Prince Adeyemi Aseperi-Shonibare

Public Analyst and APC Member

In a bold and defining move poised to reshape Nigeria’s economic trajectory, President Bola Ahmed Tinubu has signed into law four far-reaching tax bills passed by the National Assembly. The reforms mark the most ambitious overhaul of Nigeria’s tax system in over half a century, aimed squarely at strengthening government revenue, stimulating private sector growth, and positioning Africa’s largest economy to achieve its target of becoming a $1 trillion economy by 2030.

At a formal signing ceremony held at the State House on Thursday, the President declared that the new laws signal a new lease of life for the country’s economy and its people. “We are in transit; we have changed the roads. We have changed some of the misgivings. We have opened the doors to a new economy and new opportunities,” Tinubu said.

The four tax laws are:

1. Nigeria Tax Bill (Ease of Doing Business)

2. Nigeria Tax Administration Bill

3. Nigeria Revenue Service (Establishment) Bill

4. Joint Revenue Board (Establishment) Bill

The reform package is the culmination of intense policy work led by the Presidential Committee on Fiscal Policy and Tax Reforms, chaired by renowned fiscal expert Mr. Taiwo Oyedele. The initiative aims to eliminate redundant taxes, unify tax administration across all levels of government, digitalize collection systems, and promote equity through progressive tax structures.

WHAT THE NEW TAX LAWS ENTAIL

The Nigeria Tax Bill consolidates all fragmented and conflicting tax statutes into a harmonized code. It retains the current 7.5% VAT rate, introduces progressive personal income tax brackets (0% for minimum-wage earners, up to 25% for ultra-high-income earners), and eliminates tax burdens on NGOs, compensation for injury, and low-earning digital entrepreneurs. A 4% development levy on corporate profits will fund student loans and infrastructure through the Nigeria Education Loan Fund.

The Nigeria Tax Administration Bill standardizes tax operations at federal, state, and local government levels. It mandates joint audits, integrated taxpayer databases, and digital monthly filings for high-risk sectors like international shipping and aviation. Penalties are now streamlined to reduce arbitrariness and corruption.

The Nigeria Revenue Service (Establishment) Bill replaces the Federal Inland Revenue Service (FIRS) with the Nigeria Revenue Service (NRS)—a fully autonomous national revenue authority with enhanced powers to manage all public revenues including taxes, oil royalties, and levies from over 100 agencies. The new agency is performance-based and digitally driven.

The Joint Revenue Board Bill institutionalizes federal-state-local government collaboration. It enables shared infrastructure, technology, and dispute resolution frameworks. A national Tax Appeal Tribunal and Tax Ombudsman will be established to ensure fairness and justice for taxpayers.

WIN ,WIN ,SITUATION FOR ALL

For state governments, these reforms are a game changer. States will now retain 30% of VAT generated within their jurisdiction, receive 50% equal-share distribution, and 20% based on population. With streamlined processes and digital tax integration, states are now empowered to grow their internally generated revenue (IGR) sustainably and reduce reliance on federal allocation.

For the federal government, the reforms boost non-oil revenue, cut wasteful duplication among MDAs, and raise Nigeria’s tax-to-GDP ratio from a low 10.8% toward the continental benchmark of 18%. This reduces the fiscal deficit and strengthens Nigeria’s standing in global capital markets.

For corporate organizations and SMEs, the reforms bring clarity and predictability. Businesses with under ₦50 million turnover will enjoy 0% corporate tax. VAT input claims are now standardized, compliance processes are digital, and there are tax reliefs for investments in education, infrastructure, and agriculture.

For citizens, especially low-income earners, the progressive income tax brackets mean more disposable income. Compensation for injury or trauma under ₦50 million is now tax-exempt. Digital access to tax filing, reduced harassment, and better service delivery are built into the new tax ecosystem.

For international investors and development partners, the unified tax framework offers legal certainty, ease of compliance, and compatibility with global standards. The reforms also align Nigeria with the OECD’s global minimum tax requirements for multinational corporations.

IMPACT ON ECONOMIC DEVELOPMENT AND THE $1 TRILLION GDP AMBITION

According to the World Bank’s 2024 Nigeria Development Update, Nigeria’s path to a $1 trillion economy by 2030 hinges on structural reforms, public investment, and fiscal discipline. These tax laws directly address those imperatives.

“Revenues are surging… The ultimate purpose here is jobs and opportunities,” said Alex Sienaert, the World Bank’s lead economist for Nigeria. The World Bank estimates that with effective reform implementation, Nigeria’s GDP could double over the next five years, fueled by non-oil growth in agriculture, services, and manufacturing.

The IMF also praised Nigeria’s fiscal efforts. IMF Managing Director Kristalina Georgieva noted, “It’s been really good to see the government taking these head on… expanding social protection to target the most vulnerable.” This fiscal consolidation—combined with subsidy removal, FX reforms, and targeted social programs—has significantly improved Nigeria’s credit outlook.

International confidence is rising. Nigeria is in talks to rejoin JPMorgan’s Emerging Market Government Bond Index, signalling renewed foreign investor interest. Morgan Stanley analysts predict that Tinubu’s policy reforms “could fuel economic growth and the rise of a mass consumer market.”

Brazil’s recent $1 billion agricultural agreement with Nigeria is another strong vote of confidence. With new revenue, the government can expand infrastructure, digitize public services, and fund large-scale investments in power, transport, and education.

ECONOMIC ANALYSIS OF THE REFORMS

Dr. Bismarck Rewane described the reforms as “the first serious attempt in over 30 years to treat taxation as a tool for national development, rather than merely a channel for revenue collection.”

Dr. Sarah Alade observed: “The harmonization under this bill will reduce friction and stimulate business growth, especially in the SME space.”

Professor Ode Ojowu emphasized that “progressive taxation reflects redistributive justice. That is good economics and better politics.”

Ifueko Omoigui Okauru stated: “Establishing a performance-based NRS is long overdue. Autonomy breeds accountability.”

Professor Akpan Ekpo said: “This bill introduces structure and predictability, which are critical for investor confidence.”

Dr. Andrew Nevin noted: “Joint audits and unified data are powerful tools to expand the tax net without raising rates.”

Eze Onyekpere called the Joint Revenue Board “the administrative glue that binds the reform.”

Alex Sienaert concluded: “If implemented with discipline, these reforms could raise Nigeria’s tax-to-GDP ratio by five to seven percentage points.”

Kristalina Georgieva added: “This is comprehensive, courageous, and overdue.”

A PRESIDENTIAL LEGACY IN THE MAKING

Taiwo Oyedele remarked: “History will remember you for good for transforming our country.”

Dr. Zacch Adedeji described the signing as “the happiest day of my professional life.”

Senate President Godswill Akpabio said: “You have birthed a tax system that will last for generations.”

CONCLUSION

President Tinubu’s tax reforms are not just fiscal adjustments—they are a foundational blueprint for Nigeria’s economic rebirth. By prioritizing fairness, efficiency, and inclusivity, these laws aim to build trust in government, empower states, attract global capital, and enable Nigeria to take its rightful place as an emerging economic powerhouse.

However, these reforms must not remain locked away in government files or limited to elite policy circles. The federal and state governments must commit to sustained public sensitization—through town halls, multilingual roadshows, traditional and social media, and engagement with business associations, community leaders, religious institutions, and market unions. Citizens need to understand what has changed, how it affects them, and how to comply. Only through nationwide enlightenment can the spirit of these reforms be translated into real progress.

If implementation stays consistent and inclusive communication follows, Nigeria’s dream of a $1 trillion economy by 2030 will not only be possible, but inevitable.

news

Energy experts defend Dangote, blast marketers over blackmail attempt on fuel price hike

Energy experts in Nigeria’s downstream petroleum sector have defended the pricing structure of the Dangote Petroleum Refinery, accusing some fuel markers of attempting to blackmail the refinery and mislead the public over the recent increase in petrol prices.

The experts said reports suggesting that the refinery’s latest adjustment is solely responsible for the recent hike in fuel prices were misleading, noting that importers are also bringing in petrol at almost a N1,000 per litre, while the refinery’s coastal price is N948 and the gantry or ex-depot price stands at N995 per litre.

They stressed that public comparisons fail to consider the differences in pricing structures and supply channels.

According to the experts, N948 per litre represents the coastal delivery price, which refers to petroleum products transported by marine vessels or barges from the refinery to depots along the coastline. On the other hand, N995 per litre represents the gantry or ex-depot price, which is the rate paid by marketers who load petrol directly from the refinery into tanker trucks at the loading gantry for onward distribution across the country.

The experts explained that the two figures should not be interpreted as conflicting prices but rather as different logistics arrangements within the petroleum distribution chain.

Speaking with our correspondent on Sunday, energy expert David Okon said the pricing adjustments were inevitable given prevailing market conditions.

According to him, Dangote Petroleum Refinery & Petrochemicals operates in a deregulated market and procures crude at international prices, which have risen sharply due to geopolitical tensions in the Middle East.

“The refinery is already absorbing part of the cost to cushion the impact of the crisis on Nigerians. We can see what is happening in other parts of the world where shortages and scarcity are being reported despite higher prices, yet the Dangote Refinery has continued to guarantee domestic supply,” he said.

Okon explained that when the refinery previously sold petrol at N774 per litre, crude oil was landing at about $68 per barrel. However, with crude now arriving at roughly $95 per barrel, the cost difference of about $27 per barrel translates to nearly N40,000 per barrel when converted to Naira.

“You cannot expect a refinery to continue selling at the old rate under those circumstances,” he added.

“If imported products were truly cheaper, importers would still be selling at the previous prices.”

He warned that without local refining capacity, Nigeria could have faced severe fuel shortages, long queues at filling stations and a resurgence of black market sales.

“Without the Dangote Refinery, many filling stations would likely shut down, queues would return across the country and black market traders would exploit the situation, hawking four litres keg at N20,000 or more. The refinery has effectively prevented that scenario,” he said.

Another analyst, Mohammed Ibrahim, also faulted narratives circulating in some quarters suggesting that the refinery’s pricing adjustment was responsible for worsening economic hardship in the country.

Accusing some importers of attempting to manipulate public perception, he said, “What we are seeing is nothing but deliberate blackmail by some fuel importers who feel threatened by local refining.

“They are twisting the pricing structure to mislead Nigerians and create unnecessary panic in the market.

“By exaggerating the refinery’s gantry price and ignoring the comparable costs of imported fuel, they are trying to make it appear as though Dangote Refinery is the cause of rising prices and economic hardship. This is a calculated attempt to protect their import businesses and undermine local refining, which is meant to reduce our dependence on imported petrol.”

Ibrahim added that such narratives were aimed at portraying the refinery as the reason Nigerians were struggling with higher petrol prices.

He stressed that petrol pricing in Nigeria is largely influenced by global crude oil prices, exchange rate fluctuations, and distribution logistics, noting that these factors affect both locally refined and imported fuel in the country’s deregulated market.

Afolabi Olowookere, Managing Director and Chief Economist at Analysts’ Data Services and Resources (ADSR) Limited, explained that although Nigerians expect refined products from the refinery to be significantly cheaper, prevailing market realities such as global crude oil prices, the cost of crude supply and refining margins make substantial price reductions unlikely in the short term.

“Therefore, improving domestic crude allocation to the refinery would strengthen supply stability and enhance the long term benefits of local refining for the economy,” Olowookere noted.

Recent conflicts in the Middle East and disruptions along key shipping lanes have tightened global oil supply, pushing crude prices past $90 per barrel, a development that directly raises the cost of both imported and locally refined petrol in Nigeria.

The unrest has pushed up fuel costs and transportation in several countries, including Ghana, the United States, the United Kingdom, South Africa, India, Canada, Brazil, Germany, France, and Japan, as rising crude prices increase the cost of refining, distribution, and logistics globally.

news

CHETACHI NWOGA-ECTON EMPOWERS 300 WIDOWS IN IMO

CHETACHI NWOGA-ECTON EMPOWERS 300 WIDOWS IN IMO

A renowned humanitarian and proud daughter of Mbaise in Imo State, High Chief (Dr.) Princess Chetachi Nwoga-Ecton, has empowered over 300 widows and vulnerable women across the Owerri Zone, in a remarkable demonstration of compassion and service to humanity.

The empowerment programme, which took place at the Palace of the Eze of Ngor Okpala, HRH Eze Engr. Fredrick Nwachukwu, brought together community leaders, traditional rulers, women groups and beneficiaries from different communities within the zone.

During the event, the widows received food materials and cash support, aimed at helping them meet basic needs and strengthen their small-scale businesses.

The initiative was widely applauded as a timely intervention to support women who often face severe economic hardship after losing their spouses.

Many of the beneficiaries expressed heartfelt appreciation to High Chief (Dr.) Nwoga-Ecton, describing the empowerment as a lifeline that would help them take better care of their families.

Some widows, while offering prayers for the philanthropist, noted that the gesture had restored hope and dignity in their lives.

Fondly known as Ada Imo and Adaure, High Chief (Dr.) Princess Chetachi Nwoga-Ecton has earned widespread admiration for her consistent humanitarian efforts both within Nigeria and internationally.

Through her philanthropic activities and foundations, she has continued to support widows, children, and vulnerable communities with interventions in healthcare, welfare and economic empowerment.

Community stakeholders who attended the programme commended the Mbaise-born philanthropist for her generosity and dedication to uplifting the less privileged, noting that her actions reflect true leadership and compassion.

Observers say the initiative further reinforces her growing reputation as one of the most impactful humanitarians of this generation, whose commitment to humanity continues to inspire hope across Imo State and beyond.

news

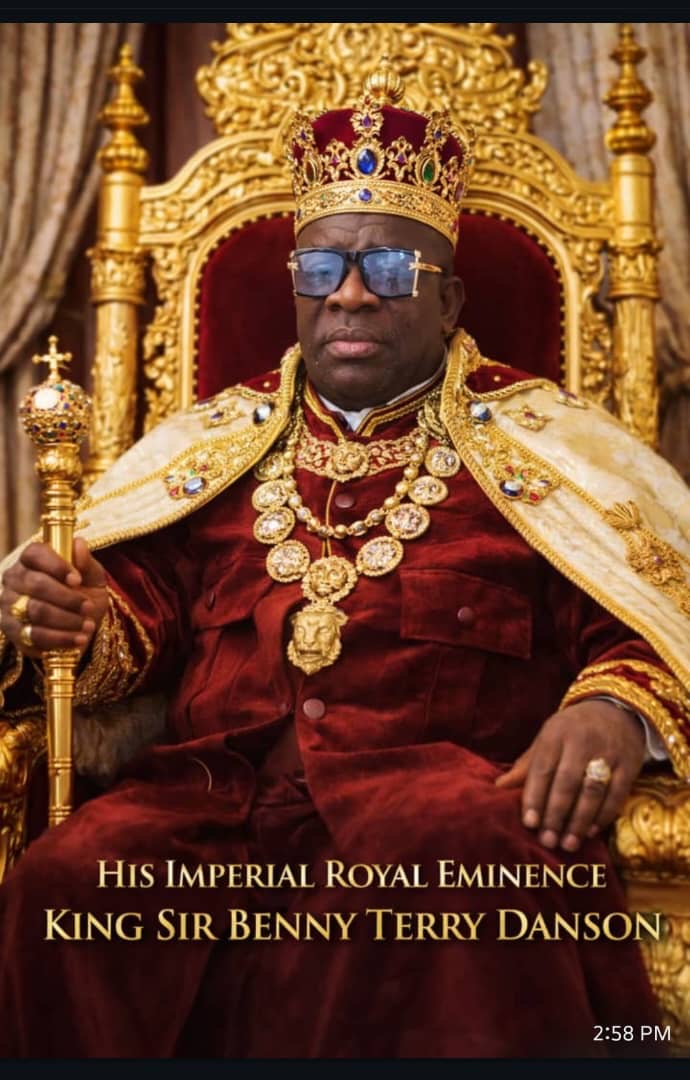

UNITED KINGDOM OF ATLANTIS ANNOUNCES APPOINTMENT OF ACTING ADMIN KING OF THE UKA THRONE

UNITED KINGDOM OF ATLANTIS ANNOUNCES APPOINTMENT OF ACTING ADMIN KING OF THE UKA THRONE

March 6, 2026 – In a landmark royal decree, the Office of the Minister of Information & Culture of the United Kingdom of Atlantis (UKA) has announced the appointment of His Imperial Royal Eminence, King Sir Benny Terry Danson, as the Acting Admin King of the UKA Throne. The nomination was issued through an official directive from the UKA Throne and is intended to pave the way for King Sir Benny Terry Danson’s eventual ascension to the title of Official Emperor Admin of the Throne, subject to the completion of necessary formal and constitutional processes.

The UKA Throne emphasized that the appointment underscores its unwavering commitment to competence, dedication, and integrity as the guiding principles for all administrative functions within the government structure. Officials stated that the decision is a strategic move to reinforce national leadership and accelerate the kingdom’s vision of becoming a more efficient, progressive, and unified nation.

The new Acting Admin King will oversee initiatives aimed at fostering sustainable growth, improving public service delivery, and promoting collective national development among citizens and followers of the UKA. The government expressed deep appreciation for the continuous love, loyalty, and support shown by the populace, noting that public engagement is essential for the kingdom’s shared prosperity and advancement.

Further details regarding the formalization of the appointment, including ceremonial schedules and administrative timelines, will be released to the public in due course through official communication channels.

Report Highlights:

– Nominee: King Sir Benny Terry Danson, Acting Admin King.

– Objective: Transition toward becoming Official Emperor Admin of the UKA Throne.

– Focus: Strengthening governance through competence, dedication, and integrity.

– Impact: Expected to drive national efficiency, progress, and unity.

– Next Steps: Official ceremonies and constitutional procedures to follow.

-

society6 months ago

society6 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news3 months ago

news3 months agoWHO REALLY OWNS MONIEPOINT? The $290 Million Deal That Sold Nigeria’s Top Fintech to Foreign Interests

-

Business6 months ago

Business6 months agoGTCO increases GTBank’s Paid-Up Capital to ₦504 Billion

-

society6 months ago

society6 months ago“You Are Never Without Help” – Pastor Gebhardt Berndt Inspires Hope Through Empower Church (Video)