Business

UNION BANK TAKES OVER SANI DANGOTE’S DANSA FOODS OVER N4 BILLION DEBT

This is not the best of times for Dana Foods boss, Sani Dangote who is the junior brother of one of

the Nigeria foremost Industrialist, Alhaji Aliko Dangote.

He is reported to have run into trouble waters as a commercial bank in Nigeria Union bank plc has appointed a Lagos Lawyer, Barrister Chukwudi Enebeli of Pinheiro and company as Receiver/Manager over his company Dansa foods limited.

The takeover of Dansa foods limited was as a result of inability of Alhaji Sani Dangote to pay back a loan of N4 billion he obtained from the bank.

Mr Chukwudi Enebeli was appointed under the deed of Denture to take over all assets of Dansa Foods limited a company incorporated in Nigeria and having its registered office at 1, Dansa Drive off

Badagry Expressway, Abule Oshun Lagos as a charge was created in favour of Union bank

over all fixed and floating assets of the company to secure the monies expressly borrowed.

By virtue of the said of the ALL ASSETS DEBENTURE, the balance of an outstanding sums thereby secured have become payable and the company has failed or neglected to pay the sums due in spite of repeated demands by the bank.

Consequently, further to the power set out in ALL ASSETS DEBENTURE the bank then exercise its power to appoint a receiver as set down in the said ALL ASSETS DEBENTUURE The Deed of Debenture appointing Mr Chukwudi Enebeli of Pinheiro and company 8A Taiwo Koya street. Ilupeju Bye- Pass Lagos has been filed and registered with Corporate Affair Commission at Abuja.

Meanwhile, due to the obstinacy and resistance of the Directors of Dansa foods company to allow the Receiver/Manager to perform his duty of running the company smoothly, the Receiver/Manager Barrister Chukuwudi Enebeli alongside Union bank of Nigeria Plc and Dansa Foods limited in Receivership have dragged Alhaji Sani Dangote and three other Directors of the company Alhaji Abdulkaarim Lawal Kaita, Alhaji Ahmed Shehu Yakasai and Alhaji Mohammed Sani Dangote before a Federal high court in Lagos,seeking the following orders of the court:

(1) A Declaration that upon the

appointment of Mr chukwudi Enebeli as

Receiver/Manager over Dansa foods Limited

the respondents who are Directors and

shareholders of the company have no power

or control over the company or any of its

assets.

(2) A Declaration that by virtue of

clauses 8 and 9 of the Deed of Debenture

dated 29th of May,2009 in favour of Mr

chukwudi Enebeli the Receiver/Manager

appointed by Union bank of Nigeria Plc is

entitled to perform all functions

specified in the deed of all assets

Debenture.

(3) An order directing all creditors of

Dansa foods Limited to pay and domicile

all monies due, incomes,or receivables

accruing to or due to the company into the

receivership account opened by the

Receive/Manager in Union bank Plc.

(4)A order of the court directing the

Receiver/Manager in exercise and discharge

of his function to take such steps as may

necessary and exercise such powers

including the powers to take over and

apply in realization of the company’s debt

to Union bank Plc all monies due to the

company

(5) An order restraining all the

respondents and their agents from

disturbing the Receiver/Manager from

exercising. Powers vested in him whether

by himself or his agents

(6) An order directing all Police Officers

of the Federal Republic of Nigeria or

other officers concerned with security and

enforcement of order to with “The

Inspector General of Police, Assistant.

Inspector General of Police and other

Police officers so instructed by the

Receiver/Manager to assist him in

performance of his duutes

In an affidavit sworn to by Mrs Olorunfunmilola Ayoola,head Food team of Union bank ,filed and argued before the court by Mr Kemi Pinheiro SAN,the Deponent averred that sometimes in 2008 Dansa Foods Limited was at its request granted loan of N5,200,000,000 by Union bank plc

The loan comprises of the following:

(1)Overdraft-N500million

(2)Short term loan for advertisement-

N500million

(3)Equipment lease-US$2,500,000,

(N300million)

(4)Equipment lease(sale and lease back)-US

$2,500,000(N300milion)

(5)Import Finance-US

$30,000,000(3,600,000,000)

The loan was disbursed to Dansa Foods company and fully utilized by the company.

The company duly executed a deed of all assets debenture in favour of Union bank

However, the company has failed to liquidate its indebtedness to the bank despite the services of several demand letters by the bank and its solicitors on the company.

Consequent upon the default of the company, the bank in exercise of its power under the clauses 8 and 9 of the all assets debenture appointed Mr Chukuwudi Enebeli as Receiver/Manager over the company,subsequently the said deed of appointment was filed at the Corporate Affairs Commission and a certificate of such filling accordingly issued.

Mrs Ayoola averred further that the loans granted the company are depositors funds and if same is not recover through the Receiver/Manager,the survival of the bank will jeopardized in view of the amount of the indebtedness consequently urged the court to grant the prayers sought by the bank so as to prevent the respondents who are directors and shareholder of the company from dissipating the assets of the company and for the effective discharge of the powers of the Receiver/Manager.

However, in a preliminary objection filed before the court by Mr Rickey Tarfa SAN on behalf of the respondents,he urged the court to strick out the suit on the ground that Mr ckuwudi Enebeli being a party in the suit,lacks the capacity to act as counsel for parties in the suit of the

instant application,in addition Mr Segun Odubela from the law firm of Ricky Tarfa contended that the court processes were signed by Chukwudi Enebeli as counsel acting for Union bank plc and Dansa Foods

Limited in receivership.

The presiding Judge Mohammed Yunusa has adjourned till 19th October, when

judgement will be delivered.

Business

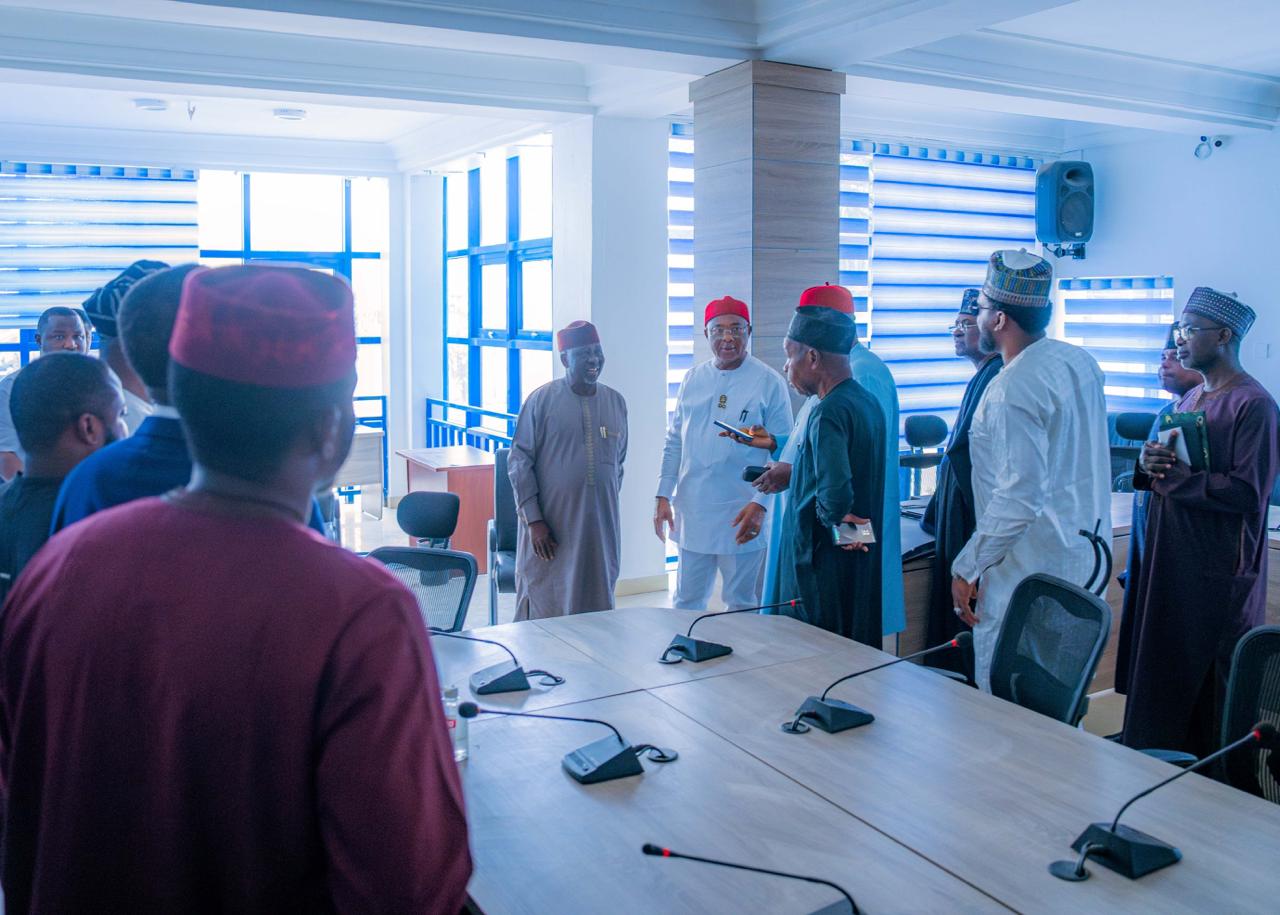

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors, led by its Director-General and the Governor of Imo State, Hope Uzodinma, alongside Zonal Coordinators (NW, NC, SE), the Media & Publicity Directorate, and other key stakeholders, inspected the RHA Secretariat two days after President Bola Tinubu unveiled the Renewed Hope Ambassadors grassroots engagement drive in Abuja.

Business

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Garden & Estate Development Limited has expanded its development activities across Ibeju-Lekki, pushing the projected long-term value of its estate portfolio beyond $1 billion.

Led by Chief Executive Officer Hon. Dr. Audullahi Saheed Mosadoluwa, popularly know Saheed Ibile, the company is developing seven estates within the Lekki–Ibeju corridor. Details available on Harmony Garden & Estate Development show a portfolio spanning land assets and ongoing residential construction across key growth locations.

A major component is Lekki Aviation Town, where urban living meets neighborhood charm, located near the proposed Lekki International Airport and valued internally at over $250 million. The development forms part of the company’s broader phased expansion strategy within the axis.

Other estates in the corridor tagged as the “Citadel of Joy” (Ogba-idunnu) include Granville Estate, Majestic Bay Estate, The Parliament Phase I & II, and Harmony Casa Phase I & II.

With multiple projects active, the rollout of the Ibile Traditional Mortgage System, and structured expansion underway, Harmony Garden & Estate Development Ltd continues to deepen its presence within the fast-growing Ibeju-Lekki real estate market.

Business

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group, one of Africa’s leading diversified conglomerates, is maintaining a strong presence at the ongoing 62nd edition of the Paris International Agricultural Show in France, participating as a premium sponsor and supporting the Nigeria Pavilion at one of the world’s most respected agricultural gatherings.

The 62nd Paris International Agricultural Show, taking place from February 21 to March 1, 2026, at Porte de Versailles in Paris, convenes global leaders across farming, agro processing, technology, finance, and policy. The event serves as a strategic platform for industry engagement, knowledge exchange, and commercial partnerships shaping the future of global food systems.

BUA Group’s participation reflects its long term commitment to strengthening the entire food production value chain. Through sustained investments in large scale processing, value addition, and branded consumer products, the Group continues to reinforce its role in advancing food security, industrial growth, and regional trade integration.

Speaking on the Group’s participation, the Executive Chairman of BUA Group, Abdul Samad Rabiu CFR, said, “BUA’s presence at the Paris International Agricultural Show reflects our belief that Africa must be an active participant in shaping the future of global food systems. We have invested significantly in local production capacity because we understand that food security, industrial growth, and economic resilience are interconnected. Platforms like this allow us to build partnerships that strengthen Nigeria’s competitiveness and expand our reach beyond our borders.”

BUA Foods, a subsidiary of BUA Group, maintains a strong footprint in flour, pasta, spaghetti, sugar, and rice production, serving millions of consumers within Nigeria and across neighbouring African markets. The Managing Director of BUA Foods, Engr. Abioye Ayodele, representing the Executive Chairman, is attending the event at the Nigeria Pavilion, engaging industry stakeholders and showcasing the company’s manufacturing capabilities.

Also speaking at the show, Engr. Ayodele stated, “BUA Foods has built scale across key staple categories that are central to household consumption. Our participation at this Show allows us to demonstrate the quality, consistency, and operational strength behind our products. We are also engaging global stakeholders with a clear message that Nigerian manufacturing can meet international standards while serving both domestic and regional markets efficiently.”

The Show provides BUA Group with an opportunity to deepen trade relationships, explore new export pathways, and reinforce Nigeria’s growing relevance within the global agricultural and food ecosystem.

BUA Group remains focused on building enduring institutions, expanding productive capacity, and positioning African enterprise competitively within global markets.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login