Business

We won’t be able to pay #18,000 minimum wage anymore – Nigerian Governors

Nigeria Governors’ Forum is worried that more states may not be able to pay workers’ salaries if the revenue of the country continues to be on the decline, its Chairman, Governor Abdul’aziz Yari of Zamfara, has said.

Mr. Yari made the statement while briefing journalists on the resolutions of the forum at its meeting in Abuja late on Wednesday.

He said the forum discussed the economy and resolved to look for means to enhance states internally generated revenues as well to cut overhead cost, especially the salaries of political office holders.

The governor said the forum also resolved to diversify the country’s economy from petroleum to agriculture and mining.

“The situation is no longer the same when we are used to pay N18, 000 minimum wage when oil was 126 dollars; now oil price is 41 dollars.

“We are coming together in a roundtable with President Muhammadu Buhari and his team of ministers, technocrats, economic experts to see how we can tackle our situation,’’ he said

Mr. Yari said that the governors had also resolved to hold a roundtable with all stakeholders to articulate a robust strategy to tackle the deplorable economic situation in the country.

In an interview with journalists, Governor Ifeanyi Okowa of Delta state said the economic situation was worrisome as more states would reach a stage where they would not be able to pay salaries.

“I believe that is the same situation with the Federal Government,’’ Mr. Okowa said.

He said there was a need to look into the salaries of political office holders and other salaries.

“It is not a situation of being able to run government now. Most states are not able to pay salaries not to talk of capital projects.

“If we cannot fund capital development, then the rest of Nigerians are just shut out of government.

“Those of us in government, both politicians and civil servants are possibly not more than five per cent of the entire population of Nigerian.

“What will happen to the other 95 per cent? What happens to infrastructure? Can we talk about industry without infrastructure?’’ Mr. Okowa asked.

Governor Abiola Ajimobi of Oyo State said there was no way the country could continue with a situation where expenditure was more than income.

He said very soon many states would be technically declared bankrupt and added that there might be need for another bailout fund for states as they were running on deficit every month.

“We are faced with a situation where we either have to reduce cost through salary reduction or downsize.

“All these we don’t want to do but prefer to have a roundtable with the president, ministers, economists to look for means of getting out of this problem,’’ Mr. Ajimobi said.

(NAN)

Business

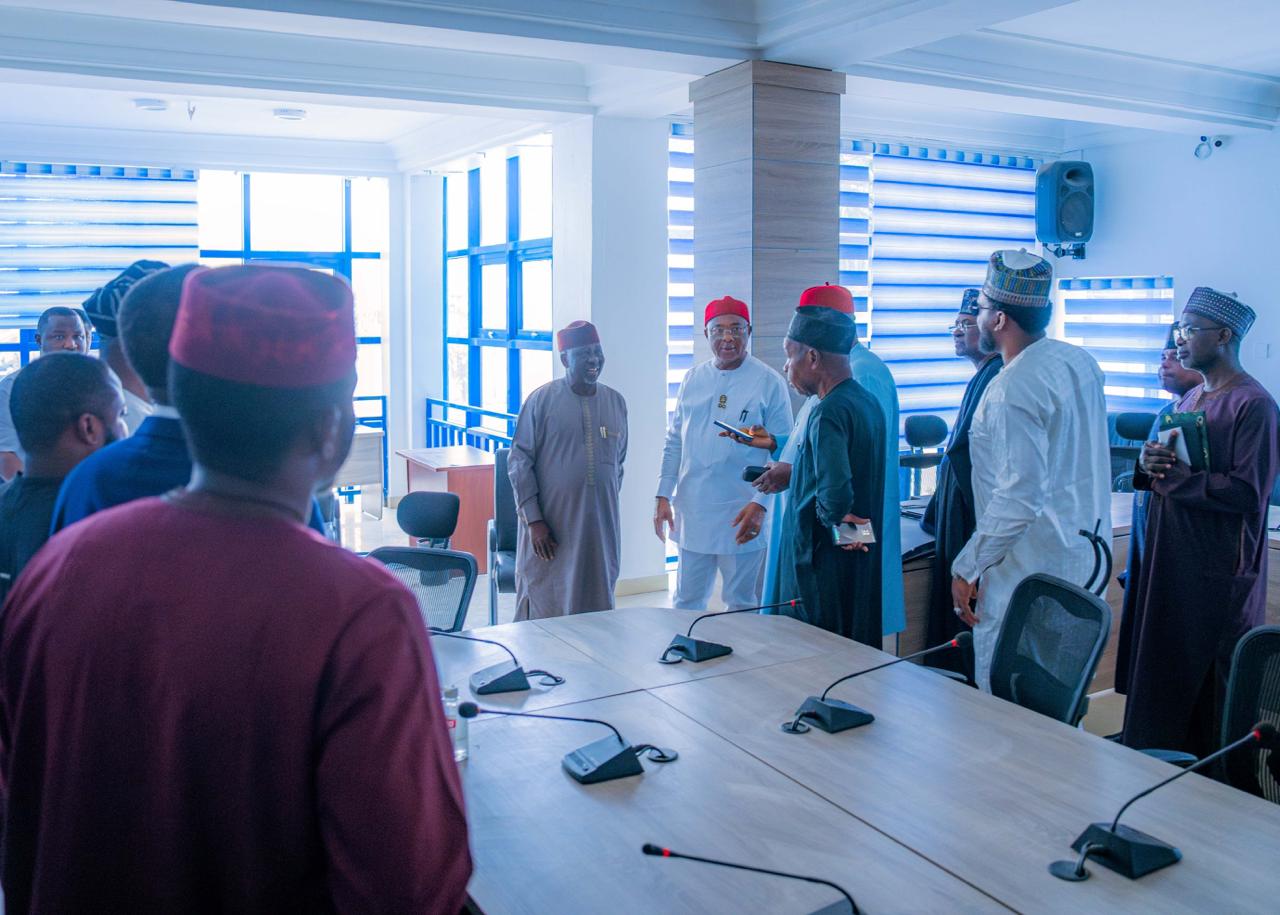

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors, led by its Director-General and the Governor of Imo State, Hope Uzodinma, alongside Zonal Coordinators (NW, NC, SE), the Media & Publicity Directorate, and other key stakeholders, inspected the RHA Secretariat two days after President Bola Tinubu unveiled the Renewed Hope Ambassadors grassroots engagement drive in Abuja.

Business

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Garden & Estate Development Limited has expanded its development activities across Ibeju-Lekki, pushing the projected long-term value of its estate portfolio beyond $1 billion.

Led by Chief Executive Officer Hon. Dr. Audullahi Saheed Mosadoluwa, popularly know Saheed Ibile, the company is developing seven estates within the Lekki–Ibeju corridor. Details available on Harmony Garden & Estate Development show a portfolio spanning land assets and ongoing residential construction across key growth locations.

A major component is Lekki Aviation Town, where urban living meets neighborhood charm, located near the proposed Lekki International Airport and valued internally at over $250 million. The development forms part of the company’s broader phased expansion strategy within the axis.

Other estates in the corridor tagged as the “Citadel of Joy” (Ogba-idunnu) include Granville Estate, Majestic Bay Estate, The Parliament Phase I & II, and Harmony Casa Phase I & II.

With multiple projects active, the rollout of the Ibile Traditional Mortgage System, and structured expansion underway, Harmony Garden & Estate Development Ltd continues to deepen its presence within the fast-growing Ibeju-Lekki real estate market.

Business

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group Showcases Food Manufacturing Strength at 62nd Paris International Agricultural Show

BUA Group, one of Africa’s leading diversified conglomerates, is maintaining a strong presence at the ongoing 62nd edition of the Paris International Agricultural Show in France, participating as a premium sponsor and supporting the Nigeria Pavilion at one of the world’s most respected agricultural gatherings.

The 62nd Paris International Agricultural Show, taking place from February 21 to March 1, 2026, at Porte de Versailles in Paris, convenes global leaders across farming, agro processing, technology, finance, and policy. The event serves as a strategic platform for industry engagement, knowledge exchange, and commercial partnerships shaping the future of global food systems.

BUA Group’s participation reflects its long term commitment to strengthening the entire food production value chain. Through sustained investments in large scale processing, value addition, and branded consumer products, the Group continues to reinforce its role in advancing food security, industrial growth, and regional trade integration.

Speaking on the Group’s participation, the Executive Chairman of BUA Group, Abdul Samad Rabiu CFR, said, “BUA’s presence at the Paris International Agricultural Show reflects our belief that Africa must be an active participant in shaping the future of global food systems. We have invested significantly in local production capacity because we understand that food security, industrial growth, and economic resilience are interconnected. Platforms like this allow us to build partnerships that strengthen Nigeria’s competitiveness and expand our reach beyond our borders.”

BUA Foods, a subsidiary of BUA Group, maintains a strong footprint in flour, pasta, spaghetti, sugar, and rice production, serving millions of consumers within Nigeria and across neighbouring African markets. The Managing Director of BUA Foods, Engr. Abioye Ayodele, representing the Executive Chairman, is attending the event at the Nigeria Pavilion, engaging industry stakeholders and showcasing the company’s manufacturing capabilities.

Also speaking at the show, Engr. Ayodele stated, “BUA Foods has built scale across key staple categories that are central to household consumption. Our participation at this Show allows us to demonstrate the quality, consistency, and operational strength behind our products. We are also engaging global stakeholders with a clear message that Nigerian manufacturing can meet international standards while serving both domestic and regional markets efficiently.”

The Show provides BUA Group with an opportunity to deepen trade relationships, explore new export pathways, and reinforce Nigeria’s growing relevance within the global agricultural and food ecosystem.

BUA Group remains focused on building enduring institutions, expanding productive capacity, and positioning African enterprise competitively within global markets.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login