Business

Access Holdings: Imprints of a Thriving Banking Powerhouse

Access Holdings: Imprints of a Thriving Banking Powerhouse, By Bolaji Israel

Access Holdings has continued to evolve and reinforce its corporate stature as a formidable force in Nigeria’s financial sector, demonstrating capacity for relentless growth, resilience and ambition through strategic expansion and innovative approaches. The entity owes its significant bulk to the Access Bank Group, supported by other allied services firms.

Also known as Access Corporation, the group has grown over the last 35 years to emerge as Nigeria’s largest financial holding company, offering services such as commercial banking, lending, payment, insurance, and asset management.

Though Access started off as a corporate bank, it swiftly expanded into personal and business banking in 2012, solidifying its role as a well rounded financial solutions provider.

In his memoir, ‘Leaving the Tarmac: Buying a Bank in Africa, ‘ Aigboje Aig-Imoukhuede detailed how himself and his partner, Herbert Wigwe walked the delicate path of buying Access Bank and never looked back since.

The bank’s acquisition in March 2022 by the maverick duo of Aig-Imoukhuede and Wigwe, which changed its entire growth, profit and branding trajectory as well as its merger with Diamond Bank in 2019 which shot up its customer base to over 42 million, granting it a status of the largest bank in Africa by customer base and the largest in Nigeria by assets, form a part of its remarkable and turnaround milestone.

With a keen focus on digitisation-driven growth and customer satisfaction, it has not only solidified its status in Nigeria but has also set its sights on becoming a formidable player in the international banking arena.

The group’s growth and expansion drive has been marked by a series of strategic acquisitions and mergers aimed at enhancing its market presence and delivering value to customers. In 2021, Access Bank acquired African Banking Corporation (ABC Holdings), a move that significantly bolstered its operations in Southern Africa. This acquisition allowed Access Bank to enter markets such as Botswana, Mozambique, and Zambia, thereby enhancing its regional footprint and customer base.

In addition to its African ventures, Access Holding has been eyeing opportunities in Europe and Asia. Recent announcements highlight the bank’s interest in potential partnerships and acquisitions that could facilitate its entry into these lucrative markets. The bank’s management has stated, “We are committed to diversifying our operations and exploring new markets that align with our growth strategy.”

The results of the expansion efforts have been promising. For the year ending 2023, Access Holding reported a staggering 300 percent growth in profit after tax to N612.4 billion, from N204.1 billion in 2022. This represents the largest profit ever recorded by the company, under the leadership of its late co-founder, Herbert Wigwe.

It revenue soared by 80% to N2.6 trillion, from N1.4 trillion in 2022 while assets rose by 78% to N26.7 trillion, from N14.99 trillion in 2022, marking a significant growth trajectory that positions Access Holding as one of Nigeria’s largest and most influential banks.

Leading Force in Financial Sector

Access Holding’s influence in the financial sector extends beyond its impressive growth metrics. The bank has taken on a leading role in advocating for financial inclusion and economic empowerment across Nigeria and Africa. Through various initiatives, Access Holdings is committed to providing access to banking services for underserved populations, thereby contributing to the broader goal of economic development.

The bank’s emphasis on technology and innovation has positioned it as a leader in the digital banking space, setting benchmarks for other financial institutions to follow. By continuously enhancing its service offerings and embracing new technologies, Access Holding is shaping the future of banking in Nigeria and beyond.

Innovations and Technological Advancements

Access has prioritized innovation as a cornerstone of its growth strategy. Over the past two years, the bank has invested heavily in upgrading its technology infrastructure to provide customers with seamless and efficient banking experiences. The launch of a robust digital banking platform is a clear testament to this commitment. The improved platform allows customers to perform a wide range of transactions, from fund transfers to bill payments, all from the convenience of their mobile devices.

The bank’s mobile banking app has also seen significant upgrades, incorporating features such as biometric authentication, personalized financial insights, and enhanced security protocols. These innovations have resulted in a marked increase in user engagement, with over 10 million active users reported in 2024.

Moreover, Access has revitalized its Point of Sale (POS) services to cater to the growing demand for cashless transactions. The bank has deployed thousands of POS terminals across Nigeria, facilitating secure and efficient payment solutions for businesses and consumers alike.

Leadership and Succession

The unfortunate demise of Dr Herbert Wigwe, CFR, the Company’s founding Group Chief Executive Officer and former Group Managing Director of its flagship subsidiary, Access Bank Plc on Friday, February 9, 2024, in a helicopter accident in the United States of America, would have constituted a permanent clog for any company without a formidable structure.

Access Holdings has however been able to rise above the dark moment and steadied the ship with the return of Aigboje Aig-Imoukhuede as Chairman and emergence of Bolaji Agbede as GCEO. The swift realignment is a clear testament to the group’s ability to deftly manage succession.

Growth Outlook and Ambition

Access growth results and targets highlight its ambitious nature. The banking group aims to achieve a market capitalization of ₦10 trillion by 2025, with plans to expand its customer base to over 50 million across its operational territories. This ambition is supported by strategic partnerships and potential mergers, not only within Nigeria but globally.

Analysts have noted that Access Holdings is well-positioned to capitalise on the growing demand for financial services across Africa and beyond. With a solid foundation and an eye on expansion, the bank is poised to become a leading financial institution on the global stage.

The landscape of mergers and acquisitions in the banking sector has been vibrant, and Access Holdings is keen on exploring potential opportunities. In Nigeria, the banking industry has witnessed a wave of consolidation, with several banks seeking to enhance their market positions through strategic mergers. Access has expressed interest in potential acquisitions that align with its growth strategy, particularly in the areas of technology and customer service.

Globally, the banking group is also exploring partnerships that can facilitate its entry into new markets. The management has indicated that Access Holding is open to collaborating with fintech companies and other financial institutions that can complement its service offerings and enhance customer value.

Awards and Commendations

Access Corp’s commitment to excellence and innovation has earned it numerous accolades over the past year. The bank was recognized as the “Best Bank in Nigeria” at the Global Finance Awards, a prestigious honour that underscores its leadership position in the industry. Additionally, the bank received the “Most Innovative Bank” award at the African Banking Awards, highlighting its commitment to embracing technology and improving customer experiences.

These awards reflect a solid dedication to maintaining high standards of service and its ability to adapt to the rapidly changing financial landscape.

Access Holdings trajeectory stands as a testament to what can be achieved through strategic expansion, innovation, and effective leadership. With its aggressive growth strategy, commitment to technological advancement, and dedication to customer satisfaction, it is firmly establishing itself as a thriving banking conglomerate.

Business

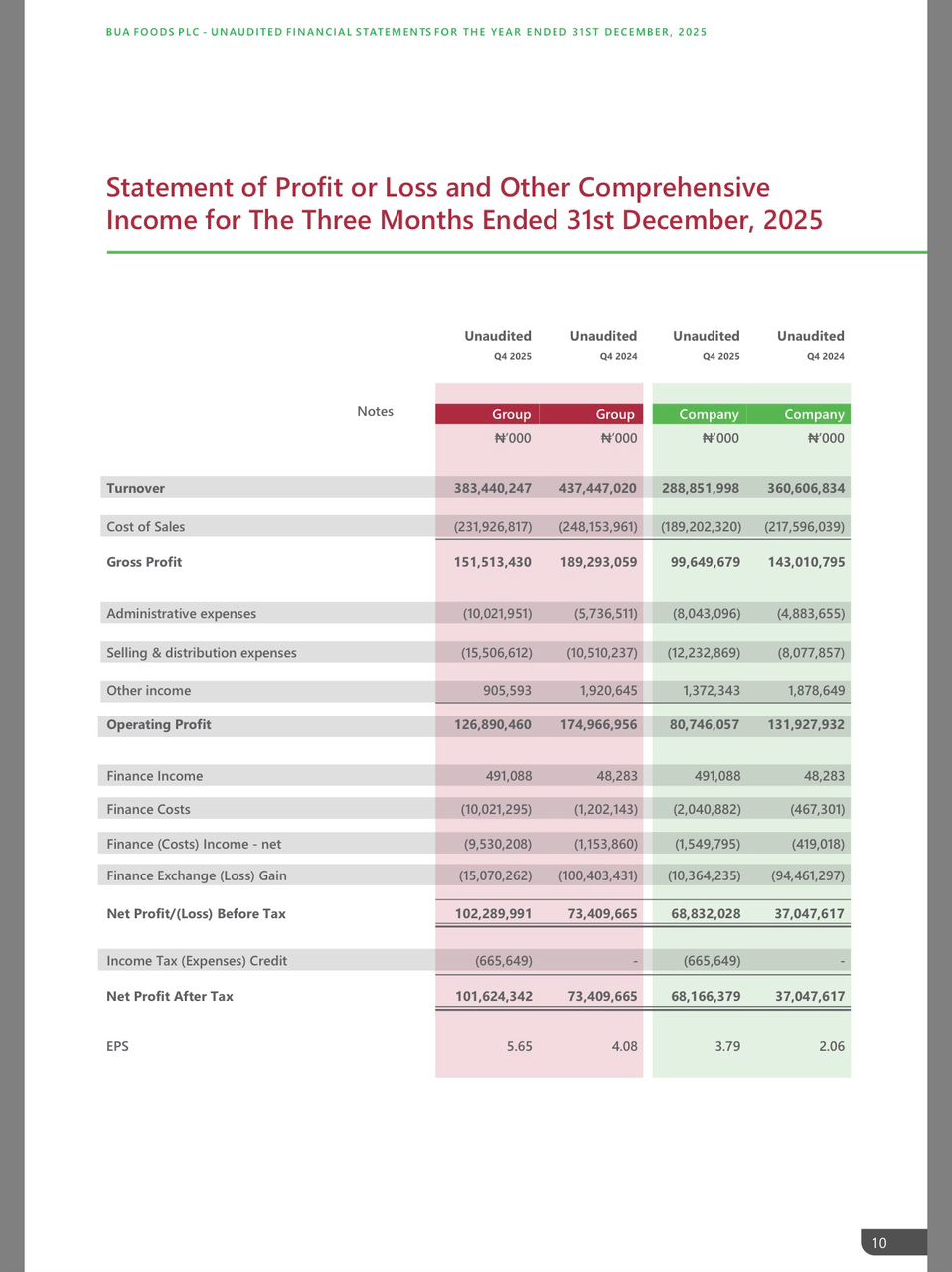

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

BUA Foods Records 91% Surge in Profit After Tax, Hits ₦508bn in 2025

By femi Oyewale

Business

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

Adron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

In celebration of the season of love, Adron Homes and Properties has announced the launch of its special Valentine campaign, “Love for Love” Promo, a customer-centric initiative designed to reward Nigerians who choose to express love through smart, lasting real estate investments.

The Love for Love Promo offers clients attractive discounts, flexible payment options, and an array of exclusive gift items, reinforcing Adron Homes’ commitment to making property ownership both rewarding and accessible. The campaign runs throughout the Valentine season and applies to the company’s wide portfolio of estates and housing projects strategically located across Nigeria.

Speaking on the promo, the company’s Managing Director, Mrs Adenike Ajobo, stated that the initiative is aimed at encouraging individuals and families to move beyond conventional Valentine gifts by investing in assets that secure their future. According to the company, love is best demonstrated through stability, legacy, and long-term value—principles that real estate ownership represents.

Under the promo structure, clients who make a payment of ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 are rewarded with a Love Hamper. Payments of ₦500,000 attract a Love Hamper plus cake, and clients who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The rewards become increasingly premium as commitment grows. Clients who pay ₦5,000,000 receive either an iPad or an all-expenses-paid romantic getaway for a couple at one of Nigeria’s finest hotels, which includes two nights’ accommodation, special treats, and a Love Hamper. A payment of ₦10,000,000 comes with a choice of a Samsung Z Fold 7, three nights at a top-tier resort in Nigeria, or a full solar power installation.

For high-value investors, the Love for Love Promo delivers exceptional lifestyle experiences. Clients who pay ₦30,000,000 on land are rewarded with a three-night couple’s trip to Doha, Qatar, or South Africa, while purchasers of any Adron Homes house valued at ₦50,000,000 receive a double-door refrigerator.

The promo covers Adron Homes’ estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger States, offering clients the opportunity to invest in fast-growing, strategically positioned communities nationwide.

Adron Homes reiterated that beyond the incentives, the campaign underscores the company’s strong reputation for secure land titles, affordable pricing, strategic locations, and a proven legacy in real estate development.

As Valentine’s Day approaches, Adron Homes encourages Nigerians at home and in the diaspora to take advantage of the Love for Love Promo to enjoy exceptional value, exclusive rewards, and the opportunity to build a future rooted in love, security, and prosperity.

Business

Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital

*Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital*

*BY BLAISE UDUNZE*

Despite the fragile 2024 economy grappling with inflation, currency volatility, and weak growth, Nigeria’s banking industry was widely portrayed as successful and strong amid triumphal headlines. The figures appeared to signal strength, resilience, and superior management as the Tier-1 banks such as Access Bank, Zenith Bank, GTBank, UBA, and First Bank of Nigeria, collectively reported profits approaching, and in some cases exceeding, N1 trillion. Surprisingly, a year later, these same banks touted as sound and solid are locked in a frenetic race to the capital markets, issuing rights offers and public placements back-to-back to meet the Central Bank of Nigeria’s N500 billion recapitalisation thresholds.

The contradiction is glaring. If Nigeria’s biggest banks are so profitable, why are they unable to internally fund their new capital requirements? Why have no fewer than 27 banks tapped the capital market in quick succession despite repeated assurances of balance-sheet robustness? And more fundamentally, what do these record profits actually say about the real health of the banking system?

The recapitalisation directive announced by the CBN in 2024 was ambitious by design. Banks with international licences were required to raise minimum capital to N500 billion by March 2026, while national and regional banks faced lower but still substantial thresholds ranging from N200 billion to N50 billion, respectively. Looking at the policy, it was sold as a modern reform meant to make banks stronger, more resilient in tough times, and better able to support major long-term economic development. In theory, strong banks should welcome such reforms. In practice, the scramble that followed has exposed uncomfortable truths about the structure of bank profitability in Nigeria.

At the heart of the inconsistency is a fundamental misunderstanding often encouraged by the banks themselves between profits and capital. Unknown to many, profitability, no matter how impressive, does not automatically translate into regulatory capital. Primarily, the CBN’s recapitalisation framework actually focuses on money paid in by shareholders when buying shares, fresh equity injected by investors over retained earnings or profits that exist mainly on paper.

This distinction matters because much of the profit surge recorded in 2024 and early 2025 was neither cash-generative nor sustainably repeatable. A significant portion of those headline banks’ profits reported actually came from foreign exchange revaluation gains following the sharp fall of the naira after exchange-rate unification. The industry witnessed that banks’ holding dollar-denominated assets their books showed bigger numbers as their balance sheets swell in naira terms, creating enormous paper profits without a corresponding improvement in underlying operational strength. These gains inflated income statements but did little to strengthen core capital, especially after the CBN barred banks from using FX revaluation gains for dividends or routine operations. In effect, banks looked richer without becoming stronger.

Beyond FX effects, Nigerian banks have increasingly relied on non-interest income fees, charges, and transaction levies to drive profitability. While this model is lucrative, it does not necessarily deepen financial intermediation or expand productive lending. High profits built on customer charges rather than loan growth offer limited support for long-term balance-sheet expansion. They also leave banks vulnerable when macroeconomic conditions shift, as is now happening.

Indeed, the recapitalisation exercise coincides with a turning point in the monetary cycle. The extraordinary conditions that supported bank earnings in 2024 and 2025 are beginning to unwind. Analysts now warn that Nigerian banks are approaching earnings reset, as net interest margins the backbone of traditional banking profitability, come under sustained pressure.

Renaissance Capital, in a January note, projects that major banks including Zenith, GTCO, Access Holdings, and UBA will struggle to deliver earnings growth in 2026 comparable to recent performance.

In a real sense, the CBN is expected to lower interest rates by 400 to 500 basis points because inflation is slowing down, and this means that banks will earn less on loans and government bonds, but they may not be able to quickly lower the interest they pay on deposits or other debts. The cash reserve requirements are still elevated, which does not earn interest; banks can’t easily increase or expand lending investments to make up for lower returns. The implications are significant. Net interest margin, the difference between what banks earn on loans and investments and what they pay on deposits, is poised to contract. Deposit competition is intensifying as lenders fight to shore up liquidity ahead of recapitalisation deadlines, pushing up funding costs. At the same time, yields on treasury bills and bonds, long a safe and lucrative haven for banks are expected to soften in a lower-rate environment. The result is a narrowing profit cushion just as banks are being asked to carry far larger equity bases.

Compounding this challenge is the fading of FX revaluation windfalls. With the naira relatively more stable in early 2026, the non-cash gains that once flattered bank earnings have largely evaporated. What remains is the less glamorous reality of core banking operations: credit risk management, cost efficiency, and genuine loan growth in a sluggish economy. In this new environment, maintaining headline profits will be far harder, even before accounting for the dilutive impact of recapitalisation.

That dilution is another underappreciated consequence of the capital rush. Massive share issuances mean that even if banks manage to sustain absolute profit levels, earnings per share and return on equity are likely to decline. Zenith, Access, UBA, and others are dramatically increasing their share counts. The same earnings pie is now being divided among many more shareholders, making individual returns leaner than during the pre-recapitalisation boom. For investors, the optics of strong profits may soon give way to the reality of weaker per-share performance.

Yet banks have pressed ahead, not only out of regulatory necessity but also strategic calculation.

During this period of recapitalization, investors are interested in the stock market with optimism, especially about bank shares, as banks are raising fresh capital, and this makes it easier to attract investments. This has become a season for the management teams to seize the moment to raise funds at relatively attractive valuations, strengthen ownership positions, and position themselves for post-recapitalisation dominance. In several cases, major shareholders and insiders have increased their stakes, as projected in the media, signalling confidence in long-term prospects even as near-term returns face pressure.

There is also a broader structural ambition at play. Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective, recapitalisation is not merely about compliance but about reshaping the competitive hierarchy of Nigerian banking. What will be witnessed in the industry is that those who succeed will emerge larger, fewer, and more powerful. Those that fail will be forced into consolidation, retreat, or irrelevance.

For the wider economy, the outcome is ambiguous. Stronger banks with deeper capital buffers could improve systemic stability and enhance Nigeria’s ability to fund long-term development. The point is that while merging or consolidating banks may make them safer, it can also harm the market and the economy because it will reduce competition, let a few banks dominate, and encourage them to earn easy money from bonds and fees instead of funding real businesses. The truth be told, injecting more capital into the banks without complementary reforms in credit infrastructure, risk-sharing mechanisms, and fiscal discipline, isn’t enough as the aforementioned reforms are also needed.

The rush as exposed in this period, is that the moment Nigerian banks started raising new capital, the glaring reality behind their reported profits became clearer, that profits weren’t purely from good management, while the financial industry is not as sound and strong as its headline figures. The fact that trillion-naira profit banks must return repeatedly to shareholders for fresh capital is not a sign of excess strength, but of structural imbalance.

With the deadline for banks to raise new capital coming soon, by 31 March 2026, the focus has shifted from just raising N500 billion. N200 billion or N50 billion to think about the future shape and quality of Nigeria’s financial industry, or what it will actually look like afterward. Will recapitalisation mark a turning point toward deeper intermediation, lower dependence on speculative gains, and stronger support for economic growth? Or will it simply reset the numbers while leaving underlying incentives unchanged?

The answer will define the next chapter of Nigerian banking long after the capital market roadshows have ended and the profit headlines have faded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING