Metro

All Lagos SARS offices shut down,suspects in the unit transfer to SCID for continuation of investigation – Odumosu

By Ifeoma Ikem

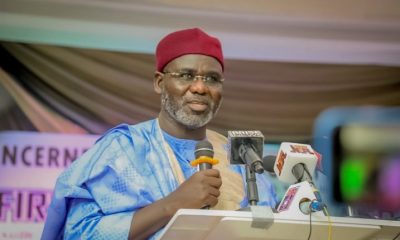

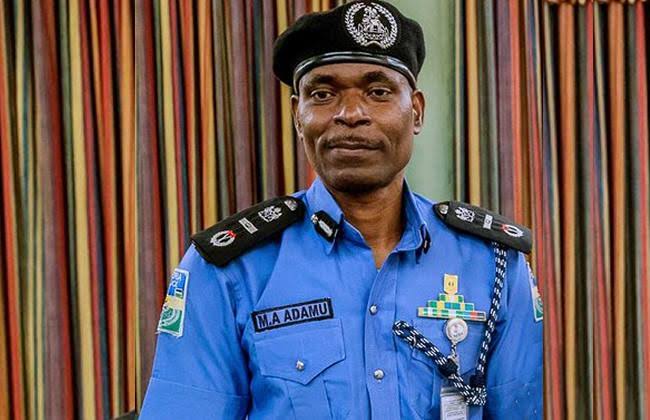

The Commissioner of Police in Lagos State, Hakeem Odumosu, said that the Inspector-General of Police, Mohammed Adamu, directive to disband the Special Anti-Robbery Squad (SARS) has been complied with.

He said this while receiving a group of lawyers led by a human rights lawyer, Inibehe Effiong, protesting police brutality as part of the raging #EndSARS campaign

CP said policemen under SARS had been disarmed and their offices have been stut down across the state.

According to him, all suspects in the unit of SARS have been transferred to the State Criminal Investigation Department Panti,for continuation of investigations.

“Based on the directive of the Inspector-General of Police for disbandment of the unit, as you are here now you will see them (SARS officers) in the regular police uniform. They’ve been disbanded, all their arms have been collected; the cases they were handling and the suspects have been transferred to the State CID, Panti for continuation of investigation.

“All these is in compliance with the Inspector-General’s directive. You should understand that in Lagos, we have many police formations; we have, for example, the Special Fraud Unit, traditionally, they are not to carry arms, they are in mufti; equally, we have the Force CID personnel in Alagbon, they are not carrying arms and they are not to be in uniform, all these are specialised arms of the police. But the one that the IG has disbanded now has been disbanded from that day. If you go to their offices now in Surulere, Gbagada, they are under lock and key; we only posted policemen to guard the places for now.

Speaking further, the police boss said officers seen in a viral video harassing a female protester had been arrested.

While insisting that no #EndSARS protester has been killed, Odumosu said the person who died from a stray bullet at Surulere on Monday, was not a protester but a driver, who came of his car to check the cause of the gridlock on the road.

Business

Elon Musk’s Team Accuses FEMA of Misusing $59 Million to House Illegal Migrants in Luxury Hotels

Elon Musk’s Team Accuses FEMA of Misusing $59 Million to House Illegal Migrants in Luxury Hotels

Elon Musk’s Department of Government Efficiency (DOGE) has made serious allegations against the Federal Emergency Management Agency (FEMA), claiming that the agency misused $59 million to accommodate illegal migrants in luxurious hotels.

The billionaire entrepreneur revealed this in a tweet on Monday morning, stating that the discovery was made last week. According to Musk, the funds were intended for American disaster relief but were instead diverted in violation of national regulations.

He wrote: “The @DOGE team just discovered that FEMA sent $59M LAST WEEK to luxury hotels in New York City to house illegal migrants. Sending this money violated the law and is in gross insubordination to the President’s executive order. That money is meant for American disaster relief and instead is being spent on high-end hotels for illegals! A clawback demand will be made today to recoup those funds.”

The revelation has sparked controversy, with critics arguing that FEMA’s allocation of funds should prioritize American citizens affected by disasters. The allegations have also intensified scrutiny on FEMA, which has faced previous accusations of financial mismanagement.

An inspector general audit recently revealed that FEMA mishandled nearly $10 billion in COVID-19 relief funds. The audit stated that $8.1 billion in costs remained questionable, while $1.5 billion was allocated prematurely and could have been better utilized for other emergencies.

As scrutiny mounts, former President Donald Trump has reportedly considered abolishing FEMA, describing the agency as “a disaster.” To address these concerns, Trump has established a council, led by Homeland Security Secretary Kristi Noem and Defense Secretary Pete Hegseth, to review FEMA’s operations and propose necessary reforms by late June.

The allegations against FEMA have triggered a broader debate on the proper allocation of taxpayer funds and the government’s role in disaster management. More updates are expected as the situation develops.

Business

Shepherd freight Cargo services Now in Lagos and Ibadan Nigeria

Shepherd freight Cargo services Now in Lagos and Ibadan Nigeria.

Business

Access Holdings: Imprints of a Thriving Banking Powerhouse

Access Holdings: Imprints of a Thriving Banking Powerhouse, By Bolaji Israel

Access Holdings has continued to evolve and reinforce its corporate stature as a formidable force in Nigeria’s financial sector, demonstrating capacity for relentless growth, resilience and ambition through strategic expansion and innovative approaches. The entity owes its significant bulk to the Access Bank Group, supported by other allied services firms.

Also known as Access Corporation, the group has grown over the last 35 years to emerge as Nigeria’s largest financial holding company, offering services such as commercial banking, lending, payment, insurance, and asset management.

Though Access started off as a corporate bank, it swiftly expanded into personal and business banking in 2012, solidifying its role as a well rounded financial solutions provider.

In his memoir, ‘Leaving the Tarmac: Buying a Bank in Africa, ‘ Aigboje Aig-Imoukhuede detailed how himself and his partner, Herbert Wigwe walked the delicate path of buying Access Bank and never looked back since.

The bank’s acquisition in March 2022 by the maverick duo of Aig-Imoukhuede and Wigwe, which changed its entire growth, profit and branding trajectory as well as its merger with Diamond Bank in 2019 which shot up its customer base to over 42 million, granting it a status of the largest bank in Africa by customer base and the largest in Nigeria by assets, form a part of its remarkable and turnaround milestone.

With a keen focus on digitisation-driven growth and customer satisfaction, it has not only solidified its status in Nigeria but has also set its sights on becoming a formidable player in the international banking arena.

The group’s growth and expansion drive has been marked by a series of strategic acquisitions and mergers aimed at enhancing its market presence and delivering value to customers. In 2021, Access Bank acquired African Banking Corporation (ABC Holdings), a move that significantly bolstered its operations in Southern Africa. This acquisition allowed Access Bank to enter markets such as Botswana, Mozambique, and Zambia, thereby enhancing its regional footprint and customer base.

In addition to its African ventures, Access Holding has been eyeing opportunities in Europe and Asia. Recent announcements highlight the bank’s interest in potential partnerships and acquisitions that could facilitate its entry into these lucrative markets. The bank’s management has stated, “We are committed to diversifying our operations and exploring new markets that align with our growth strategy.”

The results of the expansion efforts have been promising. For the year ending 2023, Access Holding reported a staggering 300 percent growth in profit after tax to N612.4 billion, from N204.1 billion in 2022. This represents the largest profit ever recorded by the company, under the leadership of its late co-founder, Herbert Wigwe.

It revenue soared by 80% to N2.6 trillion, from N1.4 trillion in 2022 while assets rose by 78% to N26.7 trillion, from N14.99 trillion in 2022, marking a significant growth trajectory that positions Access Holding as one of Nigeria’s largest and most influential banks.

Leading Force in Financial Sector

Access Holding’s influence in the financial sector extends beyond its impressive growth metrics. The bank has taken on a leading role in advocating for financial inclusion and economic empowerment across Nigeria and Africa. Through various initiatives, Access Holdings is committed to providing access to banking services for underserved populations, thereby contributing to the broader goal of economic development.

The bank’s emphasis on technology and innovation has positioned it as a leader in the digital banking space, setting benchmarks for other financial institutions to follow. By continuously enhancing its service offerings and embracing new technologies, Access Holding is shaping the future of banking in Nigeria and beyond.

Innovations and Technological Advancements

Access has prioritized innovation as a cornerstone of its growth strategy. Over the past two years, the bank has invested heavily in upgrading its technology infrastructure to provide customers with seamless and efficient banking experiences. The launch of a robust digital banking platform is a clear testament to this commitment. The improved platform allows customers to perform a wide range of transactions, from fund transfers to bill payments, all from the convenience of their mobile devices.

The bank’s mobile banking app has also seen significant upgrades, incorporating features such as biometric authentication, personalized financial insights, and enhanced security protocols. These innovations have resulted in a marked increase in user engagement, with over 10 million active users reported in 2024.

Moreover, Access has revitalized its Point of Sale (POS) services to cater to the growing demand for cashless transactions. The bank has deployed thousands of POS terminals across Nigeria, facilitating secure and efficient payment solutions for businesses and consumers alike.

Leadership and Succession

The unfortunate demise of Dr Herbert Wigwe, CFR, the Company’s founding Group Chief Executive Officer and former Group Managing Director of its flagship subsidiary, Access Bank Plc on Friday, February 9, 2024, in a helicopter accident in the United States of America, would have constituted a permanent clog for any company without a formidable structure.

Access Holdings has however been able to rise above the dark moment and steadied the ship with the return of Aigboje Aig-Imoukhuede as Chairman and emergence of Bolaji Agbede as GCEO. The swift realignment is a clear testament to the group’s ability to deftly manage succession.

Growth Outlook and Ambition

Access growth results and targets highlight its ambitious nature. The banking group aims to achieve a market capitalization of ₦10 trillion by 2025, with plans to expand its customer base to over 50 million across its operational territories. This ambition is supported by strategic partnerships and potential mergers, not only within Nigeria but globally.

Analysts have noted that Access Holdings is well-positioned to capitalise on the growing demand for financial services across Africa and beyond. With a solid foundation and an eye on expansion, the bank is poised to become a leading financial institution on the global stage.

The landscape of mergers and acquisitions in the banking sector has been vibrant, and Access Holdings is keen on exploring potential opportunities. In Nigeria, the banking industry has witnessed a wave of consolidation, with several banks seeking to enhance their market positions through strategic mergers. Access has expressed interest in potential acquisitions that align with its growth strategy, particularly in the areas of technology and customer service.

Globally, the banking group is also exploring partnerships that can facilitate its entry into new markets. The management has indicated that Access Holding is open to collaborating with fintech companies and other financial institutions that can complement its service offerings and enhance customer value.

Awards and Commendations

Access Corp’s commitment to excellence and innovation has earned it numerous accolades over the past year. The bank was recognized as the “Best Bank in Nigeria” at the Global Finance Awards, a prestigious honour that underscores its leadership position in the industry. Additionally, the bank received the “Most Innovative Bank” award at the African Banking Awards, highlighting its commitment to embracing technology and improving customer experiences.

These awards reflect a solid dedication to maintaining high standards of service and its ability to adapt to the rapidly changing financial landscape.

Access Holdings trajeectory stands as a testament to what can be achieved through strategic expansion, innovation, and effective leadership. With its aggressive growth strategy, commitment to technological advancement, and dedication to customer satisfaction, it is firmly establishing itself as a thriving banking conglomerate.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING