society

A Nation on Alert: Is FIRS’ Xpress Payments Move Consolidating a Revenue Cartel?

A Nation on Alert: Is FIRS’ Xpress Payments Move Consolidating a Revenue Cartel?

BY BLAISE UDUNZE

Nigeria’s national mood is tense. The country is facing economic hardship, insecurity, public distrust in institutions, and an increasingly widening gap between citizens and their government. Yet, in the midst of this fragility, a quiet administrative action by the Federal Inland Revenue Service (FIRS) has sparked a storm of public concern, political accusations, and renewed debate over who truly controls Nigeria’s revenue system.

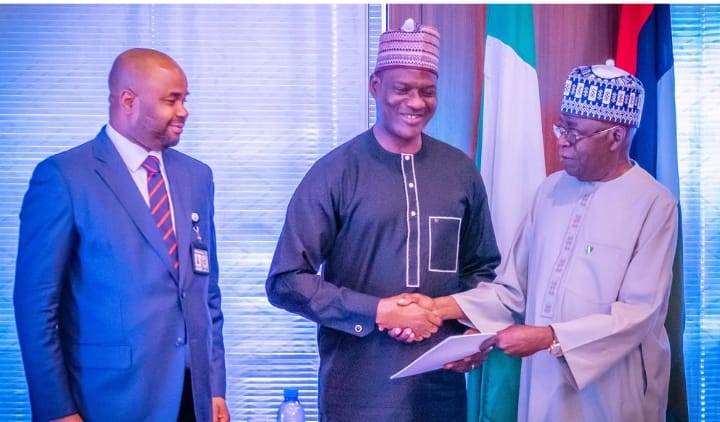

The controversy began when the FIRS quietly announced the appointment of Xpress Payment Solutions Limited, a fast-rising Nigerian fintech company, as a Treasury Single Account (TSA) collecting agent, effectively giving the company authority to process federal government tax payments through the TaxPro Max platform. With this appointment, taxpayers can now remit Company Income Tax, Value Added Tax, Withholding Tax, and other federal payments using XpressPay or the company’s in-branch e-Cashier platform.

At first glance, the move appears technical and harmless, perhaps even a necessary step to modernize Nigeria’s digital tax infrastructure. But almost immediately, outrage erupted across political, civil society, and economic circles. And within hours, the debate had escalated into what is now being framed as a national question: Is Nigeria witnessing the quiet re-emergence of a revenue cartel, this time on a federal scale?

A Tax Gatekeeper Emerges Silently

Xpress Payments is not an unfamiliar name in Nigeria’s fintech landscape. Incorporated in 2016, the company has grown steadily, offering secure payment gateways, switching services, and enterprise financial solutions. Its Acting Managing Director, Wale Olayisade, expressed delight at the appointment, describing it as a major milestone, “We are honoured to be selected by FIRS. Our systems are built to ensure ease, speed, and security for every transaction.”

He insisted that taxpayers would enjoy a seamless, transparent, and reliable experience.

Ordinarily, such remarks should settle nerves. But the public response was anything but calm. Citizens and political stakeholders immediately raised a torrent of questions:

– Why was this appointment announced quietly, without public consultation?

– What new value does Xpress Payments add that existing TSA channels, such as Remita, do not already provide?

– Were there competitive bids?

– What are the contract terms, and who benefits financially?

– Why concentrate such a sensitive national function in private hands at a time when transparency is already strained?

The silence from government circles only deepened the suspicion. In governance, especially around revenue, silence is not neutrality; it is oxygen for mistrust.

Atiku Abubakar Explodes: “This Is Lagos-Style State Capture”

The loudest reaction came from former Vice President Atiku Abubakar, who issued one of his most forceful statements in recent years. Atiku accused the Federal Government of attempting to replicate the same at a national scale. The controversial Lagos revenue model was dominated for years by Alpha Beta, a private firm accused of enjoying a monopoly over the state’s revenue pipeline.

In his words, “This is the resurrection of the Alpha Beta revenue cartel. What we are witnessing now is an attempt to nationalise that template.”

Atiku warned that the move could concentrate power around politically connected private actors, enabling them to sit at the centre of federal revenue flows. He questioned the timing, calling it insensitive given the nationwide grief over insecurity, “When a nation is mourning, leadership should show empathy, not expand private revenue pipelines.”

He issued five demands:

1. Immediate suspension of the Xpress Payments appointment

2. Full disclosure of contract terms and beneficiaries

3. A comprehensive audit of TSA operations

4. A legal framework preventing private proxies from controlling public revenue

5. A shift in national priorities toward security and transparent governance

His final warning was blunt, “Nigeria’s revenues are not political spoils. They are the lifeblood of our national survival.”

The Ghost of Alphabeta: Why Nigerians Are Worried

For many Nigerians, this controversy triggers painful memories of earlier private-sector dominance over public revenue. The “Alphabeta era” in Lagos is widely remembered, fairly or unfairly, as a time when a single private company appeared to dominate the state’s tax collection landscape, shrouded in secrecy and controversy.

Nigeria’s fear is simple:

– If revenue collection becomes controlled by one or two private companies, transparency dies, and corruption flourishes.

– Allowing private entities to sit between taxpayers and government can create:

· Monopoly power

· Inflated service fees

· Data privacy concerns

· Political weaponization of revenue information

· Institutional dependency

· Centralization of sensitive national data

Each of these risks has real consequences for economic stability.

FIRS’ Defence: “It Is Only an Additional Option”

To be fair, the FIRS insists that Xpress Payments is only one of several available channels, not the exclusive gatekeeper. Remita and other payment service providers remain operational.

According to FIRS, the move is part of a broader effort to modernize and expand taxpayer options within the TSA. In a functional environment, this would be welcomed as healthy competition. But Nigerians are not reacting to the announcement; they are reacting to the pattern:

– Sudden appointments

– Lack of transparency

– Political undertones

– Private-sector centralization of public revenue

– Timing that coincides with widespread economic strain

The concern is not the company itself; it is the impenetrability surrounding how such decisions are made.

The Big Tax Picture: Major Reforms Coming in January 2026

While the Xpress Payments controversy rages, Nigeria is simultaneously preparing for the most ambitious tax reform in decades, one that may change how individuals and businesses perceive taxation entirely.

The reforms, spearheaded by the Presidential Fiscal Policy and Tax Reforms Committee, chaired by Mr. Taiwo Oyedele, will take effect in January 2026, and they promise sweeping changes.

1. Drastic Reduction of Tax Burden on 98 percent of Nigerians

Oyedele has repeatedly emphasized, “You will pay less or no tax if you are in the bottom 98 percent of income earners.” Under the new regime:

– Workers earning below N800,000 annually pay zero personal income tax.

– Basic food, healthcare, education, and public transport become VAT-exempt, lowering living costs.

– Small companies (turnover ≤ N100m) will pay zero corporate tax, zero capital gains tax, and be exempt from the new 4 percent development levy.

2. Consolidation of Multiple Tax Laws

The reform merges numerous existing laws, CITA, PITA, VAT Act, CGT Act, into a unified tax code. This eliminates duplication, confusion, and overlapping mandates that have plagued Nigeria for decades.

3. Increased CGT for Companies, Fairer Rates for Individuals

– Companies now pay 30 percent CGT.

– Individuals pay CGT based on their income band.

4. Tax on Digital and Virtual Asset Profits

The reforms modernize the tax base to include digital transactions and virtual assets.

5. Export Incentives

Profits from goods exported will now be income tax-free, provided proceeds are repatriated legally.

6. Stronger Tax Institutions

A new Nigeria Revenue Service (NRS) will become the sole federal tax collector, while the Tax Ombudsman will resolve disputes.

7. President Tinubu Sets Up an Implementation Committee

To ensure smooth rollout, President Tinubu has approved the National Tax Policy Implementation Committee (NTPIC) chaired by Joseph Tegbe and supervised by Minister of Finance, Wale Edun.

The goal:

Improve compliance, reduce leakages, and reinforce fiscal sustainability.

So, Why Are Nigerians Still Worried?

Because reform alone does not guarantee trust. Nigerians welcome the promise of lower taxes, simpler laws, and less harassment. But they fear that while the tax burden may be reduced, the control over tax collection may be quietly shifting into private hands.

The unsettling question persists:

– How can a nation modernize its tax system while simultaneously outsourcing its revenue gateways?

– What Exactly Is the Risk?

1. Over-Centralization of Revenue Gateways

Even if Xpress Payments is “an option,” such appointments can slowly evolve into de facto monopolies, especially in Nigeria, where political influence often determines market dominance.

2. Data Privacy and National Security

Tax data is deeply sensitive. It reveals income patterns, business operations, sectoral flows, and strategic economic information. Consolidating such data under private firms raises major cybersecurity concerns.

3. Potential for Political Capture

The fear is not that Xpress Payments lacks capacity; the company is reputable, but that future actors may exploit such arrangements for political financing or influence.

4. Risk of Middlemen Profiting from Public Revenue

If service fees or transaction charges apply, taxpayers may indirectly fund private intermediaries for basic access to government services.

5. Erosion of Public Trust

A tax system must be trusted to function. When people sense secrecy, they resist compliance.

What Nigeria Needs Now: Full Transparency, Not Silence

To rebuild confidence, the federal government must take immediate steps:

1. Publish All Contract Details

Service fees, revenue-sharing models, data access permissions, contracts’ duration, and ownership disclosures must be made public.

2. Conduct an Independent Audit of TSA Payment Providers

This should include Remita, Xpress Payments, and all other agents.

3. Prevent Monopolies in Revenue Collection

No single company should control more than 30 percent of federal tax traffic.

4. Strengthen FIRS Capacity

Modern digital tax administration should rely primarily on state capacity, not outsourcing.

5. Establish a Legal Framework for Digital Tax Contractors

To regulate:

– Data usage

– Infrastructure standards

– Profit margins

– Conflict-of-interest rules

Without such laws, Nigeria remains vulnerable.

A Nation at a Revenue Intersection

Nigeria stands at a defining moment. The 2026 tax reforms promise hope: lower taxes, simpler rules, better compliance, and reduced harassment. They present an opportunity to reset the social contract around taxation.

But that promise is threatened by the unsettling perception that tax collection is quietly being privatized, again. The public narrative is now locked in a dangerous contradiction; the government promises tax relief, while citizens fear revenue capture.

Until transparency is restored, the controversy surrounding Xpress Payments will not disappear. It has grown beyond a payment gateway issue. It has become a test of Nigeria’s commitment to:

– Accountability

– Institutional integrity

– Democratic oversight

– And the protection of national revenue

A country cannot modernize its tax system while leaving its revenue gateways in the shadows. Nigerians want answers. They want openness. And they want assurance that the era of revenue cartels, real or perceived, will never return. Anything short of full disclosure leaves the nation with a painful question: Who is truly controlling Nigeria’s money?

Blaise, a journalist and PR professional, writes from Lagos, can be reached via: [email protected]

society

Stop Means Stop”: Legal Experts Warn Ignoring ‘Stop’ During Intimate Acts Can Be Criminally Punishable

“Stop Means Stop”: Legal Experts Warn Ignoring ‘Stop’ During Intimate Acts Can Be Criminally Punishable

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

“Grounded in international law and consent principles, legal authorities stress that continuing sexual activity after a partner withdraws consent may constitute sexual assault and lead to imprisonment.”

A growing body of legal interpretation and expert opinion reaffirm that consent in intimate encounters is not a one-off event but an ongoing requirement; withdrawn at any time by either participant. Legal practitioners and rights advocates are increasingly warning that if one partner clearly says “stop” during sexual activity and the other continues, this conduct can constitute a criminal offence with significant penalties, including imprisonment.

Consent must be “a voluntary agreement to engage in the sexual activity in question,” and crucially can be revoked at any stage. Once a partner expresses withdrawal of consent (by words like “stop” or by unmistakable conduct) the other party is legally obligated to cease all activity immediately. Failure to respect this is widely recognised in multiple legal jurisdictions as sexual assault or rape.

Professor Deborah Rhode, a prominent authority on legal ethics, has stated: “Respect for autonomy and bodily integrity lies at the core of consent law. Ignoring a partner’s withdrawal of consent undermines basic personal freedoms and is treated as a serious offence in criminal law.”

According to experts, this legal principle is not limited to strangers but applies equally to long-term partners and spouses. The Criminal Code in many countries explicitly rejects implied or blanket consent based on relationship status.

Human rights lawyer Amal Clooney has similarly emphasised that clear communication and mutual agreement are essential, and that “once consent is withdrawn, any continued sexual activity crosses the line into criminal conduct.”

This means that in places where consent law is well-established, ignoring an explicit “stop” can lead to charges of sexual assault, with courts interpreting such conduct as a violation of an individual’s autonomy and dignity.

The issue has gained media and legal attention in recent years across numerous jurisdictions (including Canada, parts of Europe, and reform discussions in U.S. states) as courts and legislatures clarify that sexual consent is continuous and revocable at any time. Although no globally consolidated database exists of individual cases tied specifically to a news report on this warning, reputable legal frameworks consistently reinforce that continuing after “stop” is unlawful.

The subject engages legal scholars, criminal law practitioners, human rights experts, and statutory bodies advocating sexual violence prevention. Law enforcement agencies and prosecutors may pursue charges when clear evidence shows that consent was withdrawn and ignored.

In practice, consent frameworks require that the person initiating or continuing sexual activity take reasonable steps to ensure ongoing affirmation of willingness. Silence, passive behaviour, or failure to stop when asked cannot substitute for ongoing consent.

In summary, the legal maxim is clear: verbal or unambiguous withdrawal of consent must be respected. Ignoring it shifts the encounter from consensual to criminal, potentially resulting in serious legal consequences including imprisonment.

society

Lagos Family Property Dispute Turns Violent After Death of Omotayo Ojo

Lagos Family Property Dispute Turns Violent After Death of Chief Omotayo Ojo

By Ifeoma Ikem

A festering family dispute over property has escalated into a series of violent attacks in Lagos, leaving residents of a contested apartment in fear for their safety.

Mrs. Omotayo-Ojo-Alolagbe (Nee Omotayo-Ojo) the third child and first daughter of the late Omotayo Ojo, has alleged repeated assaults and destruction of property by her siblings from her father’s other marriages.

According to her account, hostility against her began while her father was still alive, allegedly fueled by the affection and support he showed her. She claimed that tensions worsened after his death in 2019.

Mrs. Alolagbe stated that her late father had given her a particular apartment during his lifetime, assuring her she would not suffer hardship, especially after her husband left the marriage. She said the property became her primary source of livelihood and shelter.

However, she alleged that her siblings had sold off several other family properties and were determined to dispossess her of the apartment allocated to her by their father.

The dispute reportedly turned violent on Nov. 15, 2025, when unknown persons allegedly attacked the building. She said the incident prompted her to petition the Chief Judge of Lagos State and the Commissioner of Police.

Despite the pending legal proceedings, she alleged that another attack occurred on Jan. 21, 2026. During that incident, parts of the building were vandalised, including the walkway and the main gate, which was reportedly removed.

A third attack was said to have taken place on Feb.18, 2026, during which the roof, gates, and sections of the walkway were allegedly dismantled. Residents were reportedly assaulted, and some were allegedly forced to part with money under duress.

Tenants in the apartment complex are said to be living in fear amid the repeated invasions, expressing concern over their safety and uncertainty about further violence.

Mrs. Alolagbe alleged that the attacks were led by a man identified as Mr. Alliu, popularly known as aka “Champion,” whom she described as a political thug. She claimed he arrived with a group of about 50 men, allegedly brandishing weapons and breaking bottles to intimidate residents.

She further alleged that the group boasted of connections with senior police officers, politicians in Lagos State, and even the presidency, claiming they were untouchable.

According to her, some arrests were initially made following the incidents, but the suspects were later released. She expressed concern that the alleged perpetrators continue to threaten her, making it difficult for her to move freely.

She also disclosed that during a meeting on Feb. 23, 2026, an Area Commander reportedly told her that little could be done because the matter was already before a court of law.

The development has raised concerns about the enforcement of law and order in civil disputes that degenerate into violence, particularly when court cases are pending.

As tensions persist, residents and observers are calling on relevant authorities to ensure the safety of lives and properties ,while allowing the courts to determine ownership and bring lasting resolution to the dispute.

society

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

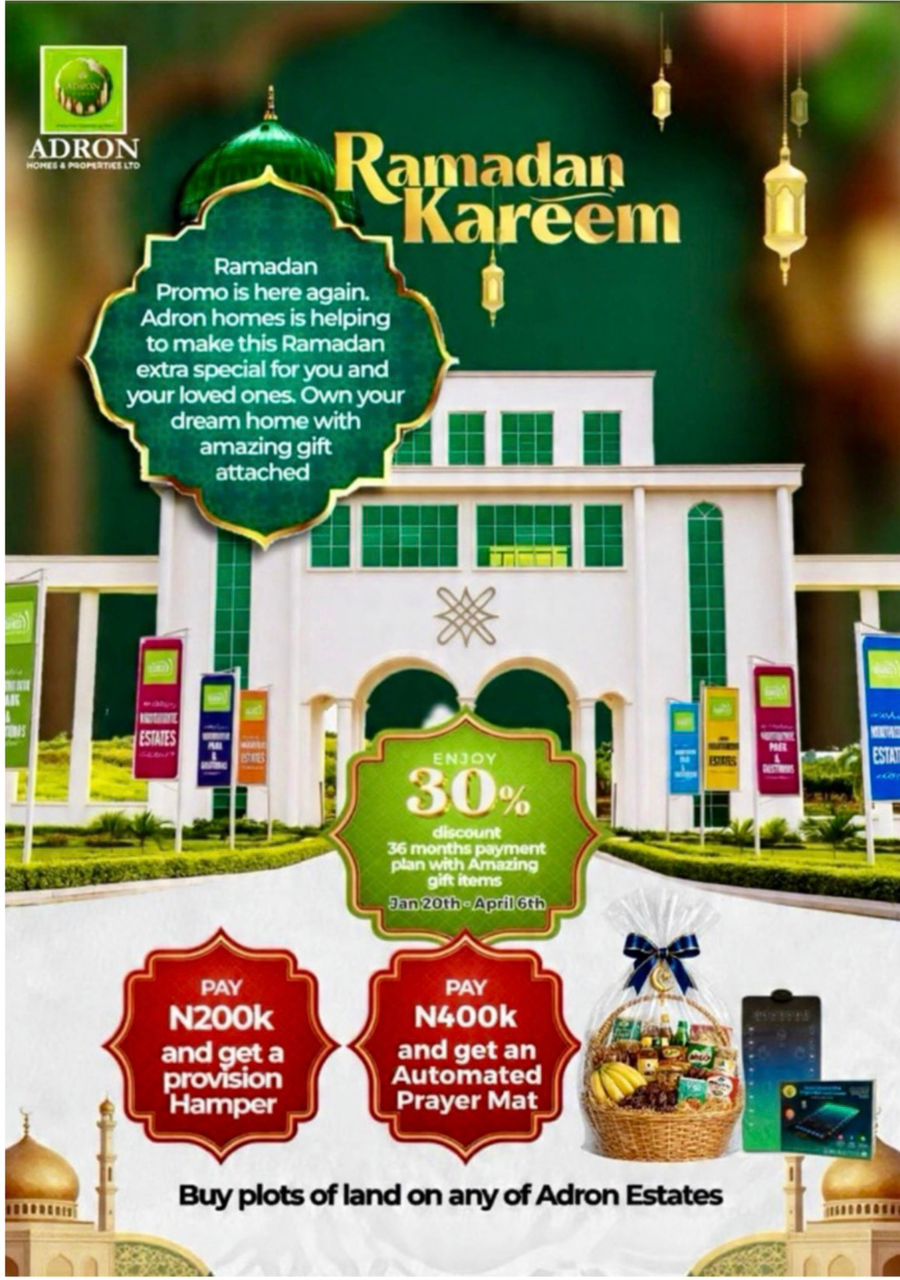

As the holy month of Ramadan inspires reflection, sacrifice, and generosity, Adron Homes and Properties Limited has unveiled its special Ramadan Promo, encouraging families, investors, and aspiring homeowners to move beyond seasonal gestures and embrace property ownership as a lasting investment in their future.

The company stated that the Ramadan campaign, running from January 20th to April 6th, 2026, is designed to help Nigerians build long-term value and stability through accessible real estate opportunities. The initiative offers generous discounts, flexible payment structures, and meaningful Ramadan-themed gifts across its estates and housing projects nationwide.

Under the promo structure, clients enjoy a 30% discount on land purchases alongside a convenient 36-month flexible payment plan, making ownership more affordable and stress-free.

In the spirit of the season, the company has also attached thoughtful rewards to qualifying payments. Clients who pay ₦200,000 receive a Provision Hamper to support their household during the fasting period, while those who pay ₦400,000 receive an Automated Prayer Mat to enhance their spiritual experience throughout Ramadan.

According to the company, the Ramadan Promo reflects its commitment to aligning lifestyle, faith, and financial growth, enabling Nigerians at home and in the diaspora to secure appreciating assets while observing a season centered on discipline and forward planning.

Reiterating its dedication to secure land titles, prime locations, and affordable pricing, Adron Homes urged prospective buyers to take advantage of the limited-time Ramadan campaign to build a future grounded in stability, prosperity, and generational wealth.

This promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states.

As Ramadan calls for purposeful living and wise decisions, Adron Homes is redefining the season, transforming reflection into investment and faith into a lasting legacy.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING