Business

Access Bank prosecutes defunct Intercontinental Bank staff for stealing N1.2bn from customers

Following the startling discovery of a whopping N1.2bn fraud, allegedly committed by one Olayinka Sanni, qa former staff of Access Bank, through illegal siphoning of customers’ money, the bank has now taken the bold step to prosecute the said former staff, through the anti-graft agency, Economic and Financial Crimes Commission (EFCC,) after intensive investigations confirmed Sanni’s culpability in the alleged fraud.

An employee of Access Bank, one Arthur Ezindu, narrated how Olayinka Sanni, then an Account General Manager, AGM, of several plum accounts, severally stole a sizeable amount of money to the tune of N1.2billion from several accounts belonging to customers of the bank. Some of these customers’ accounts include: the Falana & Falana Chambers; Babington Junior Seminary; Viju Industries; Mechano Nigeria, PWU Nigeria; Elizade Nigeria; Murhi International Group, to mention a few. Sanni was reportedly arraigned alongside one Oyebode Oteyebi by the Economic and Financial Crimes Commission (EFCC) on an eight-count charge bordering on stealing, forgery and altering of forged documents. Ezindu, who gave his office address as Block 99C Damole, off Adeola Odeku, testified as a prosecution witness before an Ikeja High Court, Lagos. While being led in evidence by the EFCC Lawyer, Rotimi Oyedepo, Ezindu said that Sanni withdrew the said huge sum of money from different customers’ accounts without their consent and thereafter issued them forged documents of confirmation which he purportedly claimed, emanated from the bank. In the course of interrogation, Arthur Ezindu told the Special Offences Court that, Olayinka, who was his boss at the time of the incident, was a regional Executive, Lagos Mainland North at Intercontinental bank, now Access Bank. According to him, “The bank received several complaints from several customers whose accounts were debited without their consent. However, during the preliminary investigation, we noticed that all the complaints were centered on our staff, Olayinka Sanni. We then invited him to the head office for questioning, but he claimed that everything was under control. He told us not to bother investigating the matter on the ground, that there was more behind what was happening. So since he was our senior officer, being the AGM at that time, we decided to petition his case to the EFCC for proper investigation. When asked how much was involved as at the time the bank petitioned for EFCC, Ezindu replied, the total sum was about N1.2billion. The prosecution thereafter tendered the petition dated September 2011 in evidence. Meanwhile, the two defendants were also arraigned alongside a company, Sidaw Ventures Limited, which was allegedly used to transfer and cash out the stolen funds. The employee further said that during the preliminary investigation, the bank discovered that the company, Sidaw had Adamu as its signatory, while Sanni indirectly managed the account. Some of the handwriting on the cheques belonged to Sanni. He was the one indirectly signing and filling the cheques for Adamu. But in the wake of this unfolding scenario that is creeping into the good image of Access Bank, it was found out that the sleaze by Sanni was actually committed when he was still a staff of now defunct Intercontinental Bank, before it was acquire by Access Bank, thus with its assets and liabilities, as normally done in cases of acquisition. Upon acquisition, Access Bank began a fresh look into the books and records of Intercontinental Bank; that was when the Olayimka Sanni’s lead was broken, as many atrocities and malfeasances were discovered, all pointing in the direction of Sanni, who by this time had resigned from Access Bank, apparently due to the fact, that it would not take long before his misdeed will be found, and he would go in for it. Subsequently, he was invited by the bank and handed over to EFCC for further investigation, which now led to his present prosecution at the Ikeja High Court (Special Offences Unit.) The case was adjourned to a later date for further hearing, while the accused was refused bail, and still in the detention of EFCC. The deduction from the case is that the implication being created is that the fraud was committed by Sanni as a staff of Access Bank, but the truth of the matter is that the fraud was committed by Sanni while he was a top official of defunct Intercontinental Bank, until it was eventually acquired by Access Bank with all its assets and liabilities, which now, in a fresh bid to regularize the acquisition, found out the sleaze committed by Sanni.

Business

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

The Aig-Imoukhuede Foundation is pleased to announce that applications are now open for the sixth cohort of its transformative AIG Public Leaders Programme (AIG PLP).

This flagship six-month executive education initiative, delivered by the University of Oxford’s Blavatnik School of Government, is designed to empower high-potential public sector leaders across Africa with the tools, networks, and strategic insight required to deliver meaningful reform across African public institutions.

Applications are now open to qualified public servants from all English-speaking African countries and will close on Sunday, April 12, 2026. The programme commences in October 2026.

Since its inception in 2021, the AIG PLP has built a formidable reputation for creating tangible impact.

Alumni from the programme have gone on to design and implement more than 230 reform projects within their ministries, departments, and agencies across Africa.

An impact survey revealed that 62% of alumni have earned promotions or assumed expanded leadership roles post-training, demonstrating the programme’s direct effect on career advancement and institutional influence.

“Across Africa, the complexity of public sector challenges demands more than good intentions. It requires reformers who understand systems, can navigate institutional realities, and are equipped to implement sustainable change.

The AIG PLP is designed to meet this need,” said Ofovwe Aig-Imoukhuede, Executive Vice-Chair of the Aig-Imoukhuede Foundation.

As part of the programme, a PLP alumna, Titilola Vivour-Adeniyi, Executive Secretary of Lagos State DSVA, launched a secure self-reporting tool that allows survivors of domestic and sexual abuse safely document incidents and preserve evidence.

Survivors are already accessing support, and the tool ensures that crucial proof is protected until justice can be sought. This is one of over 230 impactful reform projects being implemented across sectors as diverse as healthcare, finance, agriculture, and education.

We are seeing proof every day that investing in the capacity and leadership potential of people, delivers the kind of transformation that policy alone cannot achieve.”

The AIG PLP is a blended learning experience that combines online sessions with an intensive residential module.

It is offered at no cost to selected participants, with the Foundation covering all costs of the programme including accommodation and feeding during the residential weeks.

Participants gain direct access to world-class faculty from the University of Oxford, and learn to tackle core public sector challenges such as: Negotiating in the public interest. Harnessing digital technology for governance.

Strengthening public organisations.

Upholding integrity in public life.

The curriculum culminates in a capstone reform project, where participants apply their new skills to a real-world challenge within their institution.

This practical component ensures that learning translates directly into actionable solutions.

Interested candidates are encouraged to apply early. For more details on the application process and to apply, please visit the Aig-Imoukhuede Foundation website.

Business

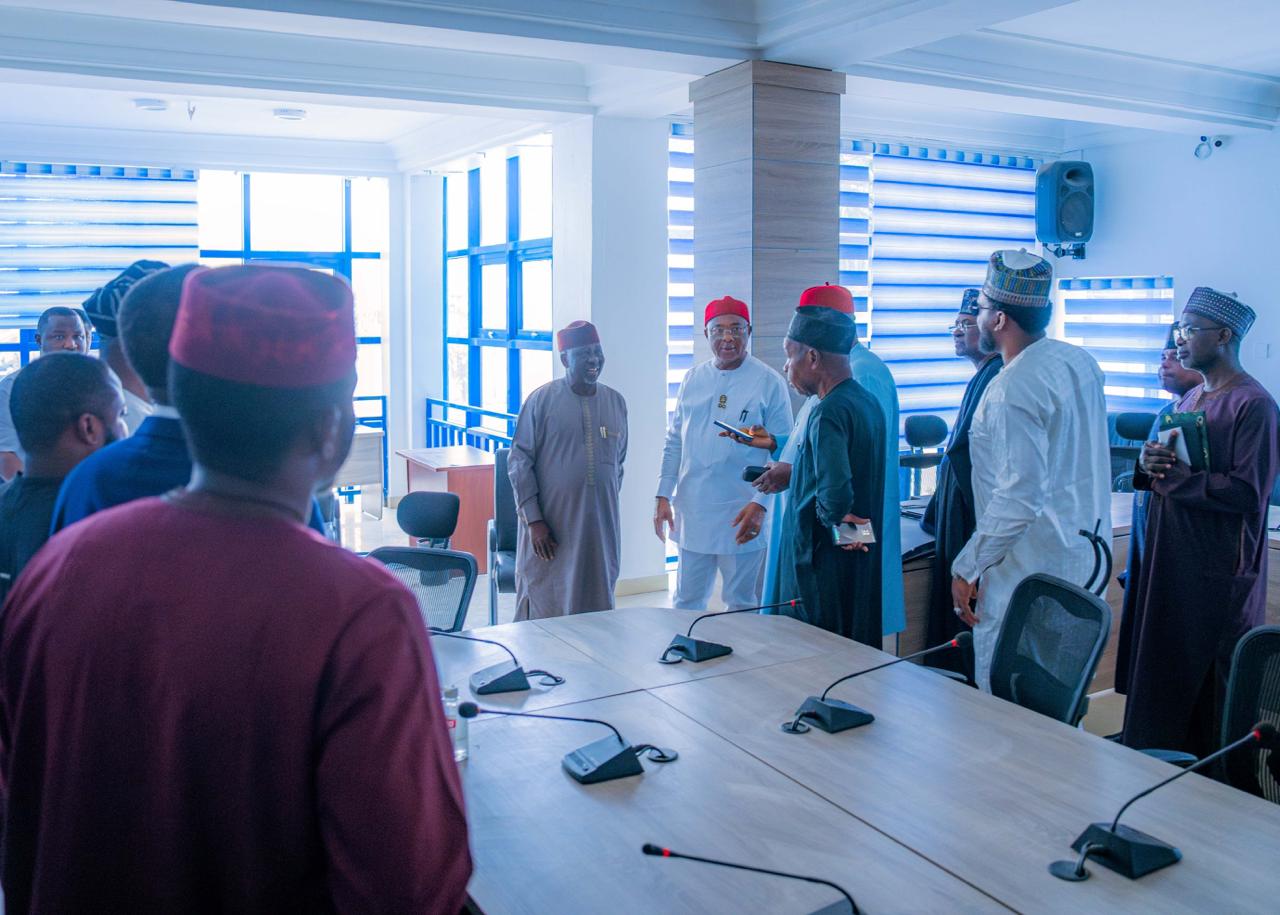

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors, led by its Director-General and the Governor of Imo State, Hope Uzodinma, alongside Zonal Coordinators (NW, NC, SE), the Media & Publicity Directorate, and other key stakeholders, inspected the RHA Secretariat two days after President Bola Tinubu unveiled the Renewed Hope Ambassadors grassroots engagement drive in Abuja.

Business

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Gardens’ Ibeju-Lekki Portfolio Crosses $1bn

Harmony Garden & Estate Development Limited has expanded its development activities across Ibeju-Lekki, pushing the projected long-term value of its estate portfolio beyond $1 billion.

Led by Chief Executive Officer Hon. Dr. Audullahi Saheed Mosadoluwa, popularly know Saheed Ibile, the company is developing seven estates within the Lekki–Ibeju corridor. Details available on Harmony Garden & Estate Development show a portfolio spanning land assets and ongoing residential construction across key growth locations.

A major component is Lekki Aviation Town, where urban living meets neighborhood charm, located near the proposed Lekki International Airport and valued internally at over $250 million. The development forms part of the company’s broader phased expansion strategy within the axis.

Other estates in the corridor tagged as the “Citadel of Joy” (Ogba-idunnu) include Granville Estate, Majestic Bay Estate, The Parliament Phase I & II, and Harmony Casa Phase I & II.

With multiple projects active, the rollout of the Ibile Traditional Mortgage System, and structured expansion underway, Harmony Garden & Estate Development Ltd continues to deepen its presence within the fast-growing Ibeju-Lekki real estate market.

-

celebrity radar - gossips7 months ago

celebrity radar - gossips7 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society7 months ago

society7 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news3 months ago

news3 months agoWHO REALLY OWNS MONIEPOINT? The $290 Million Deal That Sold Nigeria’s Top Fintech to Foreign Interests

You must be logged in to post a comment Login