Business

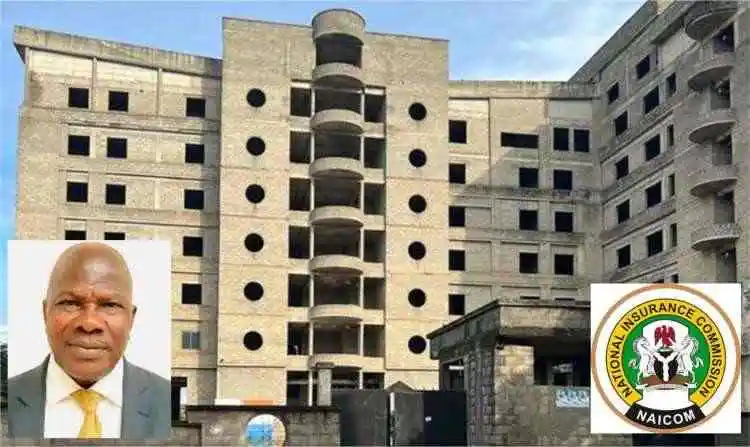

Curbing The NAICOM Cartel And Its Cut-Throat Motor Insurance

Curbing The NAICOM Cartel And Its Cut-Throat Motor Insurance

By

Felix Oboagwina

As last year drew to a close, the 58 insurance firms in Nigeria under the umbrella of the National Insurance Commission (NAICOM) served notice that minimum Third-Party subscription for motor vehicles would no longer cost N5,000 but N15,000 beginning from this New Year. Some years ago, they charged N1,000 as minimum payable on motor insurance.

Contrast with the current debate on the social media about MultiChoice serving a notice of increase on GOtv and DSTV subscribers. The increase ranges from 16 percent to 22 percent. Despite this, people are shouting BLUE MURDER! Subscribers are calling for the cable TV firm to be skinned or beheaded, saying MultiChoice would not dare such in its home headquarters, South Africa. Last time MultiChoice tried it, the matter went as far as the National Assembly.

This same National Assembly now looks the other way with the new insurance premiums. What is the cable TV’s 22 percent increment, compared to 200 percent by NAICOM? What insurers have done is brazen and indecent! To increase the minimum Third-Party motor insurance to 300 percent is not only unreasonable it is draconian. It is an act of impunity. It is extortionist, insensitive, inconsiderate, untimely, ill-advised, selfish and self-serving. It panders to the unbridled greed of industry operators. The brazenness is insulting. In short, the hike is highly inconsiderate, especially in this era of scarce and expensive fuel and an economy still reeling from the effects of the COVID-19 pandemic.

Yet insurers blame the N10,000 increment on “current economic realities.” Not acceptable!

There are an estimated 13 million vehicles in Nigeria, of which only some 3 million have been captured in the insurance net. Instead of seeking ways to lure the noncompliant 10 million vehicle-owners to buy into insurance, insurers want to milk conformists to death. Where will patrons accommodate this increase, in a country with a minimum wage of N30,000?

Of course, those earning minimum wage do not own vehicles. However, they use transportation. When the prices of vehicle inputs like fuel, tolls and spare parts become costlier, vehicle owners simply transfer them to commuters through higher fares. Adding a costlier insurance to the motor value chain amounts to subjecting vehicle owners to double, nay multiple, jeopardy, with the spiral effect translating to higher transport fares and costlier freighting fees.

Imagine if other elements in the motor driving particulars too decide to follow suit. It means that drivers and owners would pay three times on:

1. Vehicle Licence

2. Road Worthiness

3. Hackney Permit

4. Drivers Licence

5. Customs Papers

6. Tinted Glass Permits (which the Police Force deserves kudos for waiving) and other council and business locations tickets.

Someone said, “Insurance is the sale of promises. The ‘customer’ pays money now; the insurer promises to pay money in the future if certain events occur. Sometimes, the promise will not be tested for decades.” Sometimes the promise will not be even tested forever! In fact, only about 15 percent insurance subscribers ever bother to make accident claims. The greater proportion of claimants comes from corporate policyholders. Thus, the insurance firm is the greater beneficiary in the relationship because the individual motor policyholder would just lick his wound and settle the bills jejely.

Everyone knows that the Third-Party insurance on vehicles is just to fulfil all righteousness –a legal requirement with which transport owners must comply. In Nigeria here, they refer to it as, “Let-My-People-Go Insurance,” or “Let-Me-Pass Insurance.” Third-Party is the paper drivers obtain just to satisfy the police. That’s all!

In case of accident or damage to Third-Party vehicles, insurance customers hardly bother to engage themselves in the stress of filing claims. The red tape and bureaucracy is so organised as to be stressful and time-wasting. Therefore, claimants simply pay from their pockets. Commercial bus and employed drivers are a common sight, kneeling and prostrating on the ground for the mercy of those whose cars they bash. Hence, the insurance firm reaps from doing NOTHING!

Since owning personal cars for over two decades now, I have been involved in accidents. Not once have I made a single claim! In fact, apart from an Insurance Broker in my church, no one I know has EVER made a claim. Not one! In fact, late last year, someone in my neighbourhood had his SUV crushed by a falling container. The owner of the offending trailer came privately to plead for the victim to accept N7 million for a vehicle worth N12 million. Family members told the victim to thank God for surviving the ordeal and accept the money. That is how we roll.

As of 2019, the Nigerian industry ranked 62nd in the world with $1.64 billion premium. That makes it an industry worth some N1.2 trillion. In 2021, the unaudited Insurance Industry performance in Nigeria showed that insurance firms made a gross income of N630 billion, and posted N238.05 billion as net expenditure. Talk about a fertile cash cow.

Insurers benefit colossally from the statutory laws making vehicle insurance cover mandatory for cars, trucks and motorcycles. The Insurance Act 2003 mandates all motorists to carry the minimum of a Third-Party Motor Insurance Policy. Section 68 of the 2003 Insurance Act stipulates:

“No person shall use or cause or permit any other person to use a motor vehicle on a road unless a liability which he may thereby incur in respect of damage to the property of third parties is insured with an insurer registered under this Act.”

The law varies in the US, where most states, require vehicles to carry motor insurance. However, there are two US states where it is not mandatory –Virginia and New Hampshire. Countries like New Zealand, Saudi Arabia and Manila do not require a compulsory insurance for vehicles to ply the roads.

It is compulsory in Britain too, hence, we see that mandatory insurance is part of our colonial heritage. This colonial heritage must go now. As our colonial hangover, motor insurance is being weaponised for inordinate extortion, unbridled greed and excessive profiteering by insurers operating under a NAICOM cartel.

Time has come to break up this cartel. With NAICOM calling the shots, it amounts to a monopoly, which should not hold in a free enterprise and deregulated economy. NAICOM is operating like a cartel. We consumers reject being milked by this privileged cartel. Nigeria should make insurance OPTIONAL. This Ninth National Assembly or the coming Tenth National Assembly should make this a matter of urgent public importance. Legislators should change the law to deregulate insurance or scrap this motor insurance law. The NASS should tweak the Insurance Act. Expunge, reframe, rephrase, rewrite restructure or remove that part of the law that makes it compulsory for vehicles to carry an insurance paper to travel the roads. If vehicles MUST be insured, the law should permit no more than a marginal increase, going forward. Motor insurance premium should take a cue from MultiChoice –no increment should be over 20 percent.

Legislators need to make a law to make motor insurance deregulated, optional or non-exploitative. They would be writing their name in gold.

(OBOAGWINA IS AN AUTHOR AND JOURNALIST, AND MAY BE REACHED VIA: [email protected])

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING