Business

ENABLING DREAMS WITH FIRST BANK ‘DECEMBER IS A VYBE’

ENABLING DREAMS WITH FIRST BANK ‘DECEMBER IS A VYBE’

One of the most fascinating quotes of popular British business magnate and author, Sir Richard Brandson is that “A great business is simply an idea to make other people’s lives better.” This vital nugget aligns with a global view that a critical element of successful brands is the ability to beyond functional products benefits become a visible partner in customers lives, enabling them live better and happier, aim higher and achieve their dreams.

For businesses, this means seeing beyond financial gains into becoming a true ally and partner who make life worth living. This is a core hallmark of the few enduring global brands and FirstBank appears focused on towing the path.

Beyond business promotion and marketing engagements solely for commercial value, the premier bank in its 127th year is assisting Nigerians to live happier and create awesome memories of good time with cherished ones through some cool initiatives.

Globally, December heralds the holiday season during which people love to celebrate, unwind and relax with loved ones. Though checkered by Covid-19 disruptions in 2020, FirstBank is giving a new expression and meaning to ‘December in Nigeria’ with the high-octane and life enriching #FirstBankIssaVybe, #DecemberIssaVybe campaign.

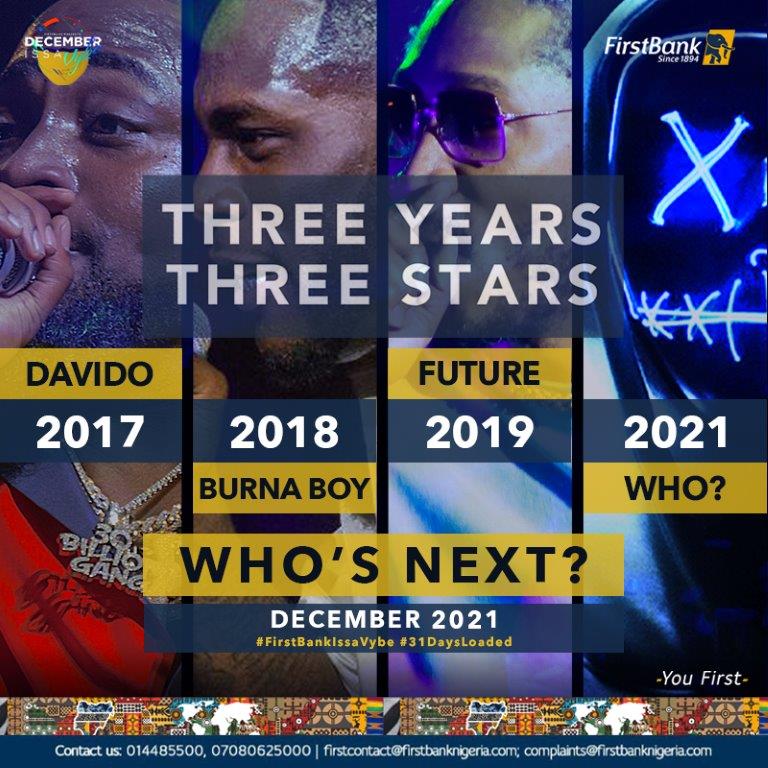

The campaign which started in 2018 is already generating ripples across the cities with Nigerians across ages anticipating the new trick FirstBank will pull out from the hat this year.

Through the annual FirstBankIssaVybe campaign, FirstBank sponsors of an array of the hottest and coolest entertainment platforms across music, fashion and arts during the month of December, with massive ticket giveaways to premium events.

The goal is to create enthralling and memorable experience for customers in the Yuletide season as they bond with family and friends, whilst connecting with their favourite superstars.

Commenting with much enthusiasm on the year-end campaign, global head marketing and corporate communication of FirstBank, Folake Ani-Mumuney says it’s simply FirstBank creating a ‘Wow December to Remember’ experience for all as a bank for all generations.

For her, #FirstBankIssaVybe offers a variety performance; FirstBank is not just considering financial well-being but also the entire well-being for customers. That is why it is enabling opportunities for families to come together to celebrate and enjoy premium concerts, plays, fashion and food, and gave out over 500 mostly VIP tickets per campaign, which cost from N15,000 to N50,000.

“We are delighted with our achievements and consider the yuletide a good way of identifying with our customers and appreciating their support. We want them to have the best of fun through this period. Through different expressions, we strive to support our heritage; the value systems we believe in and create opportunities for families to bond across generations.

“The carefully curated experiences speak to our ethos, what we believe in and what Nigerians would appreciate. We do not just concentrate like some other brands on specific areas, or just one name; we are true enablers across the raft, and offered variety. We also use the opportunity to further deepen support for arts and job creation.

“We also spread the program across the nation with sponsorship of Igue Festival in Edo State, and Calabar Carnival in Cross River State. With our partners, #DecemberIssaVybe, we curate across the country as a whole. We supported Waka the Musical in 2017 which was also taken to Abuja in 2018,” she noted.

Meanwhile, the campaign has seen customers treated to fantastic experience in previous editions and many are looking forward to the 2021 edition. From the exciting Alternative Sound 4.0, held at Terra Culture on 5 December, 2019 to the memorable Cardi B live in Lagos by Livespot Concert on 7 December 2019 and the unforgettable “An Evening with FBNHoldings” held on 13 December, 2019 to the pleasure overload of Island Block Party at Oniru Lagos on 14 December, lucky customers and followers of the Bank’s social media handles were given free tickets to have loads of fun!

Also, in the bouquet of fun extravaganza was Teni – The Billionaire Experience musical concert held at Eko Hotel on Monday, 16 December 2019 which had many customers thrilled to the finest of tunes by the Billionaire crooner and other guest artistes present. The annual Nativeland music festival at Muri Okunola Park was another event for the yuletide which has since its inauguration in 2016, had top class performances by A-lists artistes.

Youth and teenage fashion lovers were not left out; as with Street Souk, they had a feel of current trends and creativity in the fashion industry. The event held on 18 December 2019. Keen on getting exposed to the best and latest designs, wears and fabrics in fashion, then the African Fashion Week Nigeria was another port of call. The event which held 20 – 21 December, 2019 attracted leading players in the fashion industry and deepened the fashion appetite and interest of participants.

Building into Christmas was Flytime Rhythm Unplugged, starting on 20 December at the Eko Hotel and Suites. The 5-day music festival event had performances of leading and top artistes in the country. Olamide, Burna Boy, Tiwa Savage, MI, Ycee, Patoranking, Mayorkun, Teni, Zlatan, Joeboy, Fireboy, B Red, Tolani, Jeff Akoh, Oluwadamilola thrilled fun lovers to the best of tunes topping charts not just in Nigeria but the continent. On the wheels of steel was DJ Neptune, DJ Consequence, DJ Obi, and DJ Cuppy.

Kizz Daniel’s Toro concert on 26 December 2019 and Tu Face’s musical show on 28 December built up to the wrap-up of the list of December events with Future, the American trap music sensation scheduled to perform live in Lagos. The Future Live in Concert held 29 December 2019 at the Eko hotel. The 80s boy band, New Edition performance at the FlyTime Music Festival in Lagos was also electrifying with Burna Boy Live, Davido Live and many more in action!

For plays, the campaign has featured sponsorships of Moremi and Oba Eshugbayi play which focused on highlighted history of Lagos: the struggle over water tax imposed by the British on the people of Lagos and the expulsion of Oba Esugbayi, who stood against the tax, to Abeokuta. The play was from the stable of Joseph Edgar of the iconic Duke of Shomolu Production.

Two lucky fans, Tina Ediale and Timilehin Anibaba, amongst others got to see their favourite star Davido Live in Concert; another winner, Azeez Animashaun couldn’t believe his luck when he got a VIP Rhythm Unplugged ticket while some got special treat watching ace actress Omotola Jalade Ekeinde as Esumirin in Moremi The Musical.

Some social media followers also scored invitation to parties including Island Block Party, All Black Everything; conferences Golas Grit Grind 2.0; festivals: Native Land, Plamwine Festival; and pop up sales: Mente de Moda.

The FirstBank #DecemberIssaVybe and #FirstBankIssaVybe giveaway fest is again set to reward old, new and potential customers with tickets to premium events around Lagos.

And Yes, we know you want to attend these events and yes you can. Just follow FirstBank on any of its social media pages – Facebook: First Bank of Nigeria Limited, Instagram: @firstbanknigeria, and Twitter: @firstbankngr – look out for the posts announcing the giveaway and follow instructions to experience maximum party #vybes this season.

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING