Business

Exposed! How APC Chieftain, Etiebet’s 2016 letter gave new clues to alleged N2.4bn debt to Access Bank

Exposed! How APC Chieftain, Etiebet’s 2016 letter gave new clues to alleged N2.4bn debt to Access Bank

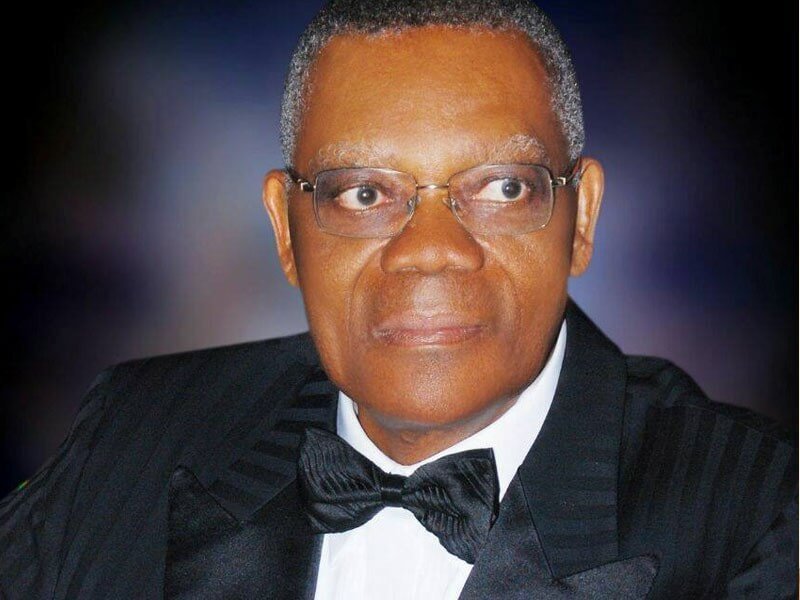

In a letter dated November 9, 2016 written by former petroleum minister and All Progressive Congress (APC) chieftain, Don Etiebet, in respect of what is turning out to be a messy N2.4 billion indebtedness by an oil and gas company, Top Oil, to Access Bank plc, appears to offer a new narrative to the dispute.

Writing in his capacity as chairman of Top Oil and Gas Company Limited, the letter shows an admission by Etiebet of the indebtedness and profused pleading for time to resolve the matter with the principal parties, CASTOIL that appear to have brought the business from Mobil Oil Nigeria Limited, for which Top Oil was hoping to profit from as a third party participant.

However, the Etiebet letter seen by Business A.M. among the documents making the court rounds, also shows while CASTOIL had the direct supply business with Mobil Oil, Top Oil made have found the business very attractive as to take full responsibility of sourcing the funds, hence the Import Finance Facility (IFF) made available to it by the bank for the purpose of importation of Automotive Gas Oil (AGO) for supply to Mobil.

In the letter addressed to “The Manager, Access Bank Plc, Business Banking Division, Chevron Roundabout Branch, Lekki” with the heading, “RE: US$6.3 MILLION OUTSTANDING L/C PAYMENT”,Etiebet refers to the ‘demands’ by the manager for the payment of an outstanding letter of credit (LC) of US$6,382,666.00, “which was used to import 10,000MT of AGO to supply Mobil Oil Nigeria Limited from Augusta Energy.”

In what appears to suggest an apology over the situation, Etiebet then wrote: “I regret that this payment is still outstanding till today. The true and correct position is that Top Oil and Gas Development Company Limited (TOPOIL) carried out this contract with a third party, CAST OIL and GAS LIMITED (CASTOIL) which brought the project from Mobil Oil Nigeria Limited. TOPOIL did not deal directly with Mobil Oil as it is common practice in the industry that companies cooperate to execute project of this nature and share the profit,”Etiebet wrote.

He went on to explain that after an initial payment made by the third party, CASTOIL, the latter failed to make further payment, suggesting this to be the reason for the delay and failure to redeem the letter of credit sum.

“Unfortunately, after the initial payment of N170,000,000.00 from CASTOIL into TOPOIL account with Access Bank Plc in August 2015 as agreed, CASTOIL failed to make further payments. CASTOIL then request (sic) TOPOIL to give it sometime to reconcile certain issues with Mobil Oil and in the process issued TOPOIL a “PAYMENT COMMITMENT” in the sum of N1,321,431,000.00, which is what CASTOIL owed TOPOIL for the L/C at N200/$ at that time plus other costs and to pay up in three instalments by the 31st of August 2015 as per attached CASTOIL letter,” Etiebet, in the letter, also referred to how the Economic and Financial Crimes Commission (EFCC) had become involved, expressing confidence that the money would be paid to TOP OIL for it to settle Access Bank, what it owes it.

The letter further reads: “When the commitment was not honoured, TOPOIL reported the case to the security agencies. In the process of the investigations, CASTOIL entered into another agreement with TOPOIL to pay up by the end of November 2015, with understanding to pay interests and any forex variation from N200/$ to the fx rate at the time of completion of payment. The case is being handled by the EFCC with CASTOIL’s Managing Director, Mr.TunjiAmushan being on Administrative Bail with sureties and his International Passport impounded as he reports to the EFCC every Thursday with promises to pay up. EFFCC has assured us that they would recover all the money plus interest and FX variation from him before long plus other sanctions.”

The letter showed that apparently while TOPOIL was trying to resolve whatever difficulties it was having with CASTOIL over the payment it did not inform or carry along its bankers.

In further demonstration of remorse, therefore, Etiebet then stated in the letter: “I am very sorry that this was not reported to you before now because we thought CASTOIL would pay up as has been promised since last year for us to liquidate the outstanding L/C payment. So I take this opportunity to commit to you that the debts of US$6,382,666 to your bank shall, meanwhile, be paid from alternative sources including profits TOPOIL would be making from its current contracts with NNPC-Retail to supply AGO to Total-Offshore. “With other contracts in the pipeline including the supply of PMS to NNPC-Retail, I hereby give my personal undertaking to pay all the outstanding in the US$6,382,666 within 90 days. I want to let you know that we all in TOPOIL regret this unfortunate situation but thank you so much for your continued understanding and cooperation,” Etiebet concluded his rapprochement to the bank.

Sources close to the situation said nothing came out of the promises made in this 2016 letter as the bank did not receive any payment. The bitter contestation of the indebtedness that is currently going on would shades this profound apologetic and hugely conciliatory position in this letter and raises questions about how things got to this point and what, if any, could be the underlying motive behind a complete repudiation of the debt that in this November 9, 2016 letter was fully admitted. In an advertorial widely published in the media, Obodex Nigeria Limited, a company in which Etiebet has large interest and is chairman, claims that it does not owe any debt to Access Bank, a claim which seems to contradict the November 9, 2016 letter.

FACT SHEET TO POINT OF DISAGREEMENT

- On November 21, 2014, Access Bank, following an accepted offer letter to the TOPOIL provides a US$6 million Import Finance Facility (IFF) to facilitate the importation of Automotive Gas Oil (AGO) for supply to Mobil Producing Unlimited by TOPOIL. The facility was tenured for a year with a maximum of 90 (ninety) days circle. In addition to the US$6 million IFF, TOPOIL was also availed a N100 million Revolving Time Loan vide the same offer letter for the purpose of facilitating the payment of Custom duties and other related Logistics.

- This was also tenured for 1 (one) year with a maximum of 90 (ninety) days circle. Several Letters of Credit (LCs) were issued on the facilities, but only 1 (one) remained unpaid which is A2015C1091CL. The facts on the stated LC are stated below: In April 2015 TOPOIL submitted a Proforma Invoice valued at $5,802,500.00 and informed Access Bank it had an order from Mobil. Consequently, LC A2015C1091CL was issued in favour of a company called Augusta Energy SA (“Beneficiary”).

- Upon presentation of all shipping documents required for this particular LC, funds were remitted by the bank to the beneficiary. In 2016, Access Bank increased the TOPOIL’s IFF from US$6 million to US$12 million and this was communicated to TOPOIL in an offer letter dated January 20, 2016. When the facility was not paid, the chairman of TOPOIL, Don Etiebet wrote to Access Bank in a letter dated November 9, 2016 that the LC was done with a third party known as Cast Oil & Gas Limited and committed to repay the Customer’s indebtedness.

- Due to TOPOIL’s failure to repay the sum of US$6,382,665.71 at the expiration of the facility, the said amount was converted into a N2.2 billion Term Loan through an offer letter dated July 4, 2017 and the unutilized sum of US$5,617,334.29 on the US$12million IFF was also converted to a N1,463,000.000.00 Time Loan through the same offer letter. The N1,463,000.000.00 Time Loan was, however, never utilised by the TOPOIL.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

Business

BUA Group, AD Ports Group and MAIR Group Launch Strategic Plan for World-Class Sugar and Agro-Logistics Hub at Khalifa Port

BUA Group, AD Ports Group and MAIR Group Sign MoU to Explore Collaboration in Sugar Refining, Agro-Industrial Development, and Integrated Global Logistics Solutions

Abu Dhabi, UAE – Monday, 16th February 2026

BUA Group, AD Ports Group, and MAIR Group of Abu Dhabi today signed a strategic Memorandum of Understanding (MoU) to explore collaboration in sugar refining, agro-industrial development, and integrated global logistics solutions. The partnership aims to create a world-class platform that strengthens regional food security, supports industrial diversification, and reinforces Abu Dhabi’s position as a hub for trade and manufacturing.

The proposed collaboration will leverage BUA Group’s industrial and logistics expertise, Khalifa Port’s world-class infrastructure, and AD Ports Group’s operational experience. The initiative aligns with the objectives of the UAE Food Security Strategy 2051, which seeks to position the UAE as a global leader in sustainable food production and resilient supply chains. It also aligns with Nigeria’s food production- and export-oriented agricultural transformation agenda, focused on scaling domestic capacity, strengthening value addition, improving post-harvest logistics, and unlocking new markets for Nigerian produce across the Middle East, Asia, and beyond.

Photo Caption: L-R: Kabiru Rabiu, Group Executive Director, BUA Group; Cpt. Mohammed J. Al Shamisi, MD/Group CEO, AD Ports Group; Saif Al Mazrouei, CEO (Ports Cluster) AD Ports Group; Abdul Samad Rabiu, Founder/Executive Chairman, BUA Group; and Steve Green, Group CFO, MAIR Group

Through structured aggregation, processing, storage, and maritime export channels, the partnership is designed to reduce supply chain inefficiencies, enhance traceability and quality standards, and also create a predictable trade corridor between West Africa and the Gulf.

BUA Group—recognised as one of Africa’s largest and most diversified conglomerates, with major investments across sugar refining, food production, flour milling, cement manufacturing, and infrastructure- brings extensive industrial expertise and large-scale operational capability to the venture. MAIR Group will provide strategic support in developing integrated logistics and agro-industrial solutions, creating a seamless platform for production, storage, and distribution.

Abdul Samad Rabiu, Founder and Chairman of BUA Group, said:

“This MoU marks an important milestone in BUA’s international expansion and reflects our long-term vision of building globally competitive industrial platforms. Together with AD Ports Group and MAIR Group, we aim to develop sustainable food production and logistics solutions that strengthen regional supply chains and support the UAE’s Food Security Strategy 2051.”

He further added that, “This partnership represents not just a commercial arrangement but a strategic food corridor anchored on shared economic ambition, resilient infrastructure, and disciplined execution, reinforcing long-term food security objectives for both nations.”

A representative of MAIR Group added:

“This collaboration underscores our commitment to advancing strategic industries in Abu Dhabi and building integrated solutions that reinforce the UAE’s position as a global hub for trade, food security, and industrial excellence.”

A spokesperson from AD Ports Group commented:

“Our partnership with BUA Group and MAIR Group highlights Khalifa Port’s role as a catalyst for high-impact industrial investments. This initiative will enhance regional food security, strengthen global trade connectivity, and support Abu Dhabi’s economic diversification goals.”

This MoU marks a historic collaboration that combines world-class infrastructure, industrial expertise, and strategic vision, setting the stage for a sustainable and resilient food and logistics ecosystem that will benefit the UAE, the region, and global markets alike.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login