Business

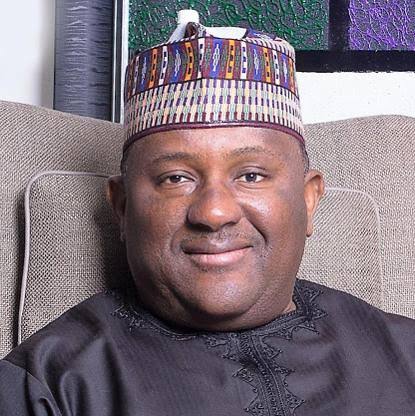

Forbes Lists BUA Chairman, Abdul Samad Rabiu Africa’s Fifth Richest Man, Second In Nigeria

Forbes Lists BUA Chairman, Abdul Samad Rabiu Africa’s Fifth Richest Man, Second In Nigeria

Interestingly, the ripples effect of the recent listing of BUA Foods PLC on the Nigerian exchange has continued to be felt internationally as it has reflected in Forbes placement of Nigerian billionaires in its Aftican listing.

Generally, Africa’s billionaires are richer than they have been in years, despite the global pandemic. As a group, the continent’s 18 billionaires are worth an estimated $84.9 billion – a 15% increase from twelve months ago and the most since 2014, when a larger number of billionaires–28–were worth a combined $96.5 billion. On average, the continent’s billionaires are worth $4.7 billion now vs. $3.4 billion in 2014. Soaring stock prices from Nigeria to Zimbabwe lifted the fortunes of these tycoons, as demand for products from cement to luxury goods ticked up.

For the 11th year in a row, Alike Dangote of Nigeria is the continent’s richest person, worth an estimated $13.9 billion, up from $12.1 billion last year following a 30% increase in the stock price of Dangote Cement, his most valuable asset. A surge in housing developments in Nigeria and growth in government infrastructure spending drove higher demand in the first nine months of 2021, analysts found. Jumping into the No. 2 spot–up from No. 4 last year–is luxury goods magnate Johann Rupert of South Africa. A more than 60% surge in the share price of his Compagnie Financiere Richemont–maker of Cartier watches and Montblanc pens–pushed his fortune to $11 billion, up from $7.2 billion a year ago, making him the biggest dollar gainer on the list. South African Nicky Oppenheimer, who formerly ran diamond mining firm DeBeers before selling it to mining firm Anglo American a decade ago, ranks No. 3, worth an estimated $8.7 billion.

The biggest gainer in percentage terms–up 125%—is Strive Masiyiwa of Zimbabwe, worth $2.7 billion, up from $1.2 billion last year. Shares of Econet Wireless Zimbabwe, which he founded, rose more than 750% in the past year, helping to drive up the size of his fortune.

Another gainer: Nigerian cement tycoon Abdulsamad Rabiu, who is $1.5 billion richer after taking yet another of his companies public. In early January 2022, Rabiu listed his sugar and food firm BUA Foods on the Nigerian stock exchange. He and his son retained a 96% stake in the company, which recently had a market capitalization of nearly $2.8 billion. (Forbes discounts the values of stakes when the public float is less than 5%.) BUA Cement, in which he and his son have a 96% stake, listed in January 2020. He is now listed as the fifth in the continent as well as the second in Nigeria.

Only two of the 18 billionaires are worth less than last year: Koos Bekker of South Africa, who dropped to $2.7 billion from $2.8 billion as the share prices of consumer Internet firms Naspers and Prosus fell more than 20% each, and Mohammed Dewji of Tanzania, whose fortune declined to an estimated $1.5 billion from $1.6 billion a year ago due to lower multiples for publicly traded competitors.

The 18 billionaires from Africa, none of whom are new to the ranks, hail from seven different countries. South Africa and Egypt each have five billionaires, followed by Nigeria with three and Morocco with two. All of the continent’s billionaires are men; the last woman to appear in the ranks, Isabel dos Santos of Angola, fell off the Forbes list in January 2021.

Our list tracks the wealth of African billionaires who reside in Africa or have their primary business there, thus excluding Sudanese-born billionaire Mo Ibrahim, who is a U.K. citizen, and billionaire London resident Mohamed Al-Fayed, an Egyptian citizen. Strive Masiyiwa, a citizen of Zimbabwe and a London resident, appears on the list due to his telecom holdings in Africa.

Net worths were calculated using stock prices and currency exchange rates from the close of business on Wednesday, January 19, 2022. To value privately held businesses, we start with estimates of revenues or profits and apply prevailing price-to-sale or price-to-earnings ratios for similar public companies. Some list members grow richer or poorer within weeks-or days-of our measurement date.

Business

Dangote Refinery Prioritises Domestic Supply Amid Global Energy Turbulence

Dangote Refinery Prioritises Domestic Supply Amid Global Energy Turbulence

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

“Nigeria insulated from international fuel shocks as Dangote Petroleum commits to uninterrupted local delivery.”

Dangote Petroleum Refinery and Petrochemicals has reaffirmed its commitment to prioritising the domestic market, pledging to shield Nigerians from the ripple effects of ongoing global energy disruptions. The assurance, delivered in Lagos on 5 March 2026, comes as international refinery operations experience shutdowns or reduced output due to escalating Middle East geopolitical tensions, which have sent crude oil and petroleum product prices soaring worldwide.

“Our mandate remains clear: Nigeria’s local market takes precedence. In times of global supply shocks, we will continue to ensure that domestic availability of petrol, diesel, and kerosene is uninterrupted,” said Mr. Folorunsho Alakija, spokesperson for Dangote Petroleum Refinery.

The refinery’s declaration arrives amid mounting concerns over fuel scarcity, triggered by export restrictions imposed by major international producers, including China, and shipping delays that have further tightened global petroleum supply chains. Industry analysts have hailed the domestic focus as a critical buffer against volatility that could otherwise push Nigeria into deeper energy insecurity.

Domestic Shield Against Global Disruption

Dangote Refinery, Africa’s largest oil processing facility, has leveraged its multi-million-barrel refining capacity to mitigate Nigeria’s historical dependence on imported petroleum products. The company emphasised that prioritising local supply provides a strategic advantage in insulating the nation from international market shocks.

“Our refinery’s scale allows Nigeria to withstand short-term external disruptions. We have the infrastructure and capacity to meet local demand even when global supply chains falter,” explained Mr. Chijioke Okonkwo, Operations Director at Dangote Refinery.

The proactive approach is particularly significant as several international refineries have either reduced throughput or temporarily halted operations, causing a global scarcity of refined products. Experts warn that without domestic cushioning, fuel prices in Nigeria could have surged sharply, exacerbating inflationary pressures in a fragile economy.

Managing Costs While Prioritising Supply

In response to rising procurement costs for crude oil amid the international crisis, Dangote Refinery introduced a modest ₦100 per litre increase in the ex-depot price of Premium Motor Spirit (PMS), absorbing roughly 20 percent of the cost escalation to lessen the impact on consumers.

“We are balancing operational sustainability with affordability. While global prices have risen sharply, we have chosen to absorb a significant portion to protect Nigerian households and businesses,” noted Mr. Emmanuel Adeyemi, Chief Finance Officer.

This pricing strategy underscores the refinery’s dual focus: ensuring uninterrupted supply while cushioning the public from abrupt spikes that could destabilize economic activity. Industry observers have lauded the approach as pragmatic, considering the volatility in international oil markets.

Strategic Distribution Initiatives

Beyond refining, Dangote Petroleum has initiated Compressed Natural Gas (CNG) powered trucks to enhance nationwide distribution efficiency. The initiative seeks to reduce logistics costs and carbon emissions while ensuring a more reliable delivery network to petrol stations across urban and rural areas.

“Logistics is a critical part of the energy supply chain. By deploying CNG-powered trucks, we reduce dependency on expensive diesel, lower delivery costs, and improve supply reliability across the country,” explained Ms. Funke Adedoyin, Head of Logistics Operations.

This strategic move reflects a broader commitment to modernising Nigeria’s petroleum distribution infrastructure, reducing bottlenecks that have historically contributed to scarcity at retail outlets.

Implications for National Energy Security

Nigeria has historically struggled with fuel imports to meet domestic demand, making the country vulnerable to international market fluctuations. Dangote Refinery’s prioritisation of local supply mitigates this vulnerability by leveraging home-grown refining capacity, which allows for timely access to petroleum products and less reliance on foreign shipments.

“With Dangote Refinery leading local prioritisation, Nigeria is less exposed to global fuel shocks. The country is moving towards self-reliance in petroleum product supply,” commented Dr. Halima Suleiman, energy sector analyst.

Experts note that sustained operations at the refinery not only enhance energy security but also preserve foreign exchange, reduce import bills, and stabilise domestic market prices.

Corporate Social Responsibility and Market Stability

The refinery’s commitment is part of a broader corporate responsibility framework. Dangote Petroleum continues to engage with government agencies and regulatory bodies, ensuring that domestic supply is coordinated with Nigeria’s Petroleum Product Pricing and Regulatory Agency (PPPRA) to prevent panic buying and market distortions.

“We are in constant consultation with the government to ensure that our supply strategies align with national economic priorities,” said Mr. Alakija.

Such collaboration helps avert artificial shortages, stabilises pump prices, and maintains confidence in the domestic fuel market. Analysts argue that this approach exemplifies how private sector capabilities can complement governmental policies to enhance national resilience.

Navigating Global Uncertainties

The refinery operates in a complex global environment, where geopolitical crises, shipping constraints, and crude oil volatility can trigger disruptions. Dangote Petroleum’s domestic-first approach positions Nigeria to weather such crises more effectively.

“Global uncertainties are unavoidable, but our infrastructure and strategy ensure that Nigerians remain insulated from immediate shocks,” said Mr. Okonkwo.

This emphasis on resilience aligns with global best practices, where national refining capacity is leveraged to protect local markets from international supply disruptions.

Stakeholder Reactions

The government, civil society, and industry stakeholders have welcomed Dangote Petroleum’s strategy. Officials from the Federal Ministry of Petroleum Resources noted that prioritising local supply aligns with Nigeria’s energy security policies and reduces the burden of foreign exchange expenditures on crude imports.

“Dangote Refinery is demonstrating leadership. Its domestic prioritisation ensures that the Nigerian economy remains insulated during turbulent global markets,” said Dr. Tunji Olumide, Special Adviser on Energy.

Consumers have also expressed cautious optimism. Retail operators and commuters reported steadier fuel availability in Lagos and other cities, though concerns remain about sustained pricing and distribution efficiency.

The Road Ahead

While Dangote Refinery’s strategy provides immediate relief, experts argue that long-term stability requires further investments in alternative energy, diversified refining infrastructure, and strategic reserves. This ensures that Nigeria can withstand global shocks without relying excessively on imports or temporary supply adjustments.

“Short-term measures like prioritising local supply are critical, but long-term energy security demands diversification, renewables adoption, and consistent policy implementation,” said Dr. Suleiman.

The refinery is exploring additional initiatives, including expanding storage capacity, upgrading pipeline networks, and adopting technology-driven monitoring systems to ensure supply continuity across the country.

Final Take

By prioritising domestic fuel supply amid global market turbulence, Dangote Petroleum Refinery and Petrochemicals has demonstrated its role as a stabilising force in Nigeria’s energy sector. Through strategic logistics, modest pricing adjustments, and engagement with government regulators, the refinery is insulating the nation from international shocks while maintaining operational sustainability.

“Our responsibility extends beyond profitability; it’s about ensuring Nigerians have reliable access to essential fuel. We take that mandate seriously,” concluded Mr. Adeyemi.

The refinery’s actions offer a blueprint for how large-scale domestic capacity can protect national economies in times of global energy instability, underscoring the critical intersection of private sector resilience, public policy, and national energy security.

Business

Time is of the essence,” the group stressed. “Every delay compounds the hardship and weakens faith in the system.”

Trapped Funds, Fading Trust: Heritage Bank Depositors Demand Urgent CBN Bailout

By Ifeoma Ikem

Nearly two years after the collapse of Heritage Bank, thousands of depositors say they are still living with the financial and emotional aftershocks of a liquidation they insist was never meant to end this way. What began as regulatory reassurances has, in their view, spiralled into prolonged uncertainty, partial payments, and mounting hardship, thus prompting a fresh and urgent appeal to President Bola Tinubu and the Governor of the Central Bank of Nigeria, Olayemi Cardoso, to intervene decisively.

In a strongly-worded statement issued in Lagos, the depositors framed their demand not simply as a financial request but as a test of the country’s commitment to safeguarding public trust in its banking system. They are asking the Central Bank to provide immediate bailout funds to the Nigeria Deposit Insurance Corporation (NDIC) to enable full reimbursement of all affected customers, arguing that the pace of recovery so far has been painfully slow and grossly inadequate.

According to them, while insured deposits up to ₦5 million were covered under statutory provisions, payments beyond that threshold (known as liquidation dividends) have amounted to just 14.2 percent of their total balances in nearly two years. The first tranche of 9.2 percent was paid in April 2024. A second installment of 5 percent followed recently. For many, that has been the extent of relief.

At this rate, they argue, the mathematics simply does not inspire confidence.

“These are not abstract figures,” one depositor said. “They represent school fees, retirement savings, working capital for small businesses, cooperative funds, and life savings built over decades.” Among those affected, they say, are civil servants, retirees, entrepreneurs, and families whose livelihoods have been upended by the prolonged wait.

What deepens their frustration, they contend, is the memory of official assurances given before the bank’s collapse. When signs of distress first emerged, depositors recall that the Central Bank publicly and privately reassured customers that their funds were safe and that the institution remained sound. Those assurances, they say, influenced their decision not to withdraw their savings at the time.

The eventual liquidation therefore came as a shock, both financially and psychologically. “We trusted the regulator,” the group noted. “Between the Central Bank and the NDIC, we were told our funds would be repaid 100 percent.”

It is that promise, they argue, that must now be honored in full.

While acknowledging that the NDIC has begun verification and payment processes, the depositors insist that the agency lacks the financial capacity to conclude the exercise within a reasonable timeframe. They point to the scale of total deposits — estimated at about ₦650 billion — and the fact that only around ₦54 billion has been paid out in 18 months. In their view, that ratio raises serious questions about whether the liquidation process, left solely to asset recovery, can realistically guarantee timely reimbursement.

The group also referenced previous instances in which the Central Bank stepped in to stabilize distressed institutions, arguing that regulatory precedent supports intervention. They cited the reported ₦460 billion facility linked to Heritage Bank before its collapse, as well as substantial financial support extended to other banks to facilitate mergers or recapitalization. In one example, they noted, a ₦700 billion support package reportedly enabled a struggling bank to qualify for a merger, with favorable repayment terms that included a five-year moratorium and extended repayment window at below-market interest rates. They also referenced regulatory intervention in Keystone Bank as evidence that decisive action is possible when systemic stability is at stake.

Given that history, they say, it is difficult to understand why a direct bailout to protect depositors is not being prioritized.

Beyond financial restitution, the depositors are also calling for accountability. They demanded a thorough investigation and immediate prosecution of any individuals or entities found culpable of asset diversion, mismanagement, or actions that may have contributed to the bank’s collapse. To them, justice is as important as compensation.

They argue that without visible consequences, public confidence in the banking system could erode further. “The integrity of the financial sector rests not only on liquidity, but on accountability,” one stakeholder said. “If people believe that funds can disappear without consequences, trust collapses.”

The broader concern, they warn, is systemic. Nigeria has not witnessed a full commercial bank liquidation in over two decades, as troubled institutions have typically been resolved through mergers, acquisitions, or regulatory restructuring. Many depositors therefore assumed that a similar pathway would apply in this case. Instead, they say, liquidation has exposed gaps in depositor protection mechanisms.

They also question the broader insurance framework, noting that banks have paid premiums to the NDIC for years precisely to safeguard depositors. If recovery remains this limited, they argue, the protective purpose of that insurance scheme comes under scrutiny.

For small business owners, the implications have been severe. Some report shutting down operations due to frozen capital. Others speak of properties sold under distress or retirement plans abruptly altered. The social cost, they insist, is real and growing.

At the heart of their appeal is a request for clarity. They want a clear, binding timeline for completion of the liquidation process and a transparent roadmap outlining how and when full repayment will occur. Without that, they fear that partial dividends will continue indefinitely, eroded by inflation and the time value of money.

They have also urged the Presidency and the National Assembly to step in, arguing that the matter transcends a single bank and touches on Nigeria’s financial credibility before the global community. Prolonged uncertainty, they warn, risks signaling regulatory inconsistency at a time when the country seeks to attract investment and deepen financial inclusion.

For the depositors, the issue is no longer simply about numbers on a ledger. It is about confidence in regulators, in institutions, and in the promise that money kept within the formal banking system is secure.

They believe the Central Bank must now assume full responsibility for resolving what they describe as a crisis of trust. Whether through direct financial support to the NDIC, accelerated asset recovery, or a hybrid intervention model, they insist that swift action is essential.

“Time is of the essence,” the group stressed. “Every delay compounds the hardship and weakens faith in the system.”

In a nation striving to strengthen its financial architecture and restore economic stability, the resolution of the Heritage Bank liquidation may well become a defining test — not only of regulatory capacity, but of the enduring covenant between citizens and the institutions entrusted with their savings.

Business

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

The Aig-Imoukhuede Foundation is pleased to announce that applications are now open for the sixth cohort of its transformative AIG Public Leaders Programme (AIG PLP).

This flagship six-month executive education initiative, delivered by the University of Oxford’s Blavatnik School of Government, is designed to empower high-potential public sector leaders across Africa with the tools, networks, and strategic insight required to deliver meaningful reform across African public institutions.

Applications are now open to qualified public servants from all English-speaking African countries and will close on Sunday, April 12, 2026. The programme commences in October 2026.

Since its inception in 2021, the AIG PLP has built a formidable reputation for creating tangible impact.

Alumni from the programme have gone on to design and implement more than 230 reform projects within their ministries, departments, and agencies across Africa.

An impact survey revealed that 62% of alumni have earned promotions or assumed expanded leadership roles post-training, demonstrating the programme’s direct effect on career advancement and institutional influence.

“Across Africa, the complexity of public sector challenges demands more than good intentions. It requires reformers who understand systems, can navigate institutional realities, and are equipped to implement sustainable change.

The AIG PLP is designed to meet this need,” said Ofovwe Aig-Imoukhuede, Executive Vice-Chair of the Aig-Imoukhuede Foundation.

As part of the programme, a PLP alumna, Titilola Vivour-Adeniyi, Executive Secretary of Lagos State DSVA, launched a secure self-reporting tool that allows survivors of domestic and sexual abuse safely document incidents and preserve evidence.

Survivors are already accessing support, and the tool ensures that crucial proof is protected until justice can be sought. This is one of over 230 impactful reform projects being implemented across sectors as diverse as healthcare, finance, agriculture, and education.

We are seeing proof every day that investing in the capacity and leadership potential of people, delivers the kind of transformation that policy alone cannot achieve.”

The AIG PLP is a blended learning experience that combines online sessions with an intensive residential module.

It is offered at no cost to selected participants, with the Foundation covering all costs of the programme including accommodation and feeding during the residential weeks.

Participants gain direct access to world-class faculty from the University of Oxford, and learn to tackle core public sector challenges such as: Negotiating in the public interest. Harnessing digital technology for governance.

Strengthening public organisations.

Upholding integrity in public life.

The curriculum culminates in a capstone reform project, where participants apply their new skills to a real-world challenge within their institution.

This practical component ensures that learning translates directly into actionable solutions.

Interested candidates are encouraged to apply early. For more details on the application process and to apply, please visit the Aig-Imoukhuede Foundation website.

-

society6 months ago

society6 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society7 months ago

society7 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news3 months ago

news3 months agoWHO REALLY OWNS MONIEPOINT? The $290 Million Deal That Sold Nigeria’s Top Fintech to Foreign Interests

-

religion7 months ago

religion7 months agoApostle Johnson Suleman: Firebrand of Faith, Prophet to the Nations, Voice to a Generation