queensworld

…………..His Mouth Tasted Warm

QUEENSWORLD Part 1

Hello friends,

Hope you had a great week. I have plenty gist for you, you won’t believe what happened to me in the cause of this week. Sit back and relax while I gist you. So I had a busy and hectic week I decided to put the week’s stress behind me and decided to take myself out for enjoyment you understand what I mean – beautiful girls like me need things like this. (LOL). 8pm on Saturday evening I stole – sorry I mean I borrowed my brother’s car without his permission. Had to treat myself in a big way. Looking all sweet and sexy I drove into the street heading to the mall, half way down the streets the car’s front light stopped to function I knew I was doomed , knowing full well I am not a night driver I tried to reverse the car and before you know it, I was hit. I didn’t want to know whether I was the one at fault or not. Whoever hit me was going to pay.

I got down from my car angrily and walked towards the car, I started barking like a bitten dog and wouldn’t give the nice looking gentle man a chance to speak at all. “Queen” he called calmly – I paused, he knew my name, slowly I started calming down – with smiles all over his face he drew me to himself, giving me a very tight hug. ‘is this guy crazy’ I thought to myself as I stood puzzled. ‘It’s me Andrew, have you forgotten me already’. Memories flipped, I let down my guard and quickly returned the hug.

It’s been two years since I saw him last. I remembered I had a strong crush on him but had to let go because hye was already taken by my friend. He had the looks of the season; he had a lean, subtly muscled body that was more at home in jeans, rather than the suit he was putting on. As a gentleman he took the blame for what solely was my fault and we stood there gisting and reliving old times. My dear friends, I wasn’t the only one oh, he also had a crush on me then – can you imagine. Before I knew what was happening, he lowered his lips to mine, I was surprised, I tried to move but my body wasn’t responding to the commands of my brain. My God, he had beautiful eyes and it was incredibly impossible to resist. This was what I have been waiting for I realized, this was what I wanted, I needed.

‘I want to make love to you Queen’ he whispered, his voice was strong, but it was clear. ‘I want you. I have wanted you for a long time ‘he continued. I slipped my hand up over his chest and neck to touch his cheek. Quietly I brought my lips to his. He drew me closer with a moan and deepened the kiss with something like panic, but I remained warm and real against him. My friends, it was heaven on earth. His mouth tasted warm and sweet and I had to fight the urge to lose control. He unbuttoned my blouse revealing my sexy boobs, I saw him blush as he placed his hands to feel them. He closed his eyes as my lips brushed his throat. “Not here” he said and suddenly stopped, he took pleasure in buttoning my loosened blouse, we were standing outside and he was gentleman enough to realize. He collected my phone number and promised to call me soon.

As I drove back home, all the week’s stress was forgotten – I was revived and blooming as I wait to push a new week forward. Thoughts of how my brother was going to kill me chipped into my mind and paused the smiles on my face. ‘Will he use a knife – does he have a gun? My thoughts were scary; I had to shake them off by reliving the moments with Andrew. Thinking of Andrew made me blush. Hmmmmm the week ahead poses to be interesting.

SEND YOUR QUESTIONS AND COMMENTS TO THE EMAIL ADDRESS BELOW

EMAIL: [email protected]

BBM PIN: 5318642A

queensworld

Lagos Assembly Reacts To Proscription of F-SARS, Sends Message To Buhari

The Lagos State House of Assembly has described the eventual proscription of the Federal Special Anti-Robbery Squad (F-SARS) as proof that democracy has come to stay.

The House also commended President Muhammadu Buhari for hearkening to the cries of the people and ensuring their immediate wish was met with the disbandment of the police unit.

A statement from the office of the Speaker of the House and Chairman of the Conference of Speakers of State Legislatures, Rt. Hon. Mudashiru Obasa, thanked those who took to the streets in Lagos State for their civility while the protests lasted.

Obasa said it was commendable that the protesters carried out their agitations with utmost respect for the authorities as well as government and residents’ property and assets.

Recall that the Lagos State House of Assembly had on Friday raised a seven-point resolution one of which was that F-SARS be scrapped.

The state lawmakers had called for the introduction of a better reformed unit of the police.

They had also called on the National Assembly to immediately commence a probe into the allegation of inhuman treatments meted out to innocent Nigerians by the personnel of the police in the unit.

The Inspector-General of Police (IGP), Mohammed Adamu, on Sunday, finally announced an end to F-SARS and added that other reforms would be announced soon.

“It is a win-win for the country and a proof that the President Muhammadu Buhari administration is prepared to listen to the yearnings of the people where it they matter.

“A special commendation goes to Nigerians who expressed their grievances peacefully for days.

“As the country awaits more police reforms as announced by the IGP, we plead with the masses to remain calm, go about their activities peacefully and continue to be good citizens of the country,” the statement said.

Business

Nigeria, Foreign Countries Share Data on Overseas Bank Accounts, Property Owned By Nigerians

The Federal Government of Nigeria and some foreign countries, including the United Kingdom Government, have commenced the Automatic Exchange of Tax Information (AETI), particularly on overseas assets held by Nigerians.

The Honourable Minister of Finance, Mrs. Kemi Adeosun, confirmed this on Friday in Abuja during the presentation of Progress Report on Tax Laws Reform by the Vice Chairman of the National Tax Policy Implementation Committee, Mr. Taiwo Oyedele.

The Minister expressed satisfaction with the data being supplied to Nigeria by foreign countries under the AETI, to which the country became a party in January 2018.

“The data received in Nigeria with regard to overseas assets held by Nigerians has been impressive and will underpin a long term improvement in the nation’s tax to Gross Domestic Product (GDP) ration, in turn, will improve life for the masses.

“The data on bank accounts, property and trusts, which has come automatically from a number of countries is being used to support the Voluntary Assets and Income Declaration Scheme (VAIDS) by allowing the tax authorities to check the accuracy of declarations received.

“The Federal Government is also using the data to generate ‘nudge’ letters which are being sent to those identified as being potential tax defaulters,” said Adeosun while responding to questions raised by journalists during the submission of progress report on tax laws reform.

She disclosed that Nigeria had written to a number of nations to request specific information about offshore trusts and bank accounts held by its citizens.

The Minister advised users of offshore structures to take advantage of VAIDS to regularise their taxes before the expiry of the amnesty programme.

“The offshore tax shelter system is basically over. Those who have hidden money overseas are being exposed and whilst Nigerians can legally keep their money anywhere in the world, they must first pay any taxes due to the Nigerian Government so that we can fund the needs of the masses and create jobs and wealth for our people.

“The moral argument against illicit financial flows and tax evasion and the strong international co-operation are such that every Nigerian tax payer should do the right thing. The needs of our people for development override any other argument against payment of tax,” she stated.

Adeosun stressed the need for a sustainable revenue that could deliver infrastructural development for Nigeria and improve the tax to GDP ratio of the country.

She assured that the Federal Government would build a robust tax system and implement the recommendations by the National Tax Policy Implementation Committee (NTPIC) on tax laws reform.

Earlier in the address, the NTPIC Vice Chairman, Mr. Taiwo Oyedele, who represented the Chairman, said the Committee considered three major policy documents namely; the Economic Recovery and Growth Plan (ERGP), the National Tax Policy and Ease of Doing Business Plan.

He disclosed that the Committee agreed that tax reforms should align with overall Government objectives as articulated in these documents, such that every action or recommendations would promote and catalyse the realisation of overall objectives.

The Committee, according to him, identified the seven major tax areas that would have the highest impact. These include: Company Income Tax (CIT), Value Added Tax (VAT), Customs & Excise Tariff (CET), Personal Income Tax (PIT), Pension Contributions, Industrial Development Income Tax Relief (IDITR); and Tertiary Education Trust Fund.

He disclosed that he proposed changes to the tax laws would achieve the following specific objectives: increase and diversify Government revenue, simplify paying taxes and doing business, promote Micro, small and medium enterprises, protect most vulnerable persons in the society, and remove obsolete, ambiguous and contradictory provisions in the law.

Oyedele added that the Committee’s work resulted in two executive orders and five amendment bills.

The executive orders include Value Added Tax Act (Modification) Order and Review of Goods Liable to Excise Duties and Applicable Rate Order, the proposed Amendment Bills are: Companies Income Tax Act (Amendment) Bill, Value Added Tax Act (Amendment) Bill, Customs, Exercise, Tariff (Consolidation) Act (Amendment) Bill, Personal Income Tax Act (Amendment) Bill and Industrial Development (Income Tax Relief) Act (Amendment) Bill

cover story

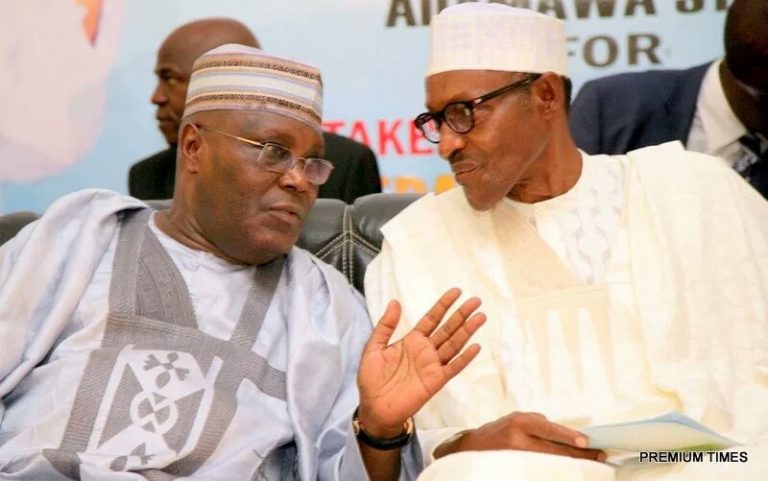

2019: Atiku’s Presidential dream hits the rock as Buhari blocks source of income, cancels contract with his company

In an apparent move to block a major source of income of Alhaji Atiku Abubakar who has declared his intention to contest the 2019 presidential election, the Muhammadu Buhari-led administration has directed the Nigerian Ports Authority (NPA) to terminate the boats pilotage monitoring and supervision agreement that the agency has with Intels Nigeria Limited, a company co-owned by the former vice president.

Government says the contract with Intels, a leading integrated logistics and facilities services provider in the maritime and oil and gas logistics sectors of the country, was void ab initio.

Attorney General of the Federation (AGF) and Minister of Justice, Mallam Abubakar Malami (SAN), in a letter dated September 27, 2017 to the Managing Director of the NPA, Ms. Hadiza Bala-Usman, said that the agreement, which has allowed Intels to receive revenue on behalf of NPA for 17 years, violates the Nigerian Constitution, especially in view of the implementation of the Treasury Single Account (TSA) policy of government.

Intels, also co-owned by Mr. Gabriel Volpi, an Italian national who also has Nigerian citizenship, will lose several millions of dollars in the cancelled deal.

In the maritime industry, pilotage is compulsory for all ships of 35 metres overall length or greater unless a valid Pilotage Exemption Certificate is held by the ship’s master.

In return for the service, ship owners/companies are required to pay a pilotage fee, which Intels collects on NPA’s behalf and retains 28 per cent of the revenue as commission for the services rendered.

In the memo obtained by Thisday, Malami stated that the agreement violates Sections 80(1) and 162(1) and (10) of the constitution, and wondered that the parties – NPA and Intels – did not avert their minds to the relevant provisions when they were negotiating the agreement in 2010.

Section 80(1) of the constitution states: “All revenues or other moneys raised or received by the Federation (not being revenues or other moneys payable under this Constitution or any Act of the National Assembly into any other public fund of the Federation established for a specific purpose) shall be paid into and form one Consolidated Revenue Fund of the Federation.”

Section 162(1) states: “The Federation shall maintain a special account to be called ‘the Federation Account’ into which shall be paid all revenues collected by the Government of the Federation, except the proceeds from the personal income tax of the personnel of the armed forces of the Federation, the Nigeria Police Force, the Ministry or department of government charged with responsibility for Foreign Affairs and the residents of the Federal Capital Territory, Abuja.”

While sub-section 10 of the same section states: “For the purpose of subsection (1) of this section, ‘revenue’ means any income or return accruing to or derived by the Government of the Federation from any source and includes: (a) any receipt, however described, arising from the operation of any law; (b) any return, however described, arising from or in respect of any property held by the Government of the Federation; (c) any return by way of interest on loans and dividends in respect of shares or interest held by the Government of the Federation in any company or statutory body.”

In the letter titled: “Request for Clarification of Conflict Between Executed Agreement and Federal Government Treasury Single Account Policy,” the attorney general said: “I refer to your letter dated 31st May 2017, ref: MD/17/MF/Vol.XX/583 in respect of the above subject matter wherein you sought clarification on the legal issues implicated by the continuous implementation of the Managing Agent Contract Agreement dated 11th February 2010 executed between the Nigerian Ports Authority (NPA) and Intels Nigeria Limited for the provision of boats pilotage operations, in the light of the Federal Government of Nigeria’s Treasury Singe Account (TSA) policy.

“Upon my review of your letter under reference and the relevant agreements, I have been able to conclude inevitably that the terms of the agreement as agreed by parties and the dynamics of its implementation which permits Intels to receive revenue generated on behalf of NPA ab initio, clearly violates express provisions of Sections 80(1) and 162(1) and (10) of the 1999 Constitution of the Federal Republic of Nigeria, 1999 (as amended). It is thus curious that parties did not avert their minds to the above provisions of the constitution whilst negotiating the agreement.

“The inherent illegality of the agreement as formed has since been expounded by the TSA policy issued by the Head of Service of the Federation on behalf of the Federal Government of Nigeria directing all ministries, departments and agencies to collect payment of all revenues due to the federal government or any of her agencies through the TSA.

“The objective of the presidential directive (TSA policy) in exercise of the executive powers of the president under Section 5 of the 1999 Constitution (as amended) was in furtherance of the spirit and intent of Sections 80 and 162 of the constitution and to aid transparency in government revenue collection and management.

“NPA being an agency of the federal government is bound by the TSA policy and has not howsoever been exempt therefrom. Due to the constitutional nature of the TSA, where there is a conflict between the TSA and the terms of the agreement, the TSA shall prevail.

“Therefore all monies due to the NPA currently being collected by Intels and any other agents/third parties on behalf of NPA must henceforth be paid into the TSA or any of the sub-accounts linked thereto in the Central Bank of Nigeria (information of the account will be communicated in due course) in accordance with the TSA policy.

“For the avoidance of doubt, the agreement for the monitoring and supervision of pilotage districts in the Exclusive Economic Zone of Nigeria on terms inter alia that permits Intels to receive revenue generated in each pilotage district from service boat operations in consideration for 28% of total revenue as commission to Intels is void, being a contract ex facie illegal as formed for permitting Intels to receive federal government revenue contrary to the express provisions of Sections 80(1) and 162(1) and (10) of the 1999 Constitution of the Federal Republic of Nigeria (as amended), which mandates that such revenue must be paid into the Federation Account/Consolidated Revenue Fund.

“In the premise of the above, the conflict between the agreement and the TSA policy presents a force majeure event under the agreement, and NPA should forthwith commence the process of issuing the relevant notices to Intels exiting the agreement which indeed was void ab initio.”

-PM News

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login