Business

How Inside Jobs and Policy Shocks Trigger Nigeria’s Rising Loan Crisis

How Inside Jobs and Policy Shocks Trigger Nigeria’s Rising Loan Crisis

BY BLAISE UDUNZE

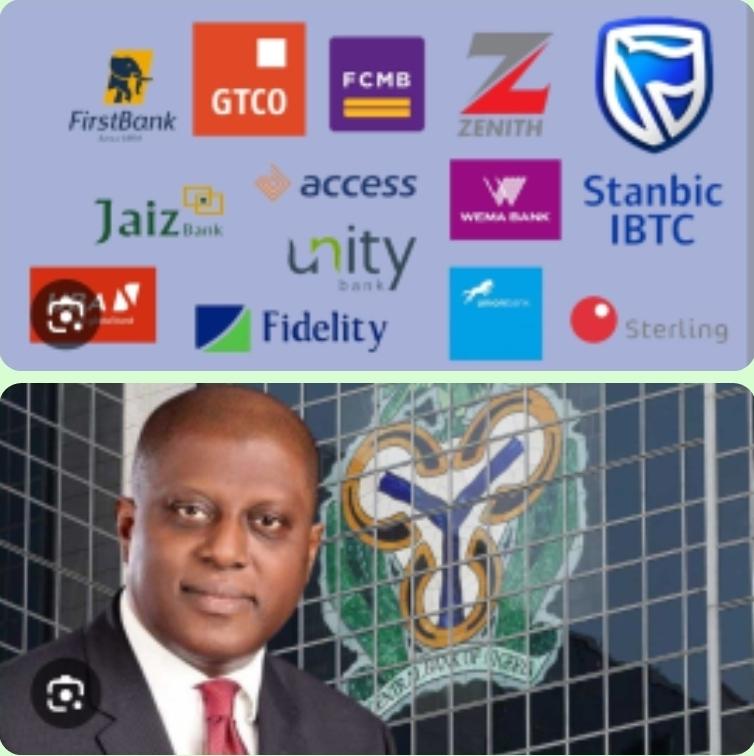

The latest in the Nigerian banking sector, as banks grapple with the recapitalization compliance deadline, is confronted with a familiar yet unsettling problem that stems from rising loan defaults amid expanding credit. Data from the Central Bank of Nigeria’s (CBN’s) latest macroeconomic outlook of 2025 showed that the banking industry’s Non-Performing Loans ratio climbed to an estimated 7 percent, pushing the sector above the prudential ceiling of 5 percent.

This deterioration has occurred even as banks report improved credit availability and strong loan demand across households and corporates. At first glance of the development, the narrative seems to defy logic in a real sense. However, below this lies a deeper story of macroeconomic strain, policy-induced shocks, and, most worryingly, persistent corporate governance abuses that continue to erode asset quality from within.

To be clear, Nigeria’s current wave of loan defaults cannot be blamed on reckless borrowers alone. The operating environment has become unusually hostile. Inflation, as reported by the National Bureau of Statistics (NBS), recently suggests that headline inflation is cooling and growth indicators show tentative improvement; regrettably, more Nigerians are slipping below the poverty line, eroding household purchasing power and raising operating costs for businesses.

Especially in the small and medium-sized enterprises, though, the economic growth appears positive, but has been uneven and insufficient to offset cost pressures in this space. This has heralded weak consumer demand that has squeezed revenues across retail, manufacturing and services, causing shrinking cash flows and also loan obligations remain fixed or, in many cases, rise. In such conditions, repayment stress is inevitable.

Tight monetary policy has compounded the problem. The CBN’s aggressive rate hikes, aimed at restoring price and exchange-rate stability, have significantly raised lending rates. Variable-rate loans have become more expensive mid-tenure, and businesses that borrowed under lower-rate assumptions now face repayment shocks. Even otherwise viable firms have found themselves pushed into distress as interest expenses consume a growing share of income. Going by the official survey for the last quarter of 2025, it shows that financial pressure on borrowers has intensified as more borrowers are failing to repay loans across all major categories for both secured loans, unsecured loans and corporate loans.

Exchange-rate volatility has delivered another blow. The naira’s depreciation and FX reforms have sharply increased the burden on borrowers with dollar-denominated loans but naira income. Import-dependent businesses have seen costs surge, while FX scarcity continues to disrupt production and trade cycles. For many firms, the problem is not poor management but currency mismatch. Loans that were sustainable under a more stable exchange regime have become unserviceable almost overnight.

Layered onto these macro pressures is Nigeria’s weak business environment, which has further worsened the situation, alongside chronic power shortages forcing firms to rely on costly alternatives, logistics challenges and insecurity disrupting supply chains, and regulatory uncertainty complicates planning. More on the burner that has continued to heighten the challenges is the multiple taxation and compliance burdens, further compressing margins. In survival mode, businesses naturally prioritise payrolls, energy, and raw materials over debt service. Defaults, in this context, are often a symptom rather than the disease.

Yet while these systemic pressures explain much of the stress, they do not tell the whole story. A critical and often underemphasised driver of rising loan defaults lies within the banks themselves, most especially corporate governance abuse, which emanates particularly from insider-related lending. This is the uncomfortable truth that Nigeria’s banking sector has struggled to confront decisively.

Corporate governance, at its core, is about discipline, accountability, and oversight. In the banking context, it determines how credit decisions are made, how risks are assessed, and how early warning signs are addressed. Where governance is weak, loan quality inevitably suffers. Nigeria’s history offers painful lessons, especially the banking failures of the 1990s to the post-2009 crisis clean-up, insider lending and boardroom abuses have repeatedly emerged as central culprits.

Recent evidence suggests that the problem has not disappeared. Industry estimates indicate that a significant portion of bad loans remains linked to insider and related-party exposures. Former NDIC officials have disclosed that, historically, directors and insiders accounted for as much as 40 per cent of bad loans in deposit money banks, with a handful of institutions holding the majority of insider-related NPLs. It would be said that governance frameworks have improved since then, but enforcement gaps still persist.

Insider abuse manifests in several ways. Loans are extended to directors, executives, or connected parties with inadequate due diligence. Credit decisions are influenced by relationships rather than repayment capacity, and this has been one of the critical problems as collateral is overvalued, covenants are weak, and stress testing is often superficial. When early signs of distress emerge, enforcement is delayed, restructuring is repeated without fundamental improvement, and recoveries are treated with undue caution to avoid internal embarrassment or exposure.

The result is predictable. These loans default faster and are harder to recover. Worse still, they distort bank balance sheets by crowding out credit to productive sectors. When insiders default, the signal to the wider market is corrosive. Here, credit discipline is optional, and accountability is selective, and it further fuels moral hazard, encouraging strategic defaults even among borrowers who could otherwise repay.

Governance failures also weaken loan recovery processes. Poorly empowered risk and audit committees miss warning signs or fail to act decisively because the system has been built to fail. Legal remedies are pursued slowly, if at all. In an environment where judicial delays already undermine contract enforcement, such reluctance turns manageable problem loans into fully impaired assets. Over time, NPLs accumulate not because recovery is impossible, but because it is poorly pursued.

Compounding these internal weaknesses are government policy shifts and fiscal stress, which have become major external shock absorbers for bank balance sheets. Policy inconsistency has made cash flow planning increasingly difficult for borrowers. For instance, the sudden tax changes or aggressive enforcement drives will definitely alter cost structures overnight. Delays in government payments to contractors starve businesses of liquidity, and this will surely push otherwise solvent firms into default. In theory, although removing fuel subsidies, while economically justified, have often occurred without adequate transition buffers, transmitting immediate cost shocks across energy, transport, and consumer goods sectors.

The banking sector, heavily exposed to government-linked projects and regulated industries, absorbs these shocks directly. Loans tied to this sector showed that the banks are hugely exposed to oil and gas, power, and infrastructure; they are particularly vulnerable when fiscal pressures delay receivables or alter contract economics. For instance, a total of 9 banks’ exposure to the Oil & gas sector increased to N15. 6 trillion in 2024, representing about 94.4per cent increase from N10. 17 trillion reported in 2023 financial year. It is therefore no coincidence that NPL concentrations remain high in these sectors. In effect, fiscal stress is being intermediated through bank balance sheets.

When the CBN ended the special leniency measures known as forbearance in 2025, the real extent of loan stress in the banking industry became much clearer. For a longer time, pandemic-era reliefs allowed banks to renegotiate stressed loans without immediately classifying them as non-performing. While this helped preserve surface stability, it also masked underlying vulnerabilities. With the end of forbearance, many restructured facilities have crystallised as bad loans, pushing the industry NPL ratio above the prudential ceiling. This does not mean risk suddenly increased; it means it is now being recognised.

To the CBN’s credit, transparency has improved as the industry witnessed stricter classification rules and reduced forbearance have forced banks to confront economic truth rather than regulatory convenience. And, despite the challenges, the financial system appears to be generally sound because banks have enough cash to meet obligations and sufficient capital buffers that still exceed regulatory floors, while these buffers are under pressure. Though the ongoing recapitalisation efforts are expected to provide additional buffers.

However, stability should not be confused with health. Rising NPLs, even in a liquid system, carry real consequences. Banks must set aside provisions, eroding profitability and capital. Credit supply tightens as lenders grow cautious, starving the real economy of funding. One known fact is that the moment governance and transparency concerns grow, investors, particularly foreign ones, become less willing to commit capital and this loss of confidence eventually slows down overall economic growth.

The policy response, therefore, must go beyond macroeconomic management. While stabilising inflation and the exchange rate is essential, it is not sufficient. Governance reform within banks must be treated as a systemic priority, not a compliance exercise. Insider lending rules must be enforced rigorously, with real consequences for violations. Boards must be strengthened, not merely in composition but in independence and courage. Risk and audit committees must be empowered to challenge management and act early.

Equally important is addressing the fiscal-banking nexus. The government must recognise that policy volatility and payment delays are not costless. They translate directly into higher credit risk and weaker financial intermediation. A more predictable policy environment, timely settlement of obligations, and credible transition frameworks for major reforms would significantly reduce default risk without a single naira of direct intervention.

The Global Standing Instruction framework, which the CBN continues to promote, can help improve retail and MSME recoveries. But frameworks cannot substitute for culture. Credit discipline begins at the top. When banks lend to themselves without consequence, the entire system pays the price.

Nigeria’s rising loan defaults are not merely an economic statistic; they are a governance signal. They reflect a system under stress, yes, but also one still wrestling with old habits. If recapitalisation is to be meaningful, it must be accompanied by recapitalisation of trust, through transparency, accountability, and consistent policy. Otherwise, the cycle will repeat the same strong balance sheets on paper, weak loans underneath, and another reckoning deferred, but not avoided.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

Business

Time is of the essence,” the group stressed. “Every delay compounds the hardship and weakens faith in the system.”

Trapped Funds, Fading Trust: Heritage Bank Depositors Demand Urgent CBN Bailout

By Ifeoma Ikem

Nearly two years after the collapse of Heritage Bank, thousands of depositors say they are still living with the financial and emotional aftershocks of a liquidation they insist was never meant to end this way. What began as regulatory reassurances has, in their view, spiralled into prolonged uncertainty, partial payments, and mounting hardship, thus prompting a fresh and urgent appeal to President Bola Tinubu and the Governor of the Central Bank of Nigeria, Olayemi Cardoso, to intervene decisively.

In a strongly-worded statement issued in Lagos, the depositors framed their demand not simply as a financial request but as a test of the country’s commitment to safeguarding public trust in its banking system. They are asking the Central Bank to provide immediate bailout funds to the Nigeria Deposit Insurance Corporation (NDIC) to enable full reimbursement of all affected customers, arguing that the pace of recovery so far has been painfully slow and grossly inadequate.

According to them, while insured deposits up to ₦5 million were covered under statutory provisions, payments beyond that threshold (known as liquidation dividends) have amounted to just 14.2 percent of their total balances in nearly two years. The first tranche of 9.2 percent was paid in April 2024. A second installment of 5 percent followed recently. For many, that has been the extent of relief.

At this rate, they argue, the mathematics simply does not inspire confidence.

“These are not abstract figures,” one depositor said. “They represent school fees, retirement savings, working capital for small businesses, cooperative funds, and life savings built over decades.” Among those affected, they say, are civil servants, retirees, entrepreneurs, and families whose livelihoods have been upended by the prolonged wait.

What deepens their frustration, they contend, is the memory of official assurances given before the bank’s collapse. When signs of distress first emerged, depositors recall that the Central Bank publicly and privately reassured customers that their funds were safe and that the institution remained sound. Those assurances, they say, influenced their decision not to withdraw their savings at the time.

The eventual liquidation therefore came as a shock, both financially and psychologically. “We trusted the regulator,” the group noted. “Between the Central Bank and the NDIC, we were told our funds would be repaid 100 percent.”

It is that promise, they argue, that must now be honored in full.

While acknowledging that the NDIC has begun verification and payment processes, the depositors insist that the agency lacks the financial capacity to conclude the exercise within a reasonable timeframe. They point to the scale of total deposits — estimated at about ₦650 billion — and the fact that only around ₦54 billion has been paid out in 18 months. In their view, that ratio raises serious questions about whether the liquidation process, left solely to asset recovery, can realistically guarantee timely reimbursement.

The group also referenced previous instances in which the Central Bank stepped in to stabilize distressed institutions, arguing that regulatory precedent supports intervention. They cited the reported ₦460 billion facility linked to Heritage Bank before its collapse, as well as substantial financial support extended to other banks to facilitate mergers or recapitalization. In one example, they noted, a ₦700 billion support package reportedly enabled a struggling bank to qualify for a merger, with favorable repayment terms that included a five-year moratorium and extended repayment window at below-market interest rates. They also referenced regulatory intervention in Keystone Bank as evidence that decisive action is possible when systemic stability is at stake.

Given that history, they say, it is difficult to understand why a direct bailout to protect depositors is not being prioritized.

Beyond financial restitution, the depositors are also calling for accountability. They demanded a thorough investigation and immediate prosecution of any individuals or entities found culpable of asset diversion, mismanagement, or actions that may have contributed to the bank’s collapse. To them, justice is as important as compensation.

They argue that without visible consequences, public confidence in the banking system could erode further. “The integrity of the financial sector rests not only on liquidity, but on accountability,” one stakeholder said. “If people believe that funds can disappear without consequences, trust collapses.”

The broader concern, they warn, is systemic. Nigeria has not witnessed a full commercial bank liquidation in over two decades, as troubled institutions have typically been resolved through mergers, acquisitions, or regulatory restructuring. Many depositors therefore assumed that a similar pathway would apply in this case. Instead, they say, liquidation has exposed gaps in depositor protection mechanisms.

They also question the broader insurance framework, noting that banks have paid premiums to the NDIC for years precisely to safeguard depositors. If recovery remains this limited, they argue, the protective purpose of that insurance scheme comes under scrutiny.

For small business owners, the implications have been severe. Some report shutting down operations due to frozen capital. Others speak of properties sold under distress or retirement plans abruptly altered. The social cost, they insist, is real and growing.

At the heart of their appeal is a request for clarity. They want a clear, binding timeline for completion of the liquidation process and a transparent roadmap outlining how and when full repayment will occur. Without that, they fear that partial dividends will continue indefinitely, eroded by inflation and the time value of money.

They have also urged the Presidency and the National Assembly to step in, arguing that the matter transcends a single bank and touches on Nigeria’s financial credibility before the global community. Prolonged uncertainty, they warn, risks signaling regulatory inconsistency at a time when the country seeks to attract investment and deepen financial inclusion.

For the depositors, the issue is no longer simply about numbers on a ledger. It is about confidence in regulators, in institutions, and in the promise that money kept within the formal banking system is secure.

They believe the Central Bank must now assume full responsibility for resolving what they describe as a crisis of trust. Whether through direct financial support to the NDIC, accelerated asset recovery, or a hybrid intervention model, they insist that swift action is essential.

“Time is of the essence,” the group stressed. “Every delay compounds the hardship and weakens faith in the system.”

In a nation striving to strengthen its financial architecture and restore economic stability, the resolution of the Heritage Bank liquidation may well become a defining test — not only of regulatory capacity, but of the enduring covenant between citizens and the institutions entrusted with their savings.

Business

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

Aig-Imoukhuede Foundation opens applications for 6th Cohort Programme

The Aig-Imoukhuede Foundation is pleased to announce that applications are now open for the sixth cohort of its transformative AIG Public Leaders Programme (AIG PLP).

This flagship six-month executive education initiative, delivered by the University of Oxford’s Blavatnik School of Government, is designed to empower high-potential public sector leaders across Africa with the tools, networks, and strategic insight required to deliver meaningful reform across African public institutions.

Applications are now open to qualified public servants from all English-speaking African countries and will close on Sunday, April 12, 2026. The programme commences in October 2026.

Since its inception in 2021, the AIG PLP has built a formidable reputation for creating tangible impact.

Alumni from the programme have gone on to design and implement more than 230 reform projects within their ministries, departments, and agencies across Africa.

An impact survey revealed that 62% of alumni have earned promotions or assumed expanded leadership roles post-training, demonstrating the programme’s direct effect on career advancement and institutional influence.

“Across Africa, the complexity of public sector challenges demands more than good intentions. It requires reformers who understand systems, can navigate institutional realities, and are equipped to implement sustainable change.

The AIG PLP is designed to meet this need,” said Ofovwe Aig-Imoukhuede, Executive Vice-Chair of the Aig-Imoukhuede Foundation.

As part of the programme, a PLP alumna, Titilola Vivour-Adeniyi, Executive Secretary of Lagos State DSVA, launched a secure self-reporting tool that allows survivors of domestic and sexual abuse safely document incidents and preserve evidence.

Survivors are already accessing support, and the tool ensures that crucial proof is protected until justice can be sought. This is one of over 230 impactful reform projects being implemented across sectors as diverse as healthcare, finance, agriculture, and education.

We are seeing proof every day that investing in the capacity and leadership potential of people, delivers the kind of transformation that policy alone cannot achieve.”

The AIG PLP is a blended learning experience that combines online sessions with an intensive residential module.

It is offered at no cost to selected participants, with the Foundation covering all costs of the programme including accommodation and feeding during the residential weeks.

Participants gain direct access to world-class faculty from the University of Oxford, and learn to tackle core public sector challenges such as: Negotiating in the public interest. Harnessing digital technology for governance.

Strengthening public organisations.

Upholding integrity in public life.

The curriculum culminates in a capstone reform project, where participants apply their new skills to a real-world challenge within their institution.

This practical component ensures that learning translates directly into actionable solutions.

Interested candidates are encouraged to apply early. For more details on the application process and to apply, please visit the Aig-Imoukhuede Foundation website.

Business

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors Inspect RHA Secretariat

Renewed Hope Ambassadors, led by its Director-General and the Governor of Imo State, Hope Uzodinma, alongside Zonal Coordinators (NW, NC, SE), the Media & Publicity Directorate, and other key stakeholders, inspected the RHA Secretariat two days after President Bola Tinubu unveiled the Renewed Hope Ambassadors grassroots engagement drive in Abuja.

-

celebrity radar - gossips7 months ago

celebrity radar - gossips7 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society7 months ago

society7 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news3 months ago

news3 months agoWHO REALLY OWNS MONIEPOINT? The $290 Million Deal That Sold Nigeria’s Top Fintech to Foreign Interests