Business

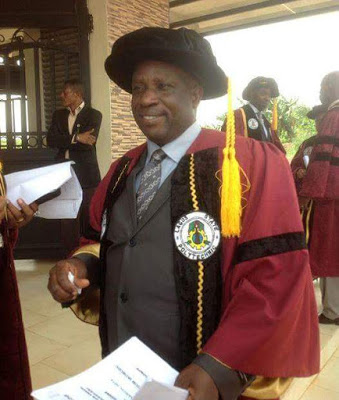

LASPOTECH Crisis Update Rector Boast;”Nobody Can Remove Me, I Have the Backing of Tinubu and Akiolu”

+ Many Financial Improprieties Leveled against him

…Save us from His Clutches: Staffs Appeal to Tinubu and Akiolu

There seems to be no visible end in sight to the current crisis bedeviling the Lagos State Polytechnic, it will be recalled that the staffs of the institution has for months now been at loggerhead with the rector of the Lagos State owned institution over issues that allegedly has to do with terrible administration of Mr. OluyinkaSogunro, led school authority.

Sources within the school recently informed us that the Rector, who is having several allegation of financial improprieties leveled against him is recently in boastful mood, according to this source, Mr, Sogunro is allegedly telling whoever cares to hear that nothing will move him from his position because he’s having the backing of Asiwaju Bola Ahmed Tinubu and the Oba of Lagos.

He was also alleged to have openly declared that he’s untouchable for Gov. AkinwunmiAmbode or any members of the State Assembly.

It will be recalled that the whole thing became public knowledge months back immediately after the convocation of the school attended by the Governor of Lagos State, Mr. AkinwumiAmbode, that the staffs decided to down tools for a couple of weeks after which they called it off for 21days to allow negotiation after days of protest by the 3 association in the institution on the premises of the governor’s office.

Effort by the leadership of NASU, SSANIP and ASUPin the institution to also make the legislative arm intervene in the whole situation is also not yielding any effort as the appearance of the bodies before the House committee of Education did not seems to be yielding any fruits, it was even after this that he allegedly boasted publicly that he’s untouchable because of his relationship with former Lagos Governor, Bola Tinubu and Eleko of Eko, Oba RilwanAkiolu.

The staff had in an earlier letter sent to the Governor of Lagos State, pleaded that he quickly intervene, investigate and liberate the staff , pensioners and students of Lagos State Polytechnic from constant security harassments at the instance of the rector, MrOluyinka Samuel Sogunro.

In the letter dated June 9, 2017, the rector was accused of harassing the staff and students with both internal and external security organizations. The letter reads “The staff and students have been at the mercy of the gun-toting security guards since the current administration assumed office. Students are always escorted out of the campuses with guns and siren like common criminals and equally molested in the name of dress code meant for adults of a tertiary institution ages.”

It reads further that “on Tuesday, 8th November, 2016 when the Non Academic Staff Union (NASU) was having a meeting with Governing Council on the implementation of CONTISS 15 Migration,, the rector ordered the Onyabo Vigilante group and a dispatched of a police van to swoop on the staff inside the Ikorodu campus, owing to what the rector termed as ‘unruly behavior’ of his staff. The confrontation was so fierce that it took the intervention of well-meaning senior staff to avert bloodshed.

‘Subsequently, the militarization of the campuses received a boost when the rector approved the purchase of fifteen (15) magnum series of semi-automatic pump action guns through the BLACK MARKET to the tune of Six Million , Four Hundred and Fifty Thousand naira (N6, 450, 000) in addition to the 25 pieces of existing guns on campus, and also recruited OPC members and many other untrained hands to carry arms on the campuses.

‘This singular action increased panic and defiance actions amongst the staff and students. It is however sad to know that, an institution that could not afford to buy consumables for students’ practical across departments , expended a whooping N6,450,000 on unlicensed guns to ‘terrorize’ its staff and students from the students’ acceptance levy. These guns were later discovered from a grapevine to have been bought by the Deputy Rector (Administration) – Dr. Ola Olateju.

In the wake of the industrial face-off between the Management and the labour Unions, the rector was accused of setting the staffs of the institution up when he allegedly called the men of the Department of State Security (DSS) and Nigeria Security and Civil Defence Corps (NSCDC) on the Non Academic Staff Union Executives under the guise that he was going to be kidnapped. The statement read“Sogunro robed his staff members with kidnapping and attempted murder cases and walks freely touting his regular threat- “if you stand on my way, I will crush you.”

He was also accused of setting the soldiers from 174 battalion, Odogunyan on the staffs and the students on Wednesday 7th June during a peaceful protest of the continuous closure of the school and the highhandedness of the rector. Though the school claimed the soldiers were trying to pass through the school premises to their destination since the road is bad, the soldiers however stated that they were invited by the school management.

In the letter the unions speak against the decision of the management expending so much on guns as against educational material. “To this end, we condemn in totality the preference for illegal acquisition of guns to meaningful academic needs, naked display of arms on our campuses, brazen and flagrant use of military force to evacuate the students from campuses daily, harassment by both the internal and external security agents, militarization/invasion of our campuses and despotic style of leadership of the rector.

‘We call on the Governor to investigate all these aforementioned security breaches, especially the ruthless and bestial invasion of Wednesday, 7th that led to infliction of pains, brutality, wanton destruction of properties, disruption of business activities of Lambo Lasunwon community, molestation of innocent students and staff in their hostels and homes, etc.”

They also pray that the government should intervene in the whole issue, “Sanctions should be appropriately meted out to anybody found culpable to avoid the reoccurrence of such undemocratic act in future and serve as a deterrent to undemocratic tendencies.” The letter concluded.

Members of staff of Lagos State polytechnic are of the opinion that even with Sogunro’s closeness claims to Asiwaju Bola Tinubu, the ruling All Progressive Congress (APC) National Leader, his ways are showing trait contrary to the believe and ways of the distinguished individual, they are therefore pleading that Senator Bola Ahmed Tinubu should come to their aid and save them from further brutalization from the power drunk rector.

However, a detailed list of atrocities committed by Mr. Samuel OlayinkaSogunro, the Lagos State Polytechnic embattled rector has been released in a statement jointly signed by the three unions in the institution, NASU, SSANIP and ASUP and it includes;

- Placement of Polytechnic N1.3 Billion Naira in First City MonumentBank Plc

It is pertinent to inform the concern authority that, the Rector, Mr. SamuelOluyinkaSogunro placed N1.3 Billion Naira of the Polytechnic fund with FirstCity Monument Bank Plc. without obtaining approval from the GoverningCouncil or the State Government at a ridiculous interest rate lower than whatis obtain in the other banks.

It is disheartening that while the Pensioners are being owed 13 monthsallowances, their hard earn pay was yielding interest for the Rector atundisclosed interest rate.

- Deduction 10% Processing Fee by the Rector

Under the administration of Mr. Samuel OluyinkaSogunro, beneficiaries of TETFUND most agree to pay 10% processing fee to the Desk Officer, Dr. Kareem Rasaq before the releasing of fund and the Rector is in the know.

It should be noted that the Desk Officer, claimed that 10% processing fee deduction was a directive from TETFUND Headquarters. Majority of staff members that access the fund for Seminars/Conferences claimed that they were unable to attend because this deduction adversely affected their travelling and accommodation allowances.

Also, mostly research projects where abandoned, because the team members do not approve the deductions.

- Violation of Financial Regulation during the 2017 Convocation

The concern authority should please endeavour to set up a special investigation panel to look into the money expended during the 2017 convocation of the Polytechnic. It was discovered that a whooping sum of N40Million (Forty million Naira) was released as “Cash Advance” by the Rector during the period in question.

- Fraudulent Employment

It will interest you to know that two of the newly employed staff in the Department of Mathematics namely: Ajilore Joshua GL13 (Community Secondary School, Ojo) and Akinyemi Joseph GL12 (Both Classroom Teacher) are still in the service of Lagos State Ministry Education, kindly please consult oracle for details.

- Sweeping of Report of Investigation into Financial Misconduct in the Polytechnic Staff School Involving A Deputy Registrar Under theCarpet

The Rector, Mr. Samuel OluyinkaSogunro is managing the administration of the Polytechnic with an act of Nepotism.

The Concern Authority equally need to investigate why the report of a petition tagged “Save LASPOTECH Staff School from the brim of Collapse” involving a Deputy Registrar, Mr. Isaac OluwaseunAdekoya, a member of the same church with the Rector, was sweep under the carpet. (See Attached Comprehensive Report signed by the Deputy Rector, Admin)

- Investigating the Employment Status of the Deputy Rector (Admin.)Dr. OlatunjiAgboolaOlateju in Relationship with SwanseaUniversity, United Kingdom

The concern authority should also set up a special investigation panel to look into the employment status of the Deputy Rector (Admin.) Dr. OlatunjiAgboolaOlateju.

Dr. OlatunjiAgboolaOlateju joined the services of the Polytechnic in May 1998 as a Lecturer II, and left for United Kingdom for a PHD programme in 2008 where he was until his appointment as a Deputy Rector (Admin).

Dr. Olateju is in full time employment with Swansea University, United Kingdom and from his Curriculum Vitae he is a visiting Lecturer with Lagos State Polytechnic, Ikorodu, Lagos-Nigeria (Confirmation can be source from Swansea University, through British Council).

It is pertinent to note that, since Dr. Olateju assumed office as the Deputy Rector (Admin), he has spent most of his period in United Kingdom, claiming that he is on visit to his family (Request his International Passport).

It is equally important to inform the concern authority that Dr. Olateju is a full time Politician; he is currently the National Organising Secretary of the Unity Party of Nigeria (UPN) which is against the rule guiding the public servant.

Dr. Olateju abandoned his duty post between December 2016 and April 2017 to attend to his “Primary” assignment in Swansea University, United Kingdom. The job he so much cherish as to absent himself from attending the last Convocation Ceremony of the Polytechnic which we have in attendance His Excellence, The Governor of Lagos State, Mr. AkinwunmiAmbode.

- Other Pressing Issues not Mentioned above includes :

- Setting standard for academic : Lack of Consumables, Power, Academic Allowances, internet facilities, Decay in Infrastructures etc

- Review and application of condition of service without due diligence eg. Selection of Dean, Directors, Wardrobe Allowance to Principal Officer

- Delay in remittance of pension contribution

- Security breaches and intimidation of staff of the Polytechnic

- Removal of 4% pension annuity

- Flagrant Usurpation of Governing Council Power

- Connivance with Mr. Sutton, Director Higher Education, OSAE to commit forgery of letters said to have emanated from the Special Adviser on Education

- Staff Bonding and promotion on study leave contrary to global best practices.

- Bullying and threatening of students and staff by the Rector and his cohorts.

- Arbitrary increment in salary and allowances of Bursar, Registrar and Polytechnic Librarian

- Usurpation and outright threatening of the Audit Unit by the Rector and his cohorts

- Bypassing the Governing Council for approval by the SAE

- Fractionalizing of staff, destroying trust and encouraging academics ineptitude.

Documents below:

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

You must be logged in to post a comment Login