society

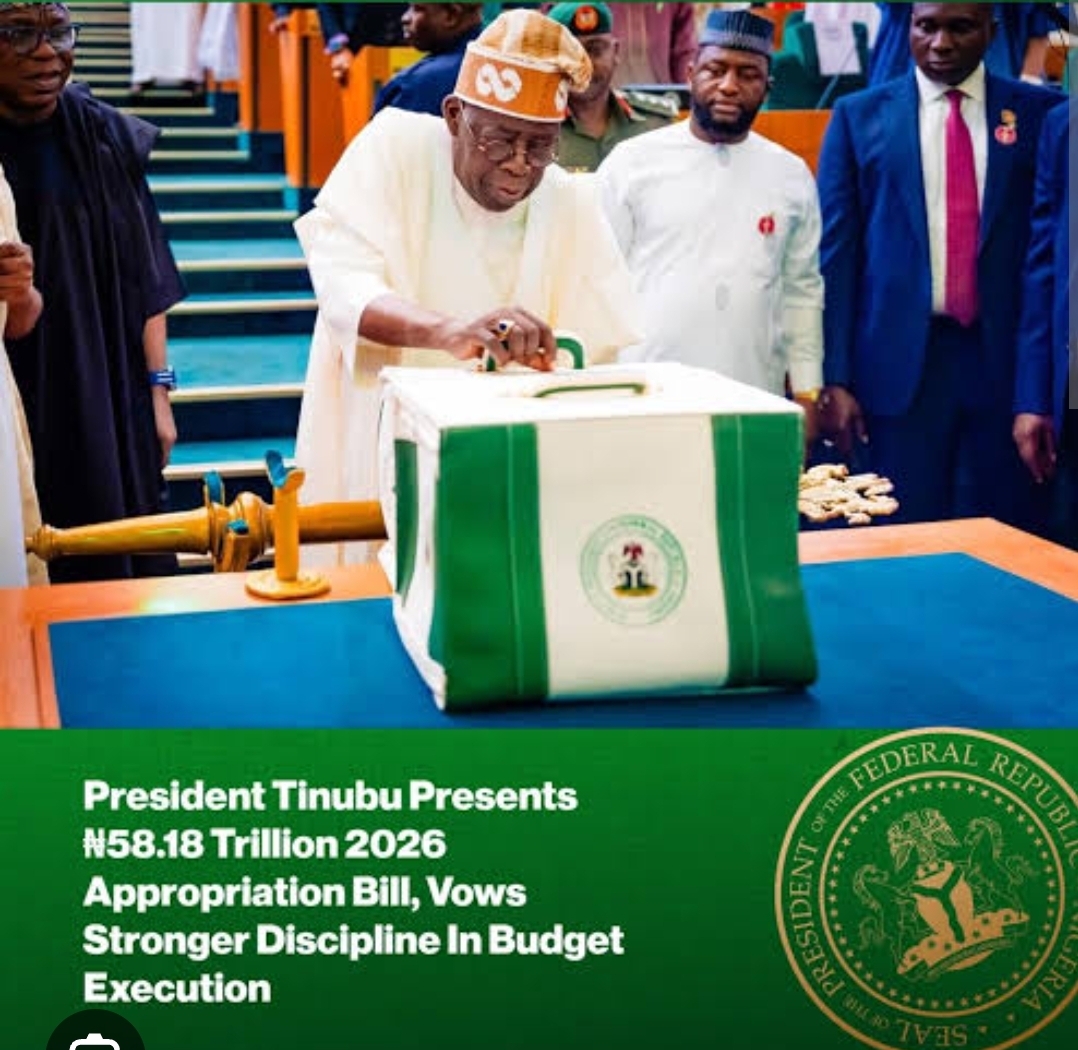

Nigeria’s N58.18trn Budget and Rising Cost of Deficit Governance

Nigeria’s N58.18trn Budget and Rising Cost of Deficit Governance

BY BLAISE UDUNZE

When President Bola Tinubu presented the N58.18 trillion 2026 Appropriation Bill to the National Assembly, unbeknownst to some, it opened with a contradiction that should unsettle even its most optimistic readers. It is an irony that a budget promises consolidation, renewed resilience, and shared prosperity, at the same time, it is built on a deficit of N23.85 trillion, as the largest budget in the nation’s history, equivalent to 4.28 percent of GDP, financed largely through borrowing, and debt servicing alone will consume N15.52 trillion, nearly half of the projected revenue. What a contradiction! The reality today is that Nigeria is borrowing not primarily to expand productive capacity or unlock long-term growth, but to keep the machinery of the state running. Salaries, overheads, inherited liabilities, and interest payments increasingly define the purpose of new debt. Capital formation, though loudly advertised, struggles to keep pace with fiscal reality. This raises a fundamental and unavoidable question. How sustainable is a fiscal model where debt service crowds out development spending year after year? Until this question is convincingly answered, no amount of reform rhetoric can restore confidence in Nigeria’s budgeting process.

A Nation Drowning in Deficits and Debt

The problem with the deficit is that it is not a number by itself. It shows that there are problems with the way things are set up. By the middle of 2025, Nigeria owed a lot of money, N152.4 trillion, which represented about a 348.6 percent increase following the assumption of President Bola Tinubu into office in 2023. Before he assumed office, the country owed N33.3 trillion, and this is a country that was already having trouble paying for basic things it needed to.

Reflecting on Nigeria’s predicament, it mirrors a wider African crisis. Reviewing the occurrences across the continent of Africa, external debt now surpassed $1.3 trillion, while the debt servicing costs are estimated at $89 billion this year alone. Nigeria’s case is unique not because of the amount of debt, but because of its poor productive return. The lingering challenge is that Nigeria’s borrowing has skyrocketed, yet the economy remains conspicuously faced with fragile infrastructure. The fiscal irony is stark that Nigeria is borrowing to survive, not to thrive.

A Deficit-Fuelled Budget and the Rising Cost of Survival

Deficits can be useful tools when deployed strategically. But Nigeria’s deficits have become structural, persistent, and increasingly divorced from growth outcomes. The N23.85 trillion deficit in the 2026 budget represents a dramatic escalation from the N11-N12 trillion range of recent years. Analysts warn that this is no longer a counter-cyclical policy; it is a sign of fiscal stress. Tilewa Adebajo, Chief Executive Officer of CFG Advisory, describes Nigeria’s fiscal space as “the biggest threat to our economic recovery.” According to him, the country continues to expand its budget despite failing to meet revenue targets. “We cannot have a N23 trillion deficit, that’s not sustainable,” he warned, noting that deficits have doubled in just a few years. More troubling is what the deficit implies. With N15.52 trillion earmarked for debt servicing, nearly half of the projected revenue is already spoken for before development spending begins. Some estimates suggest that over 25 percent of Nigeria’s annual revenue now goes directly into debt servicing, and in certain months, the ratio rises far higher. Experts warn that when over 90 percent of revenue is consumed by old debts, governance becomes an exercise in survival rather than progress. This is the fiscal corner Nigeria is steadily backing itself into.

Borrowing to Run Government, Not to Build the Economy

Between July and October 2025 alone, Nigeria secured over $24.79 billion in new borrowings, alongside €4 billion, ¥15 billion, N757 billion, $500 million in sukuk, and other facilities, most justified as “development financing.” Yet the real sector continues to wait for a tangible impact. The African Democratic Congress (ADC) argues that a budget planning to generate N34 trillion in revenue while borrowing nearly N24 trillion amounts to an admission of fiscal insolvency. A deficit-to-revenue ratio approaching 70 percent, it insists, would be unacceptable in any functional fiscal system. While opposition language is often sharp, the underlying concern is valid. Borrowing makes economic sense only when it finances self-liquidating projects like investments that generate revenue to repay the loans. Instead, Nigeria increasingly borrows to service past debts and plug recurrent expenditure gaps. Uche Uwaleke, Professor of Finance and Capital Markets at Nasarawa State University, underscores the danger: “Nigeria’s debt service ratio is inimical to economic development, chiefly because what could have been used to build infrastructure and invest in human capital is used to service debt. The opportunity cost for the country is high.” In effect, debt has shifted from a development instrument to a fiscal life support system.

Revenue Projections Caught Between Reform Ambition and Structural Limits

The Nigerian government projected N34.33 trillion in revenue for 2026, which is squarely anchored on improved oil output, non-oil tax reforms, and digitised revenue mobilisation across Government-Owned Enterprises (GOEs). To actualize its target, President Tinubu vowed to clamp down on leakages, enforce performance targets, and deploy real-time monitoring systems. Though these reforms are necessary. The question is whether they are sufficient and timely. Recent performance suggests caution. As at Q3 2025, only 61 percent of revenue targets had been achieved. Capital releases lagged sharply, and comprehensive implementation reports have not been published. Ayokunle Olubunmi, Head of Financial Institutions Ratings at Agusto & Co., expressed doubts about the credibility of the projections, citing weak performance in 2024 and 2025. “We don’t even know how many budgets we are implementing now,” Olubunmi observed, pointing to overlapping cycles and missing reports. The ADC goes further, describing revenue projections as detached from reality, while noting that revenue growth in 2024 was largely driven by currency devaluation, not structural expansion, before being doubled for 2025 and increased again for 2026. Nominal gains, it argues, are being mistaken for real fiscal strength. Without deep structural reforms, reliable power, export diversification, and productivity growth, revenue expansion risks remaining inflationary and fragile, unable to support the scale of spending proposed.

Budget Execution and the Credibility Gap

President Tinubu has declared 2026 a turning point. He promised an end to overlapping budgets, abandoned projects, and perpetual rollovers. All prior capital liabilities, he said, will be closed by March 31, 2026, ushering in a single budget cycle. Yet Nigeria’s execution record invites skepticism. The Coalition of United Opposition Political Parties (CUPP) points out that no comprehensive 2025 budget implementation report has been published, the first such lapse in 15 years. Quarterly performance reports, once routine, have been withheld, violating fiscal responsibility norms. “How can a new budget be proposed when the performance of the current one remains unknown?” CUPP asked. Execution failure is not cosmetic; it is costly. Projects stall, costs balloon, and borrowed funds yield no returns. Without transparency and enforcement, discipline risks becoming a slogan rather than a system.

Capital Spending vs the Persistent Cost of Governance

The N26.08 trillion allocated to capital expenditure is one of the budget’s most advertised strengths, with infrastructure, agriculture, education, and health featuring prominently. Yet Nigeria’s history cautions against equating allocations with outcomes. Recurrent non-debt expenditure remains high at N15.25 trillion, reflecting a governance structure that consumes significant resources. Ministries, departments, agencies, and political overheads continue to limit fiscal space. Mr. Idakolo Gbolade of SD&D Capital Management acknowledges the budget’s ambition but warns that over 70 percent of capital expenditure may be carried over into 2026. This suggests that implementation bottlenecks remain unresolved. Borrowing to fund capital projects that are delayed or abandoned compounds fiscal inefficiency. Nigeria risks paying interest on infrastructure that exists only on paper. Until the cost of governance is structurally reduced, capital spending will struggle to deliver transformative impact, regardless of headline figures.

Security Spending at Scale, But Lacking Clarity

Security receives the largest sectoral allocation, N5.41 trillion, alongside a new national counterterrorism doctrine targeting all armed non-state actors. The administration argues, correctly, that without security, investment cannot thrive. On the contrary, Nigeria’s experience shows that security spending does not automatically translate into security outcomes. Over the years, allocations have risen while insecurity persists across multiple regions. The challenge is not merely funding, but accountability, coordination, and effectiveness. Without transparency in procurement and deployment, security budgets risk becoming opaque sinks for public funds, undermining the very growth assumptions embedded in the budget.

Shared Prosperity Under Pressure

Though the budget promises shared prosperity, citing allocations of N3.52 trillion for education and N2.48 trillion for health, alongside agricultural and infrastructure investments, and with the National Bureau of Statistics announcement that inflation has moderated, and growth has improved modestly. Yet for ordinary Nigerians, relief remains elusive. Food prices are high, transport costs elevated, and real incomes squeezed. Social sector spending still struggles to keep pace with population growth. Shared prosperity cannot remain an aspiration deferred to the future. It must translate into jobs, affordable food, functioning schools, accessible healthcare, and rising real incomes.

Borrowing Without Beneficiaries

At the 2025 IMF and World Bank Annual Meetings in Washington, D.C., global leaders again pledged to address developing countries’ debt burdens. But as Nigeria continues to issue Eurobonds, sukuk, and bilateral loans, a simple question demands attention: who benefits from all this borrowing? If the answer is not citizens, businesses, and future generations, then the debt is not development finance; it is deferred hardship.

When Deficits Become Destiny

The 2026 budget reflects an administration aware of Nigeria’s fiscal dysfunctions and eager to correct them. The language of discipline, digitisation, and delivery signals intent. But credibility is not declared; it is earned. A deficit-driven budget that leans heavily on borrowing, struggles with revenue realism, and carries unresolved execution gaps places Nigeria on a narrow fiscal path. If borrowing is decisively tied to self-liquidating projects, transparency restored, and governance costs reduced, the budget could mark a turning point. If not, it risks confirming a grim truth as Nigeria is financing today by mortgaging tomorrow. Until debt stops crowding out development and revenue begins to fund governance rather than merely service it, deficits will no longer be temporary tools. They will become destiny.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

society

Stop Means Stop”: Legal Experts Warn Ignoring ‘Stop’ During Intimate Acts Can Be Criminally Punishable

“Stop Means Stop”: Legal Experts Warn Ignoring ‘Stop’ During Intimate Acts Can Be Criminally Punishable

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

“Grounded in international law and consent principles, legal authorities stress that continuing sexual activity after a partner withdraws consent may constitute sexual assault and lead to imprisonment.”

A growing body of legal interpretation and expert opinion reaffirm that consent in intimate encounters is not a one-off event but an ongoing requirement; withdrawn at any time by either participant. Legal practitioners and rights advocates are increasingly warning that if one partner clearly says “stop” during sexual activity and the other continues, this conduct can constitute a criminal offence with significant penalties, including imprisonment.

Consent must be “a voluntary agreement to engage in the sexual activity in question,” and crucially can be revoked at any stage. Once a partner expresses withdrawal of consent (by words like “stop” or by unmistakable conduct) the other party is legally obligated to cease all activity immediately. Failure to respect this is widely recognised in multiple legal jurisdictions as sexual assault or rape.

Professor Deborah Rhode, a prominent authority on legal ethics, has stated: “Respect for autonomy and bodily integrity lies at the core of consent law. Ignoring a partner’s withdrawal of consent undermines basic personal freedoms and is treated as a serious offence in criminal law.”

According to experts, this legal principle is not limited to strangers but applies equally to long-term partners and spouses. The Criminal Code in many countries explicitly rejects implied or blanket consent based on relationship status.

Human rights lawyer Amal Clooney has similarly emphasised that clear communication and mutual agreement are essential, and that “once consent is withdrawn, any continued sexual activity crosses the line into criminal conduct.”

This means that in places where consent law is well-established, ignoring an explicit “stop” can lead to charges of sexual assault, with courts interpreting such conduct as a violation of an individual’s autonomy and dignity.

The issue has gained media and legal attention in recent years across numerous jurisdictions (including Canada, parts of Europe, and reform discussions in U.S. states) as courts and legislatures clarify that sexual consent is continuous and revocable at any time. Although no globally consolidated database exists of individual cases tied specifically to a news report on this warning, reputable legal frameworks consistently reinforce that continuing after “stop” is unlawful.

The subject engages legal scholars, criminal law practitioners, human rights experts, and statutory bodies advocating sexual violence prevention. Law enforcement agencies and prosecutors may pursue charges when clear evidence shows that consent was withdrawn and ignored.

In practice, consent frameworks require that the person initiating or continuing sexual activity take reasonable steps to ensure ongoing affirmation of willingness. Silence, passive behaviour, or failure to stop when asked cannot substitute for ongoing consent.

In summary, the legal maxim is clear: verbal or unambiguous withdrawal of consent must be respected. Ignoring it shifts the encounter from consensual to criminal, potentially resulting in serious legal consequences including imprisonment.

society

Lagos Family Property Dispute Turns Violent After Death of Omotayo Ojo

Lagos Family Property Dispute Turns Violent After Death of Chief Omotayo Ojo

By Ifeoma Ikem

A festering family dispute over property has escalated into a series of violent attacks in Lagos, leaving residents of a contested apartment in fear for their safety.

Mrs. Omotayo-Ojo-Alolagbe (Nee Omotayo-Ojo) the third child and first daughter of the late Omotayo Ojo, has alleged repeated assaults and destruction of property by her siblings from her father’s other marriages.

According to her account, hostility against her began while her father was still alive, allegedly fueled by the affection and support he showed her. She claimed that tensions worsened after his death in 2019.

Mrs. Alolagbe stated that her late father had given her a particular apartment during his lifetime, assuring her she would not suffer hardship, especially after her husband left the marriage. She said the property became her primary source of livelihood and shelter.

However, she alleged that her siblings had sold off several other family properties and were determined to dispossess her of the apartment allocated to her by their father.

The dispute reportedly turned violent on Nov. 15, 2025, when unknown persons allegedly attacked the building. She said the incident prompted her to petition the Chief Judge of Lagos State and the Commissioner of Police.

Despite the pending legal proceedings, she alleged that another attack occurred on Jan. 21, 2026. During that incident, parts of the building were vandalised, including the walkway and the main gate, which was reportedly removed.

A third attack was said to have taken place on Feb.18, 2026, during which the roof, gates, and sections of the walkway were allegedly dismantled. Residents were reportedly assaulted, and some were allegedly forced to part with money under duress.

Tenants in the apartment complex are said to be living in fear amid the repeated invasions, expressing concern over their safety and uncertainty about further violence.

Mrs. Alolagbe alleged that the attacks were led by a man identified as Mr. Alliu, popularly known as aka “Champion,” whom she described as a political thug. She claimed he arrived with a group of about 50 men, allegedly brandishing weapons and breaking bottles to intimidate residents.

She further alleged that the group boasted of connections with senior police officers, politicians in Lagos State, and even the presidency, claiming they were untouchable.

According to her, some arrests were initially made following the incidents, but the suspects were later released. She expressed concern that the alleged perpetrators continue to threaten her, making it difficult for her to move freely.

She also disclosed that during a meeting on Feb. 23, 2026, an Area Commander reportedly told her that little could be done because the matter was already before a court of law.

The development has raised concerns about the enforcement of law and order in civil disputes that degenerate into violence, particularly when court cases are pending.

As tensions persist, residents and observers are calling on relevant authorities to ensure the safety of lives and properties ,while allowing the courts to determine ownership and bring lasting resolution to the dispute.

society

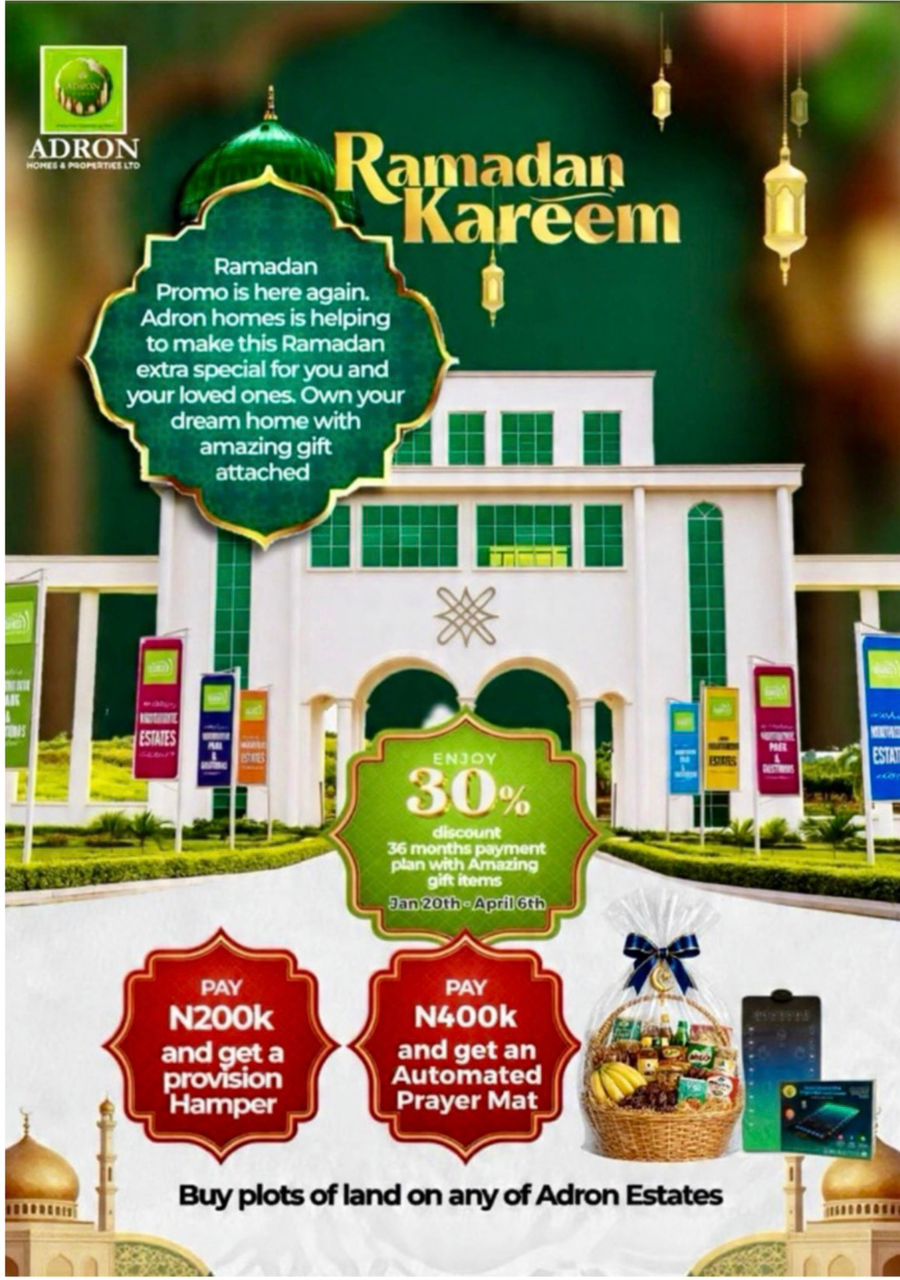

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

As the holy month of Ramadan inspires reflection, sacrifice, and generosity, Adron Homes and Properties Limited has unveiled its special Ramadan Promo, encouraging families, investors, and aspiring homeowners to move beyond seasonal gestures and embrace property ownership as a lasting investment in their future.

The company stated that the Ramadan campaign, running from January 20th to April 6th, 2026, is designed to help Nigerians build long-term value and stability through accessible real estate opportunities. The initiative offers generous discounts, flexible payment structures, and meaningful Ramadan-themed gifts across its estates and housing projects nationwide.

Under the promo structure, clients enjoy a 30% discount on land purchases alongside a convenient 36-month flexible payment plan, making ownership more affordable and stress-free.

In the spirit of the season, the company has also attached thoughtful rewards to qualifying payments. Clients who pay ₦200,000 receive a Provision Hamper to support their household during the fasting period, while those who pay ₦400,000 receive an Automated Prayer Mat to enhance their spiritual experience throughout Ramadan.

According to the company, the Ramadan Promo reflects its commitment to aligning lifestyle, faith, and financial growth, enabling Nigerians at home and in the diaspora to secure appreciating assets while observing a season centered on discipline and forward planning.

Reiterating its dedication to secure land titles, prime locations, and affordable pricing, Adron Homes urged prospective buyers to take advantage of the limited-time Ramadan campaign to build a future grounded in stability, prosperity, and generational wealth.

This promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states.

As Ramadan calls for purposeful living and wise decisions, Adron Homes is redefining the season, transforming reflection into investment and faith into a lasting legacy.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING