Business

Oil Producing Communities Group threatens to seal all Oil pipeline facilities over poor treatment of Dangote, other Modular Refineries

…Warn IOCs against economic sabotage

…Urge FG to end fuel, diesel importation

The Host Communities of Nigeria Producing Oil and Gas (HOSTCOM), over the weekend, threatened to renew agitation for greater autonomy and control of their natural resources, if the Nigerian National Petroleum Corporation (NNPC) and the International Oil Companies (IOCs) fail to sell and supply crude oil to Dangote Refinery and other local Refineries, in their bid to ensure that Nigeria becomes self-sufficient in local production of Premium Motor Spirit (PMS) and diesel.

The Group, comprising all the states producing oil and gas in Nigeria, lamented that despite the billions of dollars spent on turnaround maintenance of Nigeria’s refineries, the country remains reliant on importing refined products. This persistent issue, it argues, highlights the widespread corruption within Nigeria’s oil and gas industry, allegedly orchestrated by influential cabals who are intent on maintaining the status quo of exporting crude oil while importing refined petroleum products. HOSTCOM warned that it will not hesitate to publicly name these identified cabals if necessary.

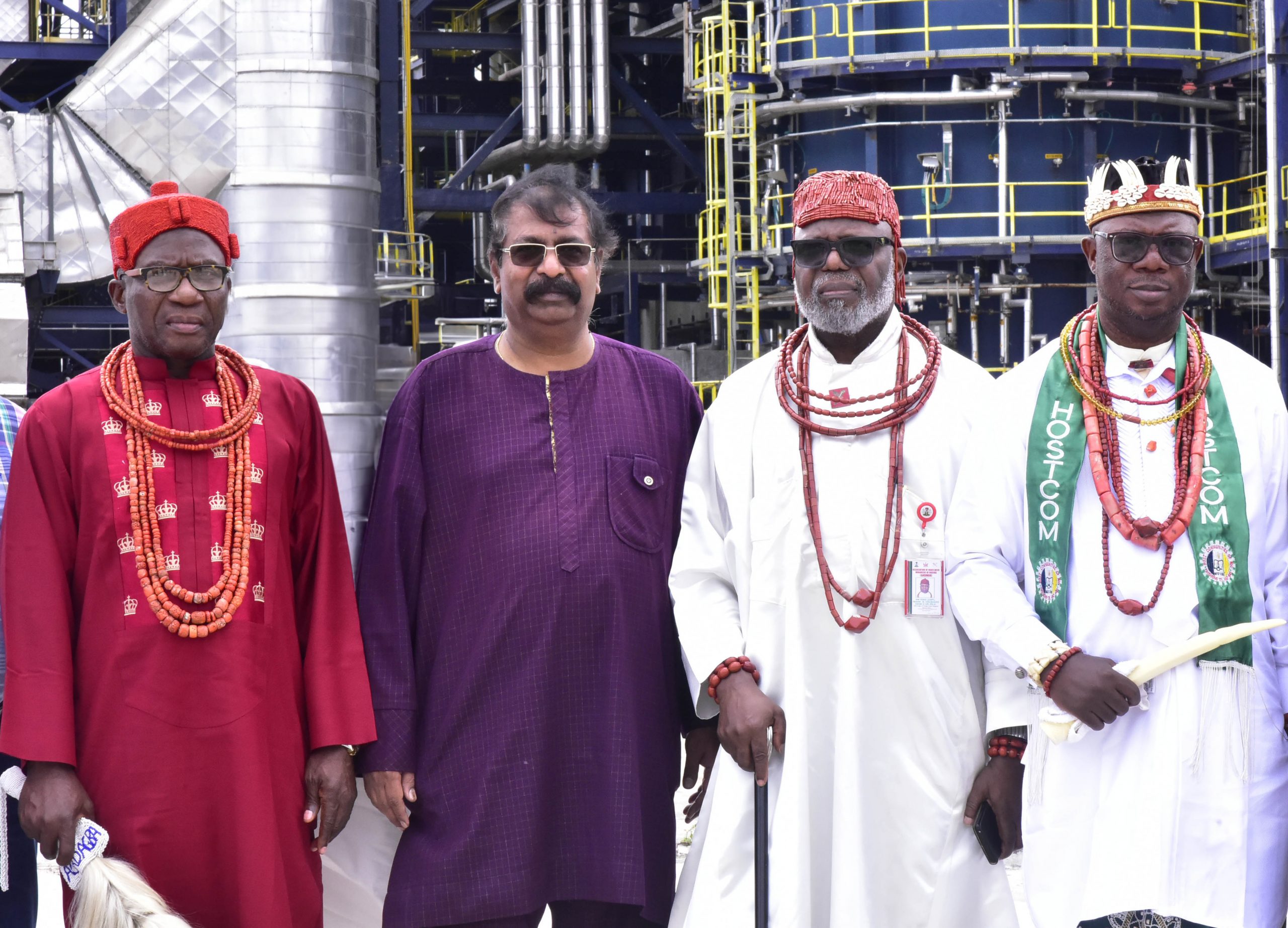

The National President of HOSTCOM, Dr. Benjamin Tamaramiebi, accompanied by his executives and traditional rulers from the Niger Delta region, toured the Dangote Petroleum Refinery & Petrochemicals and the Dangote Fertiliser Limited complex. Notable traditional rulers included the Chairman of the Niger Delta Monarchs Forum, HRM Frank Okorakpo; Deputy Chairman of the Traditional Rulers of Oil Mineral Producing Communities of Nigeria (TROMPCON), HRM Obafemi Ogaro; and Egbesuwei Gbanraun X Agadagba Pere, HRM (Capt) Frank Okiakpe, among others

After the tour, the National President, Dr. Tamaramiebi said: “Our visit today to the largest and magnificent 650,000 bpd private Refinery in Africa (Dangote Refinery) has opened our eyes to several ills, particularly to the monumental corruption going on in the Nigeria oil and gas industry.”

“It is obvious why the existing Federal Government Refinery in Port Harcourt, Warri and Kaduna can never work or operate maximally despite the billions of dollars spent on the so-called Turn Around Maintenance over the years. It is now clear that some persons in government and outside government have been identified as the cabal holding Nigeria oil sector by the jugular. We have identified them, and we shall reveal their names to the people of Nigeria if this trend continues,” he said.

While emphasising on the need for Nigeria to refine its crude locally, HOSTCOM urged the Federal Government to back the Dangote Petroleum Refinery & Petrochemicals and other domestic refineries to end the nation’s persistent reliance on imported petrol, diesel, and other refined products.

The Group’s President also called for nationwide support for Dangote Petroleum Refinery and other modular refineries to eliminate the need for imported refined products. It expressed gratitude to the National Assembly and Nigerians but warned against any sabotage that could hinder the country’s progress towards self-sufficiency in refined products.

“We are grateful to the 10th National Assembly, good-spirited individuals and associations who have been rallying support for Aliko Dangote. We at HOSTCOM have come today to drum up support for Dangote Refinery. We will stand with Dangote to put an end to continuous importation of less quality and costly refined petroleum products into Nigeria,” stated the group.

HOSTCOM, which emphasised that every Nigerian’s aspiration is for the country to refine its own crude oil for the benefit of its people, warned that any individual who opposes this national desire will face the wrath of the masses.

The group also lampooned the Chief Executive of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), Farouk Ahmed, over his recent statement that the government would not halt the importation of refined petroleum products. HOSTCOM called on President Bola Ahmed Tinubu to remove Ahmed from his position, arguing that his previous associations with key players in the sector make him unfit to effectively regulate the downstream industry.

“We unequivocally call for the immediate sack of Farouk Ahmed. It is now clear that he as the CEO of NMDPRA is responsible for issuing import licences to his cronies outside the government to continue to import sub-standard refined petroleum products into the country. This is not surprising given that he has served on the boards of some downstream companies in the past. He is therefore obviously conflicted and incapable of performing the duties of a regulator for the downstream sector. It is important to immediately replace him with an individual who is not encumbered by such conflict,” the group added.

The group praised the President of Dangote Industries Limited, Aliko Dangote for his patriotism in investing in and constructing the refinery in Nigeria, noting that his endeavour has significantly contributed to the country’s economic growth and development. It emphasised that the refinery is crucial in providing local solutions to Nigeria’s refining needs, thereby reducing the nation’s dependency on imported refined petroleum products.

The group urged President Tinubu to support the project, highlighting that it will enhance the economy, create thousands of jobs, ensure the sustainability and affordability of products, and bring substantial benefits to the host communities, among other positive effects.

“We called on President Bola Tinubu to support and sustain this refinery which is in his own state. He must do away with the cabals holding the oil sector to ransom,” it added.

The group further asserted that the President must not tolerate the economic sabotage being carried out by the IOCs operating in Nigeria, which have refused to sell crude oil to the Dangote Refinery and other modular refineries. They condemned this as an affront to the Nigerian people and a deliberate attempt to undermine the President’s renewed hope agenda, which aims to revive the economy.

“We call on Mr. President to direct NNPC or NNPCL to compel the IOCs operating in our communities to sell and supply crude oil to Dangote Refinery and other local Refineries in line with section 109 of the Petroleum Industry Act PIA 2021 particularly section 109(4)(b) which states that “the supply of crude oil shall be commercially negotiated between the lessee and the crude oil refining licensee, having regard to the prevailing international market price for similar grades of crude oil,” it added.

It also pointed out that, despite the PIA, the IOCs continue to lack transparency and accountability, alleging ongoing exploitation of oil-producing communities. The group warned that if the IOCs fail to supply crude oil to domestic refineries, host communities will be forced to take decisive action.

The Vice President (Oil & Gas) at Dangote Industries Limited, Devakumar Edwin, who hosted the delegates, explained that the refinery was established primarily to source and refine local crudes for the benefit of Nigeria, while also exporting excess production to boost the economy.

Edwin noted that the lack of sufficient Nigerian crude supplies has necessitated importing crude from other countries and continents. He said that if the refinery had not been designed to process a wide range of crudes, including various African and Middle Eastern crudes as well as US Light Tight Oil, it would have become inactive due to the lack of Nigerian crude supplies.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

Business

BUA Group, AD Ports Group and MAIR Group Launch Strategic Plan for World-Class Sugar and Agro-Logistics Hub at Khalifa Port

BUA Group, AD Ports Group and MAIR Group Sign MoU to Explore Collaboration in Sugar Refining, Agro-Industrial Development, and Integrated Global Logistics Solutions

Abu Dhabi, UAE – Monday, 16th February 2026

BUA Group, AD Ports Group, and MAIR Group of Abu Dhabi today signed a strategic Memorandum of Understanding (MoU) to explore collaboration in sugar refining, agro-industrial development, and integrated global logistics solutions. The partnership aims to create a world-class platform that strengthens regional food security, supports industrial diversification, and reinforces Abu Dhabi’s position as a hub for trade and manufacturing.

The proposed collaboration will leverage BUA Group’s industrial and logistics expertise, Khalifa Port’s world-class infrastructure, and AD Ports Group’s operational experience. The initiative aligns with the objectives of the UAE Food Security Strategy 2051, which seeks to position the UAE as a global leader in sustainable food production and resilient supply chains. It also aligns with Nigeria’s food production- and export-oriented agricultural transformation agenda, focused on scaling domestic capacity, strengthening value addition, improving post-harvest logistics, and unlocking new markets for Nigerian produce across the Middle East, Asia, and beyond.

Photo Caption: L-R: Kabiru Rabiu, Group Executive Director, BUA Group; Cpt. Mohammed J. Al Shamisi, MD/Group CEO, AD Ports Group; Saif Al Mazrouei, CEO (Ports Cluster) AD Ports Group; Abdul Samad Rabiu, Founder/Executive Chairman, BUA Group; and Steve Green, Group CFO, MAIR Group

Through structured aggregation, processing, storage, and maritime export channels, the partnership is designed to reduce supply chain inefficiencies, enhance traceability and quality standards, and also create a predictable trade corridor between West Africa and the Gulf.

BUA Group—recognised as one of Africa’s largest and most diversified conglomerates, with major investments across sugar refining, food production, flour milling, cement manufacturing, and infrastructure- brings extensive industrial expertise and large-scale operational capability to the venture. MAIR Group will provide strategic support in developing integrated logistics and agro-industrial solutions, creating a seamless platform for production, storage, and distribution.

Abdul Samad Rabiu, Founder and Chairman of BUA Group, said:

“This MoU marks an important milestone in BUA’s international expansion and reflects our long-term vision of building globally competitive industrial platforms. Together with AD Ports Group and MAIR Group, we aim to develop sustainable food production and logistics solutions that strengthen regional supply chains and support the UAE’s Food Security Strategy 2051.”

He further added that, “This partnership represents not just a commercial arrangement but a strategic food corridor anchored on shared economic ambition, resilient infrastructure, and disciplined execution, reinforcing long-term food security objectives for both nations.”

A representative of MAIR Group added:

“This collaboration underscores our commitment to advancing strategic industries in Abu Dhabi and building integrated solutions that reinforce the UAE’s position as a global hub for trade, food security, and industrial excellence.”

A spokesperson from AD Ports Group commented:

“Our partnership with BUA Group and MAIR Group highlights Khalifa Port’s role as a catalyst for high-impact industrial investments. This initiative will enhance regional food security, strengthen global trade connectivity, and support Abu Dhabi’s economic diversification goals.”

This MoU marks a historic collaboration that combines world-class infrastructure, industrial expertise, and strategic vision, setting the stage for a sustainable and resilient food and logistics ecosystem that will benefit the UAE, the region, and global markets alike.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING