society

The Fiscal Renaissance and Socio-Economic Re-Engineering of Zamfara State by Governor Dauda Lawal’s Administration

The Fiscal Renaissance and Socio-Economic Re-Engineering of Zamfara State by Governor Dauda Lawal’s Administration

By: Bashorun Oladapo Sofowora

In 2023, when His Excellency, Governor Dauda Lawal, ascended to the governorship of Zamfara State against considerable odds, he brought with him a wealth of experience as a seasoned banker in the financial and banking sector. His emergence as governor proved timely, as his mandate was to revitalize a state that had fallen into a state of extreme stagnation and disrepair. Previous administrations had rendered Zamfara nearly ungovernable, with widespread poverty and a lack of meaningful development. Governor Lawal, however, entered into the political arena with a clear vision; to inject life back into the state and prepare it for competitiveness with its regional counterparts.

Zamfara is rich in abundant minerals, yet it has been marred by infrastructural deficits and pervasive poverty, leading many to believe that true development was out of reach. Unfazed by these challenges, Governor Lawal embraced the monumental task of restoring the state. His determination and proactive approach earned him the moniker of ‘Chief Rescuer.’ Today, just over two years into his administration, Zamfara has emerged as one of the most improved states in the region, far exceeding initial expectations.

The journey of transforming a sub-national economy within Nigeria’s federal system mandates a dual strategy; aggressive fiscal consolidation paired with targeted socio-economic investments. Historically, Zamfara faced significant hurdles, including an over-reliance on federal allocations, systemic inefficiencies in public expenditure, and a turbulent security landscape that repeatedly hampered agricultural and industrial productivity. Once hailed as the ‘Farming State,’ Zamfara had struggled to live up to that name due to ongoing security and infrastructural challenges.

However, the period from 2023 to 2025 marks a pivotal shift in the state’s developmental trajectory under Governor Dauda Lawal’s leadership. This era is defined by a transition from fiscal fragility to emerging viability. Objective performance metrics, bolstered by comprehensive institutional reforms, reflect this transformation. To illustrate the depth and sustainability of these changes, detailed analyses will delve into comparative statistics regarding revenue growth, debt sustainability, and sectoral performance. This comprehensive evaluation aims to provide a clearer understanding of the mechanisms driving Zamfara’s revitalization and the long-term viability of these reforms.

The creation of a Sub-National Fiscal Resilience

The primary indicator of Zamfara’s fiscal recovery is its dramatic ascent in the annual State of States rankings conducted by BudgIT, a renowned civic organization dedicated to fiscal transparency and accountability. In 2023, at the onset of the current administration, Zamfara was ranked 36th, the lowest position among Nigeria’s 36 states. By 2024, the state had ascended to 26th, and the 2025 report reveals a further jump to 17th position. This 19-place improvement within two years suggests a fundamental change in the state’s capacity to manage its resources and generate independent revenue. This ranking is not merely symbolic; it is built on a massive expansion of the state’s revenue base. The recurrent revenue of Zamfara State increased from N87.44 billion in 2023 to N246.88 billion in 2024, representing a year-on-year growth rate of approximately 182.34%. The Total revenue, which includes capital receipts and aids, grew from N144.95 billion to N315.53 billion in the same period, a 117.68% increase. While a portion of this growth is attributable to the increased Federal Account Allocation Committee (FAAC) disbursements resulting from national-level fiscal changes, the state’s internal efforts to optimize revenue collection have been pivotal.

The BudgIT report further classifies Zamfara as one of the few states that would theoretically possess independent viability if they were to exist as sovereign entities. This classification is reserved for states that demonstrate a limited and decreasing dependence on federally distributed revenue for their basic operations. Although Zamfara’s Internally Generated Revenue (IGR) currently accounts for approximately 10.31% of its total revenue, the rapid expansion of the non-tax revenue component specifically; fees and licenses indicates a diversification of the local tax base.

Non-tax revenue, which had plummeted to N1.07 billion in 2022, rebounded to N7.42 billion in 2023 and further increased to N12.91 billion in 2024. This recovery in non-tax revenue is largely driven by a 5,921.47% increase in licenses in 2023 followed by a 44.53% growth in 2024, alongside an 88.24% increase in revenue from fees.

The data indicates that while FAAC revenue surged by 239.18% between 2023 and 2024, the state’s IGR also showed a positive trajectory, rising by 14.86% from N22.16 billion in 2023 to N25.46 billion in 2024. This growth is particularly significant when viewed through the lens of long-term trends; for instance, the state’s IGR was as low as N2.74 billion in 2015. The current administration’s ability to maintain a growth trajectory in IGR amidst security challenges suggests that the implementation of the Harmonized Revenue Law and the digitalization of permit processing are beginning to yield results.

Component Estimation of Revenue Growth

The internal revenue structure reveals a nuanced shift from traditional taxation to service-based non-tax revenue. In 2024, total revenue generated was N358.9 billion, representing an 82% performance of the approved target of N437 billion. This performance was underpinned by steady improvements in Value Added Tax (VAT), IGR, and federal statutory allocations, alongside aids and grants from development partners.

A detailed look at the state’s IGR shows that in 2024, Zamfara ranked 25th among the 36 states in terms of absolute IGR. While the total tax collection saw a marginal decline of 1.63\% to N18.32 billion, the revenue from Ministries, Departments, and Agencies (MDAs) strengthened by 101.59% to N7.14 billion. This reflects ongoing revenue reforms in government offices, although expansion in the mining and agriculture sectors remains critical for future growth.

The precipitous decline in fines, noted at 78.15%, suggests a potential shift in enforcement strategies or a behavioral change in compliance, though the massive growth in fees and licenses more than compensated for this loss. The revenue from fees, specifically, grew from N82.44 million in 2022 to N3.06 billion in 2023 and further to N5.76 billion in 2024. This trajectory indicates a systematic effort to capture previously unrecorded or diverted service-related revenues.

Building Institutional Integrity and Payroll Sanitization

A critical component of the fiscal consolidation strategy has been the sanitization of the state’s payroll for the civil servant in the state. For decades, many Nigerian states have struggled with “ghost workers”; fictitious entries on the payroll used to siphon public funds. In August 2024, the Lawal administration constituted a high-level verification committee, led by the Head of Service and including the Commissioner of Finance and various Auditors-General, to integrate the state’s nominal and payroll systems. The findings of this audit, concluded by February 2025, were profound, exposing deep-seated systemic corruption.

The committee identified 2,363 ghost workers who were collectively drawing N193.64 million in monthly salaries. Furthermore, the audit uncovered 220 minors fraudulently listed as civil servants and receiving monthly wages. The audit report highlighted that 75 workers had first appointment dates that were not in compliance with the issue dates, as they were minors at the time of employment. The significance of these findings extends beyond the immediate N200 million in monthly savings (N2.4 billion annually).

This cleanup was a mandatory prerequisite for the implementation of the new national minimum wage of N70,000, which the state started paying in March 2025. By removing non-existent or ineligible recipients from the payroll, the administration ensured that the increased wage bill for legitimate workers was sustainable and would not compromise the state’s ability to fund capital projects. This move towards transparency is further supported by the introduction of the Zamfara e-Governance Platform (e-GovConnect) and the Digital Literacy Framework, aimed at modernizing the bureaucracy and reducing the human-centric vulnerabilities that allow for payroll fraud.

The committee’s final report highlighted that 27,109 permanent workers were verified and cleared. However, the presence of 1,082 workers due for retirement still collecting salaries totaling N80.5 million monthly indicated a significant backlog in pension transitions and personnel record management. Additionally, 395 contract staff, 261 workers not on the nominal roll, and 213 on study leave were flagged for questionable employment status, emphasizing the need for a modernized, technology-driven human resource management system.

Budgetary Architecture and Strategic Expenditure

The transition in fiscal philosophy is most evident in the composition of the state’s appropriation acts. Historically, Nigerian sub-nationals have often allocated a disproportionate share of their budgets to recurrent expenditures, salaries, overheads, and debt servicing, leaving minimal room for the capital investments required for long-term growth. The Lawal administration has sought to invert this ratio. The 2026 budget proposal, for example, totals N861.34 billion, with a striking 83% earmarked for capital projects and only 17% (N147.28 billion) for recurrent expenditure.

In the 2024 fiscal year, the state recorded an 82% performance rate against its N437 billion revenue target, bringing in N358.9 billion. While revenue fell 18% short of the ambitious budget, the expenditure patterns reflected a strong commitment to economic development. The economic sector accounted for the highest proportion of capital expenditure at 41%, while the administrative sector utilized 74% of the recurrent budget.

A noteworthy innovation in the budgeting process is the introduction of the Citizens Accountability Report. For the first time, projects totaling N105 billion were nominated directly by citizens, including those specifically focused on Gender Equity and Social Inclusion (GESI). This participatory approach aims to ensure that public funds are utilized for projects with the highest social impact and to build public trust in the administration’s fiscal management. The Lawal’s administration reported addressing legacy issues such as the non-retirement of advances and IGR being spent at the source without proper documentation.

Infrastructure priorities in the 2024 budget revisions were driven by reforms with direct bearing on health, education, and agriculture. In the Q4 2024 budget performance report, economic affairs (which typically includes roads) constituted 37% of total expenditure, while health and housing/community amenities accounted for 5% and 3% respectively. This allocation strategy underscores a focus on assets that provide immediate value and contribute to the growth of IGR in the short to medium term.

Sustainable Debt Management and Multilateral Financing

Debt sustainability has been a central concern for the administration, given the high-interest environment and currency volatility. The 2025 Debt Sustainability Analysis (DSA) covers a historical period from 2020 to 2024 and projects debt levels through 2034. As of the end of 2024, Zamfara’s total public debt stood at N104.4 billion. While the state ranks 4th in debt sustainability, a relatively strong position compared to other sub-nationals, the administration has focused on fiscal consolidation to rebuild budgetary capacity and curb the rise of public debt.

The DSA projections anticipate that inflation will remain high in 2025, with a base case scenario of 34.52%. This inflationary pressure is driven by currency depreciation, food inflation due to insecurity and climate impacts (such as flooding), and elevated logistics costs. To mitigate these risks, the state has prioritized multilateral coordination for debt resolution and to create space for necessary investments. Multilateral financing has become a cornerstone of the state’s development strategy. In March 2025, the Islamic Development Bank (IsDB) approved USD 52.38 million specifically to enhance food security in Zamfara.

This is part of a broader USD 1.4 billion IsDB approval for member countries to advance SDGs in food security, health, and transport. Furthermore, the state is an active participant in the World Bank’s Agro-Climatic Resilience in Semi-Arid Landscapes (ACReSAL) project, which seeks to increase the adoption of climate-resilient landscape practices. These partnerships provide low-interest, long-term capital that is far more sustainable than domestic commercial borrowing.

The administration has also engaged in dialogue with the African Development Bank (AfDB) to streamline and accelerate the financing of infrastructure projects. During the Africa Investment Forum in Morocco, Governor Lawal participated in high-level dialogues on mobilizing domestic capital and enhancing private investment through enabling environments. These efforts are designed to reduce the state’s reliance on FAAC, which remains high at 89.69% of total fiscal composition as of late 2024.

Education and Human Capital Transformation

Upon assuming office in 2023, Governor Lawal declared a state of emergency in the education sector, recognizing that a skilled workforce is a prerequisite for industrial and agricultural growth. The education reform agenda is built on three pillars: infrastructure modernization, personnel recruitment, and equitable access.

The recruitment drive represents one of the most significant personnel expansions in the state’s history.

The government approved the hiring of 2,000 qualified teachers, with the process carried out in phases to ensure transparency and merit-based selection. The first phase focus on 500 teachers specializing in Mathematics, Physics, Chemistry, English, Computer Science, and Entrepreneurship. The recruitment process involved an online portal attracting 11,708 applicants, a Computer-Based Test (CBT) for 3,105 candidates, and final oral interviews for 1,033 who met the 40% benchmark.

In the vocational sector, the Governor approved the recruitment of an additional 500 TVET teachers across disciplines like auto-mechanics, building construction, electrical installation, and digital technologies. This is complemented by the Oracle-ZITDA Skills Initiative, a technology certification program in Oracle Cloud, Data Science, and AI. These initiatives aim to address the deficit in technical expertise required for the state’s emerging industrial and mining sectors.

Infrastructure developments include the resumption of work at the Zamfara State University, Talata Mafara, which had been abandoned for four years, and the renovation of the College of Arts and Sciences (ZACAS) in Gusau.

The state’s commitment to the World Bank-supported Adolescent Girls Initiative for Learning and Empowerment (AGILE) project, through the payment of N3.34 billion in counterpart funding, specifically targets the reduction of gender disparities in education. These investments are intended to reverse the systemic rot and restore public confidence in the state’s education system.

Healthcare and Social Welfare Rejuvenation

The healthcare sector has seen a similar “state of emergency” declaration, focusing on primary, secondary, and tertiary care infrastructure. A centerpiece of this reform is the renovation and remodeling of the Ahmed Sani Yeriman Bakura Specialist Hospital in Gusau, which has been equipped with state-of-the-art facilities and was commissioned by former President Olusegun Obasanjo in June 2025.

The administration has also prioritized rural healthcare. This includes the construction of a new General Hospital at Nasarawa Burkullu in Bukkuyum LGA and the upgrading of Primary Health Centres across various communities. In Kauran Namoda, the newly rehabilitated and re-equipped General Hospital was unveiled to provide quality healthcare to the local community and neighboring areas.

To ensure service delivery, the government has concluded plans to recruit and train more health workers and introduce free maternal and child health services. These interventions aim to reduce maternal mortality, infant mortality, and morbidity rates across the state. The modified free medical outreach program, which completed its tenth phase in October 2025, treated 3,447 individuals, providing immediate relief to underserved populations.

Nutrition and early childhood development have also been prioritized through the constitution of the Zamfara State Council on Nutrition and the rollout of the Nutrition 774 (N774) Initiative. This community-based, multi-sectoral approach recognizes the linkage between nutrition, health, agriculture, and education. By focusing on the first 1,000 days of a child’s life, the administration seeks to build a resilient and prosperous future for the state’s citizenry.

The Agricultural Revolution Through Z-SAI

Agriculture remains the backbone of Zamfara’s economy as its predominantly inhabitated by farmers, accounting for over 70% of its GDP. However, the sector has historically been subsistence-based, with minimal mechanization and vulnerability to insecurity. The Lawal administration’s strategy centers on the Zamfara Safe Agriculture Initiative (Z-SAI), which integrates input distribution, infrastructure development, and value-chain enhancement.

In Tsafe LGA, the Governor distributed agricultural assets to 40,000 farmers as part of the COVID-19 Action Recovery and Economic Stimulus distribution program. The state-wide program aims to empower 100,000 farmers across 14 LGAs with essential equipment and seeds over four years. These inputs include fertilizer, improved rice seeds, and seed-dressing chemicals. Research into smallholder soybean production in the state suggests that the number of fertilizer bags per farmer should ideally be increased to 5-8 bags per season to maximize income and food security.

The administration has also attracted foreign investment in agriculture. Turkish investors have committed to establishing greenhouses and mechanized manufacturing plants, including soil-less and polyclima greenhouses, dairy farming, and tractor manufacturing. This is complemented by a strategic MoU with the Ministry of Finance Incorporated (MoFI) for the INTEGRANIUM Agricultural Transformation Initiative, focusing on mechanized farming, agro-processing, and global market access.

A key element of the long-term strategy is the 30% value addition policy promoted by the Raw Materials Research and Development Council (RMRDC). This initiative aims to ensure that agricultural commodities like rice, sesame, and groundnuts undergo a minimum level of processing within the state before export. By establishing community-level mills and branding support, Zamfara seeks to transition the farm from a source of raw materials to the foundation of an industrial base.

Despite these initiatives, the sector faces extreme pressure from non-state armed actors. Reports indicate that terror groups in LGAs like Anka, Bakura, and Zurmi have demanded levies as high as N12 million to N15 million from communities to allow farming activities. Some farmers have resorted to hiring local vigilantes to guard workers in the fields. The administration’s refusal to negotiate with bandits and the deployment of the Community Protection Guards (CPG) are efforts to reclaim these farmlands and ensure that landowners can return to their fields without fear of extortion or attack.

Revival of the Solid Mineral Sector

According to available reports, Zamfara State is endowed with vast deposits of gold, lithium, copper, iron ore, and tantalite in commercial quantity. However, the sector was hampered by a five-year federal ban on mining exploration, imposed in 2019 due to insecurity. The lifting of this ban in late 2024 by the Federal Government, following improvements in security, has reopened a vital revenue stream for the state.

The administration’s approach involves attracting industrial-scale investment while formalizing artisanal mining. The Comet Star Industry in Anka, a private facility processing 1,000 tons of gold ore daily, is a model for the type of investment the state seeks. The factory is equipped with modern mining technology and its operation is expected to significantly increase IGR and create local jobs.

Governor Lawal has toured mining sites in Anka and Maru to assess the state’s comparative advantage and ensure that operations resume within legal frameworks. For artisanal miners, the state is facilitating the formation of cooperative societies and providing tools to prevent environmental degradation. On the global stage, at the AfSNET conference in Algiers and the Africa Investment Forum in Morocco, the Governor has pitched Zamfara’s untapped reserves of lithium and copper to international investors, calling for partnerships with financiers such as Afreximbank to mitigate perceived risks through credit guarantees and political risk insurance.

Total Infrastructure and Urban Renewal

The infrastructure agenda is geared toward urban renewal and economic connectivity. The Magami to Dansadau road project, a 108-kilometer reconstruction awarded to Dantata and Sawoe at a cost of N81.19 billion, is a strategic priority aimed at addressing security concerns and connecting rural agrarian communities to the state capital. The contract duration is 18 months, with work including the removal of unsuitable materials and replacement with quality materials to ensure durability.

In Gusau, the Urban Renewal initiative has seen the completion of roads linking the Bello Barau Roundabout to the Central Police Station and Government House. Major roads in the GRA area, including General Ali Gusau Road and the GRA Ring Road, have been rehabilitated. These projects are complemented by the construction of an ultra-modern motor park in Gusau, expected to be completed by mid-2025. The park will feature traveler terminals, a clinic with an ambulance, a fire service unit, and a police station, creating a secure logistics hub for the region.

The Gusau International Cargo Airport, with an approved N20 billion allocation in the 2025 budget, is perhaps the most transformative project. Once completed, it will align with the state’s vision of becoming an agricultural and mineral export hub, providing direct access to global markets for the state’s produce. To manage the new road infrastructure and ensure safety, the administration recruited 250 personnel for the Zamfara Road Traffic Agency (ZAROTA). The State House of Assembly has also approved bills to establish the Zamfara State Urban and Rural Access Roads Authority (ZURARA) and the Zamfara State Roads Fund Board to ensure long-term maintenance and management of the road network.

Security Management and the Community Protection Guard Initiative

The persistent threat of banditry remains the single largest constraint on Zamfara’s development. The Lawal administration continued to tackle it heads on by maintaining a firm stance against negotiating with terrorists, emphasizing that true peace requires disarmament and reconciliation through strength. The “Zamfara model” focuses on non-kinetic lines of operation alongside localized security outfits.

In September 2023, the state resolved to recruit over 4,000 Community Protection Guards (CPG) to integrate them into the conventional fight against banditry. These guards are intended to use their knowledge of the local terrain to repel attacks and protect farming communities. However, they have faced significant challenges; five CPG members, including a Unit Commander, were killed in a bandit ambush while assisting in cultivating a farm in Jangebe in late 2024. Security personnel have expressed frustration that state-backed guards are often underequipped compared to non-state armed groups wielding sophisticated assault rifles.

To support federal efforts, the state provided the facility for the Northwest Headquarters of Operation Safe Corridor, a program focused on demobilization, deradicalization, and reintegration (DDDRRR) of insurgents. Despite periodic attacks, the Governor has assured investors and residents that security measures have been enhanced through increased patrols and proactive strategic measures. Governor Lawal has also funded the Nigerian Military through giving out incentives to soldiers and also fueling their trucks to enable them move round the state to ensure safety of lives and properties. He extablished the Zamfara Security Trust Fund headed by former Inspector General of Police M.D Abubakar. Several funds were disbursed for the procurement of patrol trucks, bikes and other community policing equipment to ensure a safer Zamfara.

The 10-Year Development Master Plan (2025–2034)

To institutionalize these reforms and provide a long-term roadmap for growth projection by the current administration. Launching the Zamfara State Development Plan (SDP) in mid-2025 indeed showed the administration has foresight believing in proper planning for the future. Developed over eight months in collaboration with KPMG Advisory, the plan is built on six pillars: Economy, Infrastructure, Social Welfare, Human Capital, Governance, and Environmental Sustainability.

The SDP is an evidence-based roadmap aligned with Nigeria’s National Development Plan 2050 and the African Union Agenda 2063. It sets clear sectoral priorities, measurable outcomes, and a monitoring and evaluation framework to ensure transparency. Key policy thrusts for the 2025 budget, which is the first budget under this new plan, include the establishment of emergency funds for health and education, the introduction of a digital budget information system, and monthly performance reviews.

The plan envisions Zamfara as a “benchmark for transformative economic growth,” utilizing resources, innovation, and governance to promote inclusive growth. It formalizes partnerships like the MoFI agreement and seeks to maximize the state’s strengths in agriculture and natural resources to reduce poverty-driven insecurity. The 2025 budget proposal was meticulously crafted to reflect these aspirations, continuing the priority of capital expenditure over recurrent costs and ensuring the equitable distribution of resources across the state.

In conclusion, the transformation of Zamfara State between 2023 and 2025 is a demonstration of how targeted fiscal reforms and aggressive human capital investment can shift the trajectory of even the most distressed sub-national economies. The state’s ascent from the 36th to the 17th position in national fiscal rankings is the objective fruit of this labor, underpinned by a 182.34% increase in recurrent revenue and the elimination of over N200 million in monthly payroll fraud. While significant challenges remain most notably the ongoing security threats to agriculture and the state’s continued, though declining, dependence on federal allocations, the foundations for a modern economy have been laid. The ongoing reform in health and education, the recruitment of 2,500 specialized personnel, and the launch of a 10-year development plan suggest a shift from short-term political rhetoric to long-term institutional planning. The Lawal Administration will successfully leverage its solid mineral deposits and agricultural potential through the cargo airport and industrial processing plants. By 2026, Zamfara move from being a “marginal player” to a regional economic engine for the North-West. The resilience of the state’s residents, combined with the administration’s fiscal discipline, provides a viable model for other sub-nationals facing similar structural crises.

society

Stop Means Stop”: Legal Experts Warn Ignoring ‘Stop’ During Intimate Acts Can Be Criminally Punishable

“Stop Means Stop”: Legal Experts Warn Ignoring ‘Stop’ During Intimate Acts Can Be Criminally Punishable

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

“Grounded in international law and consent principles, legal authorities stress that continuing sexual activity after a partner withdraws consent may constitute sexual assault and lead to imprisonment.”

A growing body of legal interpretation and expert opinion reaffirm that consent in intimate encounters is not a one-off event but an ongoing requirement; withdrawn at any time by either participant. Legal practitioners and rights advocates are increasingly warning that if one partner clearly says “stop” during sexual activity and the other continues, this conduct can constitute a criminal offence with significant penalties, including imprisonment.

Consent must be “a voluntary agreement to engage in the sexual activity in question,” and crucially can be revoked at any stage. Once a partner expresses withdrawal of consent (by words like “stop” or by unmistakable conduct) the other party is legally obligated to cease all activity immediately. Failure to respect this is widely recognised in multiple legal jurisdictions as sexual assault or rape.

Professor Deborah Rhode, a prominent authority on legal ethics, has stated: “Respect for autonomy and bodily integrity lies at the core of consent law. Ignoring a partner’s withdrawal of consent undermines basic personal freedoms and is treated as a serious offence in criminal law.”

According to experts, this legal principle is not limited to strangers but applies equally to long-term partners and spouses. The Criminal Code in many countries explicitly rejects implied or blanket consent based on relationship status.

Human rights lawyer Amal Clooney has similarly emphasised that clear communication and mutual agreement are essential, and that “once consent is withdrawn, any continued sexual activity crosses the line into criminal conduct.”

This means that in places where consent law is well-established, ignoring an explicit “stop” can lead to charges of sexual assault, with courts interpreting such conduct as a violation of an individual’s autonomy and dignity.

The issue has gained media and legal attention in recent years across numerous jurisdictions (including Canada, parts of Europe, and reform discussions in U.S. states) as courts and legislatures clarify that sexual consent is continuous and revocable at any time. Although no globally consolidated database exists of individual cases tied specifically to a news report on this warning, reputable legal frameworks consistently reinforce that continuing after “stop” is unlawful.

The subject engages legal scholars, criminal law practitioners, human rights experts, and statutory bodies advocating sexual violence prevention. Law enforcement agencies and prosecutors may pursue charges when clear evidence shows that consent was withdrawn and ignored.

In practice, consent frameworks require that the person initiating or continuing sexual activity take reasonable steps to ensure ongoing affirmation of willingness. Silence, passive behaviour, or failure to stop when asked cannot substitute for ongoing consent.

In summary, the legal maxim is clear: verbal or unambiguous withdrawal of consent must be respected. Ignoring it shifts the encounter from consensual to criminal, potentially resulting in serious legal consequences including imprisonment.

society

Lagos Family Property Dispute Turns Violent After Death of Omotayo Ojo

Lagos Family Property Dispute Turns Violent After Death of Chief Omotayo Ojo

By Ifeoma Ikem

A festering family dispute over property has escalated into a series of violent attacks in Lagos, leaving residents of a contested apartment in fear for their safety.

Mrs. Omotayo-Ojo-Alolagbe (Nee Omotayo-Ojo) the third child and first daughter of the late Omotayo Ojo, has alleged repeated assaults and destruction of property by her siblings from her father’s other marriages.

According to her account, hostility against her began while her father was still alive, allegedly fueled by the affection and support he showed her. She claimed that tensions worsened after his death in 2019.

Mrs. Alolagbe stated that her late father had given her a particular apartment during his lifetime, assuring her she would not suffer hardship, especially after her husband left the marriage. She said the property became her primary source of livelihood and shelter.

However, she alleged that her siblings had sold off several other family properties and were determined to dispossess her of the apartment allocated to her by their father.

The dispute reportedly turned violent on Nov. 15, 2025, when unknown persons allegedly attacked the building. She said the incident prompted her to petition the Chief Judge of Lagos State and the Commissioner of Police.

Despite the pending legal proceedings, she alleged that another attack occurred on Jan. 21, 2026. During that incident, parts of the building were vandalised, including the walkway and the main gate, which was reportedly removed.

A third attack was said to have taken place on Feb.18, 2026, during which the roof, gates, and sections of the walkway were allegedly dismantled. Residents were reportedly assaulted, and some were allegedly forced to part with money under duress.

Tenants in the apartment complex are said to be living in fear amid the repeated invasions, expressing concern over their safety and uncertainty about further violence.

Mrs. Alolagbe alleged that the attacks were led by a man identified as Mr. Alliu, popularly known as aka “Champion,” whom she described as a political thug. She claimed he arrived with a group of about 50 men, allegedly brandishing weapons and breaking bottles to intimidate residents.

She further alleged that the group boasted of connections with senior police officers, politicians in Lagos State, and even the presidency, claiming they were untouchable.

According to her, some arrests were initially made following the incidents, but the suspects were later released. She expressed concern that the alleged perpetrators continue to threaten her, making it difficult for her to move freely.

She also disclosed that during a meeting on Feb. 23, 2026, an Area Commander reportedly told her that little could be done because the matter was already before a court of law.

The development has raised concerns about the enforcement of law and order in civil disputes that degenerate into violence, particularly when court cases are pending.

As tensions persist, residents and observers are calling on relevant authorities to ensure the safety of lives and properties ,while allowing the courts to determine ownership and bring lasting resolution to the dispute.

society

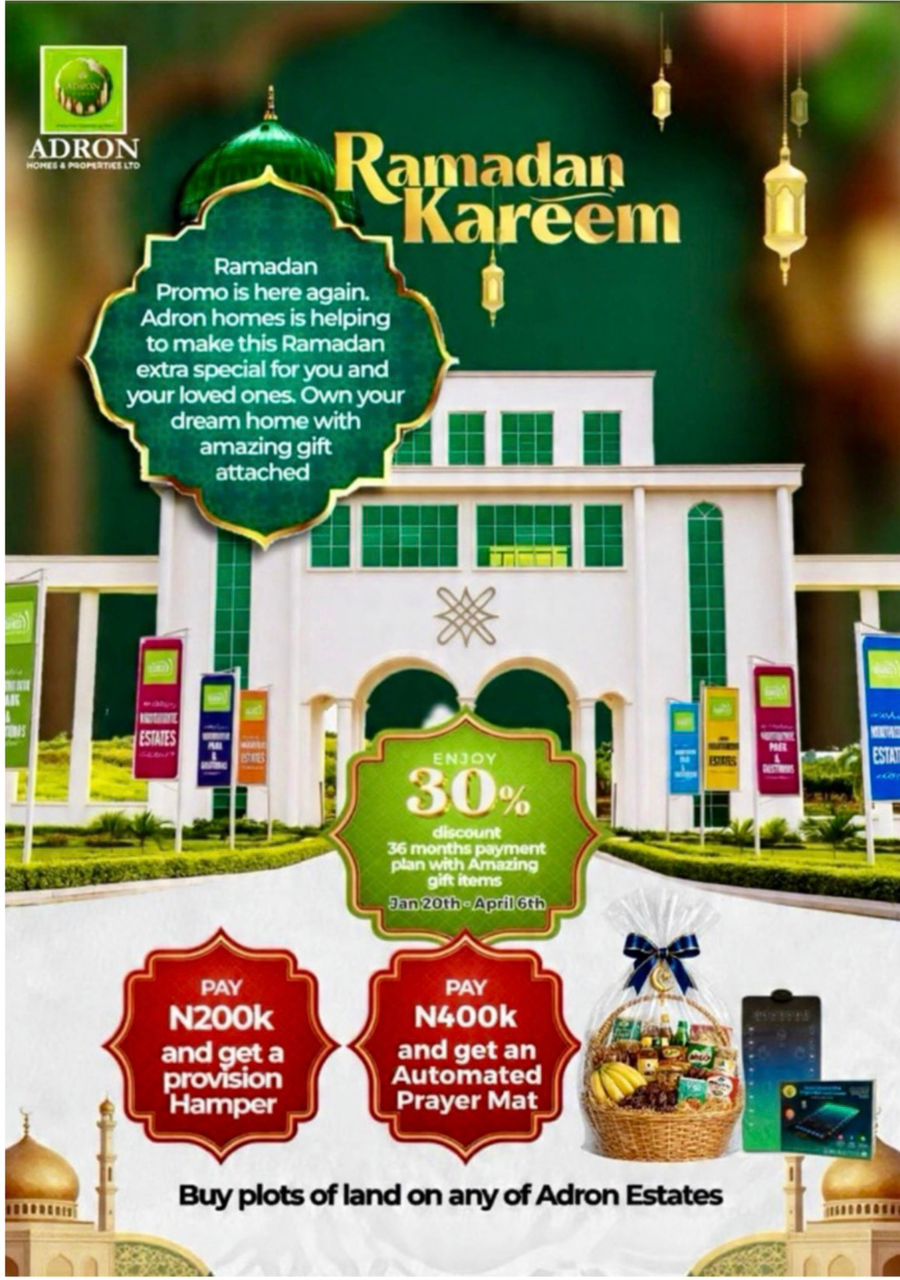

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

As the holy month of Ramadan inspires reflection, sacrifice, and generosity, Adron Homes and Properties Limited has unveiled its special Ramadan Promo, encouraging families, investors, and aspiring homeowners to move beyond seasonal gestures and embrace property ownership as a lasting investment in their future.

The company stated that the Ramadan campaign, running from January 20th to April 6th, 2026, is designed to help Nigerians build long-term value and stability through accessible real estate opportunities. The initiative offers generous discounts, flexible payment structures, and meaningful Ramadan-themed gifts across its estates and housing projects nationwide.

Under the promo structure, clients enjoy a 30% discount on land purchases alongside a convenient 36-month flexible payment plan, making ownership more affordable and stress-free.

In the spirit of the season, the company has also attached thoughtful rewards to qualifying payments. Clients who pay ₦200,000 receive a Provision Hamper to support their household during the fasting period, while those who pay ₦400,000 receive an Automated Prayer Mat to enhance their spiritual experience throughout Ramadan.

According to the company, the Ramadan Promo reflects its commitment to aligning lifestyle, faith, and financial growth, enabling Nigerians at home and in the diaspora to secure appreciating assets while observing a season centered on discipline and forward planning.

Reiterating its dedication to secure land titles, prime locations, and affordable pricing, Adron Homes urged prospective buyers to take advantage of the limited-time Ramadan campaign to build a future grounded in stability, prosperity, and generational wealth.

This promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states.

As Ramadan calls for purposeful living and wise decisions, Adron Homes is redefining the season, transforming reflection into investment and faith into a lasting legacy.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news7 months ago

news7 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING