Business

The Izuogu Z-600: Africa’s Lost Automotive Revolution

The Izuogu Z-600: Africa’s Lost Automotive Revolution.

By George Omagbemi Sylvester

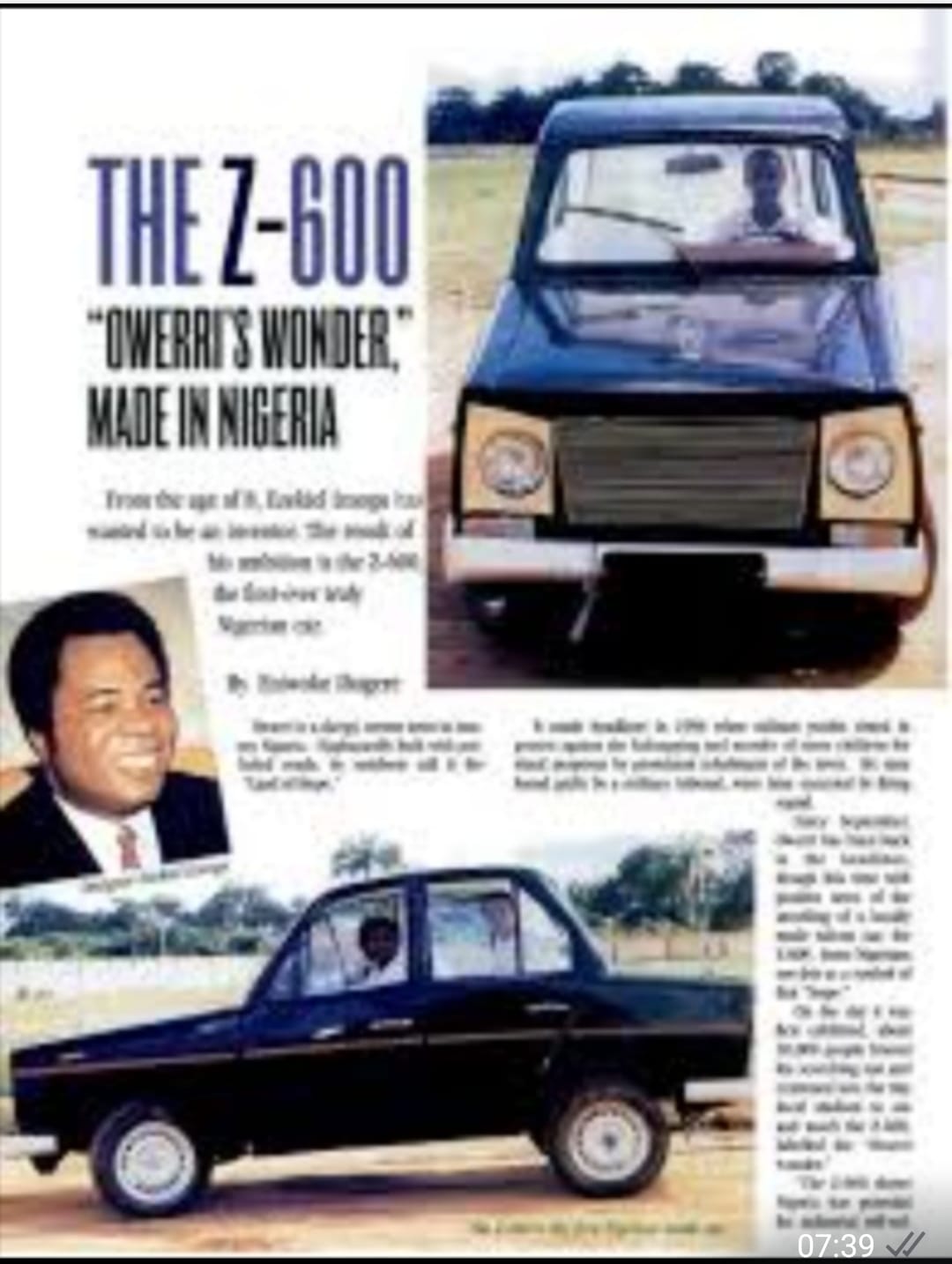

In 1997, a remarkable feat of African innovation unfolded in the heart of Imo State, Nigeria. Dr. Ezekiel Izuogu, a brilliant electrical engineer and senior lecturer at the Federal Polytechnic Nekede, unveiled what would become Africa’s first indigenous automobile: the Izuogu Z-600. It was more than a car, it was a symbol of African ingenuity, resilience and ambition. Aptly described by the BBC as the “African dream machine” the Z-600 was designed with 90% of its parts sourced locally. Its estimated retail price of just $2,000 had the potential to revolutionize transportation and economic empowerment across the continent.

A Vision Beyond Engineering

Dr. Izuogu’s dream went beyond building a car. His vision was to catalyze an industrial revolution in Nigeria, particularly in Igboland. The Z-600 was equipped with a self-made 1.8L four-cylinder engine, delivering 18 miles per gallon and reaching top speeds of 140 km/h. Front-wheel drive (FWD) was selected over rear-wheel drive (RWD) to reduce production costs, demonstrating a keen understanding of localized engineering solutions. The car was a marvel not just of machinery, but of determination in the face of overwhelming odds.

According to Dr. Izuogu, “If this car gets to mass production, Nigeria and Africa will no longer be the dumping ground for foreign cars.”

Initial Government Support and the Abandonment

Recognizing the car’s potential, the late General Sani Abacha’s administration constituted a 12-member panel of engineering experts to assess the Z-600’s roadworthiness. The committee gave the car a clean bill of health, recommending only minor cosmetic refinements. At the high-profile unveiling attended by over 20 foreign diplomats, the Nigerian government, represented by General Oladipo Diya, pledged a ₦235 million grant to support mass production.

However, like many well-meaning promises in Nigerian politics, this pledge remained unfulfilled. Not a single naira was released to Dr. Izuogu. Despite having passed official assessments and earning international interest, the Z-600 project was left to languish.

Dr. Izuogu lamented, “This was an opportunity for Nigeria to rise industrially, but it was squandered.”

Economic and Technological Loss

In 2006, a tragedy that seemed almost conspiratorial struck the Izuogu Motors factory in Naze, Imo State. At about 2:00 a.m. on March 11, twelve armed men invaded the facility, making away with vital components: the design history notebook, the Z-MASS design file for mass production, engine molds, crankshafts, pistons, camshafts and flywheels. Over ten years of research and development, worth over ₦1 billion, was effectively erased overnight.

“It seems that the target of this robbery is to stop the efforts we are making to mass-produce the first ever locally made car in Africa,” Dr. Izuogu said.

This was not just a loss to a single man, but a national economic tragedy. The theft of intellectual property on such a scale is rare and the fact that no serious investigation followed speaks volumes about the apathy toward indigenous innovation.

South African Opportunity and Another Betrayal

In 2005, a glimmer of hope emerged. The South African government, after seeing presentations of the Z-600, invited Dr. Izuogu to pitch the vehicle to a panel of top engineers. Enthralled by the innovation, South Africa offered to help set up a plant for mass production. Though flattered, Dr. Izuogu hesitated. His dream was for Nigeria to be the birthplace of an African industrial revolution not merely an exporter of talent.

Nevertheless, facing continuous neglect at home, he reluctantly began exploring the opportunity. Sadly, the robbery of 2006 dealt a final blow to this dream.

The Broader African Context

The story of the Z-600 is emblematic of a broader African malaise: the systemic failure to support indigenous innovation. According to Dr. Peter Eneh, a development economist, “Africa’s greatest tragedy is not poverty but the consistent sabotage of local ideas and talents by political inertia.”

In India, the Tata Nano was developed and rolled out in 2008, five years after Nigeria had the opportunity to lead the cheap car revolution. While the Indian government supported Tata Group with infrastructure and policy backing, Nigeria allowed politics and indifference to kill its golden goose.

As Prof. Ndubuisi Ekekwe, founder of the African Institution of Technology, noted, “Innovation dies not from lack of talent in Africa, but from institutional hostility.”

Lessons for Africa

The Izuogu Z-600 should be taught in engineering schools and policymaking institutions across Africa. It is a case study in potential wasted due to governance failure, insecurity and lack of strategic investment. The car could have generated thousands of jobs, stimulated related industries and positioned Nigeria as a pioneer in low-cost automobile manufacturing.

Instead, we mourn a lost opportunity. Dr. Izuogu’s death in 2020 closed the chapter on what might have been Africa’s most transformative technological breakthrough.

Lessons from a Forgotten Dream

Africa must learn from this colossal failure, innovation must be protected. Talent must be supported. Local entrepreneurs must be seen as national assets not nuisances.

Dr. Izuogu once said, “Our problem is not brains; our problem is the environment.” That statement still rings painfully true today.

The Tragedy of Unfulfilled Innovation

The Z-600 was not just a car but a movement, it was hope and proof that Africans can dream, design and deliver; but then dreams need nurturing. Ideas need investment. Hope needs a system that works.

Let the Z-600 remind us that the future is not given, it is made. And Africa, despite its challenges, still holds the power to create.

As the Nigerian-American businesswoman Ndidi Nwuneli puts it, “If Africa is to rise, it must learn to trust and invest in its own people.”

Let us never again allow another Z-600 to die.

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING