Business

The Nigerian Passport Rip-Off: A Symbol of National Disgrace and Diaspora Exploitation

The Nigerian Passport Rip-Off: A Symbol of National Disgrace and Diaspora Exploitation

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

When former Rivers State Governor and Minister of Transport, Rotimi Amaechi, openly admitted that the Nigerian passport is “almost worthless abroad,” he wasn’t exaggerating. In fact, his words captured the daily humiliation faced by millions of Nigerians across the globe. Despite the glaring decline in its global value, the Nigerian passport remains one of the most expensive in the world. This contradiction (PAYING A PREMIUM PRICE FOR A DOCUMENT THAT INVITES SUSPICION AND REJECTION AT BORDERS) is not just illogical; it’s criminal.

Today, in 2025, Nigerians in the diaspora are being bled dry under the pretext of acquiring basic identity documents. The National Identity Number (NIN), originally meant to be a free or affordable civic right, has become a commercial racket. It now costs as high as R1,250 (about ₦110,000) even for a six-year-old child in obtaining a NIN in South Africa. This isn’t just unethical, it’s extortion.

This is a business for someone at others’ pains,” lamented Rika Augusta, a frustrated Nigerian mother in South Africa whose six-year-old daughter was forced to pay the full amount just to be recognised as Nigerian.

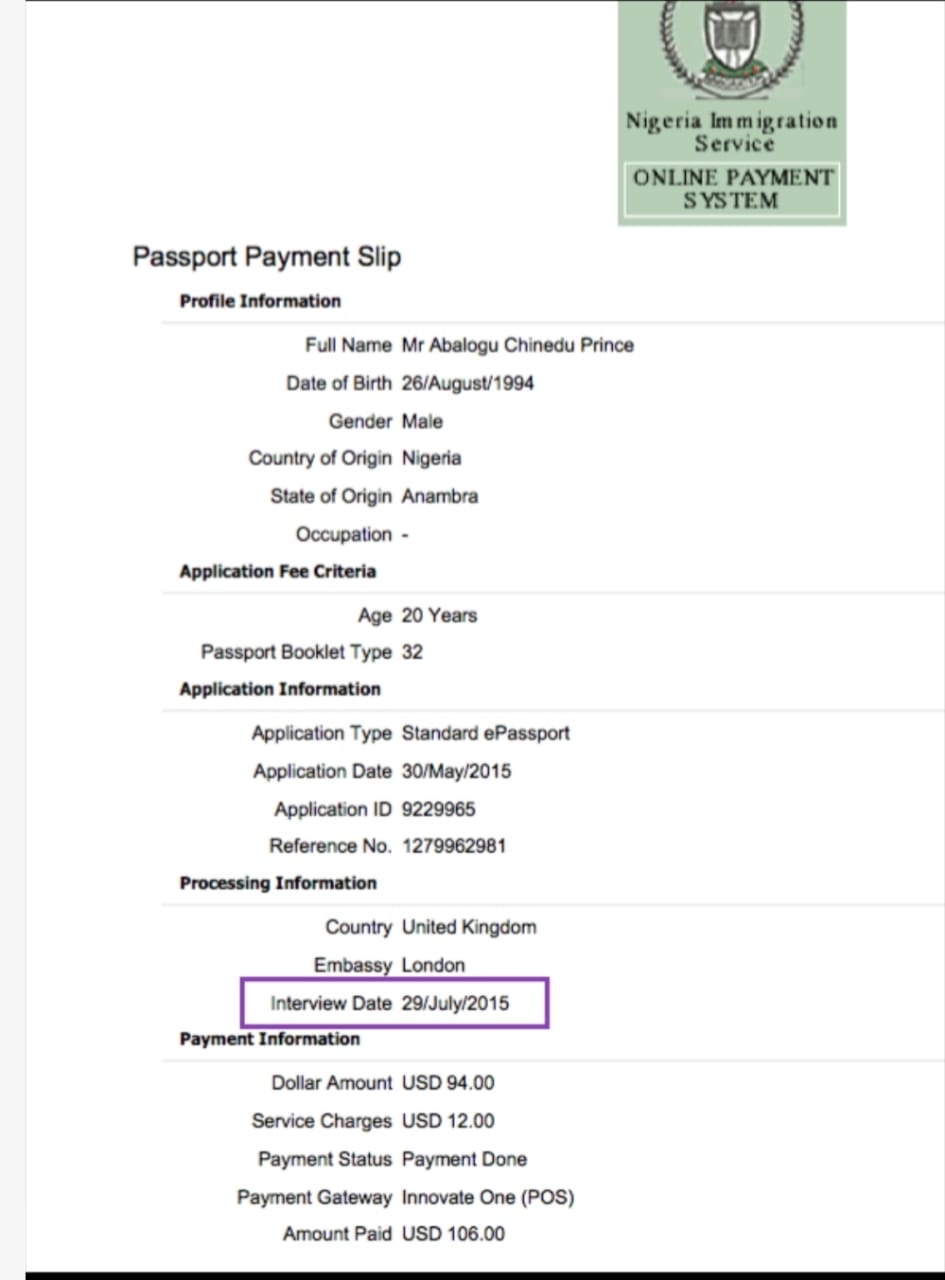

For a country ranked 131st out of 139 countries on the Henley Passport Index in terms of travel freedom, the price Nigerians pay for this underperforming passport is nothing short of madness. According to the Nigerian Immigration Service (NIS), the “enhanced e-passport” costs between ₦400,000 to ₦600,000, excluding service charges imposed by third-party agencies such as OIS and other consular fees. These costs triple when processed from abroad.

Benjy Oloye, a Nigerian in South Africa, echoes the frustration of many:

“I captured in January. Since then, it’s been one story after another. Till today, nothing. Is this a passport or a miracle

we’re praying for?”

The bottlenecks and delays are not merely bureaucratic hiccups;

they are deliberate schemes. The outsourcing of biometric capture and passport

issuance to third-party companies like Online Integrated Services (OIS) has become a well-oiled machine of financial exploitation. Nigerians are forced to pay additional “admin” and “service” fees that are neither regulated nor justified.

“OIS service fee: R100.

Consulate admin fee:

R350.

This is an organised

scam,” revealed Bennie, another Nigerian in

South Africa who has meticulously documented every extra cost.

One wonders: How did we get here?

The Politics of Pain and Profit

The answer is simple; GREED. The Nigerian system is deeply infested with a culture of monetising misery. From driver’s licenses to passports and now even the NIN, everything has become a money-making scheme for a few elites at the expense of 220 million Nigerians.

Pastor Israel Angel White, based in Pretoria, aptly described the situation:

“Some guys are making money out of this, no doubt. Greed is in their DNA. It’s awful.”

This systemic extortion is especially cruel for those in the diaspora who have already endured the trauma of leaving their homeland in search of better opportunities. They contribute over $25 billion annually in remittances, yet they are treated as nothing more than ATM machines by the Nigerian government.

“The Nigerian government sees those of us in the diaspora as nothing more than a cash cow,” says a Nigerian professional in Cape Town. “We’re paying premium prices for substandard services and being told to smile while doing it.”

Data Don’t Lie

Let’s take a moment to compare:

United States Passport: $165 (~₦250,000) with visa-free or visa-on-arrival access to over 180 countries.

United Kingdom Passport: £82.50 (~₦130,000) with 190+ countries accessible.

Nigerian Passport: ₦400,000+ with access to barely 46 countries visa-free, mostly in West Africa.

So why does the Nigerian passport cost more than world-leading passports? Why does a six-year-old child have to pay same as an adult to get a NIN? The answer lies not in logistics or technology, but in intentional extortion.

A Culture of Silence and Endurance

What’s perhaps more disturbing is how this exploitation has been normalised. Nigerians, whether at home or abroad, have become so accustomed to pain and systemic failure that they rarely push back.

“We can’t afford it; it’s a lot of money. But one thing about being Nigerian is that we’ve mastered the art of adapting, even to pain,” said one diaspora student in Durban. “We’ve normalized struggle so much that we don’t even question it anymore.”

But enough is enough. There must be a call for mass mobilisation. Nigerians in the diaspora are more than 17 million strong and their voices can no longer be silenced. Imagine if each of them sent an email or letter demanding reform, that kind of pressure is impossible to ignore.

The Diaspora Must Lead the Charge

The diaspora cannot remain passive observers. We must become vocal actors. Through organised action ie: letters, petitions, lobbying international media and using legal mechanisms in host countries, yes we can expose and dismantle this daylight robbery.

We must ask:

Why is there no price differentiation for children and economically disadvantaged citizens?

Why are there no audit reports on the revenue generated from these services?

Why are third-party companies allowed to fleece Nigerians without regulatory oversight?

Why is the Nigerian passport not getting global upgrade despite its inflated cost?

If answers are not provided, then accountability must be demanded.

A National Shame

This entire mess speaks to the deeper rot in Nigeria’s governance system. A government that cannot deliver something as basic as a passport or identity card is one that has failed fundamentally. It is a betrayal of trust, an insult to every citizen who dreams of a better life under the green-white-green flag.

When identity becomes a luxury, then nationality becomes a prison.

This is not just about passports and NIN. It’s about the dignity of Nigerians. It’s about fighting a system that sees its own people as prey. It’s about saying “No more!” to those who profit from our pain.

Final Thoughts: Nigeria, We Hail Thee?

Indeed, “Nigeria we hail thee” not in reverence, but in disbelief. For how long shall citizens continue to bleed for basic rights? For how long shall diaspora Nigerians, the backbone of our economic survival, be treated as expendable wallets?

The time to act is now.

As long as we remain silent, they will continue to inflate our costs, delay our documents, insult our intelligence and trample on our dignity.

The Nigerian passport saga is not just a national embarrassment, it is a scandal, a theft and a crime against citizenship.

George Omagbemi Sylvester

Political Analyst, Diaspora Advocate and Contributor to SaharaWeeklyNG.com

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

Business

BUA Group, AD Ports Group and MAIR Group Launch Strategic Plan for World-Class Sugar and Agro-Logistics Hub at Khalifa Port

BUA Group, AD Ports Group and MAIR Group Sign MoU to Explore Collaboration in Sugar Refining, Agro-Industrial Development, and Integrated Global Logistics Solutions

Abu Dhabi, UAE – Monday, 16th February 2026

BUA Group, AD Ports Group, and MAIR Group of Abu Dhabi today signed a strategic Memorandum of Understanding (MoU) to explore collaboration in sugar refining, agro-industrial development, and integrated global logistics solutions. The partnership aims to create a world-class platform that strengthens regional food security, supports industrial diversification, and reinforces Abu Dhabi’s position as a hub for trade and manufacturing.

The proposed collaboration will leverage BUA Group’s industrial and logistics expertise, Khalifa Port’s world-class infrastructure, and AD Ports Group’s operational experience. The initiative aligns with the objectives of the UAE Food Security Strategy 2051, which seeks to position the UAE as a global leader in sustainable food production and resilient supply chains. It also aligns with Nigeria’s food production- and export-oriented agricultural transformation agenda, focused on scaling domestic capacity, strengthening value addition, improving post-harvest logistics, and unlocking new markets for Nigerian produce across the Middle East, Asia, and beyond.

Photo Caption: L-R: Kabiru Rabiu, Group Executive Director, BUA Group; Cpt. Mohammed J. Al Shamisi, MD/Group CEO, AD Ports Group; Saif Al Mazrouei, CEO (Ports Cluster) AD Ports Group; Abdul Samad Rabiu, Founder/Executive Chairman, BUA Group; and Steve Green, Group CFO, MAIR Group

Through structured aggregation, processing, storage, and maritime export channels, the partnership is designed to reduce supply chain inefficiencies, enhance traceability and quality standards, and also create a predictable trade corridor between West Africa and the Gulf.

BUA Group—recognised as one of Africa’s largest and most diversified conglomerates, with major investments across sugar refining, food production, flour milling, cement manufacturing, and infrastructure- brings extensive industrial expertise and large-scale operational capability to the venture. MAIR Group will provide strategic support in developing integrated logistics and agro-industrial solutions, creating a seamless platform for production, storage, and distribution.

Abdul Samad Rabiu, Founder and Chairman of BUA Group, said:

“This MoU marks an important milestone in BUA’s international expansion and reflects our long-term vision of building globally competitive industrial platforms. Together with AD Ports Group and MAIR Group, we aim to develop sustainable food production and logistics solutions that strengthen regional supply chains and support the UAE’s Food Security Strategy 2051.”

He further added that, “This partnership represents not just a commercial arrangement but a strategic food corridor anchored on shared economic ambition, resilient infrastructure, and disciplined execution, reinforcing long-term food security objectives for both nations.”

A representative of MAIR Group added:

“This collaboration underscores our commitment to advancing strategic industries in Abu Dhabi and building integrated solutions that reinforce the UAE’s position as a global hub for trade, food security, and industrial excellence.”

A spokesperson from AD Ports Group commented:

“Our partnership with BUA Group and MAIR Group highlights Khalifa Port’s role as a catalyst for high-impact industrial investments. This initiative will enhance regional food security, strengthen global trade connectivity, and support Abu Dhabi’s economic diversification goals.”

This MoU marks a historic collaboration that combines world-class infrastructure, industrial expertise, and strategic vision, setting the stage for a sustainable and resilient food and logistics ecosystem that will benefit the UAE, the region, and global markets alike.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth