Business

5 Amazing Countries to Work Abroad in 2023

5 Amazing Countries to Work Abroad in 2023

Living and working abroad is a fantastic way to learn about the world, yourself, and what it means to be a global citizen. As the world becomes more and more interconnected, a growing number of people are seeking work outside of their home country, but deciding where to go abroad can be difficult.

To help you find your dream job abroad, we’ve compiled a list of the best countries to work abroad. In creating this list, we considered various factors, including work-life balance and happiness indices, the cost of living, the ease of getting a work visa, and the job opportunities in the country. With that, our goal is to provide a variety of options not limited to the most traditional expat destinations.

So, where will you go? Let’s check out the 10 best countries to work abroad to decide!

1. Great for seasonal work: New Zealand

Cost of living: $927 (1,563 NZD) a month + rent

💰 Average Salary: $3,323 (5,603 NZD) a month

⏰ Work visa duration: 12 – 23 months based on residency

😊 Happiness index ranking: 10

If you’re a young adult looking to expand your perspective through a grand adventure and plan to fund it with intermediate work along the way, New Zealand may be the perfect destination for you! From adventure sports companies to tour operators to farmers, there are seemingly endless short-term and seasonal employment opportunities throughout the country.

New Zealand regularly ranks among the happiest countries globally, including a 10th place ranking on The Global Economy 2022 Happiness index. The laid-back culture and emphasis on a healthy work-life balance create a truly unique atmosphere. Kiwis are also extremely friendly, and most travelers find it quite easy to adapt to life in New Zealand as a result.

As a remote island nation, the cost of living in New Zealand is high so it’s important to budget appropriately if you want to build savings while working there. You’ll find that most job opportunities outside of agriculture will be in or around Auckland, Wellington, or smaller, tourist towns like Queenstown. Work exchange programs are popular to mitigate this for those looking for short-term work opportunities to supplement travel.

✅ Pros:

- Relaxed work-life balance

- Progressive and welcoming government and citizens

❌ Cons:

- Limited career mobility within certain fields due to small population

- Life can feel fairly quiet and isolated

How to get a work visa in New Zealand

New Zealand offers a working holiday scheme to residents from specific countries throughout the world. The working holiday visa permits work and travel throughout New Zealand for up to 12 months, or 23 months if you are a citizen of the UK or Canada.

To learn more about acquiring a visa to work in New Zealand, visit the New Zealand Immigration web portal.

How to find work in New Zealand

Start your job search well before the season you plan to be employed during. If you want to work during the ski season, check out NZSki. Agriculture work is often listed on Seasonal Jobs New Zealand. Additionally, check out the Go Overseas Job Board and filter by job type to find recent job postings.

2. Great for jobs in research and academia: The Netherlands

Cost of living: $975 (€972) a month + rent

💰 Average Salary: $3,025 (€3,017) a month

⏰ Work visa duration: Indefinent with a company sponsor

😊 Happiness index ranking: 5

A favorite destination among expats due to its quality of life and work-life balance, the Netherlands is another excellent option for working abroad. The Netherlands actively seeks out international entrepreneurs and has many great programs to help them invest in local companies or start their own businesses, big and small.

The Netherlands is a safe country with great social programs and a strong economy. Additionally, the Netherlands is on the cutting edge of research and academia, and expats will find abundant opportunities to work in these fields. With a strong focus on sustainable energy and a clean environment, the Netherlands is also a great place to find work in tech or energy.

Working in the Netherlands requires a company sponsor for non-European citizens, and the cost of living is relatively high, so this is a destination for career-minded international workers and is not as suitable for short-term or temporary work. If you dream of finding a career in the Netherlands but aren’t sure where to start, consider getting an internship there first.

✅ Pros:

- The vast majority of Dutch people speak English

- Low crime rates

❌ Cons:

- It can be hard to make friends with local people due to close-knit social circles

- Salaries are high but expenses are also high

How to get a work visa in the Netherlands

It can be a challenge to obtain a working visa in the Netherlands, but the rewards outweigh the effort if you’re up for it. A traditional work visa requires you to have an employer willing to sponsor you and will expire when you leave the company.

The Netherlands has other programs to help international workers enter the country. The start-up visa allows investors to reside in the Netherlands for one year to develop a new innovative business idea. The government also provides you with the assistance of a local mentor to help your business grow. The Netherlands also encourages small businesses through its freelance and self-employment visa.

How to find work in The Netherlands

LinkedIn is a great place to network and search for jobs in The Netherlands. As a tech-forward country, most openings will be advertised online and accessible through top international job search sites.

3. Great for teaching English (TEFL): South Korea

Cost of living: $962 (1,340,114 KRW) a month + rent

💰 Average Salary: $2,210 (3,078,640 KRW) a month

⏰ Work visa duration: 12 months

😊 Happiness index ranking: 55

While all types of jobs are available to international workers, especially those fluent in English, South Korea stands out as one of the best destinations to teach English as a foreign language (TEFL). Whether employed by the Korean Ministry of Education (EPIK) program or a private institution, English teachers will be paid a highly competitive wage and find students eager to learn. Additionally, work benefits and the low cost of living in Korea provide teachers with a high standard of living and the opportunity to build savings.

In Korea, be prepared to work longer hours than you are used to — as Korea has the longest working hours of any developed nation! This is a contributor to its relatively low ranking on the happiness index and means you won’t get the work-life balance in Korea that you do in many of the other locations on this list.

Despite the long work week, Korea has a lot to offer. From the bustling metropolis of Seoul to the stunning natural beauty of Korea’s interior, there is something for everyone to enjoy. Seoul, Busan, and Daegu have sizable expat communities, rich nightlives, and, most importantly — delicious food. Living and working in Korea is sure to be an experience of a lifetime for any international worker.

✅ Pros:

- Work environments are collaborative and friendly

- Jobs often come with great benefits like accommodation

❌ Cons:

- If homesick, finding grocery products from home can be challenging

- Employees often work longer hours than they are contracted for due to pressure to perform

How to get a work visa in South Korea

Obtaining a working visa in Korea is relatively easy. The fastest and easiest way to get a working visa in Korea is to become an English teacher under Korea’s “E-2” visa.

If teaching is not your cup of tea, South Korea has agreements with some Western countries that allow workers to enter on a “working holiday” visa for up to a year. A “looking for work” visa allows travelers to live in Korea for up to six months while seeking a job.

How to find work in South Korea

The Korean Ministry of Education and National Institute for International Education operate English Program in Korea (EPIK), with the goal of developing the English skills of Korean students. Apply directly through the EPIK web portal. Private teaching jobs are also available. Check out the Go Overseas Job Board for the latest listings.

4. Great for work exchanges; Australia

Cost of living: $996 (1,537 AUD) a month + rent

💰 Average salary: $3,684 (5,685 AUD) a month

⏰ Work visa duration: 12 months

😊 Happiness index ranking: 12

Australia consistently ranks highly as a country with excellent quality of life, standards of living, and overall happiness. Additionally, it holds a top-10 Human Development Index (HDI) ranking, globally. People here enjoy a great work-life balance – and it is not hard to enjoy your time outside the office in such a beautiful country. Even though the cost of living is quite high in Australia, expats can still live comfortably thanks to the relatively high minimum wage.

Australia is an excellent choice for travelers looking for a work exchange experience. With an easy visa scheme, Australia is one of the most convenient countries to find a work exchange program. Organizations like World Wide Opportunities on Organic Farms (WWOOF) align volunteers with farms in exchange for food and board. WWOOF has been operating in Australia for over 40 years, providing safe, rewarding work exchange programs to thousands of volunteers.

From its wide-open outback, pristine beaches, and cosmopolitan cities, Australia has it all. Sydney and Melbourne are known for their multicultural population, making it extremely easy for an expat to adjust to life in Australia. Additionally, the need for labor in the agriculture industry across Australia and the lack of a language barrier for English speakers make Australia a formidable destination to beat.

✅ Pros:

- High salaries

- Fun and inclusive work culture

❌ Cons:

- Long wait times for public transport in major cities

- Expensive cost of living for certain things like groceries and produce

How to get a work visa in Australia

The process for obtaining a visa to work in Australia is roughly identical to that of New Zealand. Australia also has a “working holiday” visa scheme that allows foreigners of certain nationalities to enter the country for 12 months. Likewise, there are working visas available for international workers that pass a skills assessment similar to that of New Zealand.

To learn more about acquiring a visa to work in Australia, visit the Department of Home Affairs visa finder.

How to find work in Australia

There are established organizations like WWOOF that will connect you directly with a work exchange host who provides meals and lodging in exchange for up to 36 hours of work a week. Workaway is another popular resource for matching travelers with homestays, work exchanges, and volunteer opportunities.

s.

5. Great for engineering jobs; Germany

Cost of living: $886 (€883) a month + rent

💰 Average salary: $2,908 (€2,900) a month

⏰ Work visa duration: 12 months

😊 Happiness index ranking: 15

As one of the leading economies globally (per GDP) and among the largest exporters of goods, Germany is filled with incredible opportunities for career-minded people looking to work abroad, especially engineers. Many global corporations have offices in Germany, meaning there are opportunities for English-speaking positions, although the job hunt will be more challenging. Fortunately, most Germans have strong English proficiency, so the language barrier is manageable.

The enriching culture and unbeatable work-life balance make Germany a great place to build a career overseas. People work less (about 27 hours per week) and live better as a result! Excellent healthcare, generous paid leave, and unforgettable experiences await you in Germany. You may also want to consider an internship in Germany if you’re a young adult looking to take your career to the next level.

The cost of living can be higher than what you are used to, but living in Germany can be less expensive than in many other European cities, depending on where you find a job. Every city has something different to offer, making it perfect for any expat. The larger cities remain the most popular among international workers, with Berlin, Munich, and Frankfurt having the largest expat communities. Regardless of where you end up, you’ll get a taste of the eclectic charm that is characteristic of this innovative European country.

✅ Pros:

- Excellent social welfare system

- Quick and efficient public transportation

❌ Cons:

- Germans can be private and reserved at first, making it challenging to make friends

- High tax rate

How to get a work visa in Germany

Applying for a working visa can be challenging, but there are ways to obtain a permit to work and live in Germany. Nationals of most Western countries can apply for a job seeker (aka looking for work) visa that allows you to line up a job while in the country and then apply for a working visa after securing a work contract.

To learn more about acquiring a visa to work in Germany, visit the Employment in Germany web portal.

How to find work in Germany

Finding work within your career field in Germany will be more difficult if you don’t speak German. Linkedin allows you to filter available jobs by industry, type of work, and the language in which the job can be performed. Additionally, join expat Facebook groups and attend international job fairs in your local area

Business

Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital

*Why Nigeria’s Banks Still on Shaky Ground with Big Profits, Weak Capital*

*BY BLAISE UDUNZE*

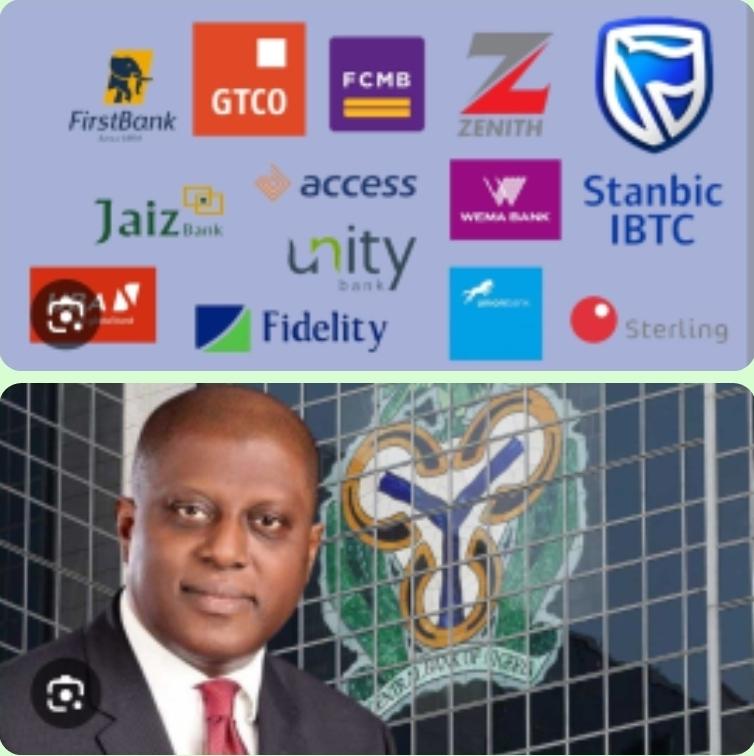

Despite the fragile 2024 economy grappling with inflation, currency volatility, and weak growth, Nigeria’s banking industry was widely portrayed as successful and strong amid triumphal headlines. The figures appeared to signal strength, resilience, and superior management as the Tier-1 banks such as Access Bank, Zenith Bank, GTBank, UBA, and First Bank of Nigeria, collectively reported profits approaching, and in some cases exceeding, N1 trillion. Surprisingly, a year later, these same banks touted as sound and solid are locked in a frenetic race to the capital markets, issuing rights offers and public placements back-to-back to meet the Central Bank of Nigeria’s N500 billion recapitalisation thresholds.

The contradiction is glaring. If Nigeria’s biggest banks are so profitable, why are they unable to internally fund their new capital requirements? Why have no fewer than 27 banks tapped the capital market in quick succession despite repeated assurances of balance-sheet robustness? And more fundamentally, what do these record profits actually say about the real health of the banking system?

The recapitalisation directive announced by the CBN in 2024 was ambitious by design. Banks with international licences were required to raise minimum capital to N500 billion by March 2026, while national and regional banks faced lower but still substantial thresholds ranging from N200 billion to N50 billion, respectively. Looking at the policy, it was sold as a modern reform meant to make banks stronger, more resilient in tough times, and better able to support major long-term economic development. In theory, strong banks should welcome such reforms. In practice, the scramble that followed has exposed uncomfortable truths about the structure of bank profitability in Nigeria.

At the heart of the inconsistency is a fundamental misunderstanding often encouraged by the banks themselves between profits and capital. Unknown to many, profitability, no matter how impressive, does not automatically translate into regulatory capital. Primarily, the CBN’s recapitalisation framework actually focuses on money paid in by shareholders when buying shares, fresh equity injected by investors over retained earnings or profits that exist mainly on paper.

This distinction matters because much of the profit surge recorded in 2024 and early 2025 was neither cash-generative nor sustainably repeatable. A significant portion of those headline banks’ profits reported actually came from foreign exchange revaluation gains following the sharp fall of the naira after exchange-rate unification. The industry witnessed that banks’ holding dollar-denominated assets their books showed bigger numbers as their balance sheets swell in naira terms, creating enormous paper profits without a corresponding improvement in underlying operational strength. These gains inflated income statements but did little to strengthen core capital, especially after the CBN barred banks from using FX revaluation gains for dividends or routine operations. In effect, banks looked richer without becoming stronger.

Beyond FX effects, Nigerian banks have increasingly relied on non-interest income fees, charges, and transaction levies to drive profitability. While this model is lucrative, it does not necessarily deepen financial intermediation or expand productive lending. High profits built on customer charges rather than loan growth offer limited support for long-term balance-sheet expansion. They also leave banks vulnerable when macroeconomic conditions shift, as is now happening.

Indeed, the recapitalisation exercise coincides with a turning point in the monetary cycle. The extraordinary conditions that supported bank earnings in 2024 and 2025 are beginning to unwind. Analysts now warn that Nigerian banks are approaching earnings reset, as net interest margins the backbone of traditional banking profitability, come under sustained pressure.

Renaissance Capital, in a January note, projects that major banks including Zenith, GTCO, Access Holdings, and UBA will struggle to deliver earnings growth in 2026 comparable to recent performance.

In a real sense, the CBN is expected to lower interest rates by 400 to 500 basis points because inflation is slowing down, and this means that banks will earn less on loans and government bonds, but they may not be able to quickly lower the interest they pay on deposits or other debts. The cash reserve requirements are still elevated, which does not earn interest; banks can’t easily increase or expand lending investments to make up for lower returns. The implications are significant. Net interest margin, the difference between what banks earn on loans and investments and what they pay on deposits, is poised to contract. Deposit competition is intensifying as lenders fight to shore up liquidity ahead of recapitalisation deadlines, pushing up funding costs. At the same time, yields on treasury bills and bonds, long a safe and lucrative haven for banks are expected to soften in a lower-rate environment. The result is a narrowing profit cushion just as banks are being asked to carry far larger equity bases.

Compounding this challenge is the fading of FX revaluation windfalls. With the naira relatively more stable in early 2026, the non-cash gains that once flattered bank earnings have largely evaporated. What remains is the less glamorous reality of core banking operations: credit risk management, cost efficiency, and genuine loan growth in a sluggish economy. In this new environment, maintaining headline profits will be far harder, even before accounting for the dilutive impact of recapitalisation.

That dilution is another underappreciated consequence of the capital rush. Massive share issuances mean that even if banks manage to sustain absolute profit levels, earnings per share and return on equity are likely to decline. Zenith, Access, UBA, and others are dramatically increasing their share counts. The same earnings pie is now being divided among many more shareholders, making individual returns leaner than during the pre-recapitalisation boom. For investors, the optics of strong profits may soon give way to the reality of weaker per-share performance.

Yet banks have pressed ahead, not only out of regulatory necessity but also strategic calculation.

During this period of recapitalization, investors are interested in the stock market with optimism, especially about bank shares, as banks are raising fresh capital, and this makes it easier to attract investments. This has become a season for the management teams to seize the moment to raise funds at relatively attractive valuations, strengthen ownership positions, and position themselves for post-recapitalisation dominance. In several cases, major shareholders and insiders have increased their stakes, as projected in the media, signalling confidence in long-term prospects even as near-term returns face pressure.

There is also a broader structural ambition at play. Well-capitalised banks can take on larger single obligor exposures, finance infrastructure projects, expand regionally, and compete more credibly with pan-African and global peers. From this perspective, recapitalisation is not merely about compliance but about reshaping the competitive hierarchy of Nigerian banking. What will be witnessed in the industry is that those who succeed will emerge larger, fewer, and more powerful. Those that fail will be forced into consolidation, retreat, or irrelevance.

For the wider economy, the outcome is ambiguous. Stronger banks with deeper capital buffers could improve systemic stability and enhance Nigeria’s ability to fund long-term development. The point is that while merging or consolidating banks may make them safer, it can also harm the market and the economy because it will reduce competition, let a few banks dominate, and encourage them to earn easy money from bonds and fees instead of funding real businesses. The truth be told, injecting more capital into the banks without complementary reforms in credit infrastructure, risk-sharing mechanisms, and fiscal discipline, isn’t enough as the aforementioned reforms are also needed.

The rush as exposed in this period, is that the moment Nigerian banks started raising new capital, the glaring reality behind their reported profits became clearer, that profits weren’t purely from good management, while the financial industry is not as sound and strong as its headline figures. The fact that trillion-naira profit banks must return repeatedly to shareholders for fresh capital is not a sign of excess strength, but of structural imbalance.

With the deadline for banks to raise new capital coming soon, by 31 March 2026, the focus has shifted from just raising N500 billion. N200 billion or N50 billion to think about the future shape and quality of Nigeria’s financial industry, or what it will actually look like afterward. Will recapitalisation mark a turning point toward deeper intermediation, lower dependence on speculative gains, and stronger support for economic growth? Or will it simply reset the numbers while leaving underlying incentives unchanged?

The answer will define the next chapter of Nigerian banking long after the capital market roadshows have ended and the profit headlines have faded.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

Business

Nigeria’s Golden Fiscal Hour: The 1979 Budget Surplus and What It Teaches Today

Nigeria’s Golden Fiscal Hour: The 1979 Budget Surplus and What It Teaches Today.

By George Omagbemi Sylvester | Published by SaharaWeeklyNG.com

“How Nigeria’s Brief Macroeconomic Triumph Under the Second Republic Reveals Enduring Lessons for Fiscal Responsibility.”

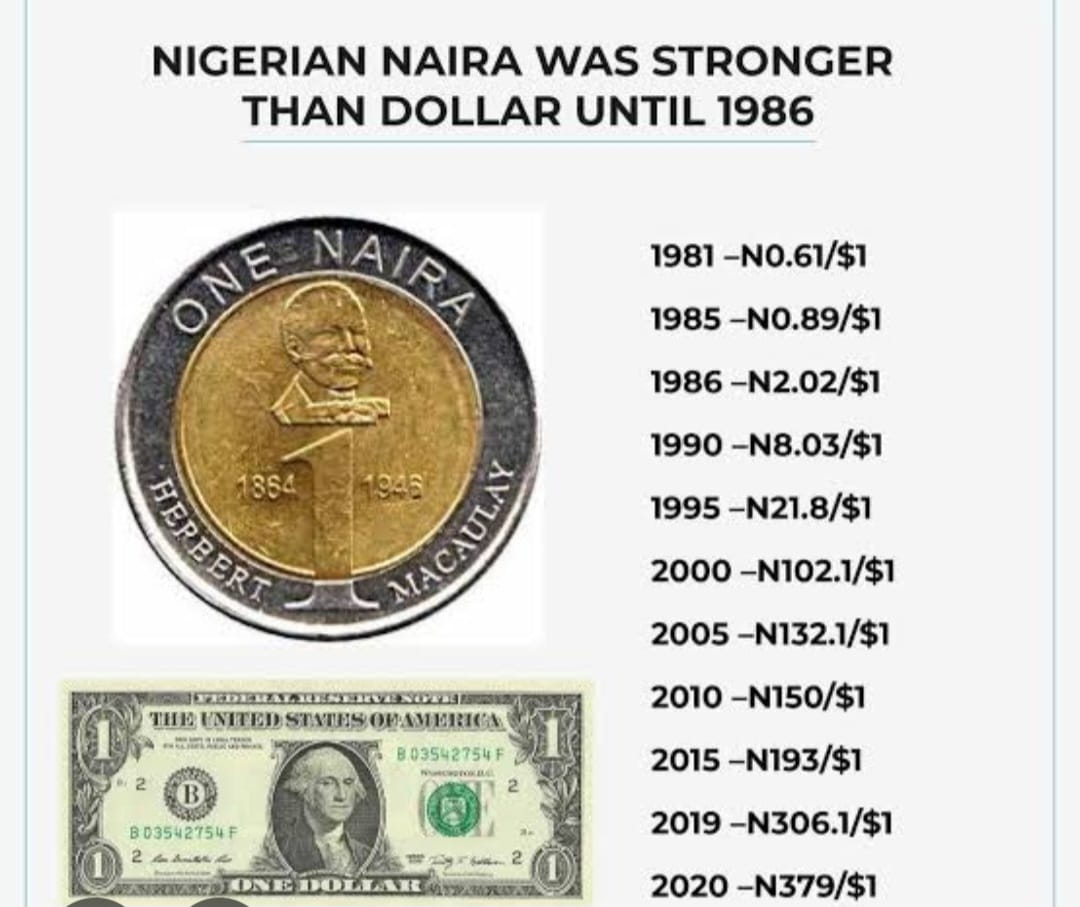

In the annals of Nigeria’s economic history, one year stands out as an extraordinary testament to fiscal prudence, macroeconomic strength, and external competitiveness: 1979. In that year, the Federal Republic of Nigeria recorded a remarkable budget surplus of approximately N1.5 billion. To fully appreciate the historical weight of this achievement, consider that the naira was stronger than the U.S. dollar at the time, trading at roughly ₦0.596 to US $1, meaning Nigeria’s surplus was equivalent to about US $2.51 billion in 1979 terms. This was not merely a statistic; it was a powerful demonstration that Nigeria could, under the right conditions, balance its books, build reserves and exercise sovereign economic judgment, lessons that remain urgently relevant today.

The Context: A Nation Riding the Oil Boom. The late 1970s were defined by an unprecedented oil windfall for Nigeria. Global oil prices surged in the wake of geopolitical shocks (notably the 1979 Iranian Revolution) which disrupted supply and drove crude prices upward. As a result, Nigeria’s oil revenues soared. Oil constituted the dominant share of the country’s export earnings, accounting for approximately 90-95% of total export earnings during this period. This influx underpinned rapid economic expansion and offered an exceptional opportunity for fiscal stability under civilian rule.

In fact, the International Monetary Fund reported that Nigeria’s foreign exchange reserves jumped from about US $1.9 billion in 1978 to an estimated US $5.5 billion in 1979, demonstrating the scale of the macroeconomic turnaround.

Yet even against the backdrop of a booming oil sector, achieving a budget surplus (where government revenues exceed expenditures) was no small feat. Most developing countries, especially those heavily reliant on volatile commodity exports, rarely achieve such fiscal discipline. For Nigeria, whose public sector had expanded dramatically in the post-civil war era, maintaining balanced books spoke to prudent revenue management during an era of extraordinary windfalls.

1979: A Snapshot of Fiscal Triumph.

1. Strong Currency –

The naira’s strength in 1979 was more than symbolic. At a time when the Nigerian currency was stronger than the dollar (a feat nearly unimaginable today) it reflected healthy foreign exchange reserves, robust export receipts and confidence in external accounts. A strong currency made imports relatively affordable and kept external liabilities manageable, though it also posed challenges for export competitiveness in non-oil sectors.

2. Budgets Balanced –

Nigeria’s budget position in 1979 stands out against a historical backdrop of chronic fiscal deficits. According to research drawing on Central Bank of Nigeria and Budget Office data, budget surplus years in Nigeria have been rare, with 1979 among only a handful of years (including 1971, 1973, 1974, 1995, and 1996) over several decades where revenues exceeded expenditures.

3. Macroeconomic Stability –

This surplus was achieved without the crippling austerity that often accompanies fiscal discipline in other contexts. Instead, it coincided with a period of economic expansion, rising domestic consumption and relative external balance. The balance of payments turned positive and foreign reserves rebounded sharply, signalling sound external-sector performance.

Leadership and Policy: The Second Republic’s Role. In October 1979, Nigeria transitioned to civilian rule with the inauguration of President Shehu Shagari and the beginning of the Second Republic (1979–1983). This political change coincided with the fiscal surplus, but it was the continuity of prudent economic management, initially grounded in the policies of the preceding military regime, that made the surplus possible.

The civilian government inherited an economy with strong export earnings and ample reserves. Instead of squandering the moment, it entered into the fiscal year with a disciplined budget anchored in realistic revenue projections. It balanced the competing demands of development and fiscal responsibility with a rare diplomatic and policy achievement in any developing economy.

As noted by respected economists studying Nigeria’s fiscal history, “budget deficits have become a norm in Nigeria’s fiscal operations since the early 1970s, with very few exceptions and 1979 being one of them.” This underscores the exceptional nature of this year.

Why the Surplus Matters for Today.

1. A Benchmark for Fiscal Responsibility.

Today’s policymakers (whether in Nigeria or comparable resource-rich developing states) would do well to study how Nigeria managed its finances in 1979. The surplus was not a result of reckless spending or short-term boom for boom’s sake; it was the product of balanced budgeting, strategic revenue retention and external competitiveness.

2. Oil Dependence Is a Double-Edged Sword.

The 1979 surplus was heavily tied to the oil boom. Critics have long warned that reliance on a single commodity exposes economies to price swings and revenue volatility. Indeed, after 1980, the global oil market underwent downturns that contributed to fiscal deficits and even economic contraction in the early 1980s. Nigeria’s experience shows that fiscal surplus driven by a volatile commodity must be paired with diversification and prudent saving.

3. Institutionalizing Discipline.

One lesson often cited by economic historians is that the absence of strong institutional frameworks for revenue management and expenditure control leads to poor outcomes once boom conditions fade. In Nigeria’s case, the later 1980s saw structural adjustment programmes, external debt accumulation, currency depreciation and social strain though all consequences of weakening fiscal discipline post-surplus era.

A respected contemporary economist once said, “Fiscal prudence is not about cutting spending at all costs; it is about strategic investment in human capital, infrastructure and savings for future volatility.” In this sense, 1979 was not just a moment of accounting success but it was also a model of strategic fiscal governance.

The Human and Institutional Dimension. While macroeconomic statistics tell one part of the story, the human and institutional dimensions are equally crucial. In 1979, Nigeria benefited from:

Strong revenue inflows, especially from crude oil

A disciplined budget office that resisted profligate spending

Coordination between the executive and legislative branches on fiscal policy

These elements helped ensure that revenues were not dissipated on unproductive expenditure or unchecked public sector expansion. Instead, the surplus created headroom for reserves and debt management strategies that strengthened Nigeria’s external accounts.

By contrast, in later decades, poor fiscal planning, unchecked borrowing and weak oversight eroded Nigeria’s fiscal capacity, contributing to perennial deficits and growing debt burdens.

Where This Leaves Nigeria: Lessons from History. The 1979 Nigerian budget surplus (N1.5 billion at a time when the naira was stronger than the dollar) represents a moment of economic possibility that transcended its era. It demonstrated that oil wealth, when managed with discipline and foresight, can yield balanced budgets, strong external positions, and macroeconomic stability. It showed that an African economy could manage its resources wisely, even under the pressures of political transition.

As Nigeria faces the complexities of the 21st-century global economy, the story of 1979 should not be a footnote, it should be a guidepost. The fiscal discipline exhibited in that year remains one of the most compelling lessons in responsible governance and strategic economic planning.

Where others see nostalgia, prudent economists see a blueprint for sustainable fiscal policy. In an era of volatile commodity markets, rising public debt, and pressure for social spending, the legacy of 1979 challenges contemporary leaders to balance aspiration with accountability.

This is not merely economic history. It is an intellectual inheritance and a reminder that competent governance, rooted in facts and disciplined budgeting, can still chart a prosperous course for Nigeria’s future.

Business

How Inside Jobs and Policy Shocks Trigger Nigeria’s Rising Loan Crisis

How Inside Jobs and Policy Shocks Trigger Nigeria’s Rising Loan Crisis

BY BLAISE UDUNZE

The latest in the Nigerian banking sector, as banks grapple with the recapitalization compliance deadline, is confronted with a familiar yet unsettling problem that stems from rising loan defaults amid expanding credit. Data from the Central Bank of Nigeria’s (CBN’s) latest macroeconomic outlook of 2025 showed that the banking industry’s Non-Performing Loans ratio climbed to an estimated 7 percent, pushing the sector above the prudential ceiling of 5 percent.

This deterioration has occurred even as banks report improved credit availability and strong loan demand across households and corporates. At first glance of the development, the narrative seems to defy logic in a real sense. However, below this lies a deeper story of macroeconomic strain, policy-induced shocks, and, most worryingly, persistent corporate governance abuses that continue to erode asset quality from within.

To be clear, Nigeria’s current wave of loan defaults cannot be blamed on reckless borrowers alone. The operating environment has become unusually hostile. Inflation, as reported by the National Bureau of Statistics (NBS), recently suggests that headline inflation is cooling and growth indicators show tentative improvement; regrettably, more Nigerians are slipping below the poverty line, eroding household purchasing power and raising operating costs for businesses.

Especially in the small and medium-sized enterprises, though, the economic growth appears positive, but has been uneven and insufficient to offset cost pressures in this space. This has heralded weak consumer demand that has squeezed revenues across retail, manufacturing and services, causing shrinking cash flows and also loan obligations remain fixed or, in many cases, rise. In such conditions, repayment stress is inevitable.

Tight monetary policy has compounded the problem. The CBN’s aggressive rate hikes, aimed at restoring price and exchange-rate stability, have significantly raised lending rates. Variable-rate loans have become more expensive mid-tenure, and businesses that borrowed under lower-rate assumptions now face repayment shocks. Even otherwise viable firms have found themselves pushed into distress as interest expenses consume a growing share of income. Going by the official survey for the last quarter of 2025, it shows that financial pressure on borrowers has intensified as more borrowers are failing to repay loans across all major categories for both secured loans, unsecured loans and corporate loans.

Exchange-rate volatility has delivered another blow. The naira’s depreciation and FX reforms have sharply increased the burden on borrowers with dollar-denominated loans but naira income. Import-dependent businesses have seen costs surge, while FX scarcity continues to disrupt production and trade cycles. For many firms, the problem is not poor management but currency mismatch. Loans that were sustainable under a more stable exchange regime have become unserviceable almost overnight.

Layered onto these macro pressures is Nigeria’s weak business environment, which has further worsened the situation, alongside chronic power shortages forcing firms to rely on costly alternatives, logistics challenges and insecurity disrupting supply chains, and regulatory uncertainty complicates planning. More on the burner that has continued to heighten the challenges is the multiple taxation and compliance burdens, further compressing margins. In survival mode, businesses naturally prioritise payrolls, energy, and raw materials over debt service. Defaults, in this context, are often a symptom rather than the disease.

Yet while these systemic pressures explain much of the stress, they do not tell the whole story. A critical and often underemphasised driver of rising loan defaults lies within the banks themselves, most especially corporate governance abuse, which emanates particularly from insider-related lending. This is the uncomfortable truth that Nigeria’s banking sector has struggled to confront decisively.

Corporate governance, at its core, is about discipline, accountability, and oversight. In the banking context, it determines how credit decisions are made, how risks are assessed, and how early warning signs are addressed. Where governance is weak, loan quality inevitably suffers. Nigeria’s history offers painful lessons, especially the banking failures of the 1990s to the post-2009 crisis clean-up, insider lending and boardroom abuses have repeatedly emerged as central culprits.

Recent evidence suggests that the problem has not disappeared. Industry estimates indicate that a significant portion of bad loans remains linked to insider and related-party exposures. Former NDIC officials have disclosed that, historically, directors and insiders accounted for as much as 40 per cent of bad loans in deposit money banks, with a handful of institutions holding the majority of insider-related NPLs. It would be said that governance frameworks have improved since then, but enforcement gaps still persist.

Insider abuse manifests in several ways. Loans are extended to directors, executives, or connected parties with inadequate due diligence. Credit decisions are influenced by relationships rather than repayment capacity, and this has been one of the critical problems as collateral is overvalued, covenants are weak, and stress testing is often superficial. When early signs of distress emerge, enforcement is delayed, restructuring is repeated without fundamental improvement, and recoveries are treated with undue caution to avoid internal embarrassment or exposure.

The result is predictable. These loans default faster and are harder to recover. Worse still, they distort bank balance sheets by crowding out credit to productive sectors. When insiders default, the signal to the wider market is corrosive. Here, credit discipline is optional, and accountability is selective, and it further fuels moral hazard, encouraging strategic defaults even among borrowers who could otherwise repay.

Governance failures also weaken loan recovery processes. Poorly empowered risk and audit committees miss warning signs or fail to act decisively because the system has been built to fail. Legal remedies are pursued slowly, if at all. In an environment where judicial delays already undermine contract enforcement, such reluctance turns manageable problem loans into fully impaired assets. Over time, NPLs accumulate not because recovery is impossible, but because it is poorly pursued.

Compounding these internal weaknesses are government policy shifts and fiscal stress, which have become major external shock absorbers for bank balance sheets. Policy inconsistency has made cash flow planning increasingly difficult for borrowers. For instance, the sudden tax changes or aggressive enforcement drives will definitely alter cost structures overnight. Delays in government payments to contractors starve businesses of liquidity, and this will surely push otherwise solvent firms into default. In theory, although removing fuel subsidies, while economically justified, have often occurred without adequate transition buffers, transmitting immediate cost shocks across energy, transport, and consumer goods sectors.

The banking sector, heavily exposed to government-linked projects and regulated industries, absorbs these shocks directly. Loans tied to this sector showed that the banks are hugely exposed to oil and gas, power, and infrastructure; they are particularly vulnerable when fiscal pressures delay receivables or alter contract economics. For instance, a total of 9 banks’ exposure to the Oil & gas sector increased to N15. 6 trillion in 2024, representing about 94.4per cent increase from N10. 17 trillion reported in 2023 financial year. It is therefore no coincidence that NPL concentrations remain high in these sectors. In effect, fiscal stress is being intermediated through bank balance sheets.

When the CBN ended the special leniency measures known as forbearance in 2025, the real extent of loan stress in the banking industry became much clearer. For a longer time, pandemic-era reliefs allowed banks to renegotiate stressed loans without immediately classifying them as non-performing. While this helped preserve surface stability, it also masked underlying vulnerabilities. With the end of forbearance, many restructured facilities have crystallised as bad loans, pushing the industry NPL ratio above the prudential ceiling. This does not mean risk suddenly increased; it means it is now being recognised.

To the CBN’s credit, transparency has improved as the industry witnessed stricter classification rules and reduced forbearance have forced banks to confront economic truth rather than regulatory convenience. And, despite the challenges, the financial system appears to be generally sound because banks have enough cash to meet obligations and sufficient capital buffers that still exceed regulatory floors, while these buffers are under pressure. Though the ongoing recapitalisation efforts are expected to provide additional buffers.

However, stability should not be confused with health. Rising NPLs, even in a liquid system, carry real consequences. Banks must set aside provisions, eroding profitability and capital. Credit supply tightens as lenders grow cautious, starving the real economy of funding. One known fact is that the moment governance and transparency concerns grow, investors, particularly foreign ones, become less willing to commit capital and this loss of confidence eventually slows down overall economic growth.

The policy response, therefore, must go beyond macroeconomic management. While stabilising inflation and the exchange rate is essential, it is not sufficient. Governance reform within banks must be treated as a systemic priority, not a compliance exercise. Insider lending rules must be enforced rigorously, with real consequences for violations. Boards must be strengthened, not merely in composition but in independence and courage. Risk and audit committees must be empowered to challenge management and act early.

Equally important is addressing the fiscal-banking nexus. The government must recognise that policy volatility and payment delays are not costless. They translate directly into higher credit risk and weaker financial intermediation. A more predictable policy environment, timely settlement of obligations, and credible transition frameworks for major reforms would significantly reduce default risk without a single naira of direct intervention.

The Global Standing Instruction framework, which the CBN continues to promote, can help improve retail and MSME recoveries. But frameworks cannot substitute for culture. Credit discipline begins at the top. When banks lend to themselves without consequence, the entire system pays the price.

Nigeria’s rising loan defaults are not merely an economic statistic; they are a governance signal. They reflect a system under stress, yes, but also one still wrestling with old habits. If recapitalisation is to be meaningful, it must be accompanied by recapitalisation of trust, through transparency, accountability, and consistent policy. Otherwise, the cycle will repeat the same strong balance sheets on paper, weak loans underneath, and another reckoning deferred, but not avoided.

Blaise, a journalist and PR professional, writes from Lagos and can be reached via: [email protected]

-

celebrity radar - gossips5 months ago

celebrity radar - gossips5 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING