society

Heritage Bank’s YNSPYRE, CREAM Platform April draw produce millionaires

Heritage Bank’s YNSPYRE, CREAM Platform April draw produce millionaires

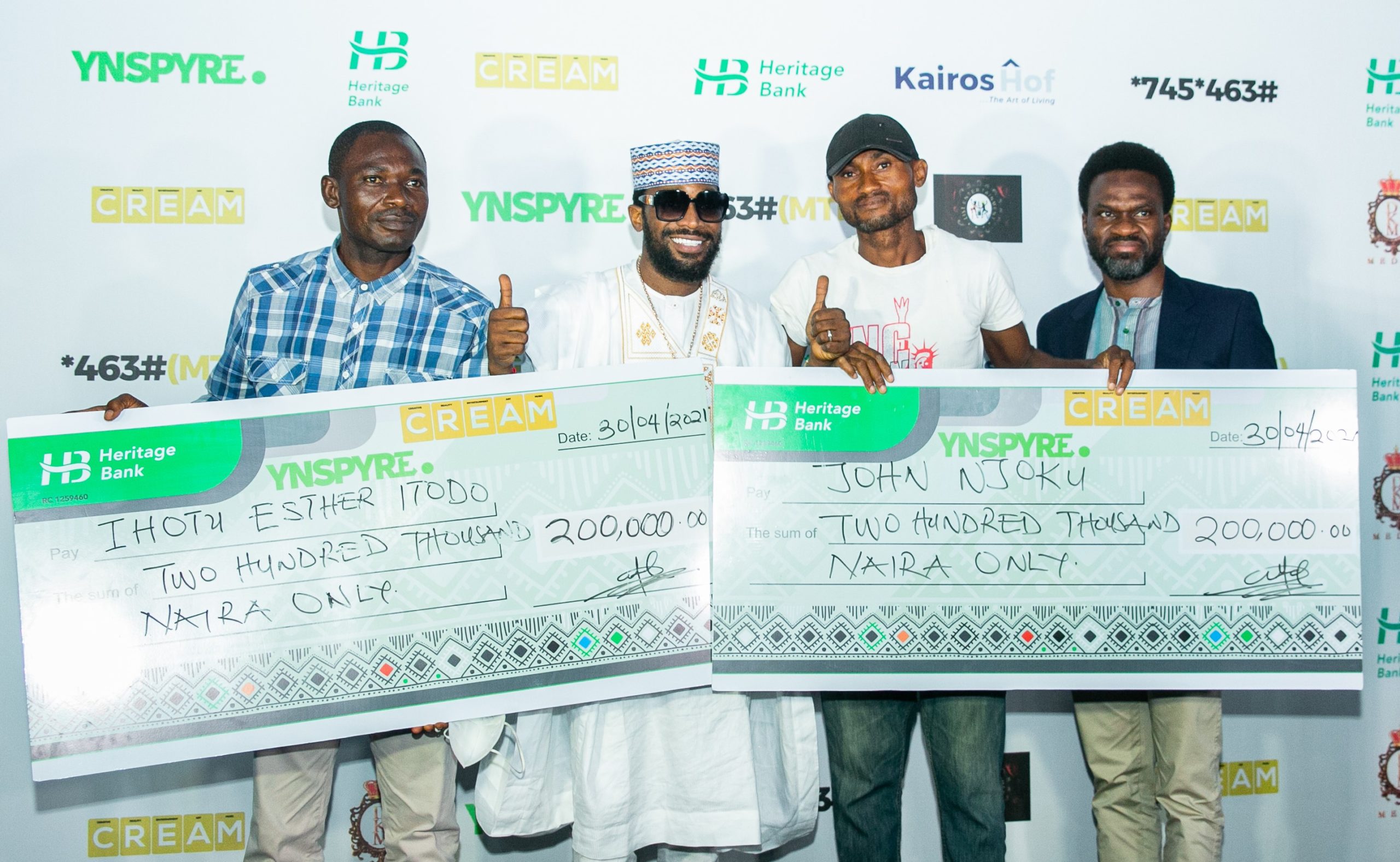

Heritage Bank has continually fulfilled its promises to support the Nigerian Creative Industry, as millionaires emerged from the YNSPYRE product in collaboration with the CREAM Platform.

The YNSPYRE account holders who subscribed to the platform by dialing *745*463# on all networks won over N12million during the second monthly raffle draw conducted in April at the weekend.

The Heritage Bank’s YNSPYRE event commenced on a great note when D’banj and CREAM Platform introduced the CREAM Merit winners for March, BERRI, a music artiste who carted away sum of N10million in form of promotional, while Clara Aden, a visual artist received N1million in financial support and Hanzy, a music artiste got over N1million Naira in form of mentorship support as well as Merchandise support from partner company – Boomplay.

Meanwhile, the April Raffle Draw produced 10 lucky winners of N50,000.00 each while cheques of N200,000 each were also presented to 5 Winners from the March 2021 Draw.

The epoch-making event, held at the Balmoral Hall of Federal Palace Hotel in Lagos had in attendance alongside Divisional Head, Corporate Communications, Heritage Bank – Fela Ibidapo; Dapo Oyebanjo a.k.a D’banj and his partner – Oje Anetor; notable dignitaries from different walks of life – Director General of the National Lotto Regulatory Commission, Lanre Gbajabiamila and Stanley Mukoro. Also present at the draw were – Sunday Are, Chief Damian Okoroafor, Poco Lee, representatives of the NLRC, Boomplay and members of the media.

Speaking during the April draw, Ibidapo stated that as a financial institution committed to delivering distinctive financial services to create, preserve and transfer wealth, Heritage Bank will continue to leverage its supports to the growth and development of the creative and entertainment sector.

According to him the bank is proud of the entertainment industry and will continue to stand by operators in it by supporting them and watch them grow.

He expressed optimism that the creative industry, if properly harnessed, has the potentials to reduce the level of unemployment in the country, boost wealth creation for the people and help the country generate the much needed foreign exchange.

He noted that with the creative industry accounting for one of the highest exports from Nigeria, time has come for operators in the sector to be supported with the finances.

With the April 2021 CREAM YNSPYRE producing another set of winners, D’banj reiterated his unending desire to boost the lives of creatives within Nigeria who will simply dial *745*463# or *463# from all networks.

“For a chance to be a part of next month’s draw, simply dial *463# or *745*463# from any network, choose a category, upload your content on creamplatform.com and promote it to be a part of the Top 10 winners and the lottery winners,” he stated.

He further explained that the Cream Platform has built a strong reputation for producing some of the brightest talents in the country over the last couple of years.

He said the purpose of the platform was to have a creative hub for Africa where people can upload their contents, be discovered and get funding support from Heritage Bank.

He said the platform would enable Nigerians discover their talents in areas such as entertainment, entrepreneurship, music, arts and other areas in the creative industry value chain

society

Tinubu Mourns Rear Admiral Musa Katagum: A National Loss for Nigeria’s Military Leadership

Tinubu Mourns Rear Admiral Musa Katagum: A National Loss for Nigeria’s Military Leadership

By George Omagbemi Sylvester | Published by SaharaWeeklyNG

“President Tinubu Pays Tribute as Nigeria’s Naval Command Mourns the Sudden Loss of a Strategic Maritime Leader at a Critical Security Juncture.”

Abuja, Nigeria – President Bola Ahmed Tinubu has officially mourned the death of Rear Admiral Musa Bello Katagum, the Chief of Naval Operations of the Nigerian Navy, who died on February 19, 2026, after a protracted illness while receiving treatment abroad. His passing has sent ripples through Nigeria’s defence establishment and national security architecture, marking the loss of one of the most experienced and respected maritime commanders in recent memory.

In a statement released on February 20, 2026 by his Special Adviser on Information and Strategy, Bayo Onanuga, President Tinubu described Rear Admiral Katagum’s death as a “significant blow to the military and the nation,” noting the late officer’s vast experience and “invaluable contributions” to both the Nigerian Navy and the broader “Armed Forces of Nigeria”. The President extended heartfelt condolences to the bereaved family, naval personnel and the nation at large, while praying for solace and strength for colleagues and loved ones.

Rear Admiral Katagum’s career was marked by distinguished service in several strategic capacities. Before his appointment as Chief of Naval Operations in November 2025, he served as Director of the Presidential Communication, Command and Control Centre (PC4) and Chief of Intelligence of the Nigerian Navy-roles that placed him at the nexus of naval operational planning and intelligence gathering. His leadership was widely credited with enhancing the Navy’s capacity to respond to growing maritime threats in the Gulf of Guinea, including piracy, illegal bunkering, and transnational crime.

Security policy experts emphasise that Katagum’s loss comes at a critical juncture for Nigeria. Dr. Adebola Akinpelu, a defence analyst at the Institute for Security Studies, observes that “Nigeria’s maritime domain remains a frontline in the broader security challenges facing the nation; the loss of an adept operational leader like Rear Admiral Katagum is not just a personnel change but a strategic setback.” His insight reflects broader concerns about continuity in military leadership amid intensifying threats.

The Nigerian Navy’s own statement, confirmed by the Directorate of Naval Information, affirmed that Katagum’s “exemplary leadership, strategic insight, and unwavering loyalty” were central to boosting operational readiness and national defence. According to Captain Abiodun Folorunsho, the Director of Naval Information, “His legacy remains a source of inspiration across the services.”

As Nigeria grapples with complex security landscapes at its land and maritime frontiers, the death of Rear Admiral Katagum underscores a broader national imperative: strengthening institutional capacities while honouring the service and sacrifice of those who defend the nation’s sovereignty. In the words of military scholar Professor James Okoye, “Leadership in security institutions is not easily replaceable; it is built through experience, trust and strategic clarity; qualities that Katagum embodied.”

Rear Admiral Musa Katagum has since been laid to rest in accordance with Islamic rites, leaving behind a legacy that will inform Nigerian naval operations for years to come.

society

Viral “Chat With God” Claim Targeting Kenyan Prophet David Owuor Proven False

Viral “Chat With God” Claim Targeting Kenyan Prophet David Owuor Proven False

By George Omagbemi Sylvester, SaharaWeeklyNG

“Viral screenshot sparks national controversy as the Ministry of Repentance and Holiness dismisses fabricated “divine” WhatsApp exchange, raising urgent questions about faith, digital misinformation, and religious accountability in Kenya.”

A sensational social media claim that Kenyan evangelist Prophet Dr. David Owuor displayed a WhatsApp conversation between himself and God has been definitively debunked as misinformation, sparking national debate over digital misinformation, religious authority and faith-based claims in Kenya.

On February 18–19, 2026, an image purporting to show a WhatsApp exchange between a deity and Prophet Owuor circulated widely on Twitter, Facebook, WhatsApp groups and TikTok. The screenshot, allegedly shared during one of his sermons, was interpreted by many as illustrating unprecedented direct communication with the divine delivered through a mainstream messaging platform; a claim that, if true, would have broken new ground in how religious revelation is understood in contemporary society.

However, this narrative quickly unraveled. Owuor’s Ministry of Repentance and Holiness issued an unequivocal public statement calling the image “fabricated, baseless and malicious,” emphasizing that he has never communicated with God through WhatsApp and has not displayed any such digital conversation to congregants. The ministry urged the public and believers to disregard and stop sharing the image.

Independent analysis of the screenshot further undermined its credibility: timestamps in the image were internally inconsistent and the so-called exchange contained chronological impossibilities; clear indicators of digital fabrication rather than an authentic conversation.

This hoax coincides with rising scrutiny of Owuor’s ministry. Earlier in February 2026, national broadcaster TV47 aired an investigative report titled “Divine or Deceptive”, which examined alleged “miracle healing” claims associated with Owuor’s crusades, including assertions of curing HIV and other chronic illnesses. Portions of that investigation suggested some medical documentation linked to followers’ health outcomes were fraudulent or misleading, intensifying debate over the intersection of faith and public health.

Credible faith leaders have weighed in on the broader context. Elias Otieno, chairperson of the National Council of Churches of Kenya (NCCK), recently urged that “no religious leader should replace God or undermine medicine,” affirming a widely accepted Christian understanding that divine healing does not supplant established medical practice. He warned against unverified miracle claims that may endanger lives if believers forego medical treatment.

Renowned communications scholar Professor Pippa Norris has noted that in digital societies, “religious authority is increasingly contested in the public sphere,” and misinformation (intentional or accidental) can quickly erode trust in both religious and secular institutions. Such dynamics underscore the importance of rigorous fact-checking and responsible communication, especially when claims intersect profoundly with personal belief and public well-being.

In sum, the viral WhatsApp chat narrative was not a revelation from the divine but a striking example of how misinformation can exploit reverence for religious figures. Owuor’s swift repudiation of the false claim and broader commentary from established church bodies, underline the ongoing challenge of balancing deeply personal faith experiences with the evidence-based scrutiny necessary in a digitally connected world.

society

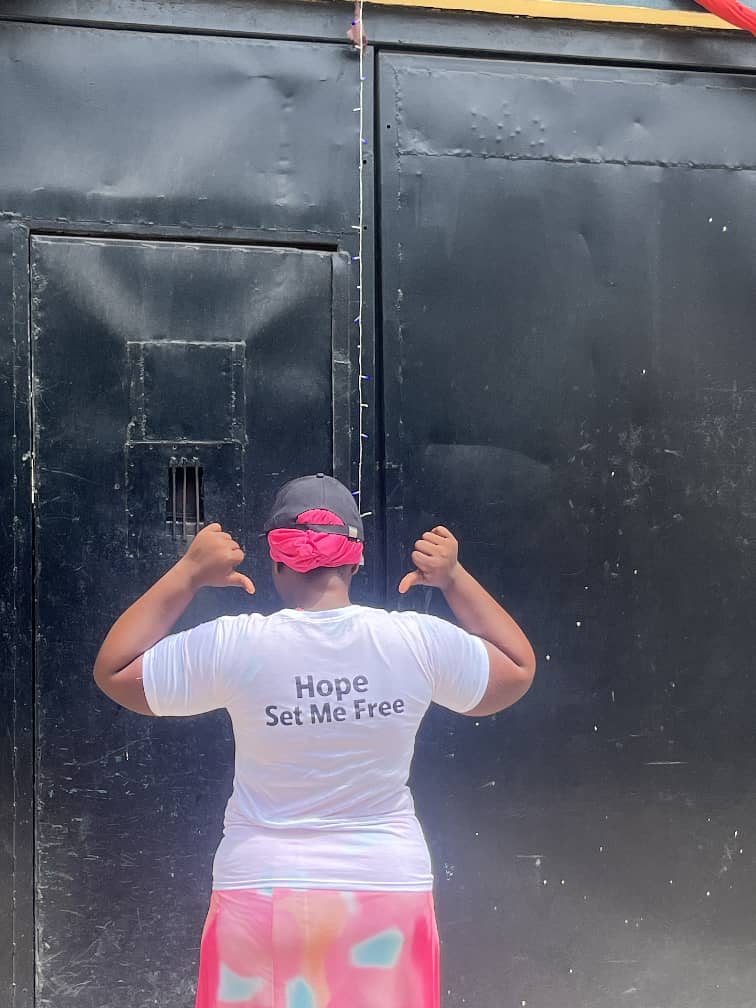

HOPE BEYOND THE WALLS 2026: ASSOCIATION OF MODELS SUCCESSFULLY SECURES RELEASE OF AN INMATE, CALLS FOR CONTINUED SUPPORT

HOPE BEYOND THE WALLS 2026: ASSOCIATION OF MODELS SUCCESSFULLY SECURES RELEASE OF AN INMATE, CALLS FOR CONTINUED SUPPORT

The Association of Models (AOMNGO) proudly announces the successful completion of the first edition of Hope Beyond the Walls 2026, a humanitarian initiative dedicated to restoring hope and freedom to deserving inmates.

Despite enormous challenges, financial pressure, emotional strain, and operational stress, the organization remained committed to its mission. Through perseverance, faith, and collective support, one inmate has successfully regained freedom a powerful reminder that hope is stronger than circumstance.

This milestone did not come easily.

Behind the scenes were weeks of coordination, advocacy, fundraising, documentation, and intense engagement. There were moments of uncertainty, but the determination to give someone a second chance kept the vision alive.

Today, the Association of Models gives heartfelt appreciation to all partners and sponsors, both locally and internationally, who stood with us mentally, financially, morally, and physically.

Special Recognition and Appreciation To:

Correctional Service Zonal Headquarters Zone A Ikoyi

Esan Dele

Ololade Bakare

Ify

Kweme

Taiwo & Kehinde Solagbade

Segun

Mr David Olayiwola

Mr David Alabi

PPF Zion International

OlasGlam International

Razor

Mr Obinna

Mr Dele Bakare (VOB International)

Tawio Bakare

Kehinde Bakare

Hannah Bakare

Mrs Doyin Adeyemi

Shade Daniel

Mr Seyi United States

Toxan Global Enterprises Prison

Adeleke Otejo

Favour

Yetty Mama

Loko Tobi Jeannette

MOSES OLUWATOSIN OKIKIADE

Moses Okikiade

(Provenience Enterprise)

We also acknowledge the numerous businesses and private supporters whose names may not be individually mentioned but whose contributions were instrumental in achieving this success.

Your generosity made freedom possible.

A CALL TO ACTION

Hope Beyond the Walls is not a one-time event. It is a movement.

There are still many deserving inmates waiting for a second chance individuals who simply need financial assistance, legal support, and advocacy to reunite with their families and rebuild their lives.

The Association of Models is therefore calling on:

Corporate organizations

Local and international sponsors

Philanthropists

Faith-based organizations

Community leaders

Individuals with a heart for impact

to partner with us.

Our vision is clear:

To secure the release of inmates regularly monthly, quarterly, or during special intervention periods through structured support and transparent collaboration.

HOW TO SUPPORT

Interested partners and supporters can reach out via

Social Media: Official Handles Hope In Motion

Donations and sponsorship inquiries are welcome.

Together, we can turn difficult stories into testimonies of restoration.

ABOUT AOMNGO

The Association of Models (AOMNGO) is a humanitarian driven organization committed to advocacy, empowerment, and social impact. Through projects like Hope Beyond the Walls, the organization works tirelessly to restore dignity and create opportunities for individuals seeking a second chance.

“When we come together, walls fall and hope rises.”

For media interviews, partnerships, and sponsorship discussions, please contact the Association of Models directly.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING