Business

The World at a Breaking Point: How Geopolitics, Climate Collapse and Food Insecurity Are Forging a Global Emergency

The World at a Breaking Point: How Geopolitics, Climate Collapse and Food Insecurity Are Forging a Global Emergency.

By George Omagbemi Sylvester | Published by saharaweeklyng.com

“Why the G20 can no longer tinker at the edges – it must act boldly and now.”

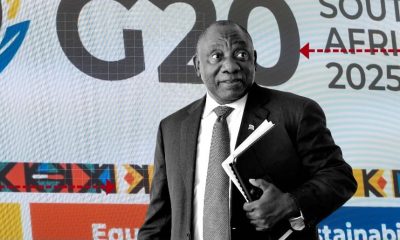

“GEOPOLITICAL TENSIONS, GLOBAL WARMING, PANDEMICS, ENERGY and FOOD INSECURITY jeopardise our collective future.” Those were not idle words from President Cyril Ramaphosa at the opening of the G20 Leaders Summit in Johannesburg; they were an urgent alarm bell for a global order fraying at the seams. South Africa’s presidency put its finger on what every honest analyst, humanitarian and climate scientist already knows, multiple, interacting crises are converging to create a cascade of risk that threatens lives, economies and the political stability of entire regions.

This is not hyperbole. The world is seeing an uncomfortable and brutal arithmetic: geopolitical conflict and economic fragmentation reduce the flow of goods, cut investment and corrode cooperation; climate change undermines harvests, water supplies and coastal livelihoods; and food insecurity (driven by war, weather shocks and runaway inflation) is spiking in the places least able to cope. The UN-led State of Food Security and Nutrition report and contemporaneous UN analyses show that hundreds of millions remain undernourished and that while global hunger edged down overall, it rose sharply in much of Africa and western Asia. That divergence is lethal and politically combustible.

The mechanics of the crisis are simple and merciless. Geopolitical tensions (trade wars, sanctions, blockades and military conflict) rip apart integrated supply chains that keep food, fertiliser and energy moving. When ports close, fertiliser becomes scarce and grain prices spike. When currencies collapse under the weight of sanctions or poor macroeconomic policy, millions lose the purchasing power to buy calories. At the same time, climate extremes (drought, floods, heatwaves) are reducing yields and increasing volatility in staple food production, consuming resilience faster than it can be rebuilt. The latest scientific syntheses make plain that warming and its knock-on effects are not some distant threat but an immediate multiplier of instability.

Experts who study planetary risk are not whispering, they are shouting warnings. Professor Johan Rockström, a leading authority on planetary boundaries, has repeatedly warned that transgressing critical Earth system thresholds risks irreversible, accelerating changes; the very “TIPPING POINT’S” that would cascade into mass crop failures, ecosystem collapse and mass displacement. “The tipping element that worries me most is coral reef systems,” Rockström has said and that is not just an environmental lament; coral reefs underpin fisheries and coastal protection for hundreds of millions of people. When ecosystems fail, livelihoods vanish overnight.

Humanitarian leaders echo this urgency. At the launch of the 2024–25 global food report, WFP Executive Director Cindy McCain bluntly stated that “one thing is very clear, the world is badly OFF-TRACK in our efforts to achieve Zero Hunger by 2030.” That failure is not a statistic; it is a moral indictment of global choices: insufficient financing, a shortfall of multilateral cooperation, and a failure to insulate vulnerable countries from shocks. The Global Report on Food Crises and related UN assessments put numbers to the suffering: in 2024, crisis-level acute food insecurity affected tens of millions more people than the year before, with conflict and climate extremes the main drivers.

So what does this mean for governance at the G20 and for global leaders who can still shape outcomes? First, the era of incrementalism is over. Patchwork measures and symbolic statements will not stabilise food systems in the face of simultaneous geopolitical and climatic shocks. The G20 must mobilise large, guaranteed financing for adaptive agriculture, targeted social protection, emergency food reserves and rapid fertiliser distribution mechanisms that bypass geopolitical chokepoints. It must also create contingency credit lines and debt-service suspensions that prevent vulnerable states from choosing between feeding their people and paying creditors. The evidence is clear: well-targeted social protection and local agricultural investment are among the most cost-effective ways to reduce hunger and build resilience.

Second, climate action has to be reframed as a security imperative, not merely an emissions accounting exercise. The IPCC’s synthesis makes this plain: unmitigated warming amplifies risks across agriculture, water, health and migration; every fraction of a degree matters for harvest reliability. That is why developing countries must receive immediate and predictable finance for adaptation; not loan-based stopgaps, but grants and concessional financing for climate-smart irrigation, soil restoration, seed systems and disaster-proof storage and transport. Without it, the Global South will continue to pay the price for emissions it did little to cause.

Third, the G20 must reopen the playbook on cooperation. The fragmentation of global governance (boycotts, unilateral sanctions and self-interested blocs) reduces the capacity for joint action where it counts most: humanitarian corridors, collective purchasing of critical inputs, and deconflicted maritime and land corridors for trade. The Johannesburg summit’s adoption of a leaders’ declaration despite diplomatic friction is a positive sign, but words must translate into mechanisms: grain and fertiliser de-risking facilities, coordinated early warning systems, and a G20 compact to stabilise critical commodity markets during geopolitical shocks.

Finally, the moral argument must become operational policy. Development economists remind us that famines and mass hunger are often political choices enabled by governance failures. Nobel laureate Amartya Sen has long argued that democracy, information transparency and entitlements prevent famines; in the present context, global institutions must protect those entitlements across borders by guaranteeing aid flows, supporting local markets and opposing weaponised scarcity. The time for blaming is over; the time for binding, enforceable compacts to protect food systems and essential supplies is now.

This is not a plea for naïve optimism, nor is it a call to surrender national interest. It is a demand for sober realism: the alternative to action is disorder. We are already seeing localized political instability linked directly to food and fuel spikes; we will see more unless the G20 and every major economy treat climate adaptation, food security and conflict de-escalation as a unified emergency program. If multilateral institutions are to retain legitimacy, they must be capable of delivering rapid, predictable assistance precisely when markets and geopolitics fail.

President Ramaphosa was correct to frame the summit around “PEOPLE, PLANET and PROSPERITY.” Though correct framing without decisive instruments is mere rhetoric. The Johannesburg G20 can be remembered either as the moment the world began to stitch back the frayed fabric of global cooperation, or as yet another summit where urgent warnings dissolved into bland communiqués. Policymakers, financiers and civil society now face a stark choice: treat these converging crises as separate policy silos, or confront them together as the systemic emergency they are. History will judge us by which path we choose.

If we have learned anything from the last decade, it is that crises compound. To avoid a future where food shortages, climate collapse and geopolitical fracture become permanent features of the international system, the G20 must act with the scale, speed and solidarity that this moment demands. Anything less is an act of negligence and the price will be paid in human lives and shattered nations.

George Omagbemi Sylvester is a contributing writer. This piece is published by saharaweeklyng.com.

Business

Nigeria’s Inflation Drops to 15.10% as NBS Reports Deflationary Trend

Nigeria’s headline inflation rate declined to 15.10 per cent in January 2026, marking a significant drop from 27.61 per cent recorded in January 2025, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics.

The report also showed that month-on-month inflation recorded a deflationary trend of –2.88 per cent, representing a 3.42 percentage-point decrease compared to December 2025. Analysts say the development signals easing price pressures across key sectors of the economy.

Food inflation stood at 8.89 per cent year-on-year, down from 29.63 per cent in January 2025. On a month-on-month basis, food prices declined by 6.02 per cent, reflecting lower costs in several staple commodities.

The data suggests a sustained downward trajectory in inflation over the past 12 months, pointing to improving macroeconomic stability.

The administration of President Bola Ahmed Tinubu has consistently attributed recent economic adjustments to ongoing fiscal and monetary reforms aimed at stabilising prices, boosting agricultural output, and strengthening domestic supply chains.

Economic analysts note that while the latest figures indicate progress, sustaining the downward trend will depend on continued policy discipline, exchange rate stability, and improvements in food production and distribution.

The January report provides one of the clearest indications yet that inflationary pressures, which surged in early 2025, may be moderating.

Bank

Alpha Morgan to Host 19th Economic Review Webinar

Alpha Morgan to Host 19th Economic Review Webinar

In an economy shaped by constant shifts, the edge often belongs to those with the right information.

On Wednesday, February 25, 2026, Alpha Morgan Bank will host the 19th edition of its Economic Review Webinar, a high-level thought leadership session designed to equip businesses, investors, and individuals with timely financial and economic insight.

The session, which will hold live on Zoom at 10:00am WAT and will feature economist Bismarck Rewane, who will examine the key signals influencing Nigeria’s economic direction in 2026, including policy trends, market movements, and global developments shaping the local landscape.

With a consistent track record of delivering clarity in uncertain times, the Alpha Morgan Economic Review continues to provide practical context for decision-making in a dynamic environment.

Registration for the 19th Alpha Morgan Economic Review is free and can be completed via https://bit.ly/registeramerseries19

It is a bi-monthly platform that is open to the public and is held virtually.

Visit www.alphamorganbank to know more.

Business

GTBank Launches Quick Airtime Loan at 2.95%

GTBank Launches Quick Airtime Loan at 2.95%

Guaranty Trust Bank Ltd (GTBank), the flagship banking franchise of GTCO Plc, Africa’s leading financial services group, today announced the launch of Quick Airtime Loan, an innovative digital solution that gives customers instant access to airtime when they run out of call credit and have limited funds in their bank accounts, ensuring customers can stay connected when it matters most.

In today’s always-on world, running out of airtime is more than a minor inconvenience. It can mean missed opportunities, disrupted plans, and lost connections, often at the very moment when funds are tight, and options are limited. Quick Airtime Loan was created to solve this problem, offering customers instant access to airtime on credit, directly from their bank. With Quick Airtime Loan, eligible GTBank customers can access from ₦100 and up to ₦10,000 by dialing *737*90#. Available across all major mobile networks in Nigeria, the service will soon expand to include data loans, further strengthening its proposition as a reliable on-demand platform.

For years, the airtime credit market has been dominated by Telcos, where charges for this service are at 15%. GTBank is now changing the narrative by offering a customer-centric, bank-led digital alternative priced at 2.95%. Built on transparency, convenience and affordability, Quick Airtime Loan has the potential to broaden access to airtime, deliver meaningful cost savings for millions of Nigerians, and redefine how financial services show up in everyday life, not just in banking moments.

Commenting on the product launch, Miriam Olusanya, Managing Director of Guaranty Trust Bank Ltd, said: “Quick Airtime Loan reflects GTBank’s continued focus on delivering digital solutions that are relevant, accessible, and built around real customer needs. The solution underscores the power of a connected financial ecosystem, combining GTBank’s digital reach and lending expertise with the capabilities of HabariPay to deliver a smooth, end-to-end experience. By leveraging unique strengths across the Group, we are able to accelerate innovation, strengthen execution, and deliver a more integrated customer experience across all our service channels.”

Importantly, Quick Airtime Loan highlights GTCO’s evolution as a fully diversified financial services group. Leveraging HabariPay’s Squad, the solution reinforces the Group’s ecosystem proposition by bringing together banking, payment technology, and digital channels to deliver intuitive, one-stop experiences for customers.

With this new product launch, Guaranty Trust Bank is extending its legacy of pioneering digital-first solutions that have redefined customer access to financial services across the industry, building on the proven strength of its widely adopted QuickCredit offering and the convenience of the Bank’s iconic *737# USSD Banking platform.

About Guaranty Trust Bank

Guaranty Trust Bank (GTBank) is the flagship banking franchise of GTCO Plc, a leading financial services group with a strong presence across Africa and the United Kingdom. The Bank is widely recognized for its leadership in digital banking, customer experience, and innovative financial solutions that deliver value to individuals, businesses, and communities.

About HabariPay

HabariPay is the payments fintech subsidiary of GTCO Plc, focused on enabling fast, secure, and accessible digital payments for individuals and businesses. By integrating payments and digital technology, HabariPay supports innovative services that make everyday financial interactions simpler and more seamless.

Enquiries:

GTCO

Group Corporate Communication

[email protected]

+234-1-2715227

www.gtcoplc.com

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING