Politics

Ogun; Abiodun signs N472bn 2023 budget into law

Ogun; Abiodun signs N472bn 2023 budget into law

Ogun State governor, Dapo Abiodun, has signed the 2023 budget into law.

Signing the N472,250,694,447.57b Appropriations Bill as passed earlier by the State House of Assembly, on Thursday, Abiodun said he would ensure full implementation of all the items on the bill to sustain the momentum of Building Our Future Together Agenda of his Administration.

“This budget is reflective of what the people of Ogun State want. I can assure you that on our part, we will ensure implementation of the budget.

“Through this budget, our people will enjoy the full dividends of democracy”, he noted.

He thanked the Speaker and members of the House of Assembly for their diligence that culminated in the passage of the budget before the end of 2022.

Governor Abiodun had presented the N472,250,694,447.58bn Budget of ‘Continued Development and Prosperity’, consisting of N270.41bn for capital projects, while N201.84bn was earmarked for recurrent expenditure, barely a month ago.

The signed budget has adjustments in the recurrent and capital estimates and projected revenue in 31 different areas across 26 agencies.

The passage of the bill entitled: ‘H.B. NO. 084/OG/2022-Year 2023 Appropriation Law-A Bill for a Law for the Appropriation of the sum of Four Hundred and Seventy-Two Billion, Two Hundred and Fifty Million, Six Hundred and Ninety Four Thousand, Four Hundred and Forty-Seven Naira, Fifty-Seven Kobo Only from the Consolidated Revenue Fund for the Service of Ogun State Government, Nigeria for the Financial Year Ending Thirty-First Day December, Two Thousand and Twenty-Three’, was consequent upon the presentation of the report of House on November 17.

Ogun State House of Assembly passed the Bill as presented by the Committee on Finance and Appropriation led by its Chairman, Olakunle Sobunkanla, who also moved the motion for its adoption, seconded by his deputy, Ganiyu Oyedeji and subsequently supported by the Whole House through a unanimous voice vote.

The Bill was later read and adopted clause-by-clause by the Committee of Supply presided over by the Speaker, Olakunle Oluomo, during the plenary held at the Assembly Complex, Oke-Mosan, Abeokuta.

According to the report, the recurrent expenditures of 22 MDAs were reviewed, while the capital expenses of four others were also adjusted; thus the adjustments led to a reduction in the proposed capital expenditure contained in the budget from the initial N270, 411, 239,527 to N269,605,938,723.32, resulting in N805.3m difference, while the recurrent expenditure was increased from N201.839bn to N202.644bn giving an increment of N805.3m.

Thereafter, the Majority Leader Yusuf Sheriff moved the motion for the third reading of the Bill, seconded by the Deputy Speaker, Hakeem Balogun and supported by the Whole House, while the Clerk/ Head of Legislative Service, Mr. ‘Deji Adeyemo did the third reading of the bill before the members.

Responding on the floor of the House, Oluomo directed that the clean copy of the bill be transmitted to the governor for his assent.

A breakdown of the budget indicated that personnel expenses would gulp N79.47bn, while N21.12bn was meant for social contribution and social benefits, with N39.90bn earmarked for public debt charge and N61.35bn for overhead cost.

Politics

Oyo 2027: Ajadi Says PDP Will Retain Power

Oyo 2027: Ajadi Says PDP Will Retain Power

…..Tasks PMS To Remain United, Peaceful

A leading People’s Democratic Party (PDP) governorship aspirant in Oyo State, Ambassador Olufemi Ajadi Oguntoyinbo, has urged the people of Oyo State to remain steadfast, saying they will continue to enjoy good governance because the PDP will produce the next governor in the 2027 general elections.

Ajadi, who made this known while addressing transport unions under the Park Management System (PMS) at their headquarters, New Garage, Ibadan, on Tuesday, urged the park managers to remain united and maintain the love and peace currently prevalent among them.

According to him, “My advice to the Park Managers and the commercial drivers in Oyo State is that they should continue the love and peaceful attitudes. They should remain united. They should not ‘scattelegs’.

“Don’t let anybody deceive you, remain steadfast. Let me assure you that our party, the PDP, will produce the next governor come 2027,” Ajadi said.

He said he came to the PMS headquarters to meet with transporters and park managers to inform them of his aspiration to serve the people of Oyo State as governor come 2027.

“Today I joined my people, the park managers in Oyo State, to familiarize myself with them and inform them of my intention to serve the people of Oyo State as the next governor by the Grace of God.”

On the plans for the transporters, Ajadi said he first wants to change the look of the City Cabs, which will be done in collaboration with the Park Management System.

He also plans to increase the number of Mass Transit buses and make them available in all locations of the State.

He said the Mass Transit buses will operate in partnership with the Park Managers.

Ajadi, who commended Governor Makinde on the newly established bus terminals in the State, said his government will ensure adequate usage of the facilities.age of the facilities.

Politics

Why Ifako-Ijaiye’s Voice Is Louder At The Lagos Assembly: The Jah Factor

Why Ifako-Ijaiye’s Voice Is Louder At The Lagos Assembly: The Jah Factor

By Ibukun Simon

In legislative politics, not all representatives are created equal. Some merely occupy seats; others shape conversations, influence outcomes, and leave visible footprints in the lives of their people. Since 2019, Ifako-Ijaiye Constituency I has belonged firmly to the latter category, thanks to the emergence of Hon. Adewale Temitope Adedeji, fondly known as JAH, as its representative in the Lagos State House of Assembly.

As a journalist who has covered proceedings of the Lagos Assembly consistently since 2015, I have witnessed first-hand how representation can either fade into the normal routine or rise into relevance. The entry of Hon. Adedeji into the Assembly marked a clear turning point—not only for Ifako-Ijaiye, but for the quality of debate, advocacy, and people-focused legislation within the House.

On the floor of the Assembly, Hon. Adedeji stands out as one of the lawmakers journalists naturally gravitate towards. His interventions during plenary sessions are deliberate, articulate, and deeply rooted in public interest and knowledge. In the 40-member House, he is widely regarded as one of the top five lawmakers whose contributions command attention, not because of theatrics, but due to his clarity of thought, persuasive delivery, and uncommon mastery of issues. When JAH speaks, the chamber listens—and the press takes notes.

This strength of presence is crucial in a legislative environment where influence matters. In parliamentary practice, experience translates to authority. The Lagos State House of Assembly, like many legislatures, places significant weight on ranking members—lawmakers whose sustained service enhances their ability to push motions, influence committee outcomes, and attract development to their constituencies. Returning Hon. Adedeji to the House in 2027 would therefore mean strengthening Ifako-Ijaiye’s bargaining power and ensuring its concerns are not just heard, but prioritized.

Beyond the chambers, the impact of Hon. Adedeji’s representation is visible across the constituency. In terms of infrastructural development, several road construction and rehabilitation projects have been attracted to Ifako-Ijaiye under his watch, improving accessibility, boosting local businesses, and easing daily movement for residents. These are practical dividends of democracy that speak louder than campaign slogans.

Equally significant is his focus on human development and social inclusion. Since assuming office in 2019, Hon. Adedeji has facilitated job opportunities, empowered the less privileged, and consistently supported students through the distribution of JAMB and GCE forms, helping to remove financial barriers to education. These interventions reflect the impact of a representative who understands that development must touch both infrastructure and people.

What further distinguishes Hon. Adedeji is his constant engagement with constituents. Through consultations, town-hall interactions, and accessibility, he has maintained a relationship that goes beyond election cycles. This closeness has fostered trust and ensured that governance remains responsive to grassroots realities.

As Lagos continues to grow and legislative responsibilities become more demanding, constituencies like Ifako-Ijaiye cannot afford experimental representation. They require lawmakers who understand the system, command respect within it, and can translate legislative influence into real benefits for the people.

From the Assembly floor to the streets of Ifako-Ijaiye, the record since 2019 is clear: effective representation works—and Hon. Adewale Temitope Adedeji has delivered it.

Ibukun writes from Ifako-Ijaiye.

Politics

Lack of Understanding or Legitimate Concern? Otti’s Defence of Tinubu’s Tax Reform Sparks National Debate

Lack of Understanding or Legitimate Concern? Otti’s Defence of Tinubu’s Tax Reform Sparks National Debate

By George Omagbemi Sylvester | SaharaWeeklyNG

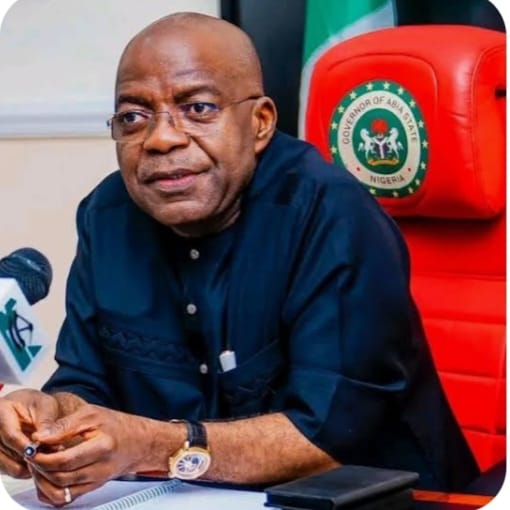

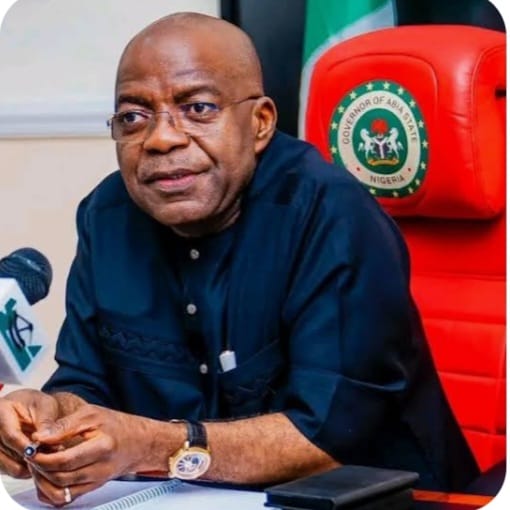

“Abia Governor Alex Otti argues critics misunderstand the overhaul of Nigeria’s tax laws, but the controversy reveals deeper anxieties about governance, transparency and economic strain.”

When Abia State Governor Alex Otti publicly defended President Bola Ahmed Tinubu’s newly enacted tax reform laws on February 13, 2026, he did more than just push back at critics, he threw the spotlight back on a fulcrum issue dividing Nigeria’s political and economic classes. Otti’s assertion that Nigerians attacking the tax policy “lack understanding” crystallises a broader fracture in public discourse over fiscal policy, governance and the future of the Nigerian economy.

The comments from Governor Otti came amid an intensifying national conversation over sweeping tax reforms signed into law in June 2025, designed to modernise Nigeria’s tax architecture and expand revenue mobilisation. These reforms (long in the making and championed by a Presidential Fiscal Policy and Tax Reforms Committee chaired by Prof. Taiwo Oyedele) mark the most far‑reaching overhaul of federal tax laws in decades. They include restructuring the Federal Inland Revenue Service into the National Revenue Service (NRS), establishing a Tax Appeal Tribunal and Ombudsman Office, and unifying revenue collection frameworks to improve transparency and efficiency.

Governor Otti’s praise for the new legislation resonated with elements of his own fiscal thinking. Drawing on economic positions he articulated nearly a decade ago, he argued that key principles now entrenched in the law reflect sound fiscal reasoning and long‑standing proposals to strengthen Nigeria’s economic foundations. “Almost 10 years ago, I wrote about the fiscal side of things,” Otti said. “When I read the new tax reform law, I saw many of those arguments reflected in it. I thank Prof. Oyedele. When people attack him, they don’t understand.”

Yet, while Otti’s intervention was meant to de‑escalate public criticism, it instead exposed how complex and emotionally charged the issue of taxation has become in Nigeria. Critics, both inside and outside government, argue that the reforms have not been adequately explained to citizens and that many fear the measures will aggravate hardship amid already high costs of living. One prominent voice of dissent, fiscal policy analyst Aborisade, warned that without transparency and clear communication on how tax revenues will be collected and returned to the people, “these reforms risk becoming deeply unpopular.” Critics also highlight that any tax increase implemented without demonstrable improvements in public services could fuel resentment and mistrust in governance.

That mistrust is not abstract. For years, Nigeria has struggled with weak tax compliance, low revenue‑to‑GDP ratios compared with other emerging economies, and public scepticism over how government revenues are utilised. Many Nigerians remember episodes where policy changes were not accompanied by visible improvements in infrastructure, healthcare or power delivery, reinforcing the belief among skeptics that new taxes equate to greater burden with little reward.

For supporters like Otti and others in government policy circles, the reforms represent a long‑overdue attempt to widen the tax net and reduce Nigeria’s chronic dependence on volatile oil revenues. Advocates argue that a modernised tax system can enhance domestic revenue mobilisation, reduce fiscal deficits, and create a more resilient economy. They point out that reforms provide exemptions and reliefs for low‑income earners and small businesses and are aimed at building a fairer, more transparent system for all stakeholders.

Still, bridging the gap between these competing narratives is challenging. Opposition voices contend that even well‑designed tax policy may fail if the state lacks the capacity to implement it equitably or if the public’s confidence in leadership remains weak. “Without accountability and clear benefits for their contributions, any tax reform risks becoming deeply unpopular,” Aborisade emphasised, warning that heavy taxation without trust can fracture the social contract.

The debate over Tinubu’s tax reform illustrates a deeper truth about contemporary Nigeria: that economic policy no longer exists in a vacuum but is deeply intertwined with public sentiment, political legitimacy, and social cohesion. As one respected economist put it, “Taxation is not just a fiscal tool, it is a trust‑building exercise between the state and its citizens.” When that trust is fragile, even technically sound reforms can be seen as punitive rather than constructive.

Analysts suggest that meaningful public engagement (including sustained information campaigns, transparent revenue utilisation reporting and constructive dialogue with civil society) is essential to soothe anxieties and build confidence in the new system. Without this, what began as an effort to stabilise public finances could widen political and social divides.

In defending the tax reforms, Governor Otti has framed the challenge as one of comprehension rather than critique. But the controversy unfolding across Nigeria is not simply about misunderstanding; it underscores a profound gap between policy design and public perception. For a reform of this magnitude to succeed, Nigerians must be assured not only of its economic merits, but also of its fairness, transparency and tangible impact on everyday lives.

As the implementation phase continues through 2026 and beyond, the Tinubu administration, state governments and economic stakeholders face the critical task of translating legislative change into broader public trust – a task as difficult as any technical reform the tax laws themselves seek to achieve.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

society5 months ago

society5 months agoReligion: Africa’s Oldest Weapon of Enslavement and the Forgotten Truth