Politics

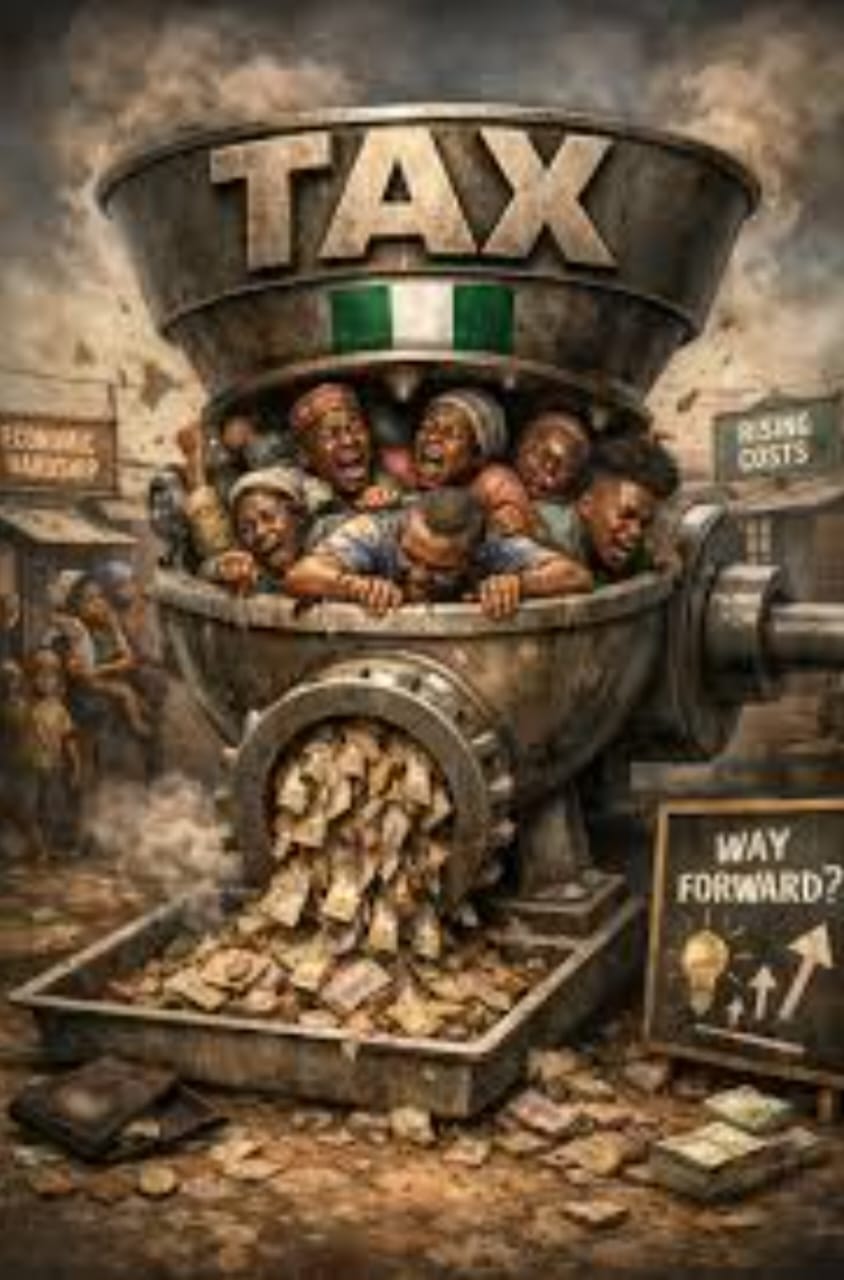

Taxing a Broken Society: Why Nigeria’s Proposed Bank Transaction Levy Threatens Social Stability

Taxing a Broken Society: Why Nigeria’s Proposed Bank Transaction Levy Threatens Social Stability.

By George Omagbemi Sylvester

“A Constitutional, Economic, and Moral Indictment of Governance Failure.”

Nigeria stands at a perilous crossroads. At a time when inflation is crushing household incomes, insecurity has become normalized and public trust in government is dangerously eroded, the proposal to impose an additional 7.5 percent charge on bank transactions is not merely an economic policy error and it is a profound governance failure with grave social implications.

This is not a debate about whether taxation is necessary. Every modern state requires revenue. The real question is legitimacy: when, how and under what moral and constitutional conditions can a government tax its citizens? In Nigeria’s current condition, this proposed levy fails every serious test of democratic governance, economic rationality and constitutional responsibility.

The Constitutional Breach: Taxation Without Welfare. Nigeria’s 1999 Constitution is unequivocal. Section 14(2)(b) states that “the security and welfare of the people shall be the primary purpose of government.” This clause is not aspirational rhetoric; it is the philosophical foundation of the Nigerian state.

Yet, after years of deteriorating public services, escalating poverty, collapsing security architecture and declining human development indicators, the Nigerian state can no longer credibly argue that it has fulfilled this foundational obligation.

According to the World Bank, over 63 percent of Nigerians (more than 133 million people) are multidimensionally poor, lacking access to basic healthcare, education, nutrition and clean water. Inflation, driven by subsidy removal and currency depreciation, exceeded 28 percent in 2024, eroding real incomes at a pace unmatched in decades. Insecurity continues to disrupt agriculture, commerce and daily life, while unemployment and underemployment remain stubbornly high.

In this context, imposing an additional financial burden on citizens for merely accessing their own money constitutes what legal scholars describe as regressive extraction with a form of fiscal policy that disproportionately punishes the poor while offering no commensurate public benefit.

As constitutional lawyer Professor Itse Sagay, SAN, once observed, “Taxation is justified only where citizens can see and feel the presence of the state in their daily lives.” In Nigeria today, that presence is largely absent.

Economic Reality: A Tax on Survival, Not Wealth. From an economic standpoint, a bank transaction levy is among the most regressive forms of taxation. Unlike progressive income or wealth taxes, transaction charges do not distinguish between surplus and subsistence. They penalize traders, small businesses, salary earners and informal workers who rely on frequent banking transactions to survive.

Nobel laureate Joseph Stiglitz has consistently warned that “unfair tax systems undermine social cohesion and weaken the legitimacy of the state.” When citizens perceive taxation as punishment rather than contribution, compliance gives way to resistance, avoidance and economic disengagement.

Nigeria’s economy is already suffering from declining productivity, shrinking consumer demand and capital flight. Adding a transaction levy risks pushing more economic activity into cash-based informality, weakening financial inclusion and undermining the very tax base the government seeks to expand.

Political Philosophy and the Collapse of Consent. Political legitimacy is not sustained by coercion but by consent. John Locke was clear: governments exist to protect life, liberty and property. Where property is arbitrarily taken without reciprocal protection, the social contract fractures.

Similarly, Jean-Jacques Rousseau argued that laws lose authority when they no longer reflect the general will or promote the common good. In Nigeria’s case, policies that deepen hardship while public officials enjoy unchecked privileges create what scholars term a legitimacy deficit.

Even Thomas Hobbes, often cited in defense of strong authority, warned that when the state becomes more frightening than the chaos it claims to prevent, social order collapses. History (from pre-revolutionary France to more recent cases of fiscal unrest across the Global South) demonstrates that economic injustice is often the spark of political instability.

Utilitarian Failure: Pain Without Public Gain. From a utilitarian perspective, the policy is equally indefensible. Jeremy Bentham’s principle of “the greatest good for the greatest number” is entirely absent. The pain imposed by the levy is collective and immediate; the benefits, if any, are speculative and opaque.

There is no transparent framework showing how revenues from this levy would translate into improved healthcare, education, security or infrastructure. Without such clarity, the policy appears not as reform but as fiscal desperation, shifting the cost of state failure onto citizens already at breaking point.

Economist Dambisa Moyo has cautioned that “states that rely excessively on extraction rather than productivity eventually face social backlash.” Nigeria risks becoming a textbook case.

Comparative Governance: Why Citizens Resist Unjust Extraction. Across the world, citizens tolerate taxation when it is visibly linked to social benefits. In countries with strong welfare systems, taxes fund healthcare, education, housing and social protection. Even in resource-rich states with controversial governance records, citizens often receive direct material benefits that sustain a fragile social bargain.

Nigeria’s tragedy lies in its constitutional promise without constitutional delivery. Chapter Two of the Constitution outlines socio-economic rights, yet Section 6(6)(c) renders them largely non-justiciable, creating what many scholars describe as a structural contradiction: rights promised but not enforceable.

Legal philosopher Ronald Dworkin argued that “a political community must treat all its members with equal concern and respect.” Policies that extract from the poor while protecting elite consumption violate this foundational principle.

The Moral Argument: When Law Loses Authority. The ancient maxim lex iniusta non est lex (an unjust law is no law at all) remains central to jurisprudence. Laws that deepen suffering without serving justice lose moral authority, even if they retain formal legality.

Nigeria’s governance crisis is not merely economic; it is ethical. Excessive public spending on political offices, opaque budgeting, and persistent corruption scandals undermine any moral justification for further taxation.

As former UN Secretary-General Kofi Annan warned, “A government that ignores the suffering of its people forfeits the moral right to demand sacrifice.”

A Warning, Not a Threat. This analysis is not a call to disorder. It is a warning grounded in history and reason. Societies pushed beyond endurance do not require incitement to react; pressure alone is enough. Governments that mistake silence for consent often discover too late that endurance has limits.

Nigeria still has a choice. Genuine fiscal reform must begin with cutting the cost of governance, enforcing accountability, expanding productivity and restoring public trust. Taxation must be the final step not the first reflex of a failing system.

Closing Reflection: The Test of Statesmanship. Great leadership is measured not by how much it can extract from its people, but by how effectively it can serve, protect, and uplift them. Nigeria’s current trajectory risks converting fiscal policy into a catalyst for deeper alienation.

History is unforgiving to governments that treat citizens as expendable revenue sources. Stability is not enforced; it is earned. And legitimacy, once lost, is far harder to recover than revenue.

George Omagbemi Sylvester

Political Analyst & Columnist

Published by SaharaWeeklyNG

Politics

Why Ifako-Ijaiye’s Voice Is Louder At The Lagos Assembly: The Jah Factor

Why Ifako-Ijaiye’s Voice Is Louder At The Lagos Assembly: The Jah Factor

By Ibukun Simon

In legislative politics, not all representatives are created equal. Some merely occupy seats; others shape conversations, influence outcomes, and leave visible footprints in the lives of their people. Since 2019, Ifako-Ijaiye Constituency I has belonged firmly to the latter category, thanks to the emergence of Hon. Adewale Temitope Adedeji, fondly known as JAH, as its representative in the Lagos State House of Assembly.

As a journalist who has covered proceedings of the Lagos Assembly consistently since 2015, I have witnessed first-hand how representation can either fade into the normal routine or rise into relevance. The entry of Hon. Adedeji into the Assembly marked a clear turning point—not only for Ifako-Ijaiye, but for the quality of debate, advocacy, and people-focused legislation within the House.

On the floor of the Assembly, Hon. Adedeji stands out as one of the lawmakers journalists naturally gravitate towards. His interventions during plenary sessions are deliberate, articulate, and deeply rooted in public interest and knowledge. In the 40-member House, he is widely regarded as one of the top five lawmakers whose contributions command attention, not because of theatrics, but due to his clarity of thought, persuasive delivery, and uncommon mastery of issues. When JAH speaks, the chamber listens—and the press takes notes.

This strength of presence is crucial in a legislative environment where influence matters. In parliamentary practice, experience translates to authority. The Lagos State House of Assembly, like many legislatures, places significant weight on ranking members—lawmakers whose sustained service enhances their ability to push motions, influence committee outcomes, and attract development to their constituencies. Returning Hon. Adedeji to the House in 2027 would therefore mean strengthening Ifako-Ijaiye’s bargaining power and ensuring its concerns are not just heard, but prioritized.

Beyond the chambers, the impact of Hon. Adedeji’s representation is visible across the constituency. In terms of infrastructural development, several road construction and rehabilitation projects have been attracted to Ifako-Ijaiye under his watch, improving accessibility, boosting local businesses, and easing daily movement for residents. These are practical dividends of democracy that speak louder than campaign slogans.

Equally significant is his focus on human development and social inclusion. Since assuming office in 2019, Hon. Adedeji has facilitated job opportunities, empowered the less privileged, and consistently supported students through the distribution of JAMB and GCE forms, helping to remove financial barriers to education. These interventions reflect the impact of a representative who understands that development must touch both infrastructure and people.

What further distinguishes Hon. Adedeji is his constant engagement with constituents. Through consultations, town-hall interactions, and accessibility, he has maintained a relationship that goes beyond election cycles. This closeness has fostered trust and ensured that governance remains responsive to grassroots realities.

As Lagos continues to grow and legislative responsibilities become more demanding, constituencies like Ifako-Ijaiye cannot afford experimental representation. They require lawmakers who understand the system, command respect within it, and can translate legislative influence into real benefits for the people.

From the Assembly floor to the streets of Ifako-Ijaiye, the record since 2019 is clear: effective representation works—and Hon. Adewale Temitope Adedeji has delivered it.

Ibukun writes from Ifako-Ijaiye.

Politics

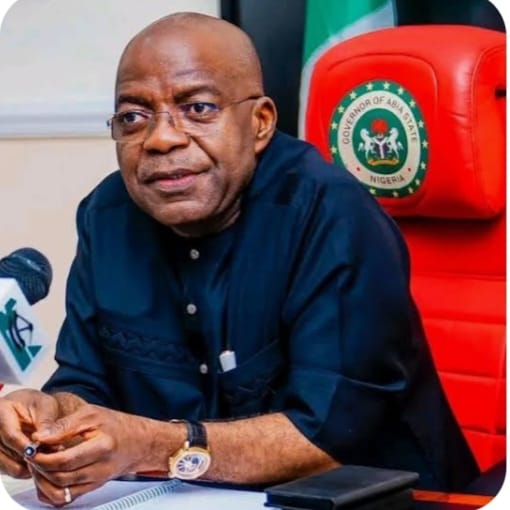

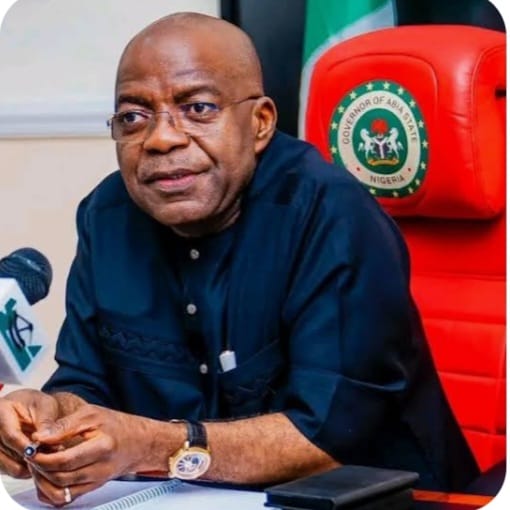

Lack of Understanding or Legitimate Concern? Otti’s Defence of Tinubu’s Tax Reform Sparks National Debate

Lack of Understanding or Legitimate Concern? Otti’s Defence of Tinubu’s Tax Reform Sparks National Debate

By George Omagbemi Sylvester | SaharaWeeklyNG

“Abia Governor Alex Otti argues critics misunderstand the overhaul of Nigeria’s tax laws, but the controversy reveals deeper anxieties about governance, transparency and economic strain.”

When Abia State Governor Alex Otti publicly defended President Bola Ahmed Tinubu’s newly enacted tax reform laws on February 13, 2026, he did more than just push back at critics, he threw the spotlight back on a fulcrum issue dividing Nigeria’s political and economic classes. Otti’s assertion that Nigerians attacking the tax policy “lack understanding” crystallises a broader fracture in public discourse over fiscal policy, governance and the future of the Nigerian economy.

The comments from Governor Otti came amid an intensifying national conversation over sweeping tax reforms signed into law in June 2025, designed to modernise Nigeria’s tax architecture and expand revenue mobilisation. These reforms (long in the making and championed by a Presidential Fiscal Policy and Tax Reforms Committee chaired by Prof. Taiwo Oyedele) mark the most far‑reaching overhaul of federal tax laws in decades. They include restructuring the Federal Inland Revenue Service into the National Revenue Service (NRS), establishing a Tax Appeal Tribunal and Ombudsman Office, and unifying revenue collection frameworks to improve transparency and efficiency.

Governor Otti’s praise for the new legislation resonated with elements of his own fiscal thinking. Drawing on economic positions he articulated nearly a decade ago, he argued that key principles now entrenched in the law reflect sound fiscal reasoning and long‑standing proposals to strengthen Nigeria’s economic foundations. “Almost 10 years ago, I wrote about the fiscal side of things,” Otti said. “When I read the new tax reform law, I saw many of those arguments reflected in it. I thank Prof. Oyedele. When people attack him, they don’t understand.”

Yet, while Otti’s intervention was meant to de‑escalate public criticism, it instead exposed how complex and emotionally charged the issue of taxation has become in Nigeria. Critics, both inside and outside government, argue that the reforms have not been adequately explained to citizens and that many fear the measures will aggravate hardship amid already high costs of living. One prominent voice of dissent, fiscal policy analyst Aborisade, warned that without transparency and clear communication on how tax revenues will be collected and returned to the people, “these reforms risk becoming deeply unpopular.” Critics also highlight that any tax increase implemented without demonstrable improvements in public services could fuel resentment and mistrust in governance.

That mistrust is not abstract. For years, Nigeria has struggled with weak tax compliance, low revenue‑to‑GDP ratios compared with other emerging economies, and public scepticism over how government revenues are utilised. Many Nigerians remember episodes where policy changes were not accompanied by visible improvements in infrastructure, healthcare or power delivery, reinforcing the belief among skeptics that new taxes equate to greater burden with little reward.

For supporters like Otti and others in government policy circles, the reforms represent a long‑overdue attempt to widen the tax net and reduce Nigeria’s chronic dependence on volatile oil revenues. Advocates argue that a modernised tax system can enhance domestic revenue mobilisation, reduce fiscal deficits, and create a more resilient economy. They point out that reforms provide exemptions and reliefs for low‑income earners and small businesses and are aimed at building a fairer, more transparent system for all stakeholders.

Still, bridging the gap between these competing narratives is challenging. Opposition voices contend that even well‑designed tax policy may fail if the state lacks the capacity to implement it equitably or if the public’s confidence in leadership remains weak. “Without accountability and clear benefits for their contributions, any tax reform risks becoming deeply unpopular,” Aborisade emphasised, warning that heavy taxation without trust can fracture the social contract.

The debate over Tinubu’s tax reform illustrates a deeper truth about contemporary Nigeria: that economic policy no longer exists in a vacuum but is deeply intertwined with public sentiment, political legitimacy, and social cohesion. As one respected economist put it, “Taxation is not just a fiscal tool, it is a trust‑building exercise between the state and its citizens.” When that trust is fragile, even technically sound reforms can be seen as punitive rather than constructive.

Analysts suggest that meaningful public engagement (including sustained information campaigns, transparent revenue utilisation reporting and constructive dialogue with civil society) is essential to soothe anxieties and build confidence in the new system. Without this, what began as an effort to stabilise public finances could widen political and social divides.

In defending the tax reforms, Governor Otti has framed the challenge as one of comprehension rather than critique. But the controversy unfolding across Nigeria is not simply about misunderstanding; it underscores a profound gap between policy design and public perception. For a reform of this magnitude to succeed, Nigerians must be assured not only of its economic merits, but also of its fairness, transparency and tangible impact on everyday lives.

As the implementation phase continues through 2026 and beyond, the Tinubu administration, state governments and economic stakeholders face the critical task of translating legislative change into broader public trust – a task as difficult as any technical reform the tax laws themselves seek to achieve.

Politics

Cubana Chief Priest Backs Tinubu Ahead of 2027, Signalling Shift in Celebrity Political Alignments

Cubana Chief Priest Backs Tinubu Ahead of 2027, Signalling Shift in Celebrity Political Alignments

By George Omagbemi Sylvester | SaharaWeeklyNG

“Socialite’s public declaration underscores growing intersection of business, entertainment and electoral politics as Nigeria inches toward another high-stakes presidential race.”

A prominent Nigerian socialite and nightlife entrepreneur, Pascal Okechukwu (popularly known as Cubana Chief Priest) has publicly declared his support for President Bola Ahmed Tinubu ahead of the 2027 presidential election, in a move that has stirred debate across Nigeria’s political and social media landscapes.

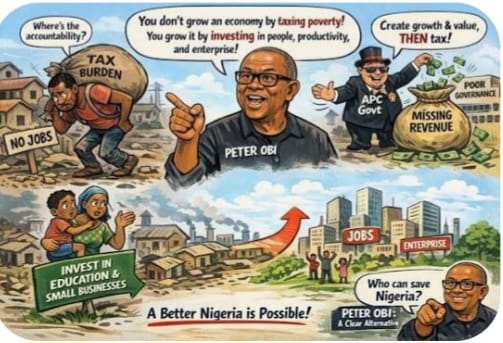

The declaration emerged in early February 2026 through a series of Instagram posts and public exchanges with critics and followers. In those posts, the celebrity businessman stated unequivocally that he would align himself with Tinubu’s political camp and work against the anticipated presidential bid of former Anambra State governor and Labour Party figure, Peter Obi.

Cubana Chief Priest, who commands a large following across Nigeria’s entertainment and hospitality sectors, framed his decision as both a political and economic calculation. In one exchange, he argued that as an employer and businessman, he preferred collaboration with the incumbent administration rather than opposition politics.

He also publicly declared that he and his family had chosen to “stay with the moving train” of Tinubu’s “Renewed Hope” agenda, signalling clear political alignment with the ruling All Progressives Congress (APC).

The shift is politically significant because the socialite had previously been associated with Peter Obi during the 2023 presidential election cycle. In his own words, he acknowledged that he worked for Obi during that campaign, even while holding an advisory role to an APC-aligned state government.

His new stance therefore represents a notable reversal, particularly within the South-East business community, where Obi enjoyed strong support during the last election.

The controversy surrounding the declaration intensified after an online clash between Cubana Chief Priest and social commentator Isaac Fayose, the brother of former Ekiti State governor Ayodele Fayose. The dispute centred on the socialite’s decision to align with Tinubu’s political movement, with Fayose accusing him of opportunism. In response, Cubana Chief Priest defended his position, arguing that political alignment was a practical choice for a businessman responsible for large-scale employment.

He also linked his support for the APC government to broader political objectives, including the potential release of detained pro-Biafra leader Nnamdi Kanu, stating that such outcomes were more achievable from within the ruling political structure than from opposition ranks.

Beyond social media statements, reports indicate that Cubana Chief Priest has expressed interest in running for a seat in the House of Representatives in 2027 under the APC platform, suggesting that his endorsement of Tinubu is part of a deeper political ambition rather than a mere celebrity opinion.

News reports also describe his announcement of political plans and explicit backing of Tinubu as part of the emerging alignment of business figures with the president’s second-term project.

The development coincides with political moves by his associate, the businessman Obinna Iyiegbu, popularly known as Obi Cubana, who has also been linked to pro-Tinubu political structures ahead of 2027.

This clustering of influential entrepreneurs around the ruling party has prompted renewed discussion about the growing role of celebrity endorsements and business interests in Nigeria’s electoral politics.

Political analysts say such endorsements, while often symbolic, can influence public perception, especially among young voters who are heavily engaged with celebrity culture. As political scientist Larry Diamond once observed, “In transitional democracies, informal power networks (business elites, media figures, and celebrities) can shape political outcomes as much as formal party structures.”

Similarly, Nigerian scholar Professor Jibrin Ibrahim has argued that “the fusion of business capital and political capital is one of the defining features of contemporary Nigerian politics.”

However, critics warn that celebrity political alignments rarely translate into structured policy debates or ideological clarity. Economist Pat Utomi has repeatedly cautioned that “Nigeria’s democracy suffers when politics becomes an extension of celebrity influence rather than a contest of ideas and development strategies.”

For now, Cubana Chief Priest’s declaration remains a personal political endorsement rather than an official party appointment at the national level. Yet its timing (more than a year before the formal campaign cycle for 2027) illustrates how early positioning has already begun among Nigeria’s political and business elites.

Key figures involved:

Pascal Okechukwu (Cubana Chief Priest): Socialite and businessman who declared support for Tinubu.

President Bola Ahmed Tinubu: Incumbent Nigerian president expected to seek re-election in 2027.

Peter Obi: Former Anambra governor and likely opposition contender.

Isaac Fayose: Social commentator who criticised the endorsement.

Obinna Iyiegbu (Obi Cubana): Business associate linked to pro-Tinubu political structures.

As Nigeria moves gradually toward the 2027 electoral cycle, the intersection of celebrity influence, business interests and party politics is likely to intensify, raising fresh questions about the nature of democratic mobilisation in Africa’s most populous nation.

-

celebrity radar - gossips6 months ago

celebrity radar - gossips6 months agoWhy Babangida’s Hilltop Home Became Nigeria’s Political “Mecca”

-

society6 months ago

society6 months agoPower is a Loan, Not a Possession: The Sacred Duty of Planting People

-

news6 months ago

news6 months agoTHE APPOINTMENT OF WASIU AYINDE BY THE FEDERAL GOVERNMENT AS AN AMBASSADOR SOUNDS EMBARRASSING

-

Business6 months ago

Business6 months agoBatsumi Travel CEO Lisa Sebogodi Wins Prestigious Africa Travel 100 Women Award